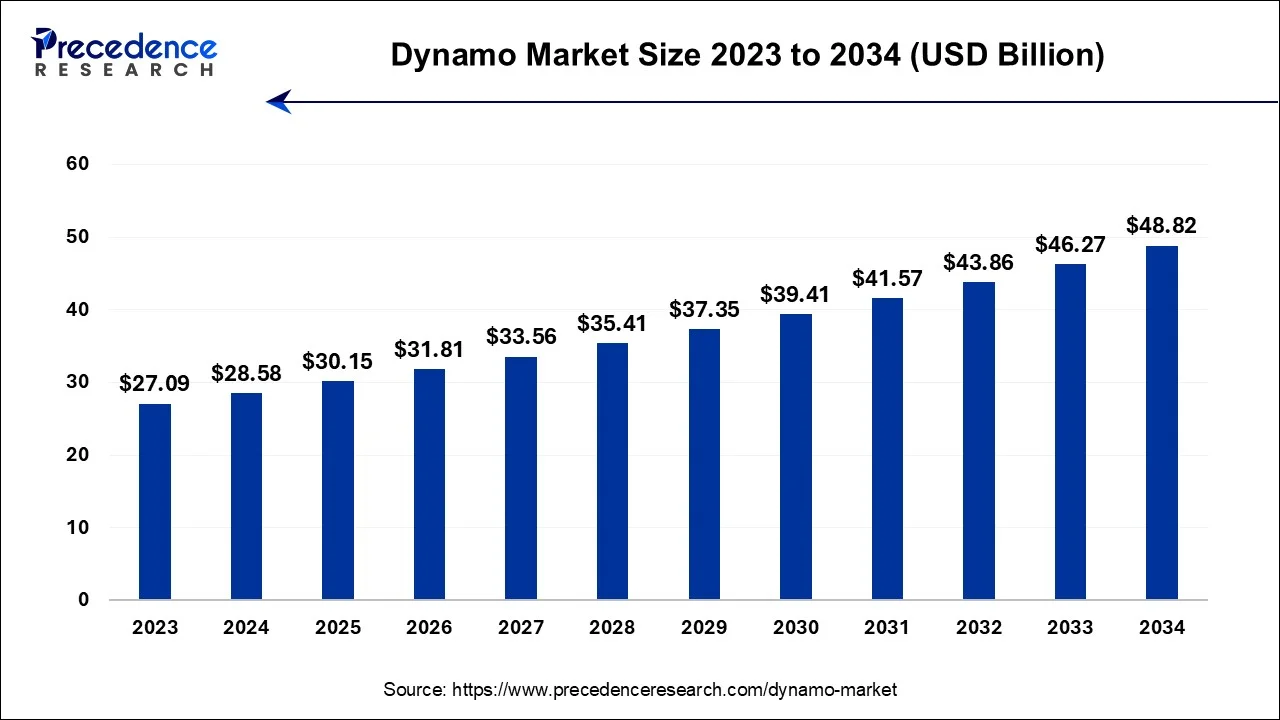

The global dynamo market size is estimated at USD 28.58 billion in 2024, grew to USD 30.15 billion in 2025 and is predicted to surpass around USD 48.82 billion by 2034, expanding at a CAGR of 5.50% between 2024 and 2034.

The global dynamo market size is estimated at USD 28.58 billion in 2024 and is anticipated to reach around USD 48.82 billion by 2034, expanding at a CAGR of 5.50% between 2024 and 2034.

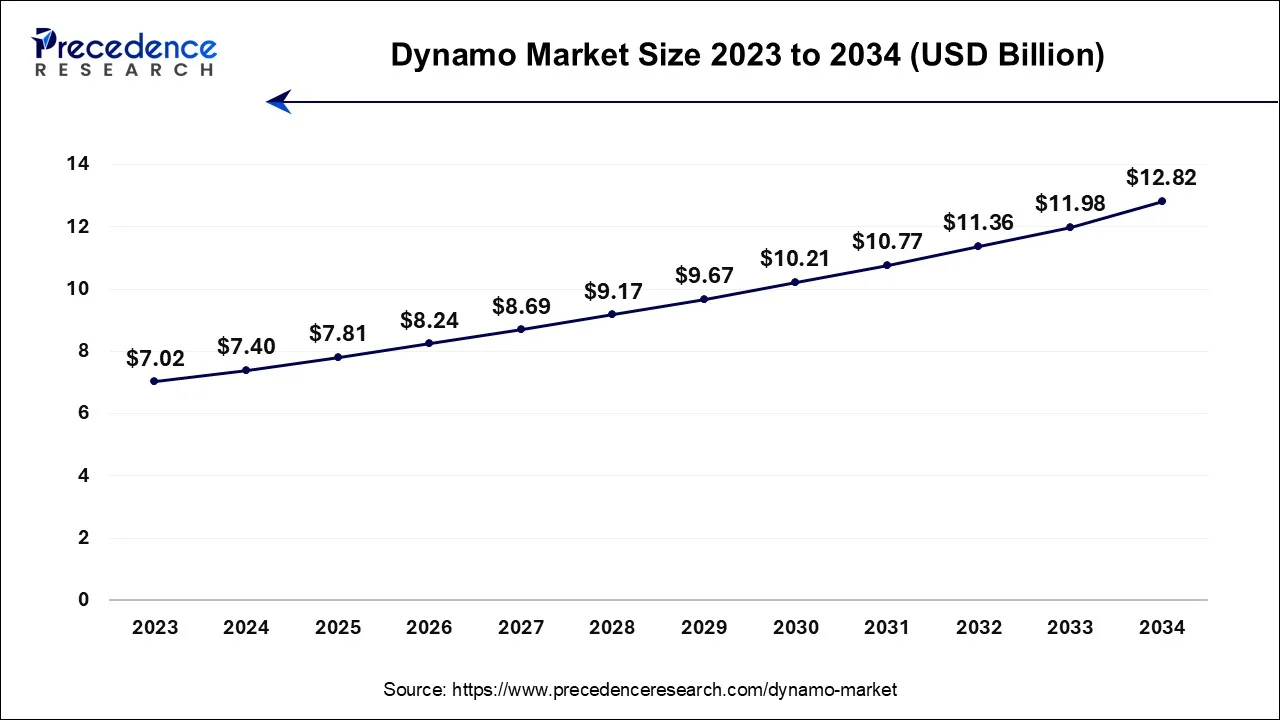

The U.S dynamo market size is estimated at USD 7.40 billion in 2024 and is expected to be worth around USD 12.82 billion by 2034, growing at a CAGR of 5.65% during the forecast period from 2024 to 2034.

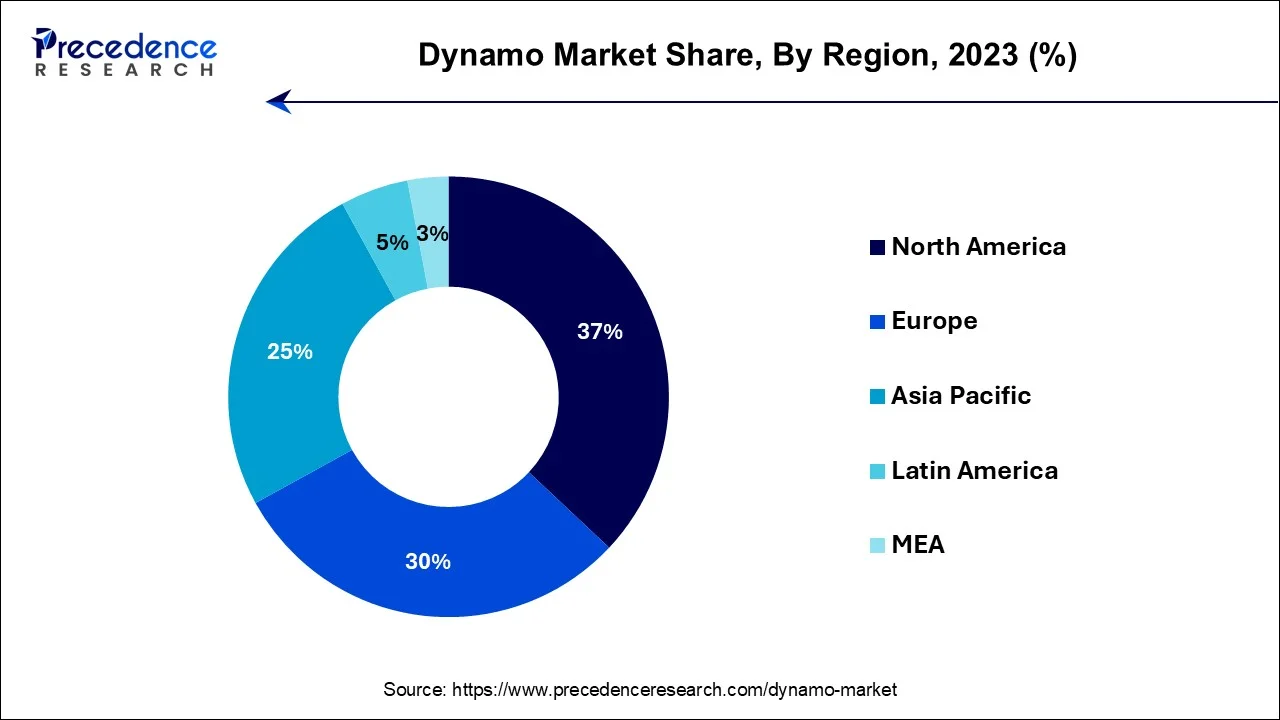

North America has held the largest revenue share 37% in 2023. North America dominates the dynamo market share due to several factors. The region is a hub for technological innovation and blockchain development, fostering a conducive environment for cryptocurrency adoption. Strong regulatory frameworks and compliance measures have also instilled confidence among users and investors, attracting substantial capital. Additionally, a high level of awareness and a large community of cryptocurrency enthusiasts further contribute to North America's leadership. Furthermore, the presence of numerous blockchain-related businesses, exchanges, and financial institutions in the region has established North America as a significant player in the global blockchain ecosystem, including the dynamo market.

Asia Pacific is estimated to observe the fastest expansion. Asia-Pacific commands significant growth in the dynamo market due to several key factors. This region's burgeoning population, coupled with a rapidly growing tech-savvy demographic, has fostered substantial cryptocurrency adoption and blockchain interest. Moreover, Asia Pacific hosts several cryptocurrency-friendly regulatory environments, encouraging innovation and investment. The region's active participation in trading, investment, and blockchain development further cements its prominent role in the dynamo market. With its large and dynamic user base, supportive regulatory climate, and active blockchain ecosystem, Asia-Pacific remains a leading driver of growth and adoption in the dynamo market.

Dynamo constitutes an avant-garde blockchain-driven enclave facilitating impervious, expeditious, and economical digital exchanges. It operates as an agora for a myriad of virtual assets and utilities, encompassing non-fungible tokens (NFTs), ingenious contracts, and decentralized finance (DeFi) stratagems. Pioneering scalability and sustainability, dynamo market endeavors to metamorphose the realm of digital commerce by endowing users with a versatile and efficient milieu for person-to-person transactions. Its indigenous token, DYN, fulfills multifarious functions within the ecosystem, embracing staking, governance, and remittances. dynamo market harnesses blockchain ingenuity to nurture groundbreaking innovation and stimulate fiscal inclusivity.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.50% |

| Market Size in 2024 | USD 7.40 Billion |

| Market Size by 2034 | USD 12.82 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Decentralized finance (DeFi) momentum

Decentralized Finance (DeFi) momentum is a significant driving force behind the growth of the dynamo market. DeFi represents a financial revolution that leverages blockchain technology to create a trustless, permissionless, and borderless financial ecosystem. As DeFi gains momentum globally, dynamo is strategically positioned to benefit in several ways. First and foremost, dynamo offers a platform that caters to the various needs of DeFi enthusiasts. Its smart contract capabilities, low transaction costs, and rapid settlement times align perfectly with the DeFi ethos, attracting users looking to engage in activities like lending, borrowing, yield farming, and decentralized trading. The growing popularity of DeFi projects, which often require interoperability and cross-chain capabilities, underscores the value of platforms like dynamo that support a range of blockchain networks.

Dynamo's cross-chain compatibility allows DeFi projects to tap into different blockchain ecosystems, further expanding their user base. Moreover, as DeFi applications continue to innovate, dynamo's flexibility and adaptability enable it to keep pace with the ever-evolving DeFi landscape. This adaptability ensures that dynamo remains a relevant and appealing platform for DeFi developers and users alike. In summary, the dynamism of the DeFi sector acts as a catalyst for dynamo market's growth, making it a hub for DeFi enthusiasts, projects, and innovators who seek a secure, scalable, and versatile environment for their financial activities.

Volatility in cryptocurrency prices

Volatility in cryptocurrency prices poses a significant restraint on the growth of the dynamo market. The price fluctuations of cryptocurrencies, including Dynamo's native token (DYN), can deter potential users and investors from participating in the ecosystem. This volatility not only hinders the confidence of traditional investors but also complicates the use of cryptocurrencies for everyday transactions and financial planning. For users and businesses, the uncertainty in token values can lead to operational challenges. Accepting payments or planning budgets becomes problematic when the purchasing power of tokens fluctuates widely over short periods. Additionally, the fear of significant losses can discourage users from engaging with the Dynamo Market and its associated services. Dynamo's growth relies on attracting a diverse user base, which includes risk-averse individuals and businesses. Mitigating the impact of cryptocurrency price volatility through strategies like stablecoins or hedging options may be necessary to foster a more stable and appealing ecosystem for users and investors alike.

DeFi expansion

The expansion of the decentralized finance (DeFi) sector presents a ripe opportunity for the dynamo Market. DeFi's rapid growth, characterized by innovative lending, borrowing, yield farming, and decentralized exchange solutions, aligns seamlessly with dynamo's offerings. By positioning itself as a robust DeFi platform, dynamo can attract developers and users seeking secure and efficient financial services within a decentralized ecosystem. The burgeoning demand for DeFi products and the need for interoperability solutions across various blockchains highlight Dynamo's potential. With DeFi expansion, dynamo can enhance its DeFi offerings, broaden its user base, and foster partnerships with DeFi projects, becoming a pivotal hub for this financial revolution. Furthermore, it can explore DeFi innovations and expand its service portfolio to capture a substantial share of the evolving DeFi sector, establishing a strong foothold in the blockchain landscape.

Impacts of COVID-19 on the dynamo market

The COVID-19 pandemic initially caused significant market volatility across the cryptocurrency industry, including dynamo. As a highly speculative and risk-sensitive market, cryptocurrencies experienced both sharp declines and surges in value. This created uncertainty, affecting investor sentiment. Many investors sought to preserve capital in the face of economic uncertainty, leading to sporadic capital outflows from riskier assets like cryptocurrencies, including dynamo's native token, DYN. As the pandemic unfolded, cryptocurrencies' volatility began to stabilize, and investors cautiously returned, with some viewing digital assets as hedges against economic instability. The overall impact highlighted the need for cryptocurrencies to prove their resilience as alternative assets during times of economic crisis.

COVID-19 accelerated the adoption of remote work and the use of digital transactions. With more businesses and individuals operating online, the use of digital currencies and blockchain technology, including dynamo, gained traction. The need for efficient cross-border payments and secure digital financial services became apparent during the pandemic. Dynamo and similar blockchain platforms found an opportunity to showcase their capabilities in facilitating remote work, digital transactions, and financial services. The pandemic-driven shift in behavior and business operations opened doors for broader blockchain adoption and served as a catalyst for the development of decentralized finance (DeFi) applications and NFT marketplaces within the dynamo ecosystem.

COVID-19's economic impact prompted governments and regulatory bodies to intensify their focus on the cryptocurrency industry, including the dynamo market. As governments sought to address economic challenges and protect financial systems, regulatory scrutiny increased. This led to discussions of digital currencies and their potential regulation. Dynamo and other blockchain projects faced the prospect of more stringent regulatory requirements. To thrive in this evolving landscape, dynamo had to adapt by prioritizing compliance and working with regulators to ensure its long-term viability. Regulatory clarity became paramount for investors and businesses in the crypto space, with dynamo needing to navigate a shifting regulatory environment.

The economic upheaval caused by COVID-19 prompted individuals and institutions to explore alternative investments, including digital assets like cryptocurrencies. This increased interest in digital investments extended to Dynamo's ecosystem. Many saw digital currencies as a hedge against traditional market volatility, resulting in growing demand for blockchain-based financial services, such as yield farming, lending, and tokenized assets within dynamo market. Additionally, the pandemic's economic impact led to discussions about the digitization of assets and the potential for blockchain technology to enhance supply chain transparency and logistics, which further underscored dynamo's relevance. As individuals and institutions sought diversification and digital solutions, dynamo had the opportunity to attract new participants, expand its user base, and solidify its position in the evolving financial landscape.

According to the product type, the AC magneto dynamo has held a 35% revenue share in 2023. The AC (Alternating Current) magneto dynamo segment holds a substantial share in the dynamo market due to its versatility and widespread utility. AC systems offer efficient power generation, making them suitable for various applications, including electricity generation, industrial machinery, and electric vehicle charging. AC dynamo technology is proven, reliable, and widely adopted, making it a trusted choice for businesses and industries. Its compatibility with existing electrical infrastructure and seamless integration into different power systems make it a preferred solution. As a result, the AC magneto dynamo segment enjoys a significant market share due to its adaptability and robust performance across diverse sectors.

The AC/DC magneto dynamo segment is anticipated to expand at a significant CAGR of 6.8% during the projected period. The dominance of the AC/DC magneto dynamo segment within the dynamo market can be attributed to its remarkable adaptability and steadfast performance. This segment possesses the unique capability to harness both alternating current (AC) and direct current (DC), rendering it exceptionally versatile and suitable for a multitude of applications. This adaptational prowess has made it the preferred choice across a diverse spectrum of industries, spanning from heavy manufacturing to the burgeoning renewable energy sector. Moreover, the AC/DC magneto dynamos are renowned for their innate resilience and minimal upkeep prerequisites, guaranteeing prolonged operational efficiency. In view of their unswerving and dynamic nature, these dynamos have firmly entrenched themselves as the cornerstone of the dynamo market, alluring a wide array of users and industries.

Based on the end user, the automotive segment is anticipated to hold the largest market share of 38% in 2023. The automotive segment holds a significant share in the dynamo market primarily due to the increasing integration of blockchain technology for data security, supply chain management, and connected vehicle applications. Automakers are leveraging dynamo to enhance vehicle data security, streamline complex supply chains, and implement innovative services like vehicle-to-vehicle communication and autonomous driving. Additionally, blockchain's transparency and trust-building capabilities resonate with consumers seeking verifiable maintenance and accident history. These applications and the growing emphasis on data integrity and connectivity in the automotive industry drive the sector's substantial presence in the dynamo market.

On the other hand, the others segment is projected to grow at the fastest rate over the projected period. The other segment holds a major share in the dynamo market due to its diverse user base, which includes individuals and entities with varied needs and use cases. This category encompasses a wide range of participants, such as developers, traders, investors, and businesses, each seeking unique services and solutions offered by dynamo. Additionally, as the blockchain and cryptocurrency industry evolves, new user categories and applications emerge, contributing to the prominence of the other segment. This flexibility and inclusivity make dynamo an attractive platform, accommodating the diverse demands of this heterogeneous user base and solidifying its position as a versatile and dynamic blockchain ecosystem.

Segments Covered in the Report

By Product Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client