July 2024

The global E-banking market size is calculated at USD 9.98 trillion in 2025 and is forecasted to reach around USD 15.59 trillion by 2034, accelerating at a CAGR of 5.08% from 2025 to 2034. The North America E-banking market size surpassed USD 3.52 trillion in 2024 and is expanding at a CAGR of 5.21% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Trillion), with 2024 as the base year.

The global E-banking market size was estimated at USD 9.50 trillion in 2024 and is anticipated to reach around USD 15.59 trillion by 2034, expanding at a CAGR of 5.08% from 2025 to 2034. High smartphone penetration worldwide, the advent of 5G network and the growing banking sector are driving growth in the e-banking market.

Artificial intelligence (AI) in banking plays an important role by improving data analysis, predicting trends and fraud risks, and increasing customer engagement. AI can help banks minimize manual errors in data analytics, onboarding, document processing, customer interactions, and other tasks through algorithms and automation that follow the same processes every single time. It can help banks to help customer service, fraud detection, and money & investment management which help the growth of the e-banking market.

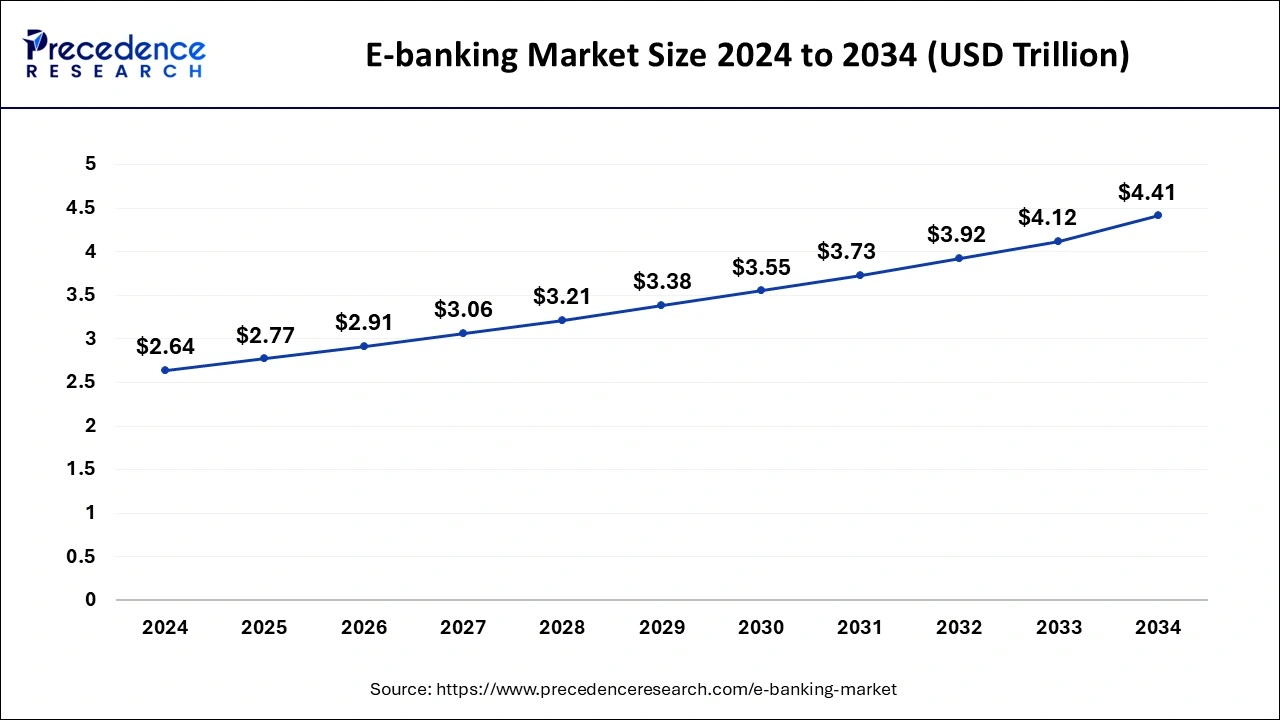

The U.S. E-banking market size was evaluated at USD 2.64 trillion in 2024 and is predicted to be worth around USD 4.41 trillion by 2034, rising at a CAGR of 5.26% from 2025 to 2034.

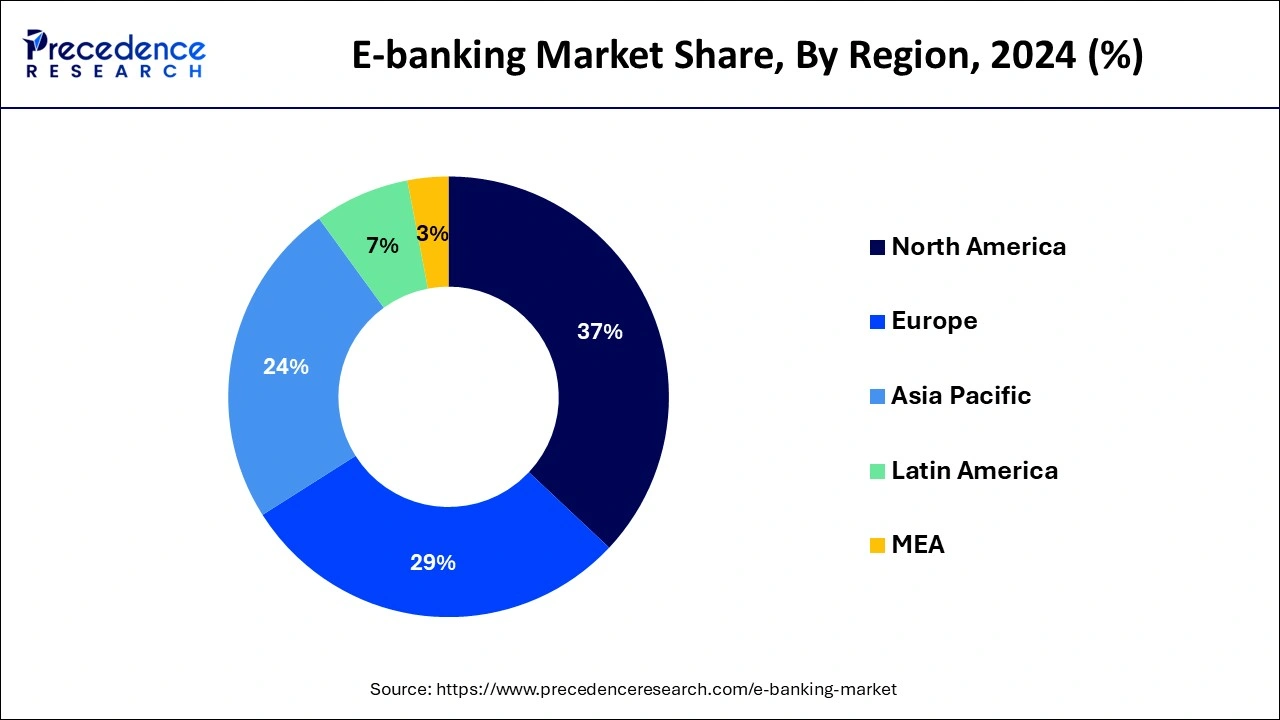

North America dominated the global E-banking market with the largest market share of 37% in 2024. The use of online-banking or mobile-banking is estimated to grow during the forecast. Asia Pacific is expected to expand at a solid CAGR during the forecast period. The developing nations in the Asia Pacific region are expected to have the highest growth. Due to awareness regarding the various online platforms and the benefits provided by these platforms there's an increase in the use of e-banking. The developed nations will show a steady growth during the forecast. There are great opportunities for the development of e-banking in developing nations. The introduction of various portals for payments and the use of these online portals for many financial transactions in the developing nations will lead to the growth in the market.

Asia Pacific region dominated the growth of the e-banking market. The use of online-banking or mobile-banking is estimated to grow during the forecast. Due to awareness regarding the various online platforms and the benefits provided by these platforms there's an increase in the use of e-banking. The developed nations will show a steady growth during the forecast. There are great opportunities for the development of e-banking in developing nations. The introduction of various portals for payments and the use of these online portals for many financial transactions in the developing nations will lead to the growth in the market.

The use of Internet for electronic payment systems which is used by the customers in the banks or any financial institutes is known as e-banking. It provides an online access to almost every banking service. Online access is provided to all the e-banking services. There are net banking portals which are secured by various login ID’s and password, which make it extremely secure to use. It is a convenient way for performing all the-banking functions. After applying for online-banking facilities a customer need not visit the bank every time for availing any of the-banking services in the future. E-banking is used by various individuals, institutes and businesses in order to access their account in order to transact business and to obtain information on various financial products. The popular types of services offered by the e-banking are mobile-banking, Internet banking, debit cards, ATM. Paying by phone systems and point of sale transfer terminals.

During the pandemic, there has been a major growth in the e-banking segment. The worldwide lockdown increased the use of Internet services for various banking options. Major drives were conducted for creating awareness in the public regarding the use of e-banking services for their banking activities. The pandemic has been a boon for increasing the market for e-banking in the developing as well as the developed nations even though the banks were opened during lockdown. The social distancing norms and the fear of the pandemic had forced the people to use the e-banking services.

The market for e-banking is expected to grow during the forecast as the people are getting accustomed to these online portals and various other ways of e-banking. The-banking industry has also seen standardization in the terms of services and the products offered by various mobile applications. The use of smartphones and Internet penetration has led to an increase in the market growth. E-banking has reduced all the geographical barriers. E-banking has helped in providing great online-banking interface to various members.

| Report Coverage | Details |

| Market Size by 2034 | USD 15.59 Trillion |

| Market Size in 2025 | USD 9.98 Trillion |

| Growth Rate from 2025 to 2034 | CAGR of 5.08% |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Software, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The online portal provides with the acknowledged slips which help in referring to the transactions in the future. There's no risk of loss or possibility of these transaction receipts getting misplaced. Tracking the history of all the transactions is very easy by sitting at home. In order to make transfers like the NEFT, RTGS and IMPS the user can do so from the convenience of their home. Making the bill payments is also easy through the online portals.

The payment of EMIs for loans or the payment of various premiums is easily done through these portals. These accounts are secured with the password for every user which helps in making it extremely secure. Apart from helping in all the financial transaction, these portals help in non-financial transactions also. Application and issuance of checkbooks can also be done through the online portal. All of these factors have helped in the growth of the market. E-banking provides access to financial institutes. They help in buying general insurance. They help in setting up an automatic recurring payments option and help in checking on investments linked with the bank.

The newly developed and accepted technologies namely artificial intelligence (AI), Internet of Things (IoT), blockchain technology, shared infrastructure, and robotic process automation (RPA), are ready to make numerous changes in the banking sector. These are the things that will lift the banking sector and transform the future of financial institutions.

One of the major important areas that banks want to enhance over digital banking is the experience of their consumers. The assumptions of consumers for these services are gradually being transformed by the experience they are getting from tech giants such as Apple, Amazon, Google, Facebook, and others, and their presumptions have increased comparing these with the other ones. The increased usage of digital technologies around several sectors is making it crucial for the banks to be on topmost priority for the delivery of their services.

From past few years, banking channels have made considerable changes. This fact is portrayed by the example of the dropped percentage of branch visits in comparison with 2011, and abiding stoppage of branches. Financial academies are re-considering at the act of branches, shifting from offering only services of transactions to a total altogether experience of banking by changing them to prominent localities, funding in services like video chats, booth of self service, and collecting areas with an attention on personal touch. All of this is entitled over digital technologies.

Several developing countries are not digitally literate yet, which hampers the huge adoption online payments. This factor affects the market growth in a negative way for the e-banking platforms. E-literacy concludes a vast range of skills like the capability to read and use the sense for gaining technical knowledge, which aids populace to function and utilize the present digital technologies. Many nations in the region of Africa have a stoop rate of this literacy. Thus, people are not able to employ digital technologies to the full extent. Tech suppliers are reluctant to make funding as a result of the less number of transactions. Therefore, the adequacy of digital literacy is hindering the market growth.

On the basis of the type, the retail banking segment is expected to have the largest market share during the forecast. The retail bank is the bank, which is also known as Consumer Bank. It provides services to the general public rather than companies or corporations. The retail banking segment is expected to grow as there are many day-to-day financial transactions that are carried on by the general public. The retail banking segment involves many payments. An increase in the consumer base availing the-banking services and the awareness regarding the online portals which makes. The-banking experience being extremely there shall be an increase in the retail banking segment. Availability of smart phones and various policies by the banks which promote the use of online portals. The retail banking segment is expected to grow.

The various online portals which are used for online payments provide many offers, like cash back offers and other promotional offers that lead an ink to an increase in the use of such portals. The ease of access provided by these portals to the consumers of the retail banking segment, the market is expected to grow. Increase in the population across the developing nations has led to an increase in the retail banking segment. The retail segment offers many benefits, such as the fixed deposits, recurring deposits and savings account. They also provide fixed and better rate of return and hence this market is expected to grow.

On the basis of the application segment for E-banking market it can be split into payments, processing services, risk management services, customer and channel management and others. The payments sub-segment is expected to grow during the forecast. The introduction of various payment portals and adoption of these portals by general public in many nations has led to a growth in this segment.

By Type

By Application

By Software

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

June 2024

August 2024

May 2025