What is the E-commerce Apparel Market Size?

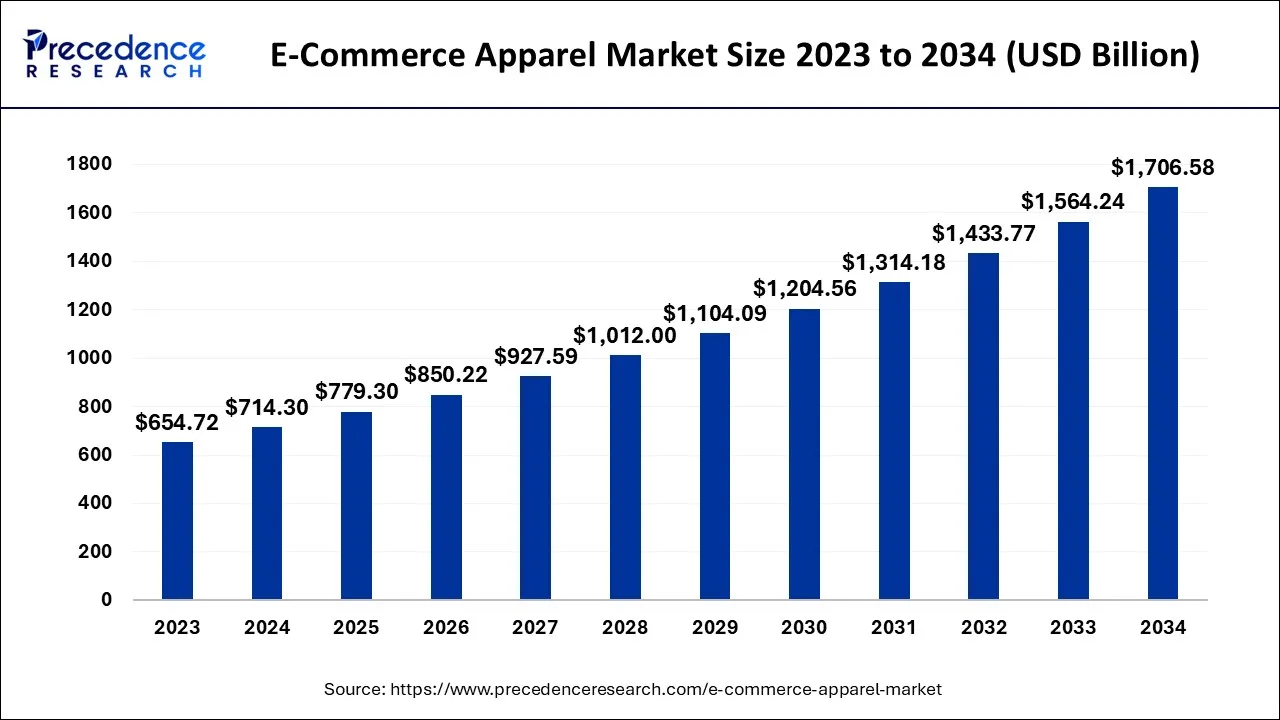

The global e-commerce apparel market size is calculated at USD 779.30 billion in 2025 and is predicted to increase from USD 850.22 billion in 2026 to approximately USD 1,706.58 billion by 2034, expanding at a CAGR of 9.10% from 2025 to 2034.

E-Commerce Apparel Market Key Takeaways

- In terms of revenue, the market is valued at $779.30 billion in 2025.

- It is projected to reach $1,706.58 billion by 2034.

- The market is expected to grow at a CAGR of 9.10% from 2025 to 2034.

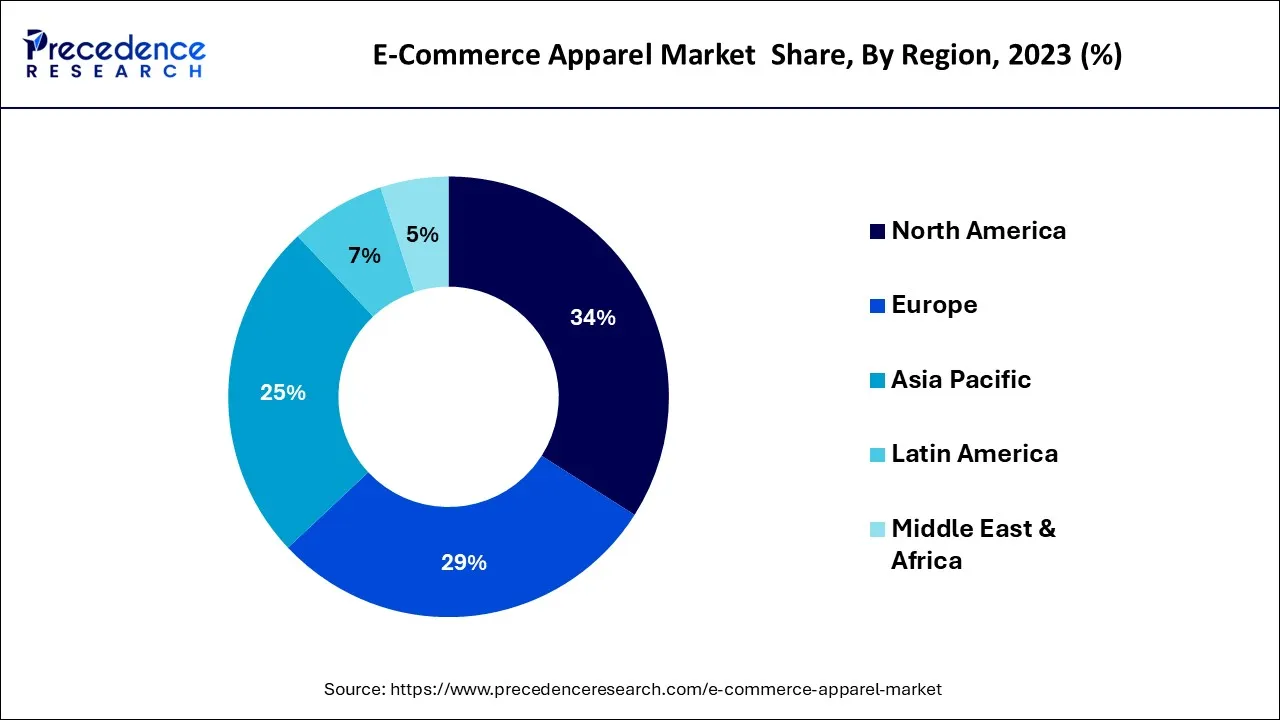

- The North America led the global market with the highest market share of 34% in 2024.

- By type, women's apparel segment accounted for 69% of revenue share in 2024.

Market Overview

The e-commerce apparel market refers to the online market for clothing and accessories. It involves buying and selling these products through various online platforms, such as online marketplaces, e-commerce websites, and social media platforms. The e-commerce apparel market has experienced significant growth in recent years, driven by factors such as the increasing use of mobile devices, the convenience of online shopping, and the availability of a broader range of products and styles than what may be available in physical stores.

- According to a report published by Internet Retailing, almost 85,000 businesses launched online shops during the Covid-19 pandemic.

- Shopify, a leading e-commerce apparel website, published its annual report for the year 2022. According to the report, the gross merchandise value of Shopify exceeded $197 billion in 2022.

- Additionally, Shopify's annual revenue for the toral year (2022) increased by 21% compared to 2021. Whereas the revenue for the fourth quarter of 2022 increased by 26% as compared to the prior year.

- Highlighting the significant activity made by Shopify, the company launched its own payment method, ‘Shopify Payments', in 2022 for Switzerland, France, the Czech Republic, and Portugal by making it available for 22 countries.

- With the rising demand for convenient shopping options, many traditional brick-and-mortar retailers have expanded their online presence, and many new online-only apparel retailers have emerged, offering customers a variety of options to purchase clothing and accessories online.

E-Commerce Apparel Market Growth Factors

The e-commerce apparel market is expected to witness a significant shift during the forecast period with the rising preferences for online shopping. More consumers are turning to online shopping for their clothing and accessory needs as e-commerce becomes more widespread and convenient. Online shopping offers a broader range of products and styles, as well as the convenience of shopping from home.

The increasing use of mobile devices, such as smartphones and tablets, has made it easier for consumers to shop online, even while on the go. Many e-commerce apparel retailers have optimized their websites and apps for mobile devices, making it easier and more convenient for customers to browse and shop on their mobile devices.

The rising influence of social media all across the globe is observed as a significant growth factor for the market. Social media platforms have become an important marketing and sales channel for e-commerce apparel retailers, with influencers and user-generated content helping to drive sales. E-commerce apparel retailers can reach a global audience, allowing them to expand their customer base beyond their local markets. Thus, the convenience offered by such platforms for retailers to expand their businesses across the world is fueling the growth of the e-commerce apparel market.

Advancements in e-commerce technology, such as augmented reality and virtual reality, have made it easier for customers to visualize clothing and accessories before making a purchase, improving the online shopping experience. Advances in logistics and fulfillment technologies have made it easier and more cost-effective for e-commerce apparel retailers to manage their supply chains and ship products to customers quickly and affordably.

E-commerce Apparel Market Outlook:

- Industry Growth Overview: The global e-commerce apparel industry is rapidly growing, fueled by smartphone adoption, better internet connectivity, and rising consumer preference for online shopping. AI-driven personalization, convenience, and omni-channel retail models are further enhancing consumer engagement and driving sales.

- Sustainability Trends: Sustainability is increasingly shaping consumer preferences and business strategies, with demand for products made from organic, recycled, or low-impact materials. Leading brands like H&M, Zara, and ASOS are adopting transparent supply chains, sustainable packaging, and carbon-neutral delivery, driven further by regulatory pressures in Europe and North America.

- Globalization: Leading e-commerce clothing platforms like Amazon, Alibaba, and Flipkart are expanding globally by enhancing fulfillment networks, last-mile delivery, and localized online stores. Platforms such as Shopify are empowering small and medium apparel brands with cross-border e-commerce solutions, supported by AI-driven analytics to tailor offerings to regional preferences and market dynamics.

- Major Investors: Private equity firms, venture capitalists, and strategic investors are increasingly drawn to the e-commerce apparel sector for its high growth potential and scalable, tech-driven models. Global investors like SoftBank, Tiger Global, Sequoia Capital, and Accel Partners are channeling funds into fashion marketplaces, D2C brands, and AI-powered logistics and recommendation technologies.

- Ecosystem Startup: The e-commerce apparel startup ecosystem is rapidly maturing, driven by AI innovation, digital marketing, circular fashion, and evolving customer engagement models. Startups like Rent the Runway, Myntra, Vinted, and Depop are redefining retail through rentals, subscriptions, and resale platforms, backed by strong investor support to scale globally and optimize supply chains.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,706.58 Billion |

| Market Size in 2025 | USD 779.30 Billion |

| Market Size in 2026 | USD 850.22 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.10% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising marketing strategies by social media influencers

Social media influencer marketing is considered one of the most highly effective methods for e-commerce apparel brands to reach a wider audience, drive sales and build brand awareness. Influencers promote e-commerce apparel brands and their products to their large social media followings, increasing the reach and visibility of the brand and its products.

- According to the latest data published by Influencer Marketing Hub in April 2024, almost 70% of marketers are planning to increase their budget for influencer-based marketing in the next 12 months.

Multiple e-commerce apparel brands are effectively targeting their marketing efforts by partnering with influencers. Influencers that create engaging content by incorporating consumer interests are expected to drive traffic towards e-commerce brands in an organic way; this is observed to act as a significant driver for the market's growth in the upcoming period.

Restraint

Risks associated with cybersecurity

E-commerce apparel retailers process and store large amounts of personal and financial data, including credit card numbers, addresses, and phone numbers. A data breach can result in the loss of sensitive customer information, leading to financial losses and reputational damage. Phishing scams can target e-commerce apparel retailers and their customers, attempting to steal login credentials and other sensitive information. Phishing emails and fake websites can be used to trick customers into entering their personal and financial information. The risk associated with cybersecurity limits consumers from shopping at e-commerce websites; this acts as a significant restraint for the growth of the e-commerce apparel market.

In August 2022, United States-based North Face, a prominent manufacturer of outdoor clothing, footwear, and accessories, stated that the company's corporate e-commerce website had suffered from a credential cyberattack, where the hackers can utilize authentication credentials, including phone number, email address, and passwords in order to get unauthorized access to consumes' accounts.

Opportunity

The deployment of artificial intelligence (AI) technology

According to a report published by McKinsey, companies that excel in personalization generate 40% more revenue than average players. The same research stated that consumers expect to receive personalized services while shopping online.

The deployment of artificial intelligence AI in the e-commerce apparel market is expected to open several opportunities for retailers to improve personalization, optimize inventory management, pricing, and customer service, and enhance security. AI-powered chatbots can provide automated customer service, helping customers with their queries and concerns 24/7. This can improve customer satisfaction and reduce the workload of customer service representatives. AI can be used to analyze pricing data and optimize pricing strategies to maximize revenue. This can help e-commerce apparel retailers to set competitive prices and increase profitability. AI can be used to optimize inventory management, predict demand, and automate the restocking process. This can help e-commerce apparel retailers to reduce inventory costs and increase efficiency.

For instance, In March 2022, Walmart announced the launch of an AI-powered virtual clothing try-on service for online shoppers, especially for Walmart's mobile app. The virtual technology service offers try-on for sizes XS to XXXL; the company aims to expand its model range in the upcoming period.

Type Insights

The women's apparel segment accounted for the largest share in 2024, and the segment is expected to maintain its dominance during the forecast period. Women's clothing tends to offer more variety in terms of styles, designs, and colors, making it more appealing to online shoppers who have access to a broader range of options.

E-commerce websites often offer more competitive prices on women's apparel than traditional brick-and-mortar stores, which can be a significant factor in attracting customers. Women's apparel is also heavily promoted on social media platforms and through influencer marketing campaigns, which can help generate buzz and increase visibility for these products. The women's apparel category carries a more significant segment of retailers and brands; this has led to additional investments in the women's apparel category.

The men's apparel segment is observed as the rapidly growing segment in the global market. With the rising number of online shoppers, multiple brands are focused on offering specialized apparel websites for men. The continuous growth in men's luxurious apparel options is another factor to boost the segment's growth.

In February 2024, Kerala-based apparel start-up, Giacca & Abito announced the launch of its online portal for apparel shopping, Tea & Tailoring. The newly launched e-commerce apparel website aims to provide premium clothing solutions, especially for men. The e-commerce platform will be offering premium innerwear, home textiles, and more.

The kids apparel segment is another attractive segment of the market, expected to witness a noticeable growth during the forecast period. With the rising number of people preferring online shopping, multiple brands launching clothing ranges for kids and expansion of e-commerce apparel businesses across the globe are observed to fuel the growth of the segment. With the launch of the kid's apparel range on e-commerce platforms, brands are focusing on differentiating themselves in the market.

- In October 2022, a globally prominent children's boutique, Danrie, announced the launch of an e-commerce shopping platform specially made for babies and children's wear.

Regional Insights

U.S. E-Commerce Apparel Market Size and Growth 2025 to 2034

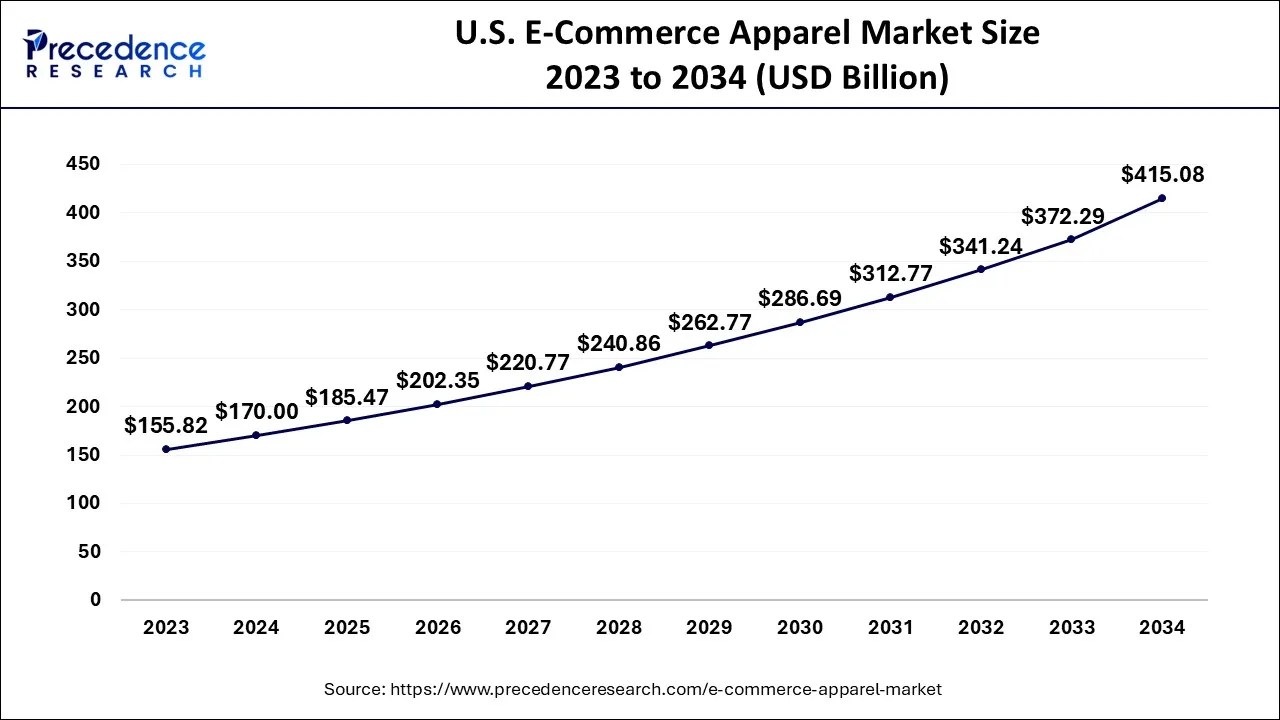

The U.S. e-commerce apparel market size is exhibited at USD 185.47 billion in 2025 and is projected to be worth around USD 415.08 billion by 2034, growing at a CAGR of 9.34% from 2025 to 2034.

North America dominates the global e-commerce apparel market, the region is expected to sustain its dominance throughout the forecast period.The e-commerce apparel market in North America has been experiencing strong growth, driven by factors such as convenience, greater variety and selection, and competitive pricing.

Online shopping in the United States reached $1.7 trillion in the duration of 2020-2022, which represents a 55% increase in online shopping. Considering the rising number of online shoppers in the region, the United States is observed to be the most significant contributor to the market's growth, followed by Canada. The most prominent e-commerce apparel companies, including Amazon, Walmart, Nike, Macy's, and Target, are based in the United States. The presence of such significant players plays an active role in the development of the market.

What Makes Asia Pacific the Fastest-Growing Area in the Market?

The e-commerce apparel market in Asia-Pacific is one of the largest and fastest-growing in the world, driven by factors such as rising disposable incomes, a growing middle class, and the increasing popularity of online shopping. China is the largest e-commerce market in the region, accounting for a significant share of total e-commerce apparel sales. As the technology becomes widely accepted by the developing countries of Asia Pacific, the e-commerce apparel market is intended to show significant growth in the region. Retailers in Asia are investing in livestream offerings, innovative services, diverse payment options, and risk management protocols; these factors are promoting the growth of the market in the region.

Moreover, the rising investments in warehouses and logistics in developing countries are fueling the market's growth. Beyond the increased demand for online shopping, sophisticated logistics services, a smooth supply chain, and the availability of diverse sources for online shopping are a few other factors to propel the market growth in Asia Pacific during the forecast period.

What Makes Europe a Notably Growing Area in the Market?

Europe e-commerce apparel market is growing at notable rate. Mobile-compatible platforms, seamless payment methods, and AI-enhanced personalization enhance user experience, boosting online apparel sales and regional market expansion. In 2023, the value of European mobile fashion commerce reached €89.6 billion, with smartphones representing 67% of total online fashion sales. Consumers seek sustainable materials, responsible sourcing, and transparent supply chains. Brands adopting sustainable practices boost market presence, enhance customer loyalty and regulatory adherence, and elevate long-term profitability. The apparel market in Europe sees cross-border e-commerce fueled by growing consumer interest in global brands, enhanced logistics, and simplified customs processes, broadening market access and boosting revenue prospects for online fashion merchants. European online clothing brands are increasingly utilizing AR-enabled virtual fitting rooms to assist customers in visualizing how garments will fit and look prior to buying. This innovation connects physical retail with digital shopping experiences, reducing return rates, enhancing customer confidence, and boosting online sales.

China E-commerce Apparel Market Trends

China is the major contributor to the Asia Pacific e-commerce apparel market, driven by its highly developed digital ecosystem, widespread smartphone usage, and dominance of major online retail platforms like Alibaba, JD.com, and SHEIN. The country's advanced logistics networks, seamless mobile payment systems, and strong consumer inclination toward online fashion shopping further reinforce its leadership in the region.

Germany E-commerce Apparel Market Analysis

Germany is expected to lead the European e-commerce apparel market due to high digital literacy, widespread internet access, and strong logistics infrastructure. Online retailers such as Zalando and About You are using omnichannel strategies to enhance the user experience, blending online shopping with delivery and returns. Trends in disposable income and urbanization are projected to further boost the market's growth.

What Opportunities Exist in Latin America for Market Growth?

Latin America presents significant opportunities for the growth of the e-commerce apparel market, supported by rising internet penetration, increased smartphone use, and a growing middle-class population. Countries like Brazil and Mexico account for most online sales, as they are urbanized and their consumers are becoming very comfortable with online payments. Additionally, regional e-commerce marketplaces boost cross-border trade, allowing international apparel brands to expand.

Brazil E-commerce Apparel Market Analysi

Brazil is expected to lead Latin America's e-commerce apparel sector, supported by rising internet access, a growing middle class, and widespread smartphone use. Online stores, including Mercado Libre and Magalu, likely increase sales as they provide convenient, localized payment options and a broad product selection. The expansion of regional logistics and last-mile delivery systems is expected to boost efficiency, especially for remote areas.

What Potentiates the Growth of the Market in the Middle East & Africa?

The Middle East and Africa e-commerce apparel market is expected to grow substantially, driven by rapid smartphone use, rising internet access, and government efforts to support digital transformation. The adoption of digital payments and fintech innovations lowers transaction barriers and encourages online shopping. Additionally, cross-border trade and regional partnerships are seen as further opportunities for growth, which would boost product availability and market reach.

UAE E-commerce Apparel Market Analysis

The UAE is expected to lead the e-commerce apparel market in the Middle East and Africa. This growth is driven by high smartphone penetration, rising disposable incomes, and strong logistics infrastructure. The trends of mobile commerce and social shopping are anticipated to foster greater involvement by younger generations. It is estimated that cross-border e-commerce partnerships expand product variety, enabling individuals to conveniently access international brands of apparel.

E-commerce Apparel Market – Value Chain Analysis

- Raw Material Sourcing

The foundation of apparel production begins with sourcing fibers and fabrics such as cotton, polyester, wool, silk, and sustainable alternatives like recycled or organic materials.

Key Players: Arvind Limited, Luthai Textile, Toray Industries, Reliance Industries. - Fabrication & Garment Manufacturing

Raw materials are converted into fabrics and then cut, sewn, and finished into ready-to-wear apparel, including dyeing, printing, and quality inspection.

Key Players: VF Corporation, H&M Manufacturing Partners, Shenzhou International, Li & Fung Limited. - E-commerce Platform Integration

Apparel brands or third-party sellers list their products on e-commerce platforms, integrating product catalogs, pricing, and digital merchandising.

Key Players: Shopify, Magento, WooCommerce (for D2C brands). - Logistics & Fulfillment

Products are warehoused, packed, and shipped using advanced supply chain management systems, ensuring timely delivery to consumers.

Key Players: Amazon Fulfillment, JD Logistics, Flipkart Supply Chain, DHL eCommerce. - Marketing & Customer Engagement

E-commerce apparel platforms use digital marketing, social media, influencer partnerships, personalized recommendations, and loyalty programs to drive sales and brand loyalty.

Key Players: Facebook/Meta Ads, Google Shopping, Instagram, TikTok, Salesforce Commerce Cloud. - Last-Mile Delivery & Returns Management

Products reach customers via home delivery or pickup points, while efficient return management and reverse logistics handle exchanges or refunds to maintain customer satisfaction.

Key Players: FedEx, UPS, Delhivery, SF Express, ZTO Express. - Post-Purchase Analytics & Consumer Feedback

Data analytics tools capture consumer behavior, reviews, and purchasing patterns, enabling brands and platforms to optimize product offerings, pricing, and inventory.

Key Players: Adobe Analytics, Google Analytics, SAS, Shopify Analytics.

E-commerce Apparel MarketCompanies

- Walmart: Walmart operates one of the largest global e-commerce platforms, offering a vast assortment of apparel through its online marketplace and direct-to-consumer channels.

- Amazon: Amazon dominates online retail with an extensive apparel portfolio, leveraging advanced logistics, Prime delivery, and private-label clothing brands.

- Alibaba Group Holding Limited: Alibaba connects millions of apparel sellers and buyers through platforms like Tmall and Taobao, enabling both domestic and international e-commerce growth.

- eBay Inc: eBay provides a global marketplace for new, vintage, and second-hand apparel, facilitating consumer-to-consumer and business-to-consumer transactions.

- Shopify, Inc: Shopify powers online stores for apparel brands of all sizes, offering customizable storefronts, payment solutions, and integrated logistics support.

- JD.com: JD.com offers a direct-to-consumer e-commerce model for apparel, known for fast delivery, authenticity guarantees, and tech-driven inventory management.

- Flipkart: Flipkart is a leading online marketplace in India, offering a wide range of apparel and fashion products with competitive pricing and regional distribution networks.

- Rakuten Inc: Rakuten provides an extensive online marketplace for apparel, integrating loyalty programs and digital services to enhance consumer engagement and retention.

Recent Developments

- In June 2025, new direct-to-consumer brand Snitch initiated a pilot program for its rapid fashion delivery service in Bengaluru, aligning with brands like Newme, Slikk, and ecommerce platforms including Myntra, Ajio, and Nykaa in examining ultra-fast delivery for fashion and apparel.

- In January 2025, Reid and Taylor Apparel adopted Unicommerce's multi-channel order management, warehouse management, and omnichannel retail systems, enhancing efficiency across its website, brick-and-mortar stores, warehouses, and digital platforms. The goal of this integration is to streamline order processing and improve the retail experience in India through a centralized dashboard for effective management.

- In April 2025, Saks Fifth Avenue collaborated with Amazon Fashion to introduce Saks on Amazon, a novel shopping experience in Luxury Stores at Amazon showcasing a curated collection of high-end products selected by Saks Fifth Avenue. The updated multi-brand shop allows customers to reach some of the most desirable luxury fashion and beauty brands within Amazon's store.

- In February 2023, globally leading e-commerce platform, Amazon announced the launch of The Plus Shop, a special line for plus-size apparels from various brands in India. The new line of clothing offers plus size clothing options from 450 brands including Bigbanana, W for Woman, Allen Solly, Plus and U.S. Polo Assn.

- In February 2023, Marks & Spencer announced the launch of its new e-commerce platform ‘Spors Edit' for sportswear designed for men and women. Sports Edit aims to offer over 200 sportswear and apparel which also includes a range of clothing from third-party brands, including Veja, Hoka, and FP Movement.

- In March 2023, We Weave, a growing brand of garments based in India, announced the launch of its e-commerce platform to fulfill the rising demand for handloom sarees. The brand aims to be valued at 100 cr by the end of 2030. The e-commerce platform by We Weave aims to offer woven handloom sarees, dupattas, and stoles produced by various weavers across the nation.

- In January 2022, Elysewalker, a luxury fashion retail brand announced the launch of an e-commerce site to expand the consumer base nationwide. With the launch the brand aims to offer personalized and elevated fashion solutions.

Segments Covered in the Report

By Type

- Men's Apparel

- Womens Apparel

- Kids Apparel

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content