What is the E-Commerce Fulfillment Services Market Size?

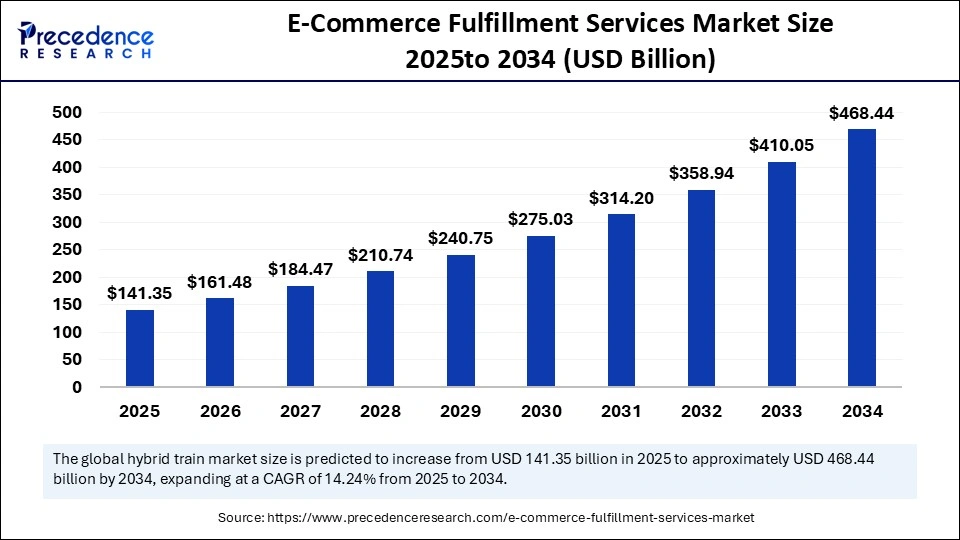

The global e-commerce fulfillment services market size is accounted at USD 141.35 billion in 2025 and predicted to increase from USD 161.48 billion in 2026 to approximately USD 468.44 billion by 2034, expanding at a CAGR of 14.24% from 2025 to 2034. The growing popularity of online shopping among consumers is expected to boost the growth of the market during the forecast period.

E-Commerce Fulfillment Services Market Key Takeaways

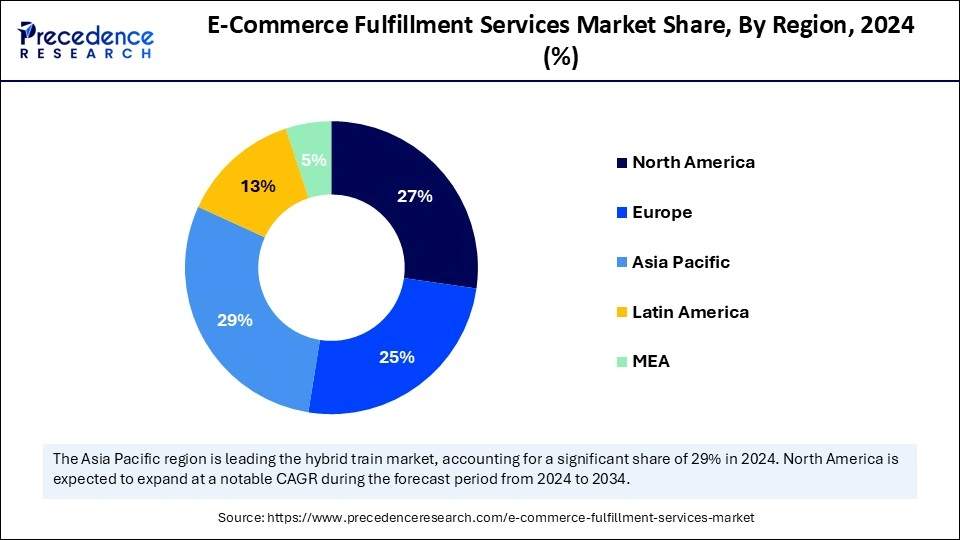

- Asia Pacific dominated the global market with largest market share of 29% in 2024.

- North America is projected to show the fastest growth during the forecast period.

- By service, the shipping fulfillment services segment led the market in 2024.

- By service, the warehouse and storage fulfillment service segment is likely to witness significant growth in the coming years.

- By sales channel, the business-to-business segment held the dominant share of the market in 2024.

- By sales channel, the business-to-customer segment is expected to grow at the fastest rate during the projection period.

- By application, the clothing & footwear segment led the market in 2024.

- By application, the consumer electronics segment is projected to grow at the fastest rate between 2025 and 2034.

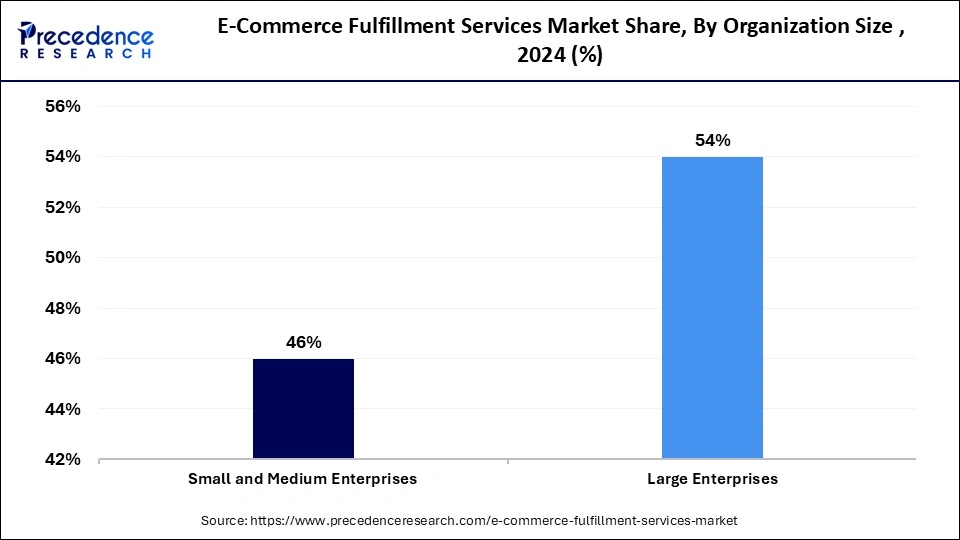

- By organization size, the large enterprises segment captured the biggest market share of 54% in 2024.

- By organization size, the small and medium enterprises segment is expected to expand at the highest CAGR in the coming years.

Why AI Integration is Boosting the E-Commerce Fulfillment Services Market?

Artificial Intelligence (AI) is making its way into several industries, including e-commerce and logistics. AI technology has emerged as an ideal solution to boost operational efficiency and cater to the varying demands of the e-commerce industry. AI-driven automation, for example, helps in automating tedious tasks like packing, picking, etc. AI can reduce labor costs and manual errors. AI technology can also help in optimizing inventory management, route selection, and streamlining operations. With AI technology, adapting to the evolving delivery needs of consumers can be fulfilled. AI helps in keeping the inventory synchronized in all the channels, which ensures a smooth shopping experience for the customers. A major benefit of AI is the enablement of real-time tracking and visibility for consumers. AI-driven tools provide customers with real-time updates on order status, allowing them to track the packages at their convenience.

- In October 2024, Amazon opened a next-generation fulfillment center that features innovative technologies like AI and robotics. The company estimated that this next-gen fulfillment center, with advanced technology, eases tasks for employees and improves operational safety.

Powering Online Shopping: How E-Commerce Fulfillment Services Are Revolutionizing Delivery And Efficiency

E-commerce retailers widely outsource processes like shipping, warehousing, and packaging. A fulfillment center offers a perfect solution to e-commerce companies that lack established warehousing capacities to manage different processes. The rapid growth of the e-commerce sector across the world is boosting the growth of the e-commerce fulfillment services market. An increase in demand for e-commerce platforms and the growing trend of online shopping are propelling market growth.

The rising adoption of advanced technologies like AI, automation, and robotics in e-commerce operations is boosting the efficiency and timeliness of e-commerce purchases. There is a strong focus on optimizing delivery processes. Moreover, the widespread accessibility of Internet services, smartphones, and other consumer electronics is supporting market growth.

E-Commerce Fulfillment Services Market Growth Factors

- The rapid expansion of the e-commerce sector worldwide is a major factor boosting the growth of the e-commerce fulfillment services market.

- The rising accessibility and availability of internet services is propelling the growth of this market.

- The increasing consumer demand for personalized shopping experiences contributes to market expansion.

- The rising demand for the same-day and next-day delivery fuels the growth of the market.

Market Outlook

- Industry Growth Offerings- The market is growing due to rising online shopping, demand for faster deliveries, outsourcing of warehousing and logistics, adoption of automation and AI technologies, and the need for efficient, cost-effective, and scalable supply chain solutions.

- Global Expansion- Global expansion of the market is driven by the rapid growth of online retail worldwide, increasing cross-border trade, adoption of advanced logistics technologies, rising demand for fast deliveries, and outsourcing of warehousing and supply chain operations.

- Startup ecosystem- The startup ecosystem for e-commerce fulfillment services is thriving due to increasing investment in logistics technology, the emergence of innovative warehousing and last-mile delivery solutions, growing demand for scalable services, and opportunities to support small and medium-sized online retailers globally.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 468.44 Billion |

| Market Size in 2025 | USD 141.35 Billion |

| Market Size in 2026 | USD 161.48 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.24% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Sales Channel, Application, Organization Size and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Penetration of Internet Services and Smartphones

The increased penetration of internet services and smartphones across the world is a key factor driving the growth of the e-commerce fulfillment services market. For instance, in 2024, there were about 5.5 billion Internet users. This represents 68% of the global population, which is more than 65% in comparison to previous years. Such widespread utilization and accessibility to the Internet are accelerating the growth of the e-commerce sector. With the increasing proliferation of smartphones and internet connectivity, the popularity of mobile commerce is rising.

Consumers are becoming more and more comfortable with making purchases online. This, in turn, boosts the demand for faster delivery services. Factors such as doorstep deliveries, an array of options available, discounts, convenience, online payments, package tracking, and easy return policies are encouraging consumers to opt for online purchasing.

Restraint

High Operational Costs

A major factor limiting the growth of the market is the high costs required for the operations of fulfillment services. Many operational components need to be streamlined and functioning efficiently. This needs substantial investments to initiate and maintain. With significant costs associated with warehousing, expenses associated with labor, logistics, and transportation can pose a challenge, especially for small and medium-sized enterprises, since they have limited resources available. The e-commerce fulfillment services costs impact the profit margins.

Opportunity

Rise of Trade Liberalization Policies and Cross-border Shipping Agreements

The rising trade liberalization policies and cross-border shipping agreements create immense opportunities in the e-commerce fulfillment services market. There has been a steady increase in the number of shipments amongst different countries because of favorable support and policies from the governments and other agencies. The growth of multilateral free trade agreements has made logistics on a global scale much easier. For instance, India has signed approximately 13 Free Trade Agreements (FTAs) in the last five years. Such policies have brought the world closer, helping transportation of goods and services to almost all parts of the world. A rapid pace of globalization also opens new avenues for the market to expand into different regions all over the world.

Service Type Insights

The shipping fulfillment services segment dominated the e-commerce fulfillment services market with the largest share in 2024. This is mainly due to the rise of trade liberalization policies as well as cross-border shipment agreements. The rapid expansion of the e-commerce sector and heightened demand for last-mile delivery further bolstered the growth of the segment. The growing trend of outsourcing shipping activities by ecommerce companies further solidifies the segment's position in the market.

Meanwhile, the warehouse and storage fulfillment service segment is likely to witness significant growth in the coming years. The growth of the segment can be attributed to the rising demand for warehousing automation solutions. The adoption of automation and augmented reality (AR) has increased in these facilities. These technologies help in enhancing operational efficiency in warehouses and storage, supporting segmental growth.

Sales Channel Insights

The business-to-business segment dominated the market in 2024. The B2B order fulfillment services help deliver large and bulk shipments to the destination company. These services help businesses to pre-store goods that are vital for companies to fulfill their orders. The increased online B2B sales in the last few years bolstered the segmental growth.

On the other hand, the business-to-customer segment is expected to grow at the fastest rate during the projection period. B2C fulfillment services include the picking and packing of smaller items for smaller or one-time purchases that are being delivered on a regular basis. B2C services eliminate middlemen, enhancing profitability for businesses and consumer shopping experiences. The rising consumer demand for fast-delivery services further boosts the growth of the segment.

Application Insights

The clothing & footwear segment led the e-commerce fulfillment services market in 2024. This is mainly due to the increased sales of clothing and footwear in the last few years. These items are considered widely purchased items on e-commerce platforms across the world. With the growing popularity of fast fashion, people are increasingly purchasing clothing and footwear, which further bolsters the growth of the segment.

Meanwhile, the consumer electronics segment is projected to grow at the fastest rate over the studied period. The increasing demand for consumer electronics around the world is a key factor supporting the growth of the segment. Several consumer electronic products, like speakers, headphones, and cables, require safe and quicker delivery. The rising demand for personalized delivery services for fragile items, such as high-end consumer electronics, is likely to contribute to segmental growth.

Organization Size Insights

The large enterprises segment dominated the e-commerce fulfillment services market in 2024. Large enterprises widely utilize e-commerce fulfillment services since they deliver large volumes of goods. These services provide large enterprises with benefits like a boost in revenue generation and a reduction in shipping costs. These enterprises are often involved in cross-border shipments. Thus, they require e-commerce fulfillment services. On the other hand, the small and medium enterprises segment is expected to expand at the highest CAGR in the coming years. These enterprises, especially those with limited budgets, are seeking ways to reduce shipping costs. However, e-commerce fulfillment services help these enterprises reduce labor and shipping costs, boosting their profit margin.

Regional Insights

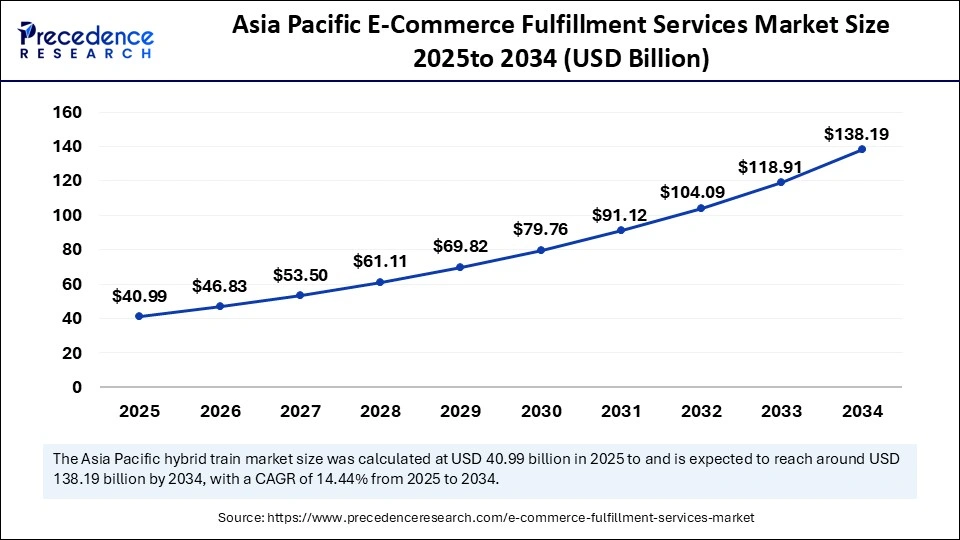

Asia Pacific E-Commerce Fulfillment Services Market Size and Growth 2025 to 2034

Asia Pacific e-commerce fulfillment services market size is exhibited at USD 40.99 billion in 2025 and is projected to be worth around USD 138.19 billion by 2034, growing at a CAGR of 14.44% from 2025 to 2034.

E-commerce Growth Fuels Asia Pacific's Fulfillment Market Dominance

Asia Pacific held the dominant share of the e-commerce fulfillment services market in 2024. This is mainly due to the increased disposable income and penetration of Internet services around the region. With the increased proliferation of smartphones and the Internet, the availability and accessibility to ecommerce platforms have increased, encouraging consumers to purchase goods from the comfort of their homes. This has led to exponential growth in e-commerce sales. The rapid expansion of the e-commerce sector further bolstered the market's growth in the region.

Countries like China, Japan, and South Korea are among the top exporters of merchandise. Online retail has increased steadily in China in the last few years. According to the data from the National Bureau of Statistics, China registered online retail sales of 14 trillion yuan (USD 1.92 trillion) in the first 11 months of 2024, up 7.4% over the same period in 2023.

Why is North America Leading the E-Commerce Fulfillment Services Boom?

North America is projected to show the fastest growth during the forecast period. The presence of key market players in the region is a key factor supporting the growth of the market in the region. There is a high level of advanced technologies, like automation, in warehouse management. The increasing trend of online shopping and rising Internet users are expected to contribute to regional market growth.

The U.S. plays a crucial role in the North American e-commerce fulfillment services market. The U.S. is home to leading e-commerce companies like Amazon and Shopify. About 50% of all e-commerce companies worldwide are located in the U.S. The rising demand for faster delivery services and increasing trade activities are likely to boost the growth of the market in the country.

Why the U.S. E-Commerce Fulfillment Services Are Sourcing in the Age of Online Shopping

The U.S. market is expanding due to the rapid growth of online shopping, increasing demand for faster and more reliable deliveries, and the rise of e-commerce platforms. Companies are outsourcing warehousing, packaging, and shipping to improve efficiency. Adoption of advanced technologies like AI, robotics, and automation enhances order accuracy and speed, while widespread internet access and smartphone usage further drive consumer demand and market growth.

What's Driving the Growth of Europe's E-Commerce Fulfillment Market?

Europe is expected to show notable growth in the upcoming period. The increasing implementation of buy online pickup in-store (BOPIS) is boosting the growth of the market. BOPIS enables retailers to drive in-store foot traffic and enhance online shopping experiences with speed. Online shopping is gaining immense popularity in the region, requiring e-commerce fulfillment services to ensure the availability of inventory and timely order processing. In addition, the rapid expansion of small and medium-sized e-commerce businesses and the increasing e-commerce activities are expected to propel the growth of the e-commerce fulfillment services market in Europe

China's Commerce Fulfillment Services Boom: Driving Speed, Efficiency, and Consumer Satisfaction

China's market is growing rapidly due to the country's booming online retail sector and increasing consumer preference for fast, reliable deliveries. Rising smartphone and internet penetration, the expansion of e-commerce platforms, and the adoption of advanced technologies like AI, automation, and robotics are enhancing operational efficiency. Additionally, businesses increasingly outsource warehousing, packaging, and logistics to meet rising demand and optimize supply chain management, driving market growth.

Revolutionizing Delivery: The Rise of. E-Commerce Fulfillment Services in the UK

The UK market is expanding as retailers focus on streamlining supply chains and meeting increasing consumer demand for same-day and next-day deliveries. Growth is supported by rising online shopping trends, technological integration such as robotics and AI, and the outsourcing of logistics, warehousing, and packaging. Additionally, government support for digital infrastructure and increased smartphone and internet usage are fueling the market's development.

Top Vendors and their Offerings

- FedEx: Provides end-to-end logistics solutions, including shipping, warehousing, order fulfillment, and express delivery services for e-commerce businesses globally.

- ShipBob, Inc.: Offers tech-driven fulfillment services with warehousing, inventory management, packaging, and fast shipping solutions for online retailers.

- Amazon.com, Inc.: Operates Fulfillment by Amazon (FBA), providing storage, packaging, shipping, and customer service for third-party e-commerce sellers.

- Ingram Micro, Inc.: Delivers global e-commerce fulfillment, logistics, warehousing, and supply chain solutions, supporting both retailers and technology providers.

- Xpert Fulfillment: Offers customized order fulfillment, inventory management, packaging, and shipping services tailored for small to medium-sized online businesses.

Recent Developments

- In February 2025, H-E-B opened a new e-commerce fulfillment center in Houston, Texas, U.S. This facility offers more capacity, improved efficiency, and adds convenience to serving the in-store and digital consumers better.

- In July 2024, ShipCalm announced the acquisition of River Source Logistics. This strategic move by the company will help it expand e-commerce fulfillment and third-party logistics capacities.

E-Commerce Fulfillment Services Market Companies

- Amazon.com, Inc.

- eFulfillment Service, Inc.

- Ingram Micro, Inc.

- Rakuten Super Logistics

- Red Stag Fulfillment

- ShipBob, Inc.

- Shipfusion Inc.

- Xpert Fulfillment

- Sprocket Express

- FedEx

- United Parcel Service of America, Inc.

Segments Covered in the Report

By Service Type

- Warehousing and Storage Fulfillment Services

- Bundling Fulfillment Services

- Shipping Fulfillment Services

- Others

By Sales Channel

- Direct-to-Customer

- Business-to-Customer

- Business-to-Business

By Application

- Automotive

- Beauty & Personal Care

- Books & Stationery

- Consumer Electronics

- Healthcare

- Clothing & Footwear

- Home & Kitchen Application

- Sports & Leisure

- Others

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting