October 2024

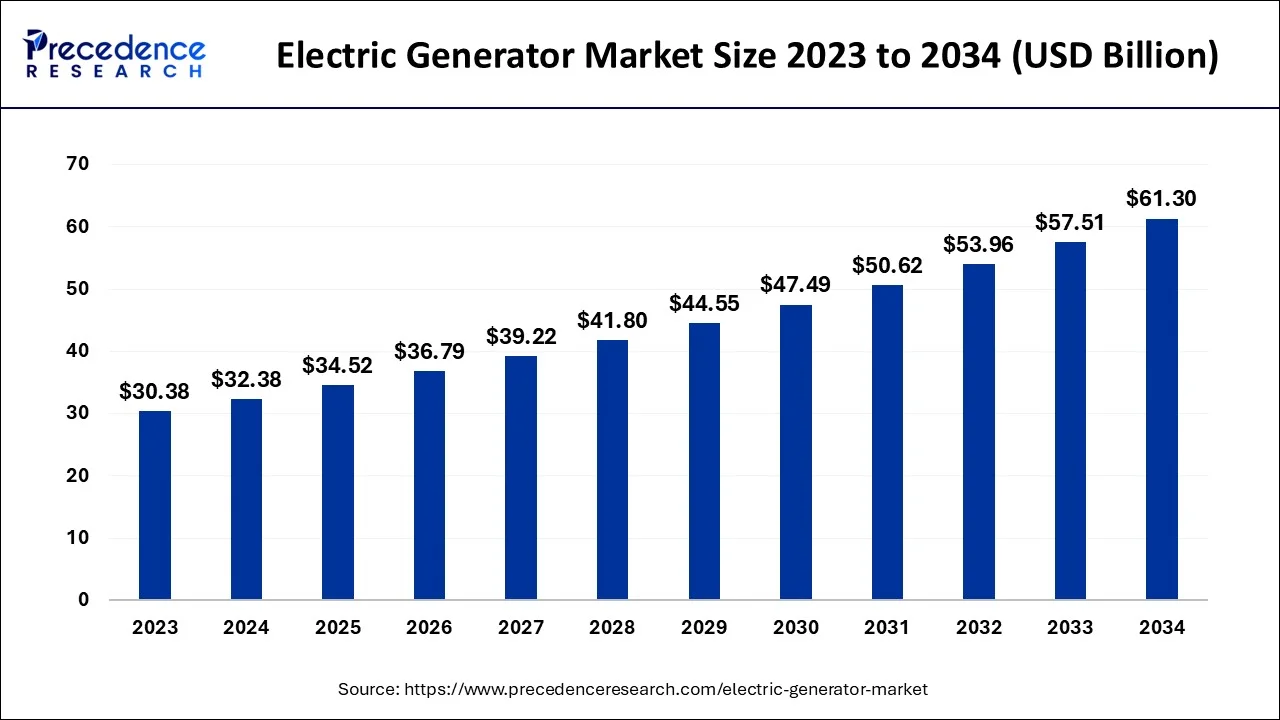

The global electric generator market size accounted for USD 32.38 billion in 2024, grew to USD 34.52 billion in 2025 and is projected to surpass around USD 61.3 billion by 2034, representing a healthy CAGR of 6.59% between 2024 and 2034.

The global electric generator market size is estimated at USD 32.38 billion in 2024 and is anticipated to reach around USD 61.3 billion by 2034, expanding at a CAGR of 6.59% from 2024 to 2034.

The electric generator market is the global market for devices that convert mechanical energy into electrical energy. These generators generate electricity in various applications, from industrial and commercial settings to residential and portable power solutions. Electric generators convert mechanical energy, such as the rotational force produced by a turbine or an engine, into electrical energy through electromagnetic induction. The resulting electricity can then be used to power electrical devices and systems.

Various factors, including the increasing demand for reliable and uninterrupted power supply in various industries, the growing adoption of renewable energy sources such as wind and solar power, and the need for backup power solutions in emergencies, drive the electric generator market. Various technological advancements also influence the market in generator design and the increasing focus on energy efficiency and environmental sustainability. Thus, the electric generator market is expected to grow as the demand for reliable and efficient power supply solutions increases across various industries and applications.

Furthermore, urbanization and industrialization are driving the demand for electric generators, particularly in developing countries. Electric generators power various industrial and commercial applications, including construction sites, oil and gas exploration, and mining. Also, the increasing need for backup power solutions in emergencies, such as natural disasters, drives the demand for electric generators. In addition, electric generators are also used as a primary power source in remote locations where grid power is unavailable. Thus, these factors drive demand for the electric generator market.

However, high initial investment, maintenance and service costs, and fluctuations in fuel prices are anticipated to impede the market growth. Electric generators can be expensive to purchase and install, especially for larger systems with higher power output. This can limit adoption, particularly for small businesses and residential applications. Thus, while the electric generator market has significant potential, it is important to consider these restraints to ensure the market can grow sustainably.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have disruptions in supply chains and manufacturing, resulting in a slowdown in the market. The subsequent increase in demand for backup power solutions has driven market growth. However, the pandemic caused disruptions in the supply chain and manufacturing of electric generators. The closure of factories and transportation restrictions led to delayed production and delivery of generators. The lockdowns also led to declining demand for generators in some sectors, such as commercial and industrial applications, as many businesses scaled back their operations.

Several Governments around the world are implementing supportive policies and programs to reduce carbon emissions and promote clean energy sources, which creates significant growth opportunities for electric generator manufacturers

How does technological innovation continue to impact the market of electric generators?

The electric generator market is expanding rapidly to meet the evolving demand for reliable power, particularly in challenging environments, by integrating innovations like smart technology, energy storage, and compact designs. Several businesses are heavily investing in generator technology with the increasing demand for uninterrupted power and reliability. There are various latest innovation that aids in shaping the future of generator technology such as hybrid power systems, smart & efficient design, advanced fuel options, emission reduction technologies, remote monitoring, energy storage integration, advanced control algorithms, and others. Generator manufacturers are increasingly focusing on automation to make generators, reliable, safer, and more cost-effective. Generators include automatic transfer switches which detect power outages and automatically switch from the grid to the generator. In Industry 4.0 generators use internet-connected technology. Generator manufacturers are incorporating IoT technology and AI into their products to enable real-time monitoring, remote control, and predictive maintenance.

| Report Coverage | Details |

| Market Size in 2024 | USD 32.38 Billion |

| Market Size by 2034 | USD 61.3 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.59% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Application, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing application of electrical generators

The rise in the application of electrical generators is expected to boost the growth of the electric generator market during the forecast period. Electrical generators are most widely used for a wide range of applications, such as power at remote construction sites, outdoor events, emergency power supply in hospitals, data centers, and manufacturing facilities, power for farm irrigation systems, and others. In recent years, portable power generators have become popular as a reliable source of backup power for businesses and homes. They are also most commonly used for outdoor activities including camping, tailgating, and powering construction equipment and tools on job sites. With the rapid advancements in technology, the future of portable power generators holds potential as a more efficient and sustainable option. They include several safety features, including overload protection and low oil shutdown, to avoid or prevent damage to the generator and connected equipment. Such factors are driving the growth of the market during the forecast period.

Growing adoption of renewable energy sources

The deployment of renewables for electricity generation plays an important role. In 2022, Key policies were announced to support the expansion of renewable energy such as the United States introduced Inflation Reduction Act (IRA), which is expected to support renewable energy in the next 10 years through tax credits and other measures and China published the 14th Five-Year Plan for Renewable Energy, which includes a target of 33 percent of electricity generation from renewables by 2025.

High initial and maintenance cost is causing hindrances to the market

Electric generators can be expensive to purchase, install, and maintain. The cost of an electric generator can vary widely depending on the power capacity, features, and brand. The high initial cost of electric generators can make them unaffordable for many residential and small business consumers. This can limit the market size for electric generators, particularly in developing countries with limited electricity access, and the cost of purchasing an electric generator may be prohibitively expensive for many households. Moreover, the operating costs of electric generators, such as fuel and maintenance expenses, can also be high. The fuel cost, for instance, can fluctuate depending on global oil prices, making the cost of operating an electric generator unpredictable and volatile.

However, the high initial cost of electric generators can be offset by their long lifespan and ability to provide a reliable and uninterrupted power supply. In addition, technological advances and increased competition in the market are expected to drive down the cost of electric generators, making them more accessible and inexpensive to a broader range of consumers. Therefore, the high initial cost of electric generators is a major restraint for the demand in the market. Their long-term benefits and the potential for cost reduction are expected to support the market's growth.

The diesel generator segment accounted for the dominating share in 2023. Diesel generator is widely used in many versatile applications across various industries including as backup power for buildings and infrastructure and in the construction, mining, and oil and gas industries. Diesel generators are preferred for their reliability, durability, and fuel efficiency, making them a cost-effective choice for many applications. Diesel generators are used to offset the peaking power needs on the grid as they can be turned on and off quickly without inducing any lag time. In rural places, diesel generators are connected to a power grid and can be used as the main power source or as a backup system. Thus, propelling the expansion of the segment in the coming years.

On the other hand, the gas generator segment is expected to witness a significant share during the forecast period. Gas generators provide a dependable supply of electricity. Gas generators are cheaper to run and more environmentally friendly options when compared to diesel generators owing to the levels of carbon dioxide they produce and provide less noise pollution. Gas generators are most extensively used to provide power to office buildings, hospitals, leisure centres, agricultural facilities, shopping centres, or domestic properties. Thereby, bolstering the growth of the segment during the forecast period.

On the basis of the application, the electric generator market is divided into stand-by, peak shaving, and continuous, with stand by accounting for most of the market. This is because the uninterrupted power supply is critical in many residential, commercial, and industrial settings. However, demand for peak shaving and continuous generators is also expected to grow as businesses and utilities seek to optimize energy usage and improve reliability.

The construction segment held the largest share of the electric generator market in 2023 and is expected to sustain the position throughout the forecast period owing to the increasing need for reliable and continuous power supply to operate machinery and equipment. Construction sites most widely deploy electric generators to provide temporary power backup to operate efficiently in areas where grid power is not available. Moreover, the surge in infrastructure development and construction activities led to an increasing demand for electric generators in the coming years. Thus, driving the growth of the segment in the coming years.

On the other hand, the mining, oil & gas segment is expected to grow significantly during the forecast period. Electric generators play a crucial role in the mining, oil & gas industry as they provide key power sources to assist with drilling and digging. The procedure of both drilling and digging requires consistent power to provide service to heavy equipment. Electric generators are most commonly used to support the processing, extraction, storage, and transportation of various critical products including crude oil, natural gas, and petroleum. Thus, bolstering the growth of the segment.

On the basis of geography, North America dominates the market, primarily driven by technological advancements in generator technology, such as the development of more fuel-efficient and environmentally friendly generators, as well as the increasing use of digital controls and automation systems. It is expected to grow, driven by the increasing demand for reliable and continuous power supply in various industries and applications.

Europe is a significant market for electric generators, with Germany, the United Kingdom, and France being the major contributors to the market's growth. The increasing adoption of renewable energy sources in Europe drives demand for electric generators that can be used as backup power sources for renewable energy systems. This is particularly relevant in countries with high levels of renewable energy generation, such as Germany and Denmark. Also, European countries have some of the strictest emissions regulations in the world, and generator manufacturers are responding with new technologies that reduce emissions and improve efficiency.

The region in Asia-Pacific is anticipated to have the greatest CAGR. The market is driven by the increasing demand for reliable and uninterrupted power supply, rapid industrialization, and growing construction activities in the region. The growing need for backup power in various industries such as healthcare, telecommunications, and data centers is also contributing to the growth of the electric generator market in the Asia-Pacific region.

Segments Covered in the Report:

By Type

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

June 2025

December 2024

October 2024