April 2023

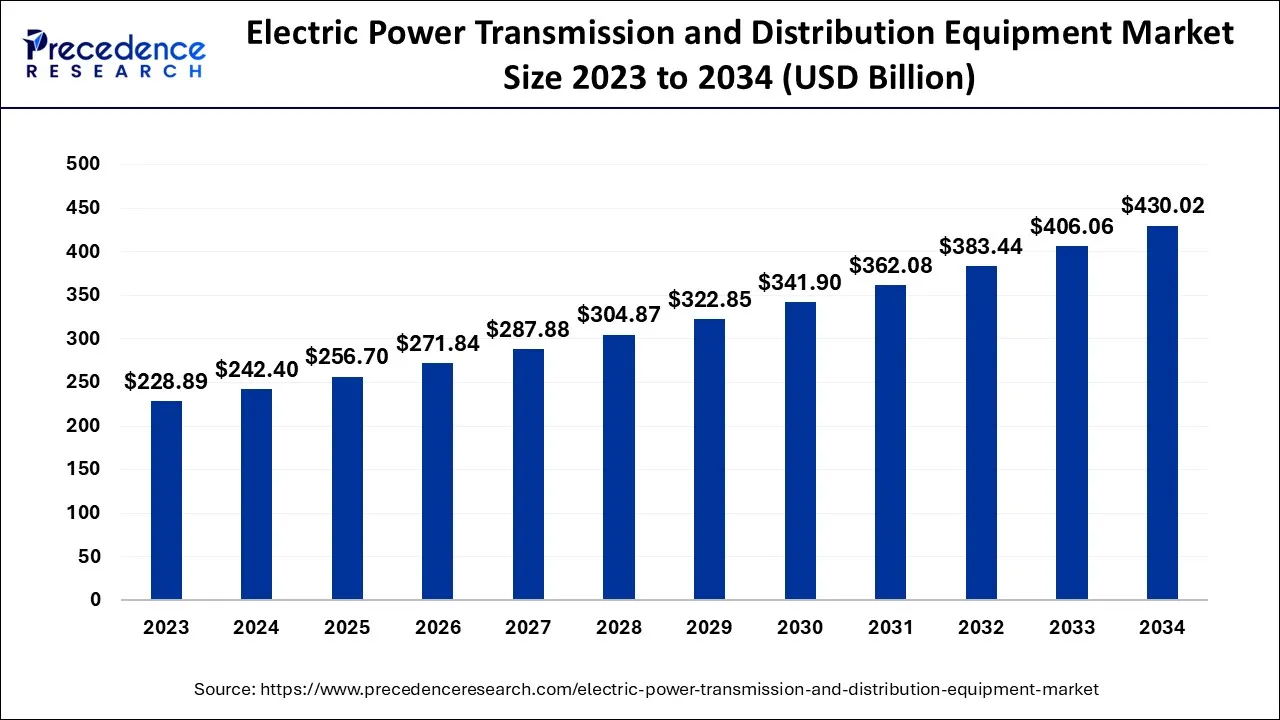

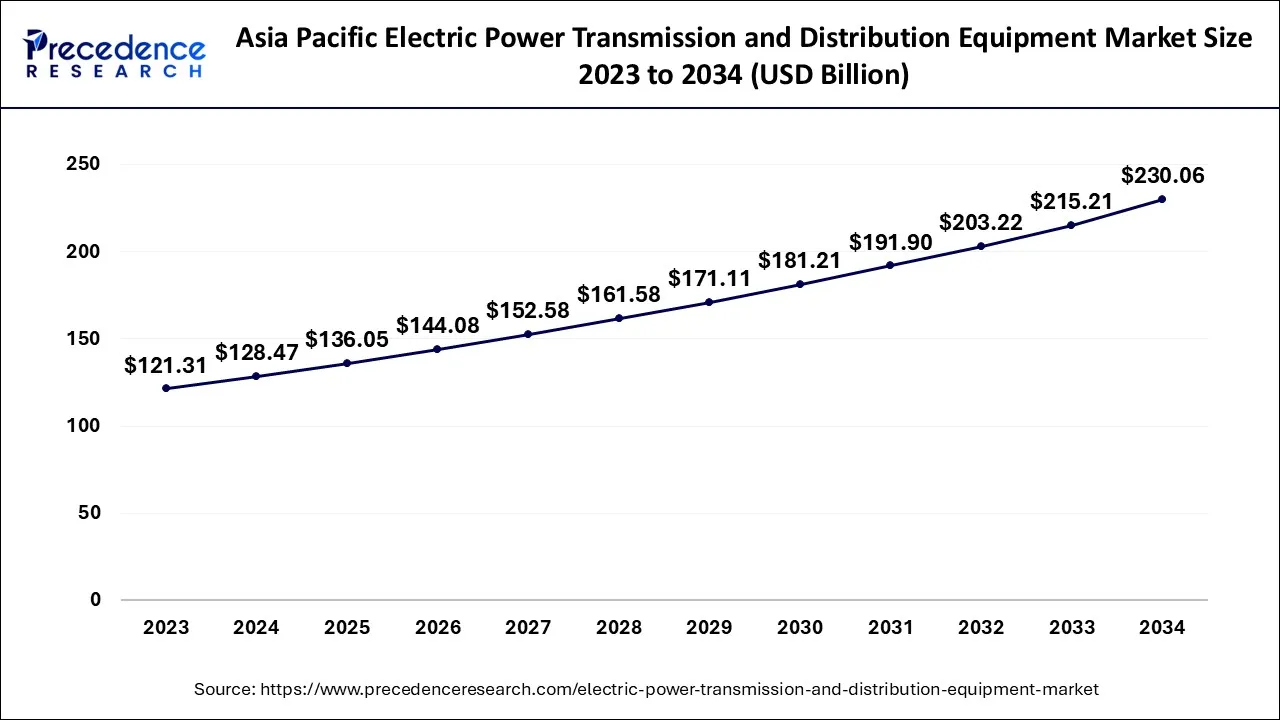

The global electric power transmission and distribution equipment market size accounted for USD 242.40 billion in 2024, grew to USD 256.70 billion in 2025 and is expected to be worth around USD 430.02 billion by 2034, registering a CAGR of 5.9% between 2024 and 2034. The Asia Pacific electric power transmission and distribution equipment market size is calculated at USD 128.47 billion in 2024 and is estimated to grow at a CAGR of 6% during the forecast period.

The global electric power transmission and distribution equipment market size is calculated at USD 242.40 billion in 2024 and is projected to surpass around USD 430.02 billion by 2034, growing at a CAGR of 5.9% from 2024 to 2034.

The Asia Pacific electric power transmission and distribution equipment market size is exhibited at USD 128.47 billion in 2024 and is projected to be worth around USD 230.06 billion by 2034, growing at a CAGR of 6% from 2024 to 2034.

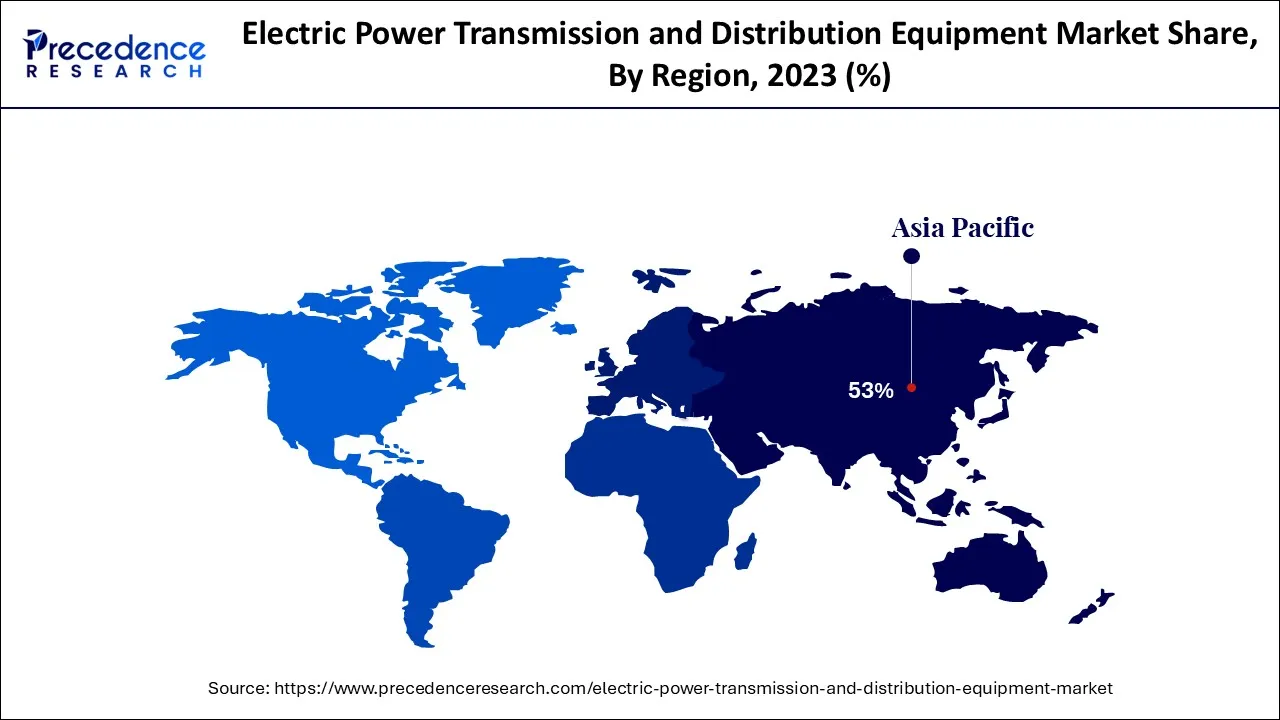

Asia-Pacific dominated the market with the highest revenue share in 2023. The region continues its dominance over the forecast period due to the increasing industrialization and commercialization across the region. The increasing population growth and the rising standards of lifestyle and disposable income of people tend to the higher demand for smart houses, smart appliances, and smart offices would drive the demand growth of the electric power transmission and distribution equipment market.

North America has a significant market share in the electric power transmission and distribution equipment market. The early and rapid adoption of the technology results in the growth of the market in the region. The rising adoption of renewable sources of energy for electricity consumption drives the market to grow. The rising investments in electric power transmission and distribution equipment would, along with the presence of major key players in the market, drive the growth of the market in the region.

The electric power transmission and distribution equipment market in Europe is expected to witness significant growth during the forecast period. The growth is attributed to the increasing consumption of electricity and rising technological advancements in the electric power transmission industry. The rising focus on the utilization of renewable energies across multiple industries will boost the market’s growth during the forecast period in Europe.

The moments of electrical energy through the interconnected lines are known as transmission networks. It is a form of electric transmission. Electric transmission and distribution types of equipment are one of the most important parts of power generation, transmission, and distribution systems. The continuous development of the transmission and distribution equipment to fulfill the future requirement of the power grid. Recently, the energy industry has focused on renewable sources to meet the demand for power.

The transmission networks allow the flow of electrical energy. It includes switches, transmitters, insulators, capacitors, etc. The increasing infrastructure development in residential and commercial sectors will result in a higher demand for electric power transmission and distribution equipment. Increasing technological adoption across the globe will be expected to boost the market demand for the electric power transmission and distribution equipment market.

The Schneider Electric Group is a leader in integrating cutting-edge process and energy technologies, an endpoint to cloud connecting products, controls, software, and services. The company recently published its revenue report for the first quarter of 2023. The revenue report stated that the company’s revenue increased by 16% organically. The company’s revenue reached 8.5 billion Euros in quarter 1 of 2023.

Electric power transmission and distribution equipment is used for transferring energy from the power generation plant to the located substations and other places. The continuous development in technology for better transmission of electrical energy in an efficient and safer way. electric power transmission is the process of moving large amounts of electrical energy from power plants to substations. The final step in the transmission of power to customers is distribution, which takes place near substations and population areas.

Electrical energy is also distributed through a distribution system network. Electrical transmission differs from electrical distribution in that it transports a significant amount of high-voltage electricity across a considerable distance. The development of electric power transmission and distribution technology is driving the growth of the global market by supplying the expanding demand for energy from the residential, commercial, and industrial sectors.

The market for electric transmission and distribution equipment is able to grow as a result of the rise in investments in renewable energy facilities and the growing awareness of the need to decrease energy losses. Rapid urbanization, a rise in transformer R&D, and governments of various countries giving domestic energy infrastructure development priority are the other factors that create possibilities for growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 242.40 Billion |

| Market Size by 2034 | USD 430.02 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.9% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Products, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising urbanization drives the market for electric transmission and distribution equipment

Rising urbanization and the increasing demand for smart appliances across the globe is expected to drive the growth of the electric transmission and distribution equipment market. The rising need for electric appliances in the population for a better lifestyle and convenience drives the growth of the market. In urbanization, the increasing industrialization infrastructure, and commercial area tends to the higher demand of the electric transmission and distribution equipment market. The increasing requirement for technologically advanced electrical equipment for smart houses, offices, etc., and the changing lifestyle habits of people around the globe are expected to increase the demand growth of the electric transmission and distribution equipment market. The increase in disposable income and adaptation of digitization positively impacts the growth of the electric transmission and distribution equipment market.

High cost of installation

Although there are many benefits and uses of electrical power transmission and distribution equipment, there are some market-hampering factors that restrain the growth of the overall market. The initial cost of material and installation of the power grid or the electric power generation is expensive, at the time of installation amount of protective devices are used like a transformer, overhead components, switchgear, etc. it also needed the relay, circuit breakers, and contractor to avoid a dangerous outbreak. More insulator is required for better connectivity. These factors show that the initial installation cost is higher than expected and would hamper the growth of the electric power transmission and distribution equipment market.

Rising focus on the utilization of renewable energy

Renewable energy is the best alternative to fossil fuel energy most organizations are looking for investment in emission-free energy. The increasing awareness of global warming in the people and shifting mindset to the renewable source of energy would drive the market to renewable energy. There are some sources of renewable energy such as wind, solar, geothermal energy, biomass, etc. Renewable energy reduced fossil fuel use and reduced the cost of electricity. In the recent era, many nations adopting renewable energy as their primary source of energy and this will positively impact the growth of electric power transmission due to the reduced cost of electricity, thus renewable energy source becomes the future opportunity for electric power transmission and distribution equipment market growth.

The cables and lines segment had the largest market revenue in 2023. The growth of the segment is attributed to the increase in the smart grid, power distribution, and power transmission. Cables have insulation, which sets them apart from naked overhead conductors in this regard. As a result, the aspect of relative safety may be guaranteed. Flexible power cables are used by portable machines, equipment, and electronics. The rated voltage, current, maximum working temperature, and intended uses of the client are taken into consideration in the design and production of these cables.

The Transformer segment is expected to increase its market share in the forecast period. The growth of the segment increased due to rapid urbanization and industrialization across the globe. The transformer is essentially an alternating current power transmission and distribution tool that controls voltage. However, the fundamental goal of utilizing transformers was to maintain equilibrium between the power produced at extremely high voltages and the consumption of electricity at very low voltages. Transformers are employed in a number of industries, including the transmission of electrical energy and the grid for power generation.

The Indirect Sales Channel dominated the market with the largest market share in 2023. The segment is increasing due to the rising number of end-users like commercial, catalog distribution, and e-commerce. In the indirect sales channel, the commercial segment took the maximum part of the market growth. Increasing commercialization in urban areas of the countries such as the United States, Canada, India, and China results in higher demand in the market. The increasing e-commerce industry also contributes to the growth of the market.

The Direct Sales Channel is expected to grow at a significant rate during the predicted period. Increasing consumer demand by going personally and validating the product lifecycle would drive the segment demand.

Segments Covered in the Report

By Products

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2023

September 2024

September 2024

January 2025