April 2025

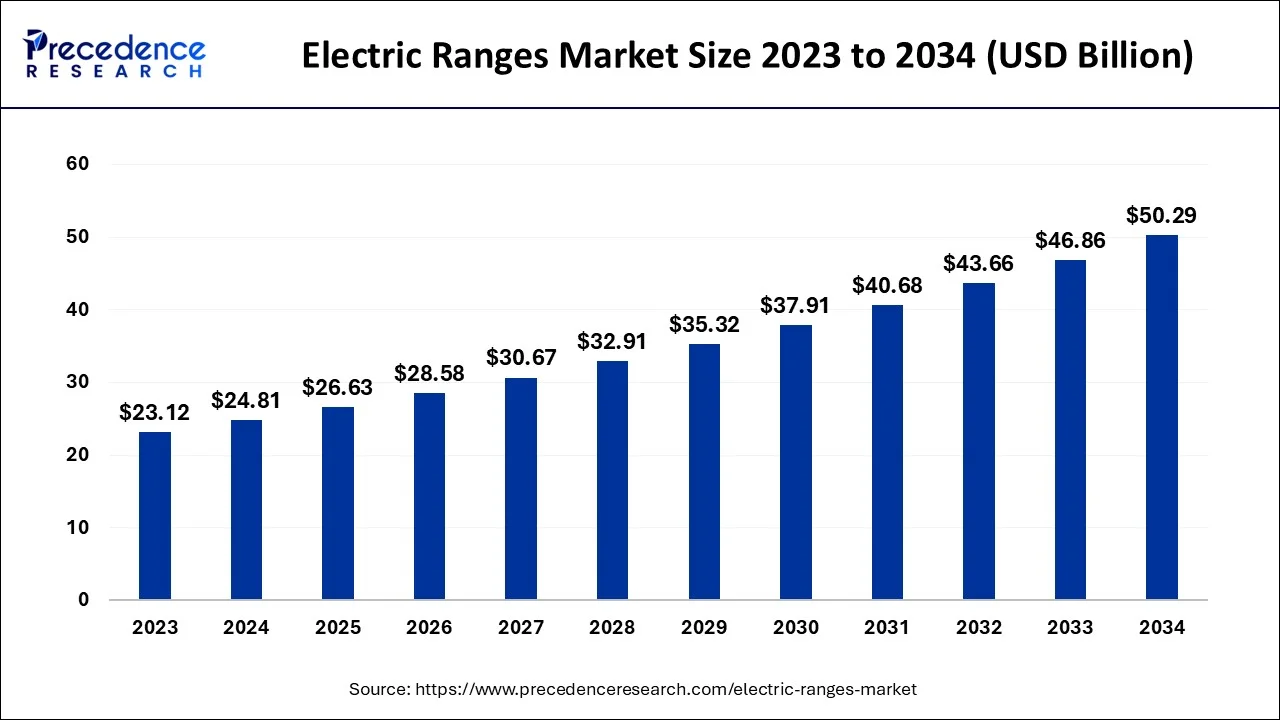

The global electric ranges market size accounted for USD 24.81 billion in 2024, grew to USD 26.63 billion in 2025 and is projected to surpass around USD 50.29 billion by 2034, representing a healthy CAGR of 7.32% between 2024 and 2034. The North America electric ranges market size is calculated at USD 9.43 billion in 2024 and is expected to grow at a fastest CAGR of 7.44% during the forecast year.

The global electric ranges market size is estimated at USD 24.81 billion in 2024 and is anticipated to reach around USD 50.29 billion by 2034, expanding at a CAGR of 7.32% between 2024 and 2034. The growing consumer demand for energy-efficient appliances is the key factor driving the growth of the electric ranges market. Also, increasing consumers' awareness about environmental sustainability coupled with the development of cooking technology can fuel market growth shortly.

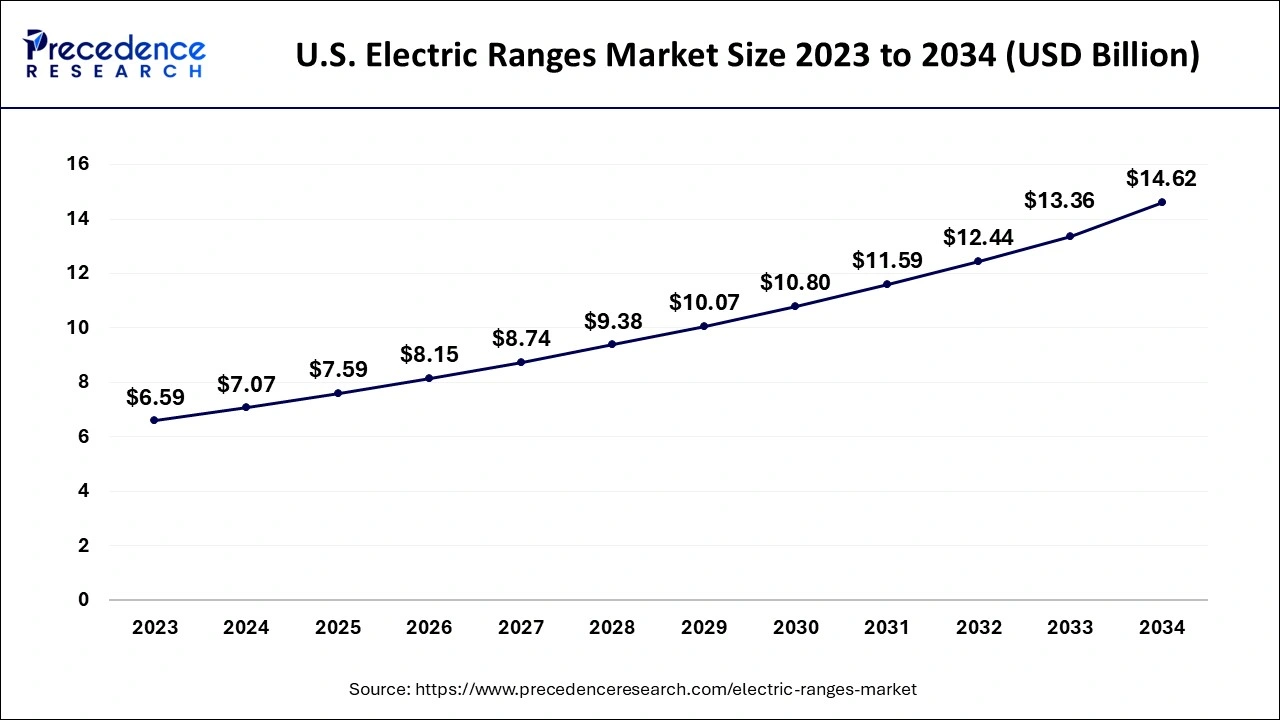

The U.S. electric ranges market size accounted for USD 7.07 billion in 2024 and is expected to be worth around USD 14.62 billion by 2034, growing at a CAGR of 7.51% between 2024 and 2034.

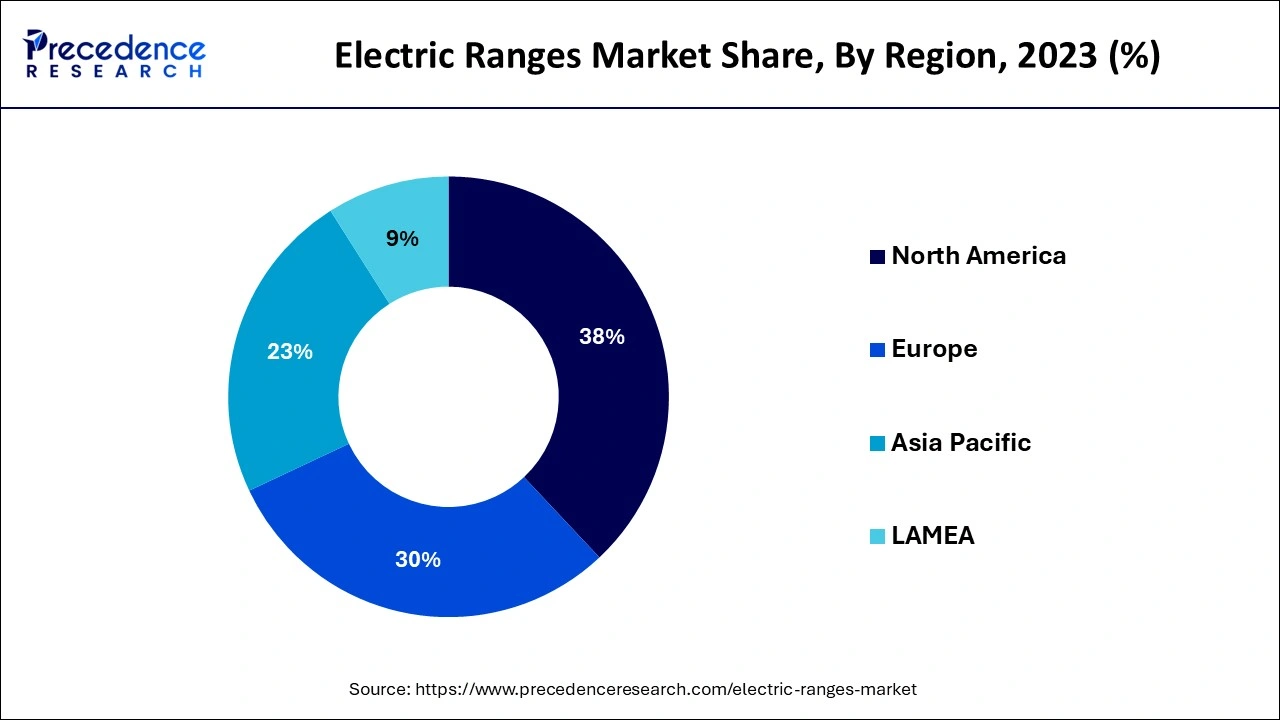

North America dominated the electric ranges electric ranges market in 2023. The dominance of the region can be attributed to the emergence of advanced cooking technologies for energy and cost-efficient appliances, such as induction cooking technology. Major market players in the region, including GE Appliances, Whirlpool Corporation, and LG Electronics, continue to launch innovative products based on factors like design, performance, and brand reputation.

Asia Pacific is expected to show the fastest growth in the electric ranges market during the studied period. The growth of the region can be driven by increasing urbanization and growing disposable incomes in nations like India and China. Moreover, raising awareness of environmental issues and energy efficiency solutions is facilitating consumers to shift from conventional cooking methods to electric options.

Electric ranges are kitchen appliances crafted for cooking purposes that use electricity as their main source of heat. They generally consist of a cooktop and an electric oven with electric heating components. The electric ranges market provides numerous key advantages like easy installation, accurate temperature control for cooking, and an extensive range of other features, including convection cooking, self-cleaning ovens, and programmable settings. Also, they regard more safer than conventional gas ranges because of the absence of an open flame.

Role of AI in the Electric Ranges Market

In the electric ranges market, AI-driven smart ovens stimulate cooking settings and monitor food. These appliances can suggest the cooking mode, temperature, and time. These ovens utilize computer vision for burn detection and food recognition. It is also able to identify various ingredients and dishes to recommend cooking settings. Furthermore, users can select a recommended program and wait till the oven is done to predict whether the dish is done or not. These ovens also possess an AI ability that enables them to learn from each other.

| Report Coverage | Details |

| Market Size by 2034 | USD 50.29 Billion |

| Market Size in 2024 | USD 24.81 Billion |

| Market Size in 2025 | USD 26.63 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Integration of smart kitchen

The growing trend of smart homes has a positive impact on electric ranges, fuelling the electric ranges market expansion of connected appliances. Smart features such as voice commands, remote control, and integration with virtual assistants can enhance user experience and convenience. Additionally, Smart kitchen integration connects appliances through Bluetooth or Wi-Fi to allow remote monitoring and control. Data generated by smart kitchen appliances can be analyzed to offer crucial insights into energy use, cooking patterns, and appliance performance.

Supply chain disruptions

The electric ranges market faces a big hurdle in the form of supply chain disruptions. Challenges like transportation delays, material shortages, and production obstacles have led to congestion in the manufacturing process. As a result, it constrained the market's ability to fulfill the increasing demand for electric ranges. Moreover, as consumer interest rises, coping with these supply chain challenges becomes important.

Increasing demand for freestanding range

A freestanding range is a kitchen appliance that iterates an oven and cooktop into a single unit. The electric ranges market products can be placed anywhere in the kitchen as they are flexible. They are available in a variety of sizes, but many of them are 30 inches wide. Freestanding ranges can be powered by electricity, gas, or a combination of both. Furthermore, these ranges have accessible sides and backs, which makes it easier to maintain and clean them without squeezing them into tight spaces.

The freestanding electric ranges segment dominated the electric ranges market in 2023. The dominance of the segment can be attributed to the features such as ease of installation, versatility, and cost-effectiveness offered by this range. These cooking appliances are famous among households for their convenience, as they can be suited anywhere in the kitchen, In addition, freestanding ranges don't have gaps (Unlike slide-in ranges) where grease and crumbs can hide.

The slide-in electric ranges segment is expected to grow at the fastest rate in the electric ranges market over the forecast period. The growth of the segment can be linked to the growing trend of smart kitchen designs that focus on aesthetic appeal and seamless integration. These ranges are generally preferred for their built-in look, which offers a professional, sleek appearance and cuts gaps between the countertops and appliances improving kitchen ergonomics. One notable product is the Samsung 30-inch Slide-In Electric Range. Having dual cooking capabilities.

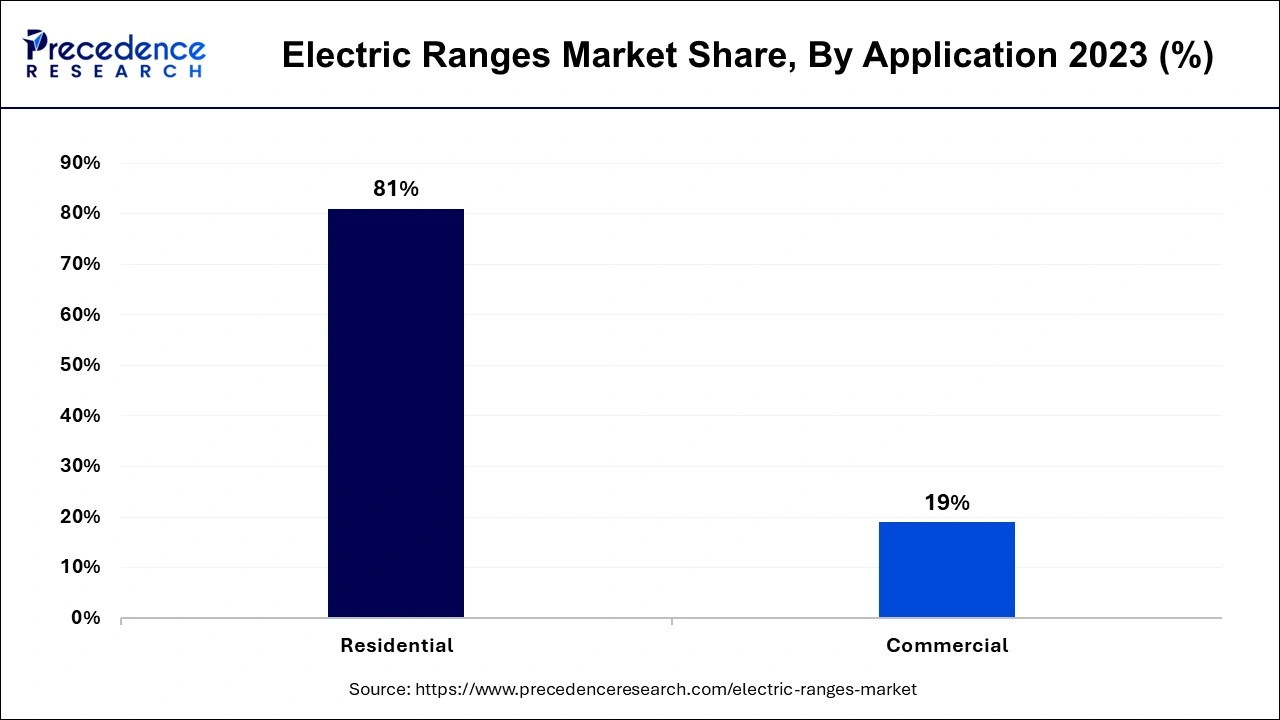

The residential applications segment led the global electric ranges market in 2023. The dominance of the segment is due to the increasing number of households looking for convenient electric cooking solutions. Modern cooking appliances can significantly reduce the amount of energy required for cooking. Furthermore, the governments of many countries are spreading awareness about electric ranges across the country by launching different campaigns, such as the Go Electric campaign launched by the Indian government recently.

The commercial applications segment is estimated to show the fastest growth in the electric ranges market over the projected period. The growth of the segment can be linked to the increasing adoption of eco-friendly, sustainable, and energy-efficient cooking solutions in the restaurant and hospitality sectors. Additionally, commercial establishments transitioning from gas to electric ranges provide accurate temperature control and rapid cooking times.

The mass retailer-driven sales segment led the electric ranges market in 2023. The dominance of the segment can be credited to the extensive selection of products offered by mass retailers from different brands at competitive prices. These attract a wide range of customer base searching convenience and value. Also, mass retailers have the capability to leverage wide distribution networks and economies of scale propelling segment growth further.

The online sales segment is anticipated to grow at the fastest rate in the electric ranges market during the forecast period. The growth of the segment can be driven by the retailers are increasingly using product reviews and seasonal promotions to attract consumers seeking tech-oriented and energy-efficient kitchen solutions. However, Online sales enable the sophistication of shopping from home on platforms like Flipkart, allowing customers to read reviews, compare products, and make firm purchasing decisions.

Segments Covered in the Report

By Product

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

October 2024

August 2024