January 2025

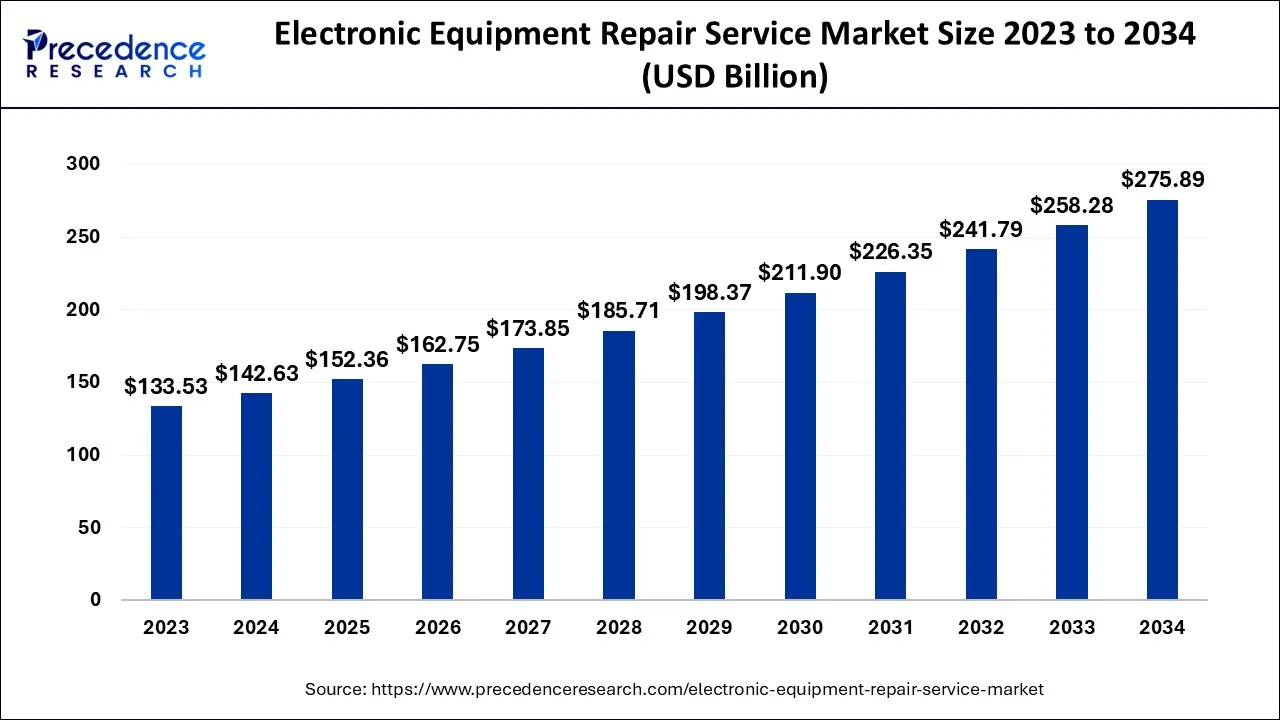

The global electronic equipment repair service market size accounted for USD 142.63 billion in 2024, grew to USD 152.36 billion in 2025 and is expected to be worth around USD 275.89 billion by 2034, registering a CAGR of 6.82% between 2024 and 2034.

The global electronic equipment repair service market size is calculated at USD 142.63 billion in 2024 and is projected to surpass around USD 275.89 billion by 2034, growing at a CAGR of 6.82% from 2024 to 2034.

The electronic equipment repair service market refers to the industry that specializes in repairing and maintaining electronic devices and equipment, including computers, smartphones, televisions, and other consumer electronics. This market is driven by the increasing use of electronic devices in everyday life, as well as the need for cost-effective repair solutions to prolong the lifespan of these devices.

The electronic equipment repair market is highly fragmented and competitive, with a large number of small and independent repair shops operating locally. However, larger national and international repair chains are also present, and they are increasingly expanding their services to cover a wider range of devices and technologies.

The market is expected to grow in the coming years due to the increasing complexity and sophistication of electronic devices, as well as the growing awareness of the environmental benefits of repair and reuse over disposal. Additionally, the market is also driven by the rising trend of do-it-yourself (DIY) repair and maintenance, which has created new opportunities for small repair shops and individual entrepreneurs. Overall, the electronic equipment repair market is a dynamic and growing industry that is expected to continue to expand in the coming years, driven by the increasing demand for repair services and the growing awareness of the environmental and economic benefits of repair and reuse.

One of the key elements influencing the market trends for electronic equipment repair services is the growing importance of the reconditioned business for electronic devices. For instance, in 2020, 2GUD.com, a marketplace for refurbished products owned by Flipkart, had almost 2.5 million product listings, of which 3-4% were for refurbished electronics like Televisions and phones. Also, over the next few years, the sector will have plenty of attractive growth prospects as global concern about the increasing generation of e-waste rises.

| Report Coverage | Details |

| Market Size in 2024 | USD 142.63 Billion |

| Market Size by 2034 | USD 275.89 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.82% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type, By Service Type, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rise in the use of automated systems

The surge in demand for electronic products like cell phones, televisions, air conditioners, and laptops has led to an increase in the need for repair services for electronic equipment. Also, the need for electronic products repair services is being driven by the expansion of automated systems across numerous industries. Due to the high cost of electronic goods, consumers are choosing to buy reconditioned gadgets more frequently than new ones.

It is projected that during the forecast period, this will generate profitable market possibilities. An increase in dependence on electronic appliances has been brought on by rising disposable money and changing consumer lifestyles. It is anticipated that this will increase household demand for technological equipment.

Rising equipment failure rates

The market for consumer electronics repair and maintenance is anticipated to be driven by rising equipment failure rates and the financial advantages of restoring outdated equipment as opposed to throwing it away. Low-cost products, both branded and unbranded, are constantly flooding the market.

Whether they were manufactured with subpar materials or require constant maintenance, they eventually need to be repaired. Yet, research indicates that businesses are now adopting a different strategy and creating items that may be readily repaired for use because mending a problem with a device is always a more affordable alternative than buying a new one, increasing the customer's trust.

Consumers are more likely to purchase and use products from a company that provides spare parts, repair manuals, support, and instructions for repairing the product. The older iPhone is now being assembled by Apple in India. People are coming together to collaborate on mending electronics thanks to organisations like iFixit and Repair Café.

In 2021, the European Commission plans to examine requirements for eco-friendly smartphone design, as well as availability to spare parts and repair information. The market for consumer electronics repair and maintenance is therefore being stimulated by a rise in equipment failure rates and the cost savings of repairing obsolete equipment.

Growing environmental awareness

Consumers are increasingly aware of the environmental impact of electronic waste and the importance of repairing and reusing devices rather than disposing of them. This creates a market for repair services that offer environmentally friendly solutions.

Poor quality or duplicate spare parts of electronic equipment

The use of poor quality or duplicate spare parts in electronic equipment repairs is a major challenge for the electronic equipment repair market. These parts may be cheaper than genuine parts, but they often fail to meet the quality and performance standards of the original parts. Poor quality parts may fail prematurely, leading to additional repairs or even device failure.

This can reduce the lifespan of the device and increase repair costs over time. Poor quality parts may not meet safety standards, leading to potential safety risks for the user of the device. This is especially true for devices that are designed to operate at high temperatures or voltages. The use of poor quality or duplicate parts can damage the reputation of repair shops and technicians, leading to decreased customer trust and fewer referrals.

Price volatility

Price volatility is another challenge that the electronic equipment repair market faces. This refers to the instability and fluctuations in the prices of electronic components, such as microchips, circuit boards, and other parts, that are needed for repairs. Price volatility can be caused by several factors, including changes in supply and demand, fluctuations in currency exchange rates, and geopolitical factors. These price fluctuations can make it difficult for repair shops and technicians to accurately estimate the cost of repairs, which can lead to unexpected costs for consumers.

Introduction of AR

Service providers for consumer electronics maintenance and repair are concentrating on employing augmented reality (AR)-based maintenance and repair techniques. In augmented reality (AR), computer-generated pictures are placed over a user's perspective of the real world and merged with direct and indirect views of physical world environments. By employing this augmented reality (AR) based repair or maintenance techniques, users can improve their field of vision with current digital information.

The user can get step-by-step directions on how to fix an asset with the help of this information. For instance, the new 2022 AR Assistant app from US-based technology company Dell employs augmented reality to walk customers through step-by-step, at-home repairs or replacements for over 97 different systems in 7 different languages. Using AR and instructional overlays on the machine being serviced, the AR Assistant app lets users see their gadgets and provides repair guidance. In order to make at-home repairs simpler, less stressful, and less wasteful, the software also offers an augmented clone technology on some systems that displays a cloned server in any desired place and allows full 360-degree interactivity.

Increasing consumer demand for repair services

Consumers are increasingly interested in repairing their electronic devices rather than replacing them, driven by environmental concerns and a desire to save money. This presents an opportunity for repair shops and technicians to expand their services and reach a wider customer base.

Based on technology, the electronic equipment repair service market is segmented into consumer electronics, home appliances, industrial equipment, and medical equipment. The home appliances segment is anticipated to rule the global market during the forecast period. This can be attributed to the significant global consumer demand for appliances like refrigerators and televisions. Appliances are frequently bought by consumers to save time and reduce effort. Appliances for the home are effective and simple to use.

In the upcoming years, it is also projected that the global market for electronic equipment repair services would be driven by product advancements, product differentiation, new product development, and the integration of several features which are adding value in consumer electronics.

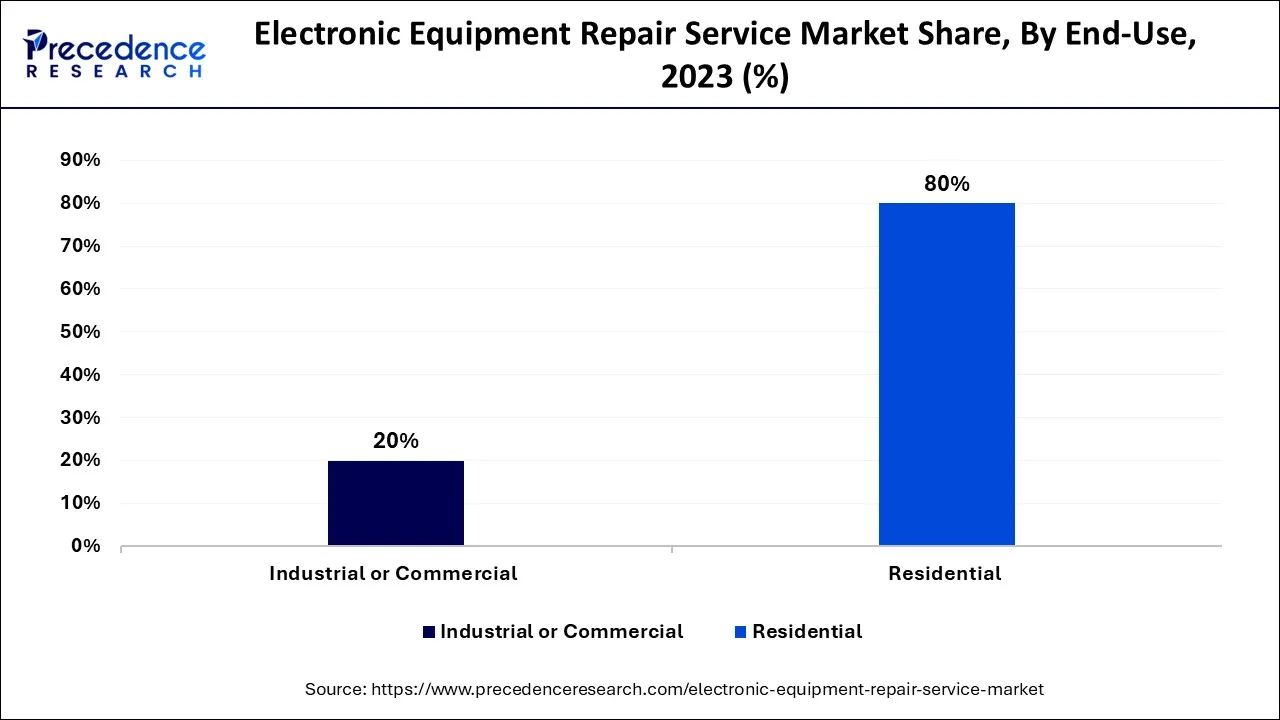

On the basis of end-use, the electronic equipment repair service market is segmented into residential, industrial, or commercial. The residential segment dominated the global electronic equipment market in 2023 and is expected to maintain its dominance during the forecast period owing to the rise in demand for consumer electronics in the domestic market. This segment is expected to dominate the electronic equipment repair service market due to the increasing demand for these devices, coupled with their frequent malfunctioning.

The growing trend of recycling and refurbishing electronic devices has also contributed to the growth of this segment. The need for residential electronic device repair services is anticipated to grow more quickly in the near future. Additionally, in the residential sector, the consumer electronics and automotive electronics segments are expected to see the most significant growth, driven by the increasing adoption of electronic devices in households and the need for repair services for personal devices and vehicles.

Furthermore, in the industrial or commercial sector, the industrial electronics segment is expected to see the most substantial growth, driven by the need to repair and maintain the electronic equipment used in factories, warehouses, and other industrial settings. Manufacturing, healthcare, automotive, IT, and telecom industries heavily rely on electronic equipment for their operations, and any malfunction can lead to significant losses. This in turn augments the growth of the end-use segment in the electronic equipment repair market.

On the basis of service type, the electronic equipment repair service market is segmented into in-warranty and out-of-warranty. Out of these service types, the out-of-warranty repair segment is currently dominating the electronic equipment repair market. This is because electronic devices often require repairs after the manufacturer's warranty period has expired, and consumers are increasingly choosing to repair their devices rather than replacing them.

In the out-of-warranty segment, the demand for repair services is driven by the need to repair electronic devices that have malfunctioned or have been damaged after the warranty period has expired. This segment offers significant growth opportunities due to the increasing use of electronic devices and the need for affordable repair services. However, this segment is also highly competitive, and service providers need to offer competitive prices, quality services, and fast turnaround times to remain competitive.

The in-warranty segment of the market is mainly driven by the need to ensure that the electronic devices are functioning correctly during the warranty period and to provide customers with a hassle-free repair service. The growth of this segment is closely tied to the sales of electronic devices, and the market is expected to grow at a steady pace due to the increasing sales of electronic devices, especially in emerging markets. However, this segment is highly competitive, and manufacturers often provide in-house repair services or authorize a limited number of service centers to provide in-warranty repair services.

On the basis of geography, Asia Pacific is anticipated to witness the highest growth rate during the forecast period due to the presence of numerous domestic and foreign players in the area. Among Asia Pacific's top users of electronic goods are Japan, China, and India. Also, it is anticipated that the region's robust R&D activities would open up new potential for the market for electronic equipment repair services in the coming years. The region is also home to several well-established electronics repair companies.

The North American electronic equipment repair service market is driven by the high demand for repairing electronic gadgets such as smartphones, tablets, and laptops. The region is also home to several well-established electronics repair companies. Additionally, the European electronic equipment repair service market is expected to grow at a moderate rate due to the increasing adoption of smart devices and rising demand for IoT-enabled devices.

Germany and the UK are the major markets in this region. Furthermore, it is anticipated that shifting consumer attitudes in developing nations would present considerable prospects for industry expansion.

Segments Covered in the Report

By Product Type

By Service Type

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

January 2025