May 2025

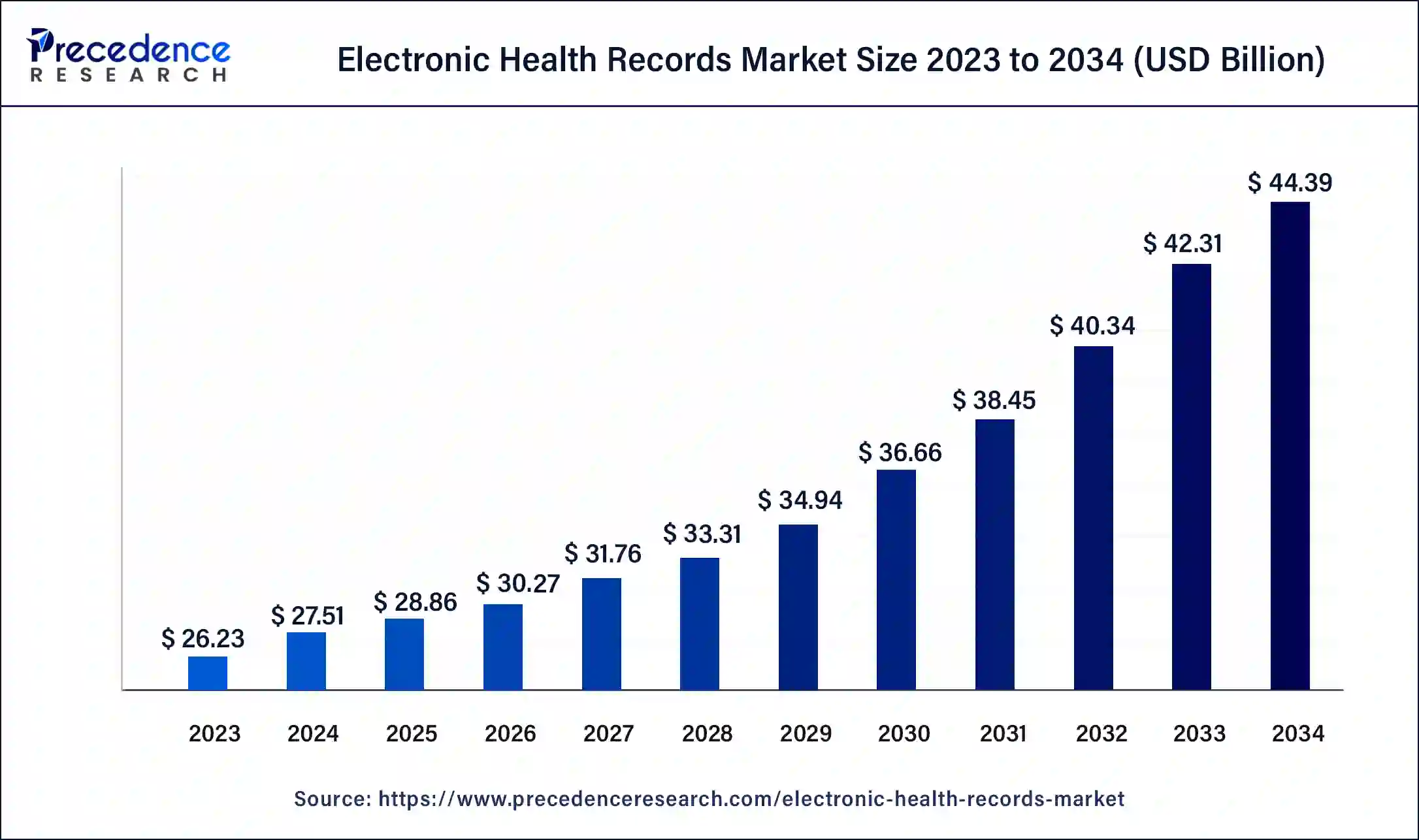

The global electronic health records market size accounted for USD 27.51 billion in 2024 and is expected to be worth around USD 44.39 billion by 2034, at a CAGR of 4.9% from 2024 to 2034. The North America electronic health records market size reached USD 12.07 billion in 2023.

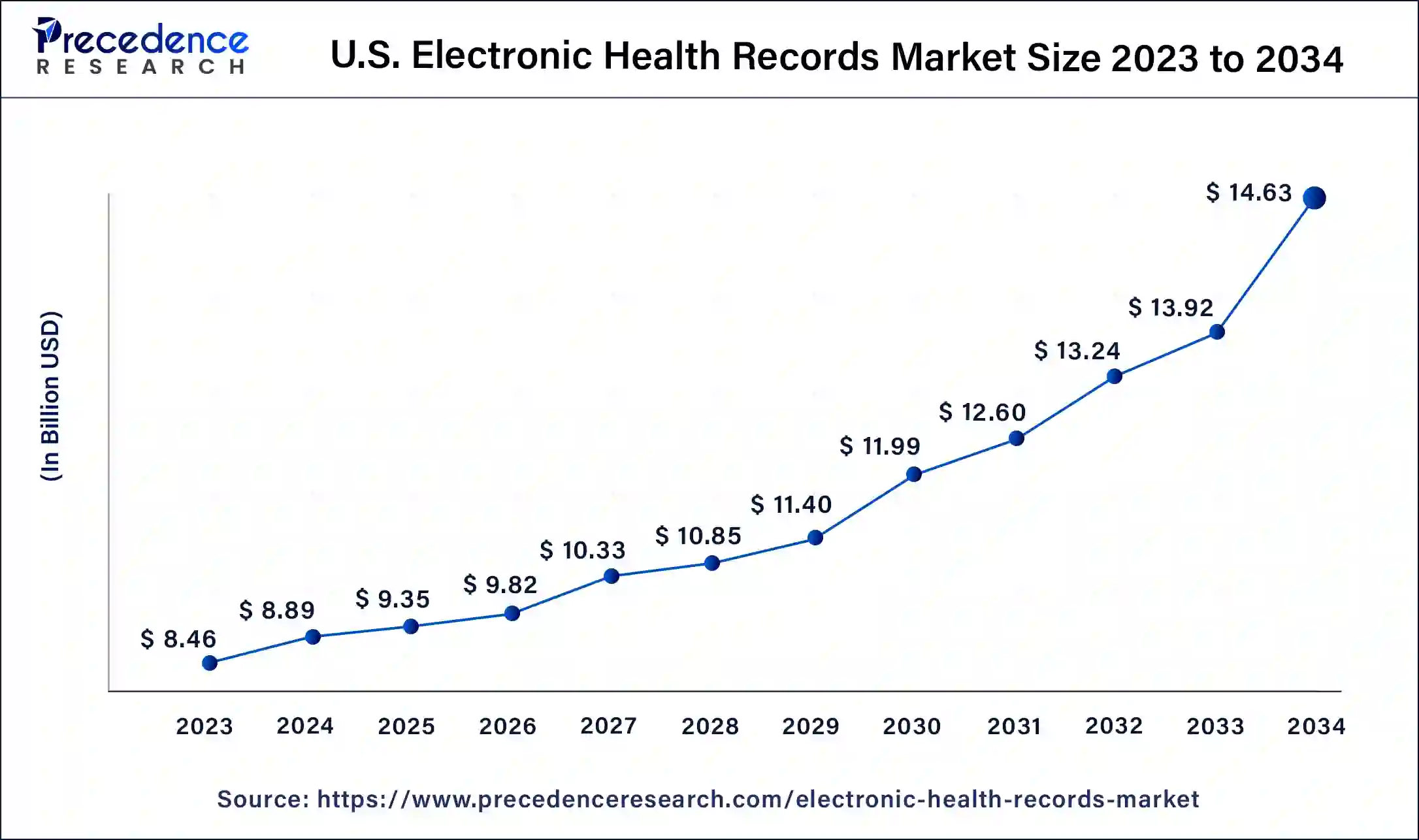

The U.S. electronic health records market size was estimated at USD 8.89 billion in 2024 and is predicted to be worth around USD 14.63 billion by 2034, at a CAGR of 5.10% from 2025 to 2034.

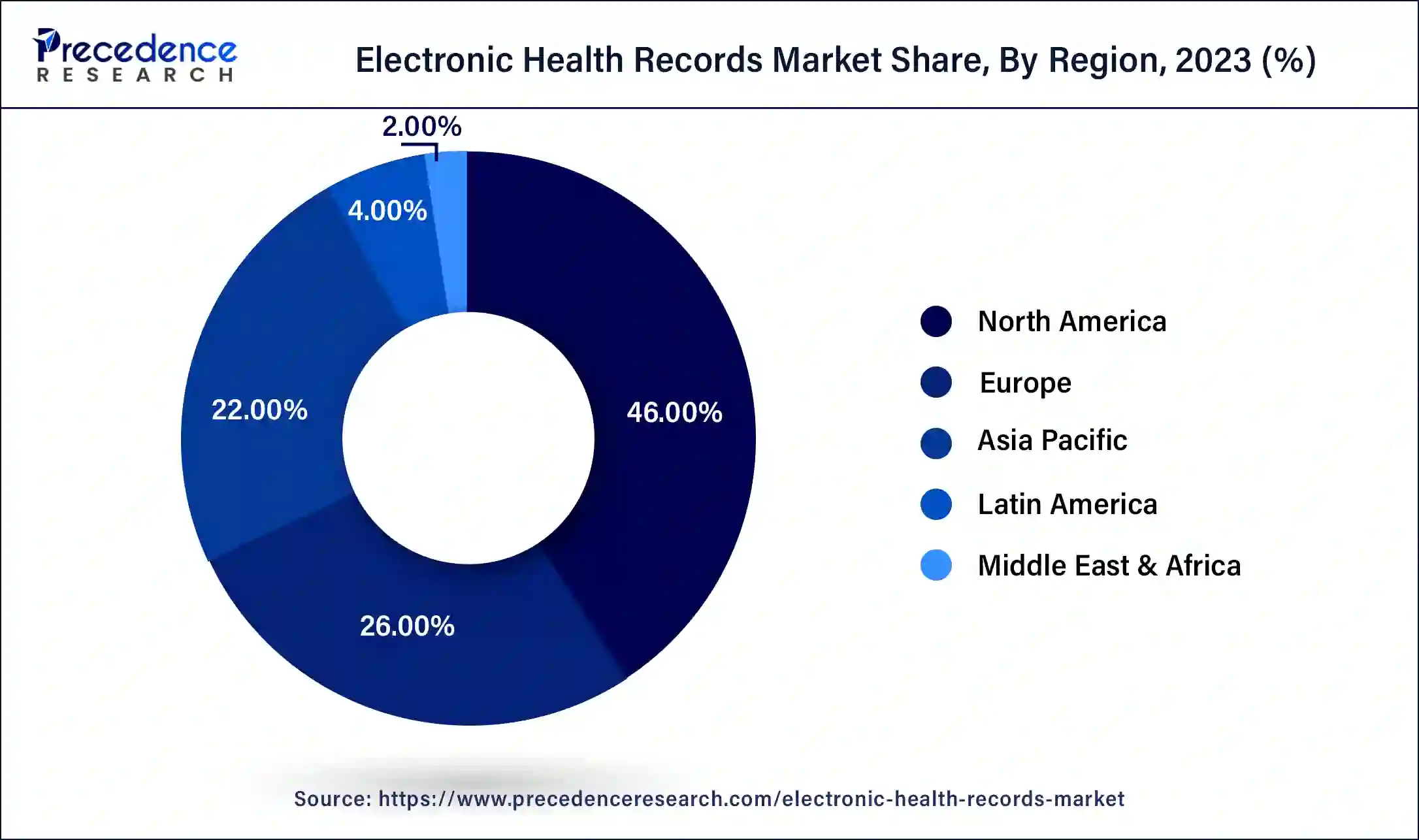

Based on region, North America accounted for a significant market share of around 46% in 2024 and is estimated to sustain its dominance during the forecast period. North America is characterized by higher adoption rate of innovative and digital technologies in the healthcare industry, which fueled the market growth in this region. Moreover, well-established IT and telecommunication infrastructure and presence of developed healthcare infrastructure facilitates the adoption of electronic health records across the North America.

The Asia Pacific is estimated to be the most opportunistic market during the forecast period. The growing government initiatives to develop strong healthcare infrastructure and adopt digital technologies across the healthcare units. The nations like China, Japan, India, and South Korea presents a lucrative growth opportunity owing to the increased demand for the quality and standard services in the healthcare units.

How Does Europe Modify the Electronic Health Records Market?

Europe is expected to grow at a considerable rate in the upcoming period, stemming from the increasing adoption of healthcare IT solutions, including improved data accuracy, better clinical decision-making, and enhanced patient outcomes. Furthermore, the rising prevalence of chronic diseases and an aging population, along with the strong push for digital transformation in healthcare, contributed to the growth of the market in the region, with improved patient care and at an affordable cost.

The rising number of patients in the hospitals and other healthcare units is rising owing to the rising prevalence of various chronic diseases and growing geriatric population across the globe. The need for reducing paperwork and demand for digitalization of the healthcare systems is boosting the growth of the global electronic health records market. The government initiatives to digitalize the healthcare facilities is a major contributor to the growth of the electronic health records market. For instance, My Health Record is a digital health record platform for the Australian citizens. These health records can enhance the patient care in the hospitals as the past medical and health records of a particular patient can be analyzed to provide better treatment to the patient. The growing adoption of electronic health records platform among the hospitals, clinics, and diagnostic labs is expected to significantly drive the global market during the forecast period.

The presence of the numerous market players and various developmental strategies adopted by them such as new product launches, acquisitions, partnerships, and agreements is a major factors that influences the growth of the electronic health records market. For instance, Allscripts Healthcare Solutions entered into a strategic partnership with the US Orthopedic Alliance to introduce improved electronic health records. The rising government and corporate investments to develop a strong and sophisticated IT and telecommunications infrastructure is expected to foster the adoption rate of electronic health records across the globe. Furthermore, the growing need for the integration of healthcare system and introduction of the big data in the healthcare industry is expected to drive the growth of electronic health records market during the forecast period. In March 2021, the European electronic health record exchange was a recommendation adopted by the European Commission, which will securely transfer health related data across the European nations. These types of government initiative to promote electronic health records is expected to fuel the adoption rate across the globe.

| Report Highlights | Details |

| Market Size in 2025 | USD 28.86 Billion |

| Market Size in 2024 | USD 27.51 Billion |

| Market Size by 2034 | USD 44.39 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.9% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, End User, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Based on type, the acute segment accounted for around 48% of the market share in 2024 and is estimated to sustain its dominance during the forecast period. The increased government initiatives to implement the adoption of electronic health records in the small healthcare facilities have significantly contributed towards the growth of this segment.

On the other hand, the post-acute segment is estimated to be the most opportunistic segment during the forecast period. This is attributed to the extensive usage of post-acute electronic health records in the rehabilitation centers, home health service providers, and long term healthcare units. The segment’s growth is expected to grow owing to the rising consumer expenditure on the rehabilitation services.

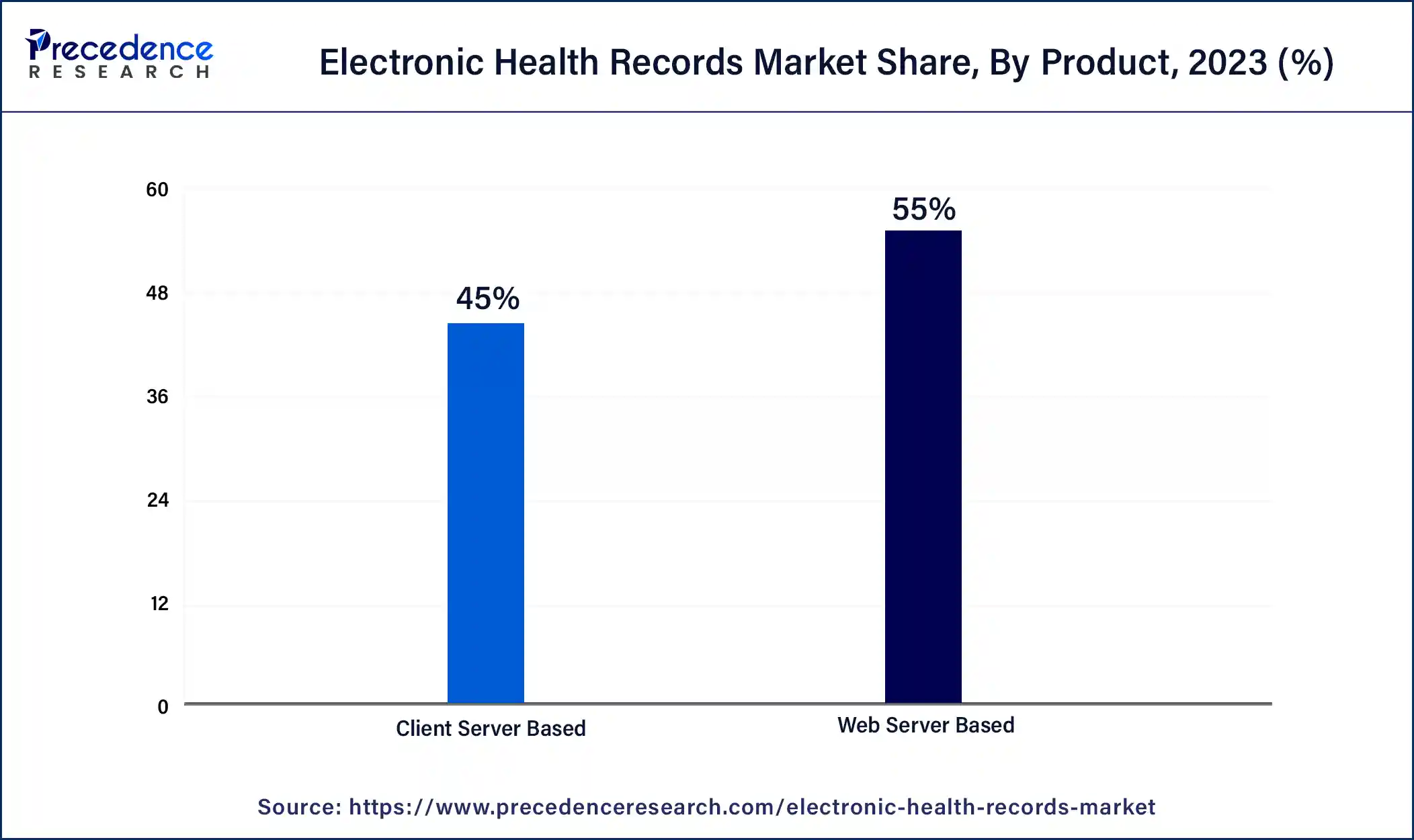

Based on product, the web based segment accounted for around 55% of the market share in 2024 and is estimated to sustain its dominance during the forecast period. This is attributed to the increased popularity and higher adoption of the web based electronic health records among the doctors/physicians and other small scale healthcare service providers across the globe. The web based electronic health records can be customized and altered as per the requirements and hence, the demand for this is higher.

On the other hand, the client server based segment is expected to be the fastest-growing segment during the forecast period. The client server based electronic health records offers in-house data storage that provides high data security and eliminates the chances of data breach and data theft. Moreover, it can be operated without a stable internet connection and is considered to be an idle choice for the multi-physician healthcare units.

Based on end user, the hospitals segment accounted for around 60% of the market share in 2024 and is expected to sustain its dominance during the forecast period. This can be attributed to the increased number of hospital admissions which generates huge amount of data. This data needs to be stored safely and this need is perfectly served by the electronic health records systems. The rising number of private hospitals across the globe is expected to further drive the growth of this segment during the forecast period.

On the other hand, the ambulatory services segment is estimated to be the most opportunistic segment during the forecast period. Ambulatory services includes pharmacies, laboratories, and clinics that are popular for the conveniences they offer to the patients. The rising number of pharmacies and clinics across the developed and developing nations is expected to drive the growth of this segment in the foreseeable future.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

The various developmental strategies like acquisition, partnerships, mergers, and government policies fosters market growth and offers lucrative growth opportunities to the market players.

By Type

By Product

By Business Models

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

November 2024

May 2025

June 2025