April 2025

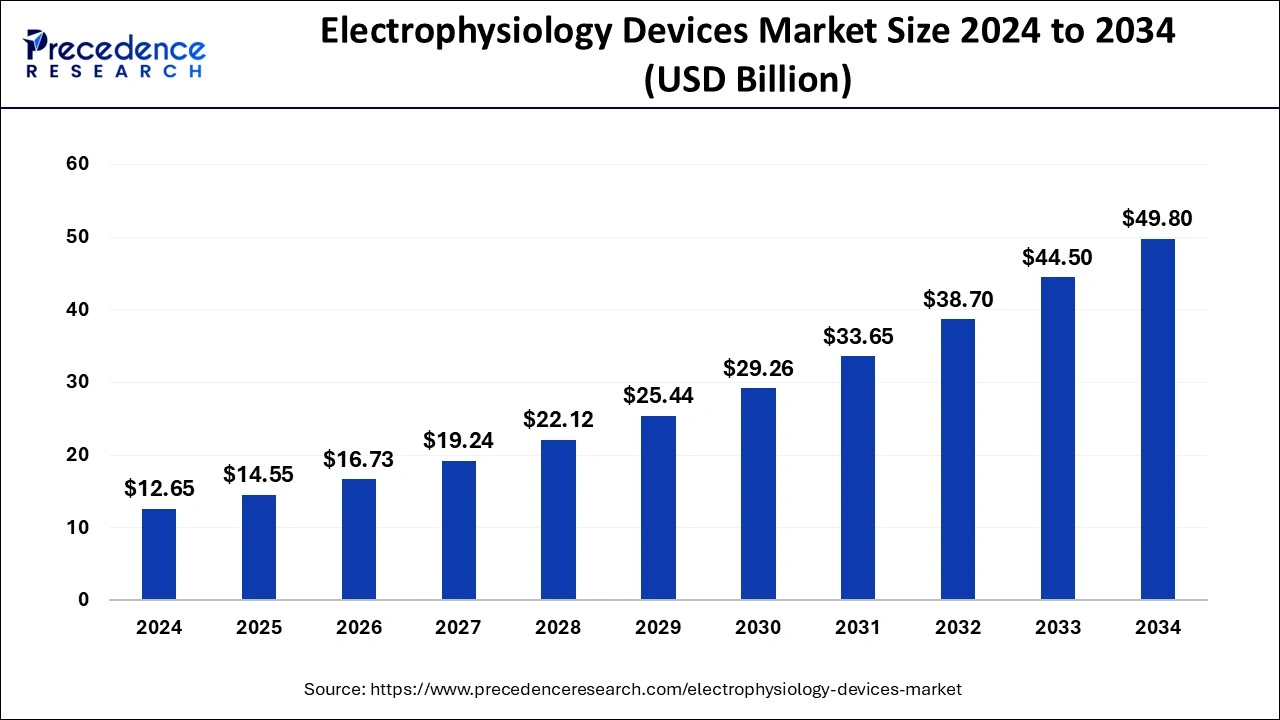

The global electrophysiology devices market size is estimated at USD 14.55 billion in 2025 and is anticipated to reach around USD 49.80 billion by 2034, expanding at a CAGR of 14.69% from 2025 to 2034. The North America electrophysiology devices market size is evaluated at USD 6.20 billion in 2024 and is expanding at a CAGR of 14.72% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global electrophysiology devices market size accounted for USD 12.65 billion in 2024 and is predicted to reach around USD 49.80 billion by 2034 and is poised to grow at a CAGR of 14.69% from 2025 to 2034.

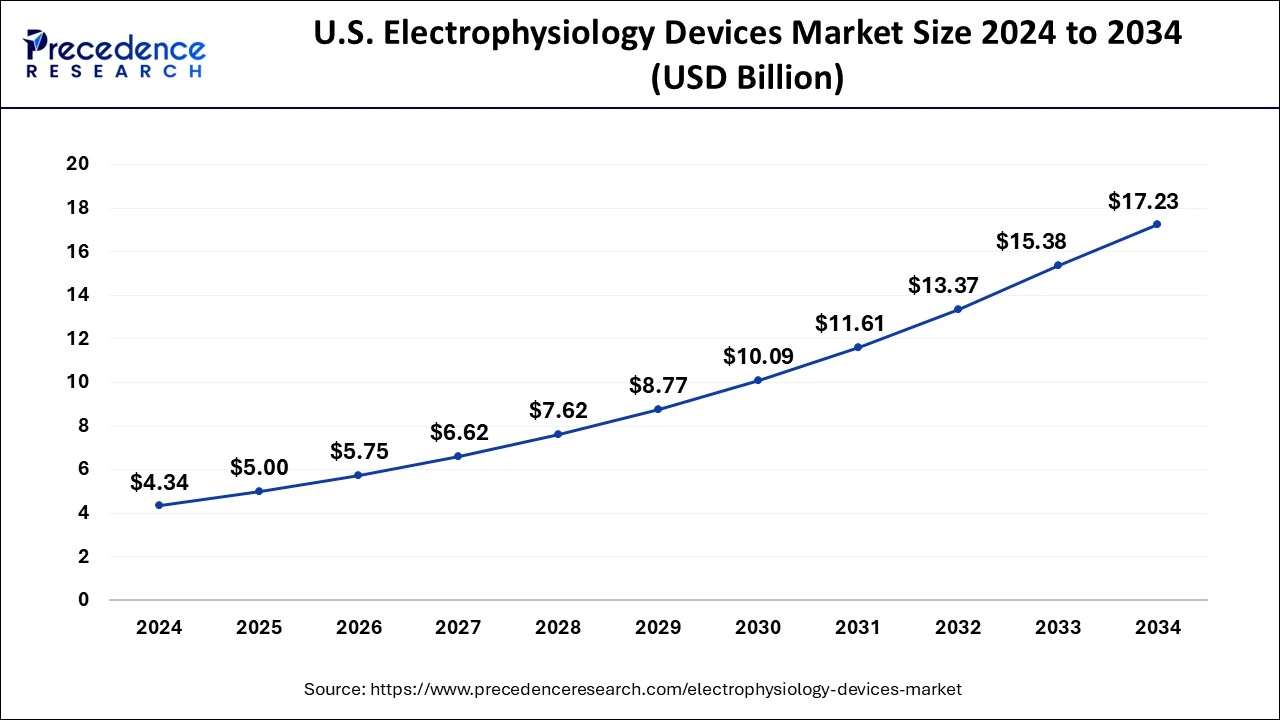

The U.S. electrophysiology devices market size was valued at USD 4.34 billion in 2024 and is expected to be worth around USD 17.23 billion by 2034, at a CAGR of 15% from 2025 to 2034.

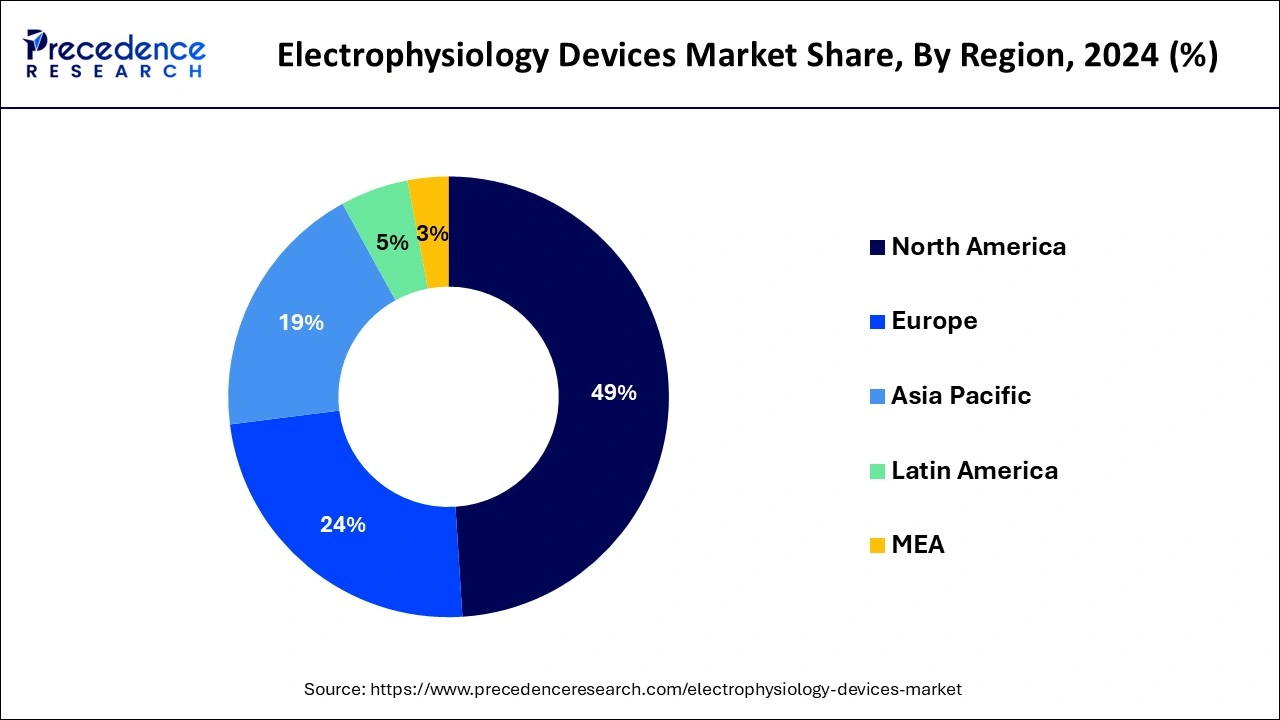

North America emerged as a global leader in the global electrophysiology devices market ad account for the largest value share of 49% in 2024. The growth of the region is primarily because of rising prevalence of cardiac arrest cases, Heart Failure (HF), and cardiac arrhythmia as a result of smoking, an unhealthy lifestyle, and alcohol consumption. The favorable reimbursement policies and presence of sophisticated healthcare infrastructure are anticipated to drive the growth of the region over the analysis period.

On the contrary, the Asia Pacific electrophysiology devices market has significant presence of untapped opportunities in reference to unmet medical requirements along with rapid growth in the incidence rates of target diseases. Furthermore, increasing patient awareness, improving healthcare infrastructure, and rising healthcare expenditure levels in the region are anticipated to assist manufacturers in grabbing maximum advantage on these available opportunities. Rapid developments in the healthcare infrastructure coupled with rise in disposable income in emerging economies such as China and India are likely to provide new opportunities and avenues for the market players to get maximum benefit over the forecast period.

Increasing application of electrophysiology devices in the treatment and diagnosis of cardiovascular diseases that includes atrial fibrillation, rising demand for cardiac rhythm management devices used for continuous monitoring and increasing implementation of these devices in out-of-hospital settings are some of the high impact rendering growth drivers for the market.Growing prevalence of cardiac arrest and heart failure (HF) cases among the millennial owing to lifestyle habits such as excessive alcohol consumption and smoking is the other major factor that propels the market growth.

Introduction of new technologies that includes laser ablation, cryoablation, and ultrasound ablation as well as advanced mapping technologies are also anticipated to boost the demand of electrophysiology devices over the forecast period. Besides this, the presence of strict regulations related to the application of electrophysiology devices, high costs associated with these products, and the availability of alternative therapies are the key factors projected to impede the market growth.

| Report Highlights | Details |

| Market Size by 2034 | USD 49.80 Billion |

| Market Size in 2025 | USD 14.55 Billion |

| Market Size in 2024 | USD 12.65 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.69% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Indication, Application, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Atrial fibrillation leads the indication segment in the global electrophysiology devices market for the year 2024. It is a general type of arrhythmia related to high risk of blood clotting and stroke. In many cases, it remains undiagnosed in medical practices using conventional monitoring that result in inadequate treatment at the right time. Consequently, monitoring of atrial fibrillation involves enhanced technological devices for diagnosis that mitigates the limitations imposed by conventional technologies.

Electrophysiology diagnostic devices and treatment devices are two major application segments studied in this report. Diagnostic devices application segment accounted for the largest value share in 2024. Significant application of cardiac monitors as a standard monitoring and diagnostic tool for arrhythmias is one of the major factors attributing for the largest share of the market.

Subsequently, cardiac monitors dominated the electrophysiology diagnostic segment in 2024. The segment includes Electrocardiograph (ECG) monitors, holter monitoring devices, and Insertable Cardiac Monitors (ICM). Increasing application of these devices in interventional medical procedures for example catheter placement along with the introduction of digital and portable systems are some of the major factors expected to propel the growth of the segment during the forthcoming years.

On the other hand, the electrophysiology treatment devices segment offers lucrative growth opportunity in the coming years. Pacemakers emerged as the largest sub-segment in the year 2022. Increasing incidences of different forms of arrhythmia is one of the prime factors attributing for its rapid growth. Besides this, Automated External Defibrillators (AEDs) predicted to witness the highest growth rate over the analysis period. According to the CDC report, increase in the number of Sudden Cardiac Arrest (SCA) cases is a major threat to the population of the United States. Increased use of AEDs has proved useful in reducing the number of deaths among patients suffering from cardiac arrest outside hospitals.

The global electrophysiology devices market seeks intense competition with companies observing to extensive R&D investments and new product development as sustainability strategies. Companies such as Abbot Laboratories, Medtronic Plc., Boston Scientific Corporation, and Biosense Webster, Inc. (Johnson & Johnson) hold significant brand recognition and strong product portfolios.

The market players are adopting inorganic growth strategies to strengthen their product portfolio along with cementing their foothold in the market. For instance, in January 2019, Medtronic Plc acquired EPIX Therapeutics, a private medical device company that designs and manufactures wide range of cardiac electrophysiology devices.

By Indication

By Application

By End-User

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

February 2025