January 2025

Electrosurgical Generator Market (By Type: Bipolar, Monopolar; By Application: Optical, Gynecology, Dermatology, Cardiac, Dental, ENT, Maxillofacial, Orthopedic, Urology, Neurology, Others; By End-use: Hospitals, Ambulatory Surgical Centers, Clinics, Others,) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

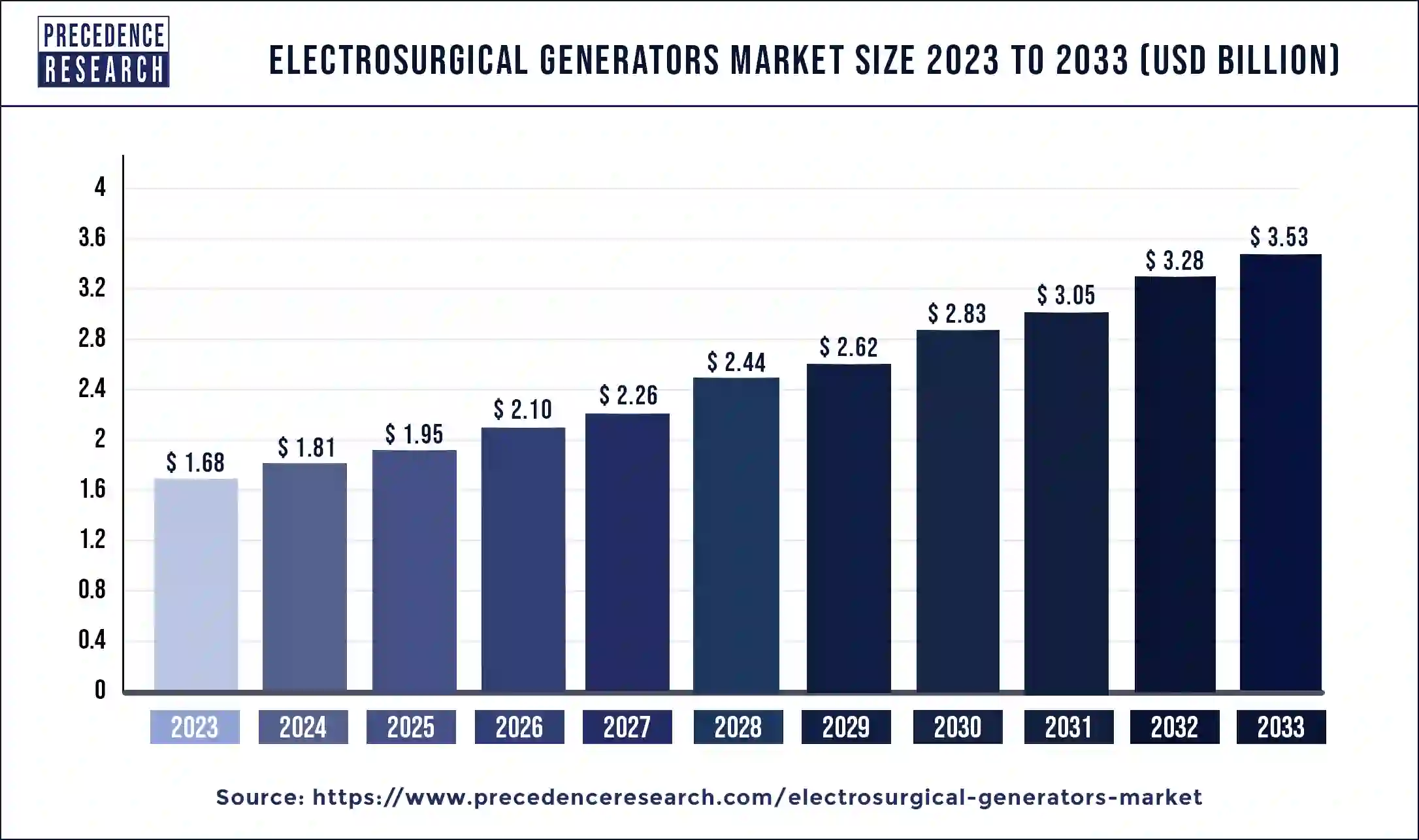

The global electrosurgical generators market size was valued at USD 1.68 billion in 2023 and is anticipated to reach around USD 3.53 billion by 2033, growing at a CAGR of 7.72% from 2024 to 2033. Technological advancement in healthcare practices and increasing preference towards MIS are expected to remain the key growth drivers for the electrosurgical generators market during the forecast period.

Electrosurgical Generators Market Overview

Electrosurgery is used for different medical purposes, such as stopping bleeding (hemostasis) and removing abnormal skin growth. This technique uses electricity to destroy tissue through dehydration, coagulation, or thermal vaporization. The tissue's resistance to the high-frequency current creates a heating effect that destroys the tissue. Electrosurgical generators produce a high-frequency electrical current to cut tissue and control bleeding by causing coagulation.

Electrosurgical generators are designed to create high-frequency electric currents and can produce different types of electrical currents for either bipolar or monopolar electrosurgery, depending on the specific type of surgery. In monopolar electrosurgery, the current flows from the probe electrode to the tissue and completes the circuit as it returns through the patient.

| Report Coverage | Details |

| Electrosurgical Generator Market Size in 2023 | USD 1.68 Billion |

| Electrosurgical Generator Market Size in 2024 | USD 1.81 Billion |

| Electrosurgical Generator Market Size by 2033 | USD 3.53 Billion |

| Electrosurgical Generator Market Growth Rate | CAGR of 7.72% from 2024 to 2033 |

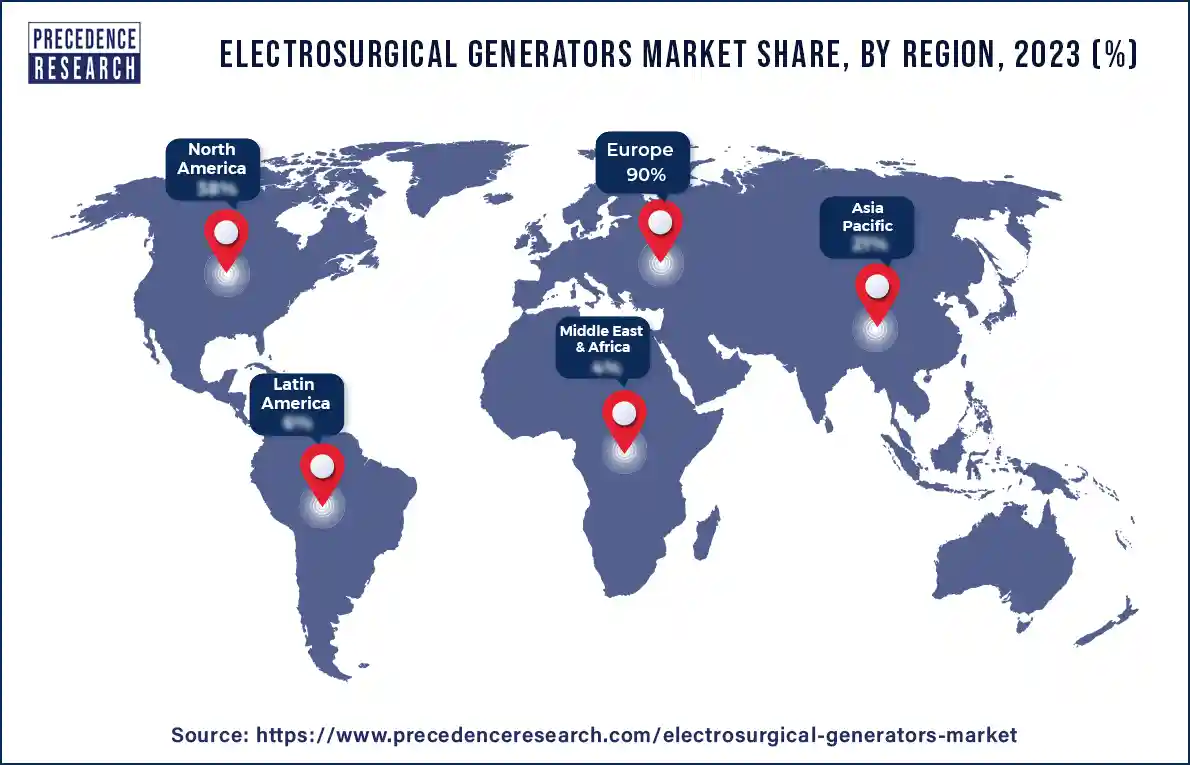

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver: Increasing surgical procedures

The increasing demand for surgical techniques, including minimally invasive procedures, is a significant driver for the electrosurgical generators market. These generators are extensively used in various surgical fields, such as urology, general surgery, gynecology, and orthopedics, to cut, coagulate, and ablate tissues.

The growing global population and the prevalence of chronic diseases have led to a rise in surgical interventions and boosted the demand for electrosurgical generators. These devices allow for precise tissue cutting and coagulation by facilitating minimally invasive surgeries with smaller incisions and quicker recovery times. Additionally, electrosurgical generators enhance surgical precision, reduce bleeding, and improve patient safety, further driving the demand for the electrosurgical generators market.

Restraint: Safety concerns and risk of complications

While electrosurgery offers numerous benefits, such as reduced blood loss and shorter recovery times, it is not without risks. Incorrect use or settings can lead to complications like burns, tissue damage, or accidental harm to surrounding structures. These safety concerns have increased scrutiny and necessitated comprehensive training for healthcare professionals. Additionally, adverse events and litigation related to electrosurgery can deter some providers from adopting this technology and can pose a constraint to the growth of the electrosurgical generators market.

Opportunity: Rising adoption of electrosurgical generators in gynecology and neurology

In gynecology, the electrosurgical generators market services are employed for procedures such as endometrial ablation, cervical conization, and the removal of cervical and vaginal lesions. They enable precise tissue cutting and coagulation with minimal thermal damage to surrounding tissues, crucial for preserving fertility and ensuring patient recovery.

In neurosurgery, the electrosurgical generators market aids in spinal surgery, tumor removal, and epilepsy surgery. The precision provided by these devices is vital in neurology, where operations often involve delicate structures. The ability to perform exact tissue ablation and blood vessel coagulation without causing extensive damage is indispensable.

The bipolar electrosurgical segment held a considerable share of the electrosurgical generators market in 2023. Bipolar electrosurgical generators are designed for procedures that demand precision and reduced thermal spread. In bipolar electrosurgery, the electrical current flows between the two tips of a forceps-shaped instrument, which is applied directly to the target tissue. This configuration confines the electrical energy to the specific tissue area held within the tips and provides enhanced control over the surgical site.

The monopolar generator segment is expected to grow at a notable rate during the forecast period. Monopolar electrosurgical generators are utilized in a wide range of surgical procedures, including general surgery, orthopedics, and urology. These systems are known for their versatility and ability to efficiently coagulate, cut, and dissect tissues. Technological advancements have led to the development of safer and more efficient monopolar electrosurgical generators, which propelled their rapid market growth.

The dermatology segment held a significant share of the electrosurgical generators market in 2023. This growth can be attributed to the increasing awareness of aesthetic dermatology procedures, such as skin resurfacing, mole removal, and cosmetic enhancements. The rising obsession with physical appearance and the desire to look youthful have escalated the demand for aesthetic surgeries. As people become more conscious of their appearance, the demand for dermatological procedures continues to surge, driving the adoption of electrosurgical generators in this field.

The gynecology segment is projected to show notable growth in the electrosurgical generators market over the projected period. Electrosurgery is employed to coagulate tissue during gynecological procedures, enhancing precision and minimizing unnecessary tissue injury. This increased precision contributes to the growth of the gynecology segment.

The hospital segment dominated the electrosurgical generators market in 2023. The hospitals segment holds the largest revenue share over the forecast period. Hospitals extensively use electrosurgical generators for various surgical procedures due to their high patient volume. Given hospitals' critical role in ensuring patient safety and delivering high-quality care, stringent regulations mandate the use of safe and effective electrosurgical generators, further driving their adoption in this segment.

The ambulatory surgical centers segment will grow substantially in the electrosurgical generators market over the studied period. The ambulatory surgical center segment is expanding due to the rise in surgeries, the prevalence of chronic diseases, and the growing elderly population. Ambulatory surgery centers (ASCs) are a crucial part of the healthcare industry, offering outpatient surgical procedures cost-effectively and conveniently. These centers provide high-quality care in a specialized setting and help to enhance the efficiency of the healthcare system.

North America dominated the global electrosurgical generators market in 2023. Europe, with its advanced healthcare systems and stringent regulatory standards, ensures the high quality of medical devices. The demand for electrosurgical devices is expected to increase due to their rising adoption in various surgical procedures across the continent. Additionally, the need for innovative and customized electrosurgical instruments and accessories that meet surgeons' requirements is fueling the market growth. Germany holds the largest share of the electrosurgical devices market in Europe, driven primarily by significant investments in the healthcare sector.

Europe will experience notable growth in the electrosurgical generators market during the projected period. The region's sophisticated healthcare facilities and advanced technological approach contribute significantly to market growth. Key factors such as the increasing prevalence of chronic diseases like cancer, an aging population, and ongoing technological advancements are expected to drive market expansion. Furthermore, the presence of major market players and the growing adoption of advanced medical technologies underpin North America's dominance in the electrosurgical generators market.

Segments Covered in the Report

By Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025