January 2025

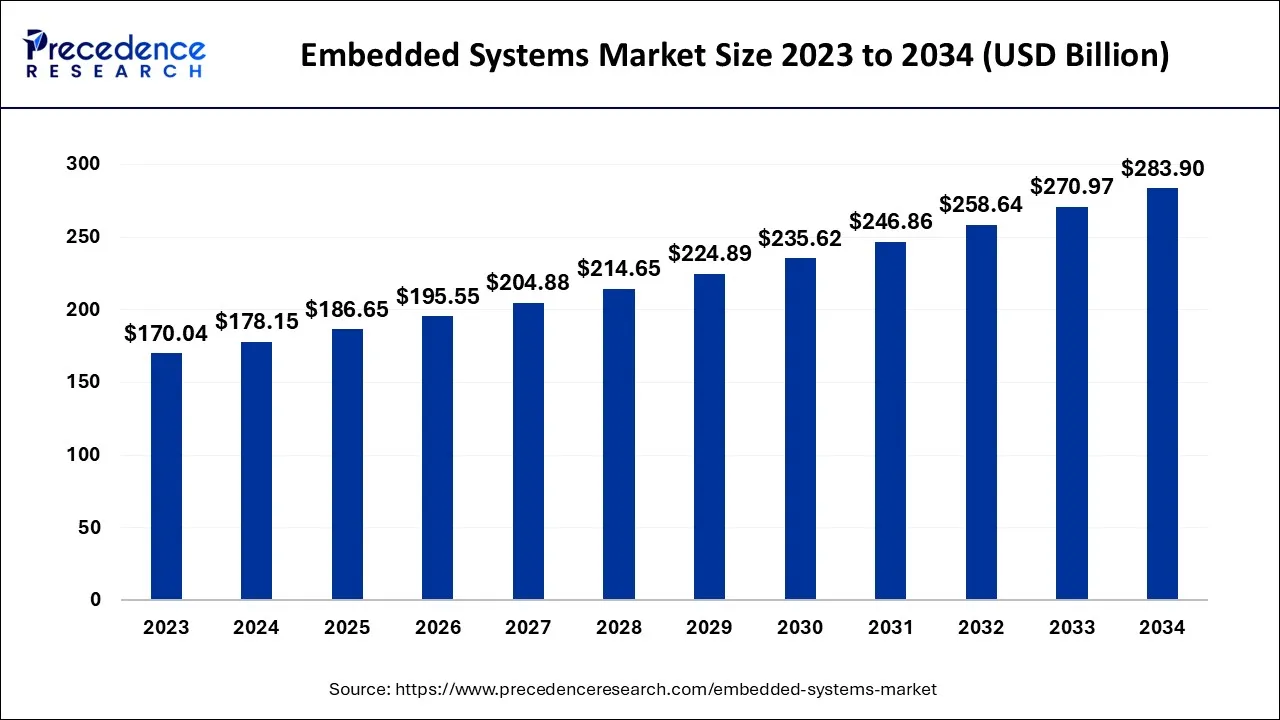

The global embedded systems market size accounted for USD 178.15 billion in 2024, grew to USD 186.65 billion in 2025, and is expected to be worth around USD 283.90 billion by 2034, poised to grow at a CAGR of 4.77% between 2024 and 2034. The North America embedded systems market size is predicted to increase from USD 90.86 billion in 2024 and is estimated to grow at the fastest CAGR of 4.87% during the forecast year.

The global embedded systems market size is expected to be valued at USD 178.15 billion in 2024 and is anticipated to reach around USD 283.90 billion by 2034, expanding at a CAGR of 4.77% over the forecast period from 2024 to 2034.

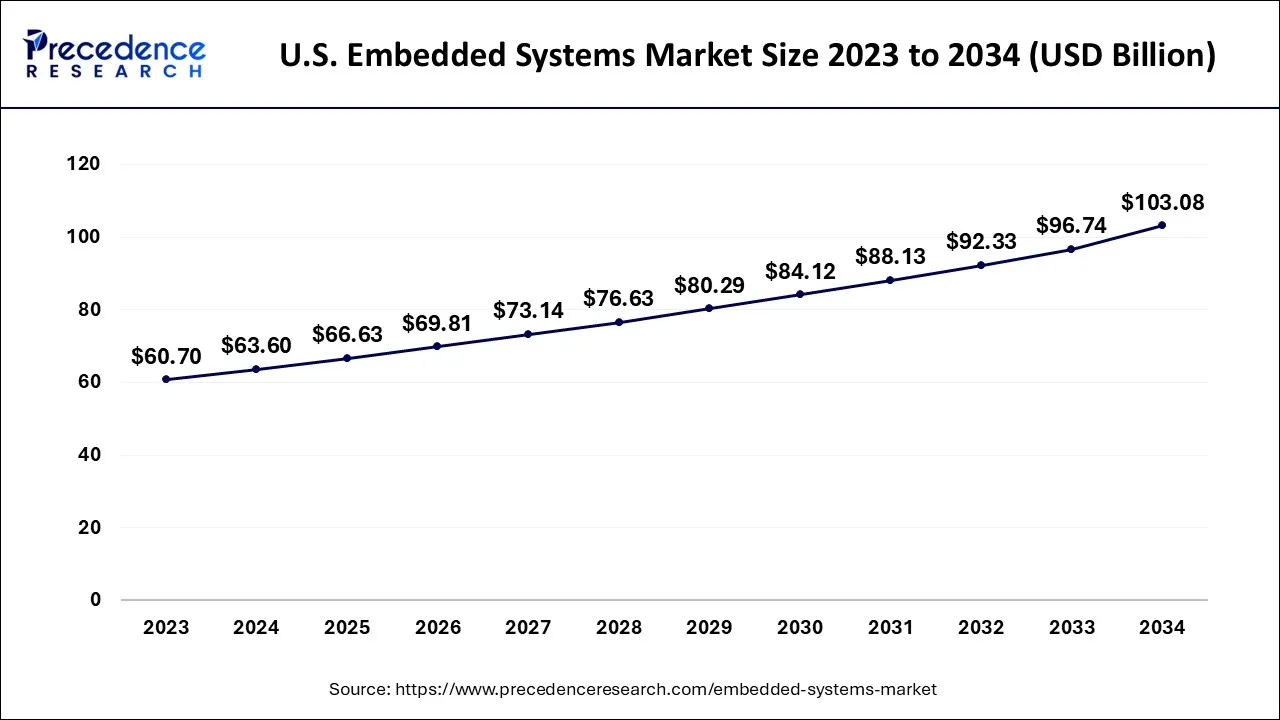

The U.S. embedded systems market size is exhibited at USD 63.60 billion in 2024 and is projected to be worth around USD 103.08 billion by 2034, growing at a CAGR of 4.95% from 2024 to 2034.

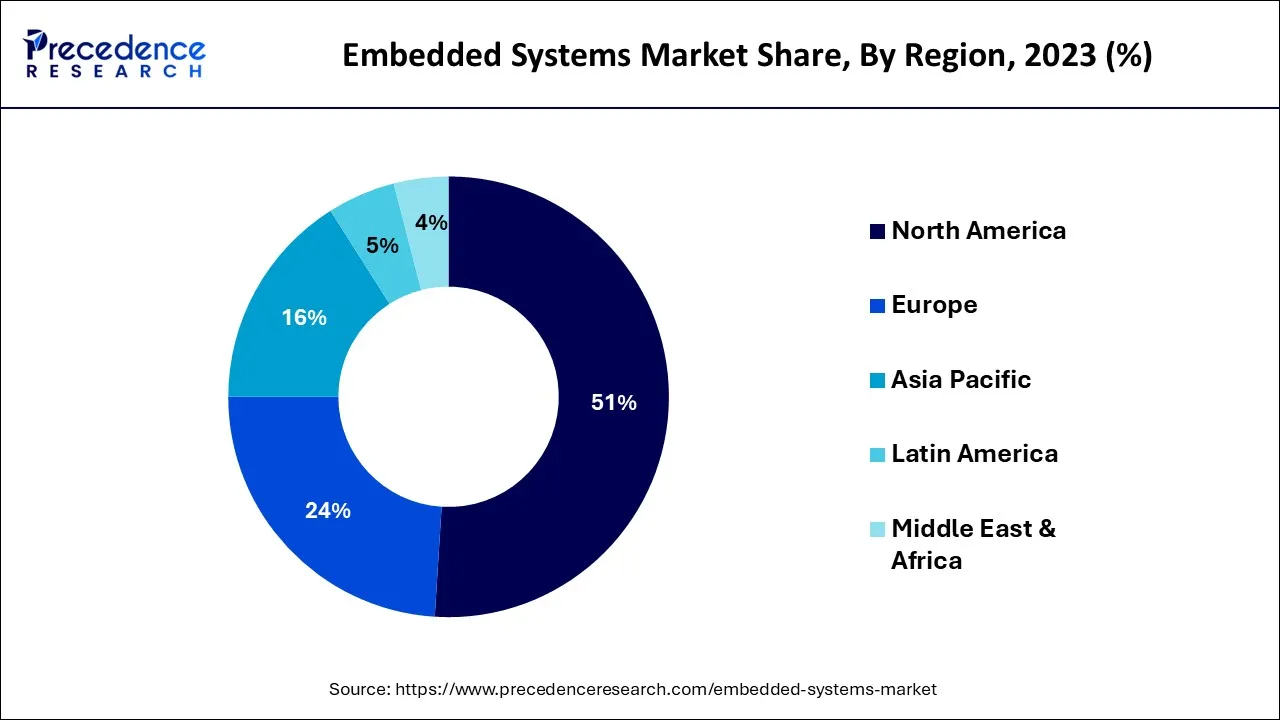

On the basis of geography, North America dominates the market because the region is home to several leading companies in the embedded system industry, as well as many end-users in industries such as automotive, aerospace, healthcare, and industrial automation. The high level of regional research and development investment drives the North American embedded system market. Companies in North America are investing heavily in developing new and innovative embedded systems, which is helping to drive growth in the market.

Another factor driving the growth of the North American embedded system market is the increasing demand for connected devices and systems. As more devices connect to the internet and each other, the demand for embedded systems that can handle this connectivity is growing rapidly.

Europe embedded system market is another major region for embedded systems, with a strong focus on innovation, research, and development. The increasing use of automation and artificial intelligence in various industries drives the market. These technologies rely heavily on embedded systems to operate, and as they become more widespread, this will further create the demand for embedded systems that can handle these functions.

The region in Asia-Pacific is anticipated to have the greatest CAGR driven by various factors, such as the growing adoption of connected devices, increasing demand for automation, and the rise of smart cities. The region is home to several large markets, including China, Japan, India, and South Korea, major global embedded system market players. These countries have strong manufacturing capabilities, significant investments in research and development, and growing demand for embedded systems in various applications in the Asia-Pacific region.

South Korea is one of the Asia-Pacific region's leading markets for embedded systems, driven by strong government support for research and development and a highly skilled workforce. The country is home to many of the leading manufacturers of embedded systems and many end-users in industries such as automotive, consumer electronics, and industrial automation. One of the key drivers of the South Korean embedded system market is the increasing demand for connected devices and systems. The South Korean government has set a target of achieving a 5G penetration rate of 50% by 2022, driving innovation in developing new and more sophisticated embedded systems that can handle this connectivity.

The embedded systems market is the market for computer systems integrated into other devices or systems to control or monitor their operations. These systems are designed to perform specific functions and are used in various applications, including automotive, healthcare, industrial automation, and consumer electronics. They are typically designed to be highly reliable and efficient, with low power consumption and small form factors. They can be programmed to perform various functions, such as controlling machines, monitoring sensors, collecting and transmitting data, and managing power and resources.

Furthermore, increasing demand for automation, connected devices, advancements in microprocessor technology, IoT adoption, smart homes and buildings, and medical devices. Additionally, the emergence of new technologies and advancements and the growing demand for electric and hybrid vehicles are the major factors driving the growth of the embedded systems market.

The Internet of Things (IoT) adoption drives the demand for embedded systems to collect and transmit data from connected devices to cloud-based applications. This data can then be used for analysis and decision-making. The advancements in microprocessor technology, such as miniaturization, low power consumption, and high processing power, are enabling the development of more sophisticated and complex embedded systems has fueled the global embedded systems market growth over the last few decades.

However, high development costs and the complexity of integration are anticipated to impede market growth. Integrating embedded systems into existing devices or systems can be complex and time-consuming, requiring specialized expertise and skills. This can limit the adoption of embedded systems in some applications and industries.

The COVID-19 pandemic have increased demand for healthcare applications. As healthcare systems around the world struggled to cope with the pandemic, there was a need for innovative solutions to help monitor and manage patient care. This has increased demand for medical devices and equipment, such as ventilators, monitors, and diagnostic tools, which rely heavily on embedded systems technology.

The demand for accurate and reliable for accurate and reliable testing is the factor that propelled the market demand. The various factors are helping to drive the market are:

| Report Coverage | Details |

| Market Size in 2024 | USD 178.15 Billion |

| Market Size by 2034 | USD 283.90 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.77% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Function, By Application and By Components |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing use of embedded systems technology for healthcare applications to brighten the market prospect

As healthcare systems worldwide become increasingly advanced and complex, there is a growing need for innovative medical devices that can improve patient outcomes, reduce costs, and increase efficiency. Embedded systems technology is crucial in developing these devices, providing the processing power, memory, and connectivity needed to support advanced functionality. For instance, devices monitor vital signs such as blood pressure, heart rate, and oxygen saturation levels. They often rely on embedded systems technology to collect, process, and transmit data and to provide alerts and notifications when abnormal values are detected.

In addition, there is also a growing demand for connected medical devices that can transmit data to healthcare providers in real-time. This drives the adoption of IoT-enabled medical devices, which often rely on embedded systems technology to support their connectivity and data processing requirements. Thus, the rising demand for medical devices is expected to drive the embedded systems market. As healthcare systems become increasingly advanced and connected, there is likely to be a growing need for innovative embedded systems solutions to support the development of new and improved medical devices.

Increasing demand for electric and hybrid vehicles

Growing demand for electric and hybrid vehicles further helps increase demand for the embedded system market. In the case of electric and hybrid vehicles, embedded systems are used for various functions such as controlling the electric motor, managing battery charging and discharging, monitoring the vehicle's performance, and providing information to the driver.

As the demand for electric and hybrid vehicles continues to grow, the demand for embedded systems that can handle these functions is also increasing. In addition, as these vehicles become more advanced and sophisticated, the complexity of the embedded systems required to run them also increases.

As a result, the embedded system market is expected to grow considerably, largely driven by the increasing demand for electric and hybrid vehicles. This growth is expected to be particularly strong in areas such as automotive electronics, power management systems, and electric vehicle charging infrastructure, which relies heavily on embedded systems technology.

The high cost of embedded systems is causing hindrances to the market

The high manufacturing cost of embedded systems can restrain the demand for embedded systems in the market. Embedded systems can be complex to design and manufacture, requiring specialized components and production processes. This can result in higher manufacturing costs, making it difficult for some companies to enter and drive up consumer prices. In addition, the cost of developing embedded systems can be significant, particularly for highly specialized applications or industries with strict safety or regulatory requirements. This can be a significant barrier to entry for smaller companies and limit the pace of innovation in the market.

However, it is worth noting that the cost of embedded systems has been declining over time, partly due to technological advances and economies of scale. As demand for embedded systems grows, manufacturing costs will likely continue to decrease, making these systems more accessible to a broader range of companies and industries.

These are the following factor which is likely to create opportunity over the forecast period.

On the basis of application, the embedded systems market is divided into automotive, consumer electronics, industrial, aerospace and defense, and others, with the automotive accounting for most of the market. This is partly due to the increasing use of embedded systems in modern vehicles, which are becoming more complex and sophisticated each year. Embedded systems are used in various automotive applications, including safety and driver assistance systems, infotainment systems, and powertrain control systems. These systems rely on a combination of hardware and software components and are essential for ensuring modern vehicles' safe and efficient operation.

On the basis of components, the embedded systems market is divided into hardware and software, with the hardware accounting for most of the market. Hardware refers to the physical components of an embedded system, such as microprocessors, sensors, and other electronic components. Hardware components are essential for building embedded systems. In many cases, they are expensive and critical parts of an embedded system, and companies invest significant resources in developing and manufacturing these components.

In addition, hardware components are typically more visible and tangible than software components, making them easier for customers to understand and evaluate. This can lead to a greater emphasis on hardware regarding marketing and sales efforts.

The software segment is also growing in importance as embedded systems become more complex and sophisticated. Software plays a critical role in controlling and managing the hardware components of an embedded system, and companies that can develop high-quality software can gain a competitive advantage in the market.

Segments Covered in the Report

By Function

By Application

By Components

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

July 2024

August 2024