September 2024

Embolic Protection Devices Market (By Product: Distal Occlusion Filters, Proximal Occlusion Filters, Distal Filters; By Application: Neurovascular Diseases, Cardiovascular Diseases, Peripheral Vascular Diseases) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

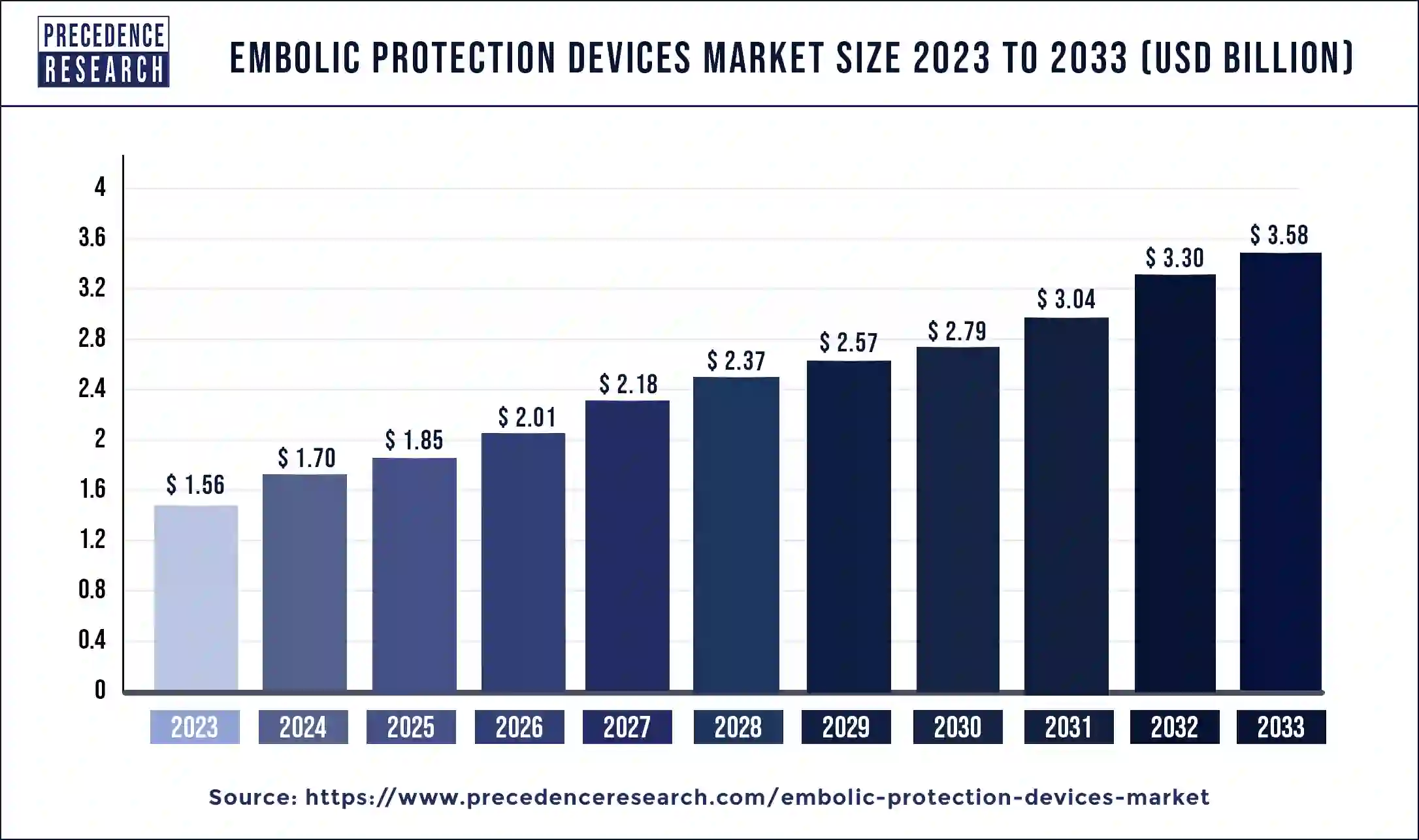

The global embolic protection devices market size was valued at USD 1.56 billion in 2023 and is anticipated to reach around USD 3.58 billion by 2033, growing at a CAGR of 8.64% from 2024 to 2033. Rising cases of peripheral and neurovascular surgeries and heavy investments in the R&D of embolic devices are the prime factors that are propelling market growth of the embolic protection devices market.

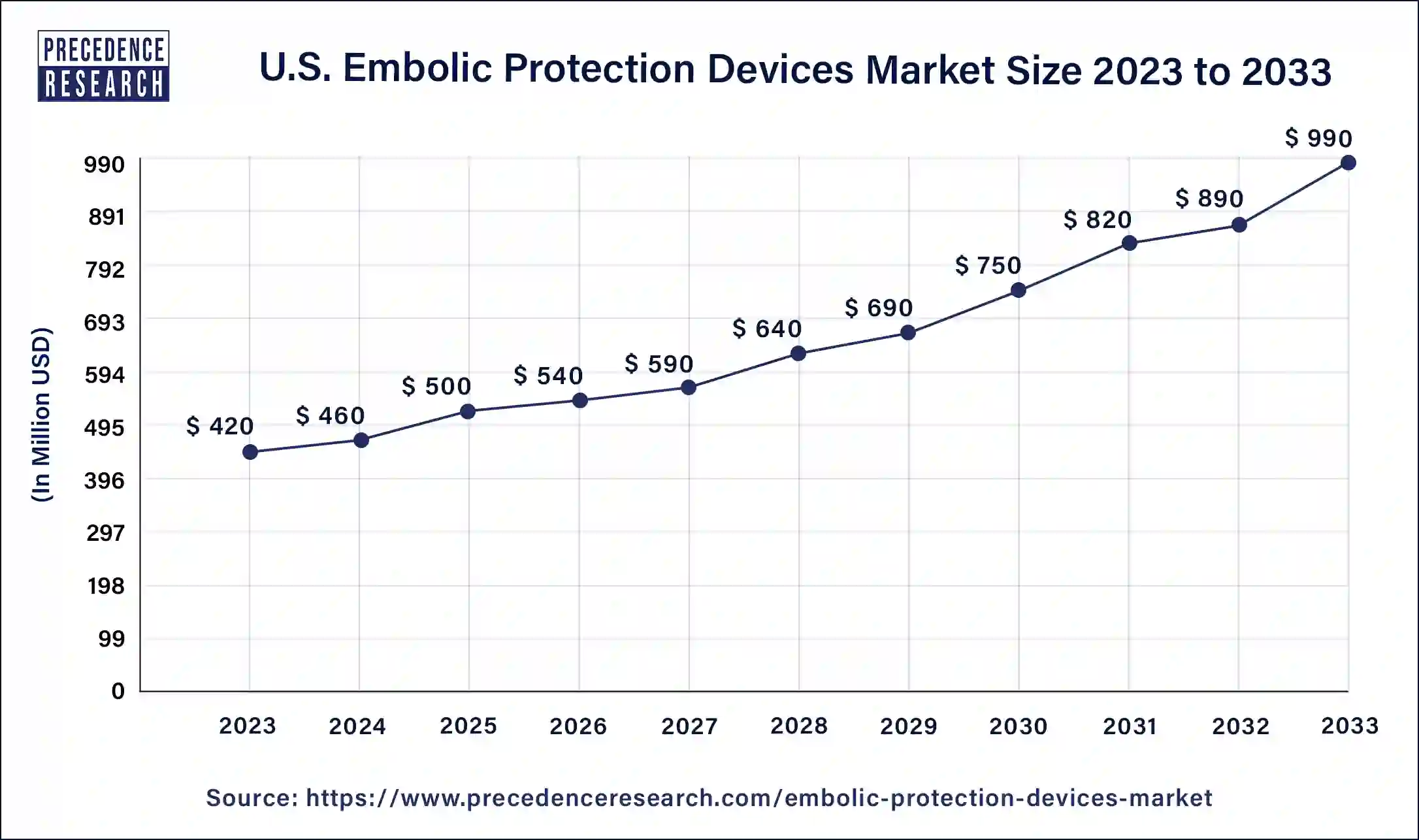

The U.S. embolic protection devices market size was estimated at USD 420 million in 2023 and is predicted to be worth around USD 990 million by 2033 with a CAGR of 8.95% from 2024 to 2033.

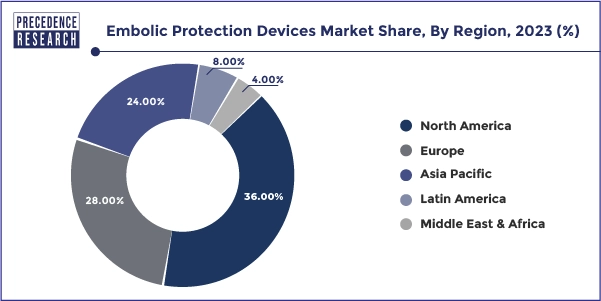

North America's region dominated the global embolic protection devices market in 2023. The region's robust healthcare infrastructure, technological advancements, and high prevalence of cardiovascular diseases drive the demand for effective embolic protection strategies. Well-established healthcare facilities, a strong focus on patient safety and outcomes, favorable reimbursement policies, and a tendency to adopt innovative medical technologies can further promote the use of embolic protection devices in various cardiovascular interventions.

Asia Pacific is expected to show rapid growth in the global embolic protection devices market during the forecast period. The region is experiencing rapid market growth due to several factors, including a growing elderly population, increasing incidence of cardiovascular diseases, improved access to healthcare services, and rising healthcare infrastructure investments.

Additionally, rising disposable incomes, an expanding medical tourism industry, and greater awareness of the benefits of minimally invasive procedures are driving the demand for embolic protection devices. Furthermore, supportive government initiatives and collaborations between regional and international market players are expected to further fuel market growth in Asia Pacific in the coming years.

The Asia Pacific embolic protection devices market size was calculated at USD 370 million in 2023 and is projected to expand around USD 880 million by 2033, poised to grow at a CAGR of 9.05% from 2024 to 2033.

| Forecast Year | Market Size in USD |

| 2023 | $ 370 Million |

| 2024 | $ 410 Million |

| 2025 | $ 440 Million |

| 2026 | $ 480 Million |

| 2027 | $ 520 Million |

| 2028 | $ 570 Million |

| 2029 | $ 620 Million |

| 2030 | $ 670 Million |

| 2031 | $ 730 Million |

| 2032 | $ 790 Million |

| 2033 | $ 880 Million |

Embolic Protection Devices Market Overview

Embolic protection devices are specialized medical instruments designed to prevent debris, blood clots, or other harmful particles from migrating during minimally invasive procedures, particularly in cardiovascular interventions. These devices function as filters or barriers, capturing emboli that could otherwise travel through the bloodstream and cause complications such as stroke or organ damage. Embolic protection devices are widely used in healthcare, playing a crucial role in minimizing post-procedural complications and preserving patient well-being. The increasing focus on reducing post-procedural complications and hospital stays has accelerated the adoption of these devices globally.

| Report Coverage | Details |

| Embolic Protection Devices Market Size in 2023 | USD 1.56 Billion |

| Embolic Protection Devices Market Size in 2024 | USD 1.70 Billion |

| Embolic Protection Devices Market Size by 2033 | USD 3.58 Billion |

| Embolic Protection Devices Market Growth Rate | CAGR of 8.64% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver: The growing incidence of cardiac diseases and the adoption of PCI

The embolic protection devices market is driven by the increasing prevalence of cardiovascular and neurovascular diseases, technological advancements, and the frequent introduction of new products by key market players in the diagnostic field. Additionally, the growing government initiatives in research and development for pre-diagnostics contribute to revenue growth.

EPDs capture blood and debris inside Saphenous vein grafts (SVGs), preventing distal embolization during stenting procedures. Using EPDs is the most effective method for reducing periprocedural myocardial infarction and major adverse cardiovascular events during SVG treatments. The American College of Cardiology recommends the use of EPDs whenever it is feasible.

Restraint: Adverse events

In the embolic protection devices market, despite technological advancements, embolic protection devices carry risks of complications such as embolization, vascular injuries, and device malfunctions. Concerns about safety and effectiveness, particularly in high-risk situations, may discourage patients and healthcare professionals from using these devices. Furthermore, some patients and healthcare professionals may prefer alternative treatments, such as medical therapy or conventional surgery, over interventional procedures using embolic protection devices. Factors influencing this preference include patient comorbidities, clinical judgment, and perceived risks.

Opportunity: New possibilities in emerging economies

Emerging economies such as India, China, and South Africa are driving the growth of the global embolic protection devices market. Contributing factors include the increasing prevalence of chronic diseases, increasing private healthcare investments, rising income levels, growing healthcare awareness, and government initiatives to develop rural healthcare. Companies like Boston Scientific, Terumo, Stryker, and Medtronic are capitalizing on growth opportunities in these regions by increasing R&D investments and expanding their presence. They are also building and expanding manufacturing facilities in these countries due to the availability of low-cost labor and a large patient population.

The distal occlusion systems segment held a significant share of the embolic protection devices market in 2023. These devices are designed to be placed distally in the vessel to capture and prevent emboli from reaching critical organs during invasive cardiovascular procedures. Distal occlusion filters have become popular due to their effectiveness in reducing the risk of embolization and their compatibility with various interventional procedures. They offer benefits such as ease of use, improved patient safety, and clinical outcomes, which makes them the preferred choice for many healthcare professionals.

The proximal occlusion systems segment is expected to grow rapidly in the embolic protection devices market over the projected period. Proximal occlusion devices provide cerebral protection by reversing blood flow from the internal carotid artery into the arterial guide sheath, which serves as the conduit for deploying devices across the carotid bifurcation. The growing recognition of their effectiveness in preserving cerebral and peripheral circulation has led to increased adoption among healthcare professionals, driving demand for these devices.

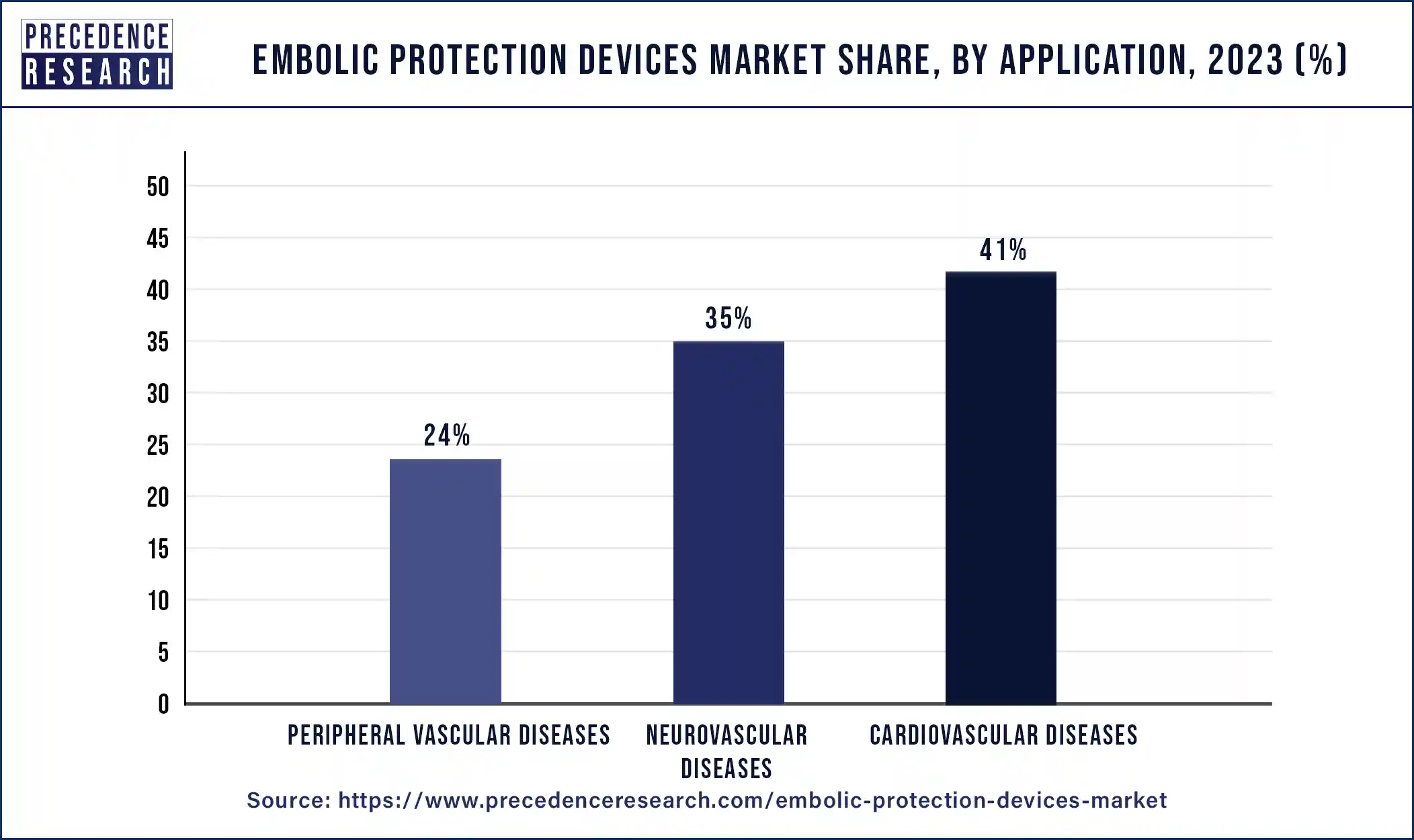

The cardiovascular diseases segment dominated the embolic protection devices market in 2023. Cardiovascular diseases include conditions such as coronary artery disease, valvular heart disease, and peripheral artery disease. These often require invasive procedures like percutaneous coronary intervention (PCI) or transcatheter aortic valve replacement (TAVR), where embolic protection devices are essential in preventing complications. The global prevalence of cardiovascular diseases and the increasing use of minimally invasive procedures have driven the dominance of the cardiovascular segment in the market.

The peripheral vascular diseases segment is expected to witness the fastest growth in the embolic protection devices market over the forecast period. Peripheral vascular disease (PVD) is a blood disorder that causes the arteries and veins outside of the brain and heart to narrow due to plaque formation after surgery. The peripheral diseases segment is expected to grow positively due to increased awareness of minimally invasive procedures and rising lifestyle disorders.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

April 2025

January 2025

January 2025