January 2025

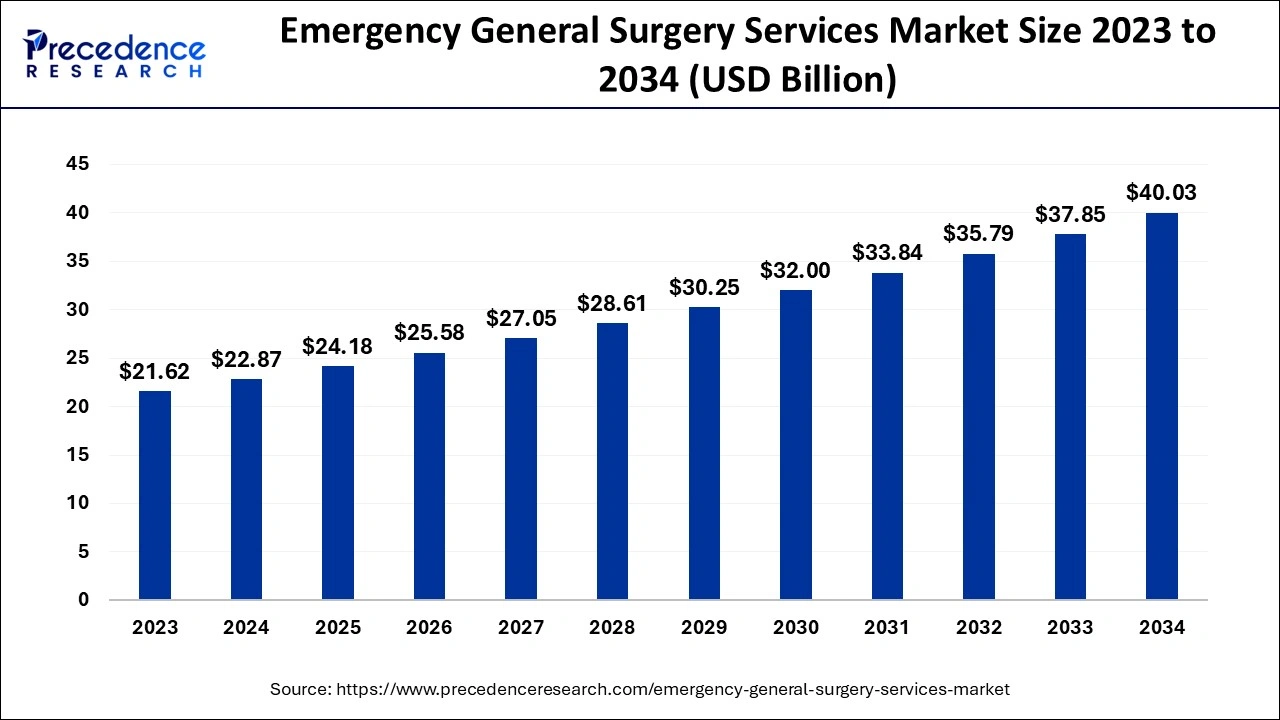

The global emergency general surgery services market size is calculated at USD 22.87 billion in 2024, grew to USD 24.18 billion in 2025 and is projected to reach around USD 40.03 billion by 2034. The market is expanding at a CAGR of 5.76% between 2024 and 2034.

The global emergency general surgery services market size is worth around USD 22.87 billion in 2024 and is predicted to surpass around USD 40.03 billion by 2034, growing at a CAGR of 5.76% from 2024 to 2034. The emergency general surgery services market is set to rise due to increasing rates of acute surgical illnesses, increasing urbanization, development in medical technology, and better health systems.

Emergency general surgery (EGS) is defined as complex surgeries that involve both general surgeons and other medical specialists for patients with traumatic and non-traumatic acute pathologies during the same admittance. Emergency surgery is a medical specialty that focuses on the surgical treatment of acute conditions that require an urgent response. This includes trauma, abdominal emergencies, and other critical surgical situations. Emergency surgery (EGS) is an evolving surgical specialty that adopts trauma care principles such as 24/7 organized teams, evidence-based processes and procedures, and a continuous focus on quality improvement.

How AI Impacts on Emergency General Surgery Services Market?

Artificial intelligence (AI) has the potential for integration into the emergency general surgery services market solutions from the diagnostic level, decision-making, and physical assisting the surgeon regarding the risks assigned to each patient. AI in healthcare has been created and deployed with the worthy possibility of solving health disparities and social and economic gaps, achieving universal health coverage, and bettering health results around the world.

AI integration in the emergency general surgery services market might enhance the clinical work and management of operation theatres as it supports consistent and standard approaches during admitting decisions. It has become one of the most powerful tools in medicine, and it affects diagnostics and treatment planning in almost all specialties. In fields like radiology and oncology, AI has been enhancing the efficiency of diagnosis, detecting diseases at early stages, and enhancing the right treatment plans.

| Report Coverage | Details |

| Market Size by 2034 | USD 40.03 Billion |

| Market Size in 2024 | USD 22.87 Billion |

| Market Size in 2025 | USD 24.18 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.76% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing incidence of chronic and acute diseases

The population is aging, people adopt healthy lifestyles, and treatment costs are ever-rising. They are long-term conditions and are largely a result of unhealthy lifestyles, which include poor diets, lack of exercise, tobacco use, and excessive use of alcohol. Surgery, which is done on an emergency basis, is done on patients who have conditions that need immediate treatment. The need to perform operations in an emergency has steadily grown in healthcare organizations. The growth in the rate of acute and chronic surgical ailments has propelled the demand for emergency surgeries and expanded the emergency general surgery services market.

Operation costs are high because the equipment, human resources, and even maintenance costs are highly demanding while providing emergency surgical services. Budget issues because small institutions cannot afford to purchase quality restraint devices and provide extensive training to reduce healthcare costs. Also, there is a shortage of skilled professionals, including trained surgeons and staff.

Advancements in surgical technologies

A relative improvement over surgical technologies such as robotic surgery and better imaging in emergency surgeries has enhanced the standards of the emergency general surgery services market. Other reasons for increased utilization of operative procedures include short periods of recovery after surgery, decreased incidences of complications after the surgery, and minimal soreness after the surgery. Robotics, artificial intelligence, and digital health as technological innovations will change the landscape of the surgical profession. Recent developments show the application of robotic systems in surgery, thus illustrating that such improvements improve the quality and speed of emergency operations.

The abdominal surgery segment contributed the largest share of the emergency general surgery services market in 2023. EGS is an acute surgical service that provides care for patients with acute surgical conditions as well as abdominal emergencies. Abdominal surgery is an operation in which the abdomen is opened to treat diseases or injuries in the gastrointestinal tract, liver, gall bladder, pancreas, and other organs. Emergency General Surgery includes a complete range of surgical procedures required to be done for acute surgical pathologies. These processes usually present acute surgical pathology, which is expected of EGS surgeons with qualifications in a broad spectrum of trauma, abdominal emergency surgeries, and other complicated surgical procedures.

The trauma surgery segment is expected to show considerable growth in the emergency general surgery services market over the forecast period. EGS is a group of operations that are usually performed on a patient during a hospital admission for an acute disease or injury. Surgical emergencies are procedures that embrace trauma surgeries that are done in an emergency and the patient is critically ill. Emergency surgery is severe trauma or any other critical illness, and trauma surgery is the type of emergency surgery. The management of trauma patients includes resuscitation and stabilization, operative interventions, surgical procedures after injury, and postoperative management of the trauma patient.

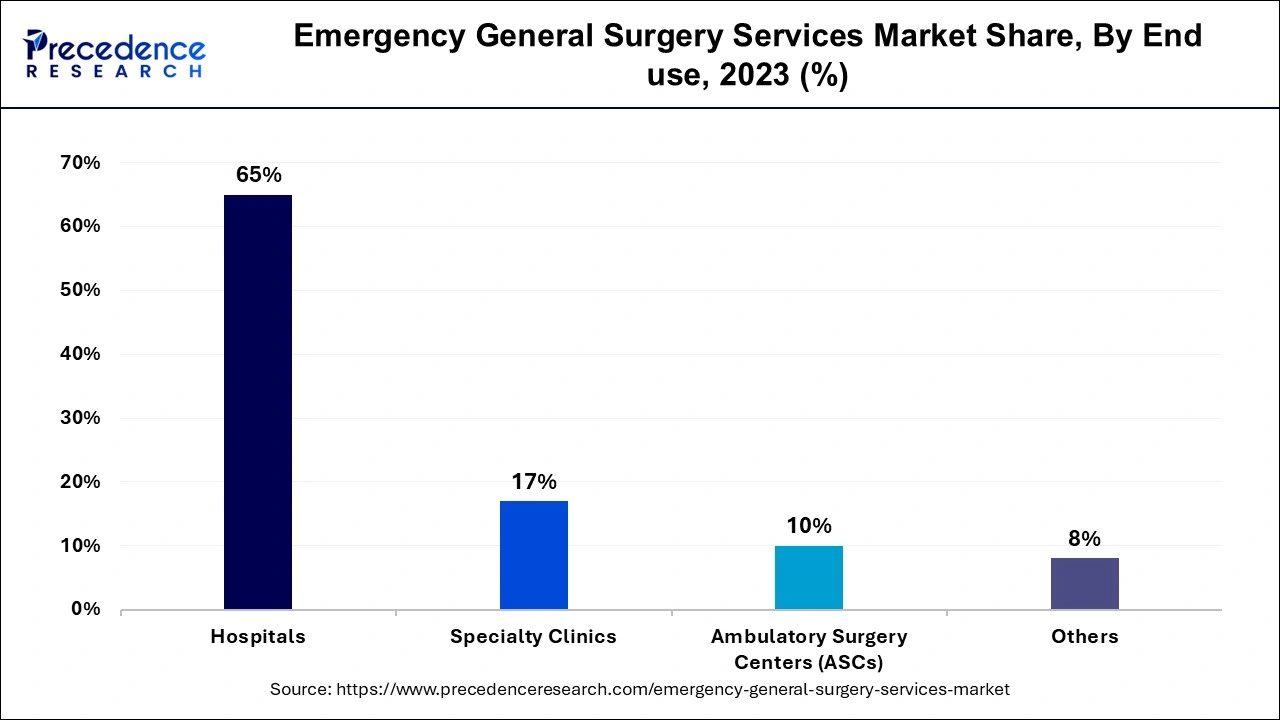

The hospital segment accounted for the largest share of the emergency general surgery services market in 2023. Hospitals are well-endowed with equipment, professional surgical teams, and institutional frameworks that best suit most unexpected disasters. This ability to respond immediately and work cross-functional improves the overall fate of patients. Furthermore, the increase in user rates of trauma cases and acute surgical diseases also contributed to increased demand for emergency services within the hospital environment.

The ambulatory surgery centers (ASCs) segment is anticipated to witness significant growth in the emergency general surgery services market over the studied period. An ambulatory surgery center is a specialized medical facility that provides surgical operations and procedures that can be performed on an outpatient basis. Compared to outpatient procedures in a hospital, ASCs are more convenient and provide some additional advantages. Ambulatory surgery centers, also known as outpatient surgery centers, are new models of healthcare facilities for the delivery of same-day surgical care and the majority of diagnostic and preventive treatments.

North America led the global emergency general surgery services market in 2023. North America was the largest market due to the increase in healthcare systems, qualified surgeons, and increased investments in health technology. Both the structure of the hospitals and emergency care services are well-developed in the region. This increases innovation and enhances outcome delivery as leading healthcare organizations and research as well as learning institutions exist.

Asia Pacific is expected to host the fastest-growing emergency general surgery services market throughout the forecast period. These factors include rising population density, higher rates of occurrence of traumatology-related injuries, and status diseases. A growing number of hospitals and clinics, together with the state encouraging the development of the infrastructure of emergency medical care, all contribute to the market growth. Also, the evolution of better surgical equipment and efficient health professionals in the region has created and improved intervention in emergency surgical services.

Segments Covered in the Report

By Procedure

By End use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

February 2025

February 2025