January 2025

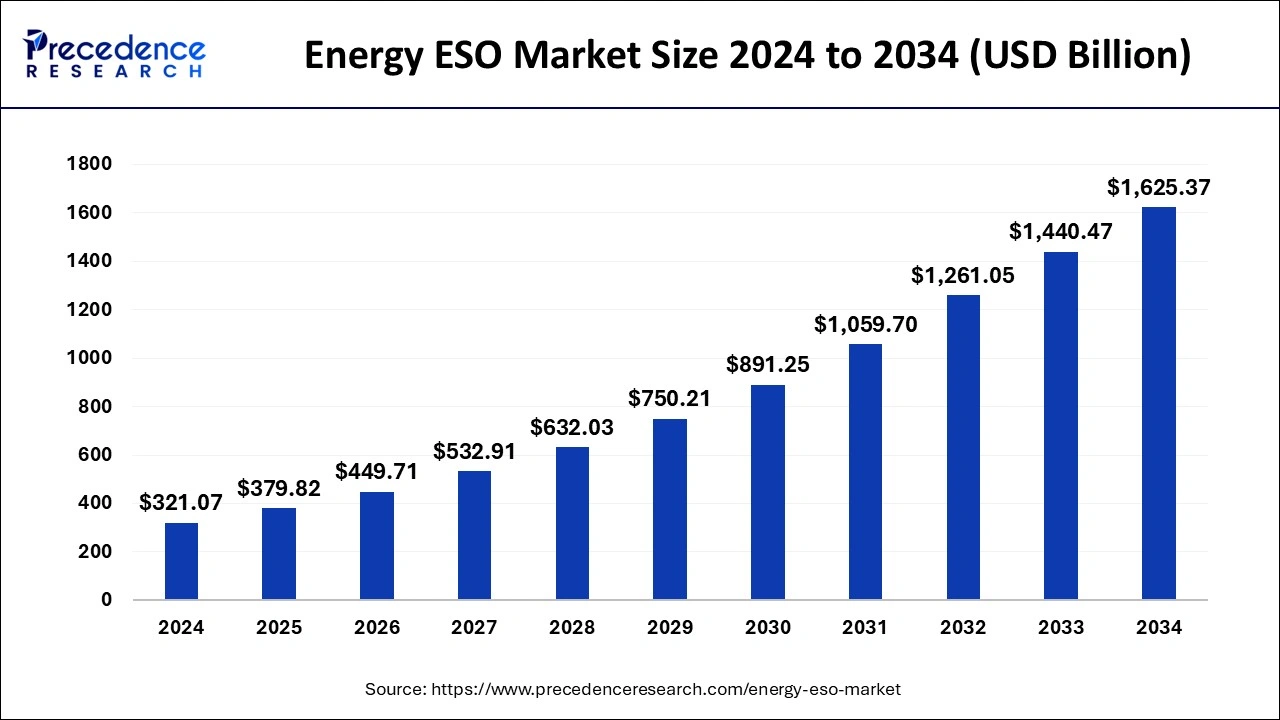

The global energy ESO market size is calculated at USD 379.82 billion in 2025 and is forecasted to reach around USD 1,625.37 billion by 2034, accelerating at a CAGR of 17.61% from 2025 to 2034. The North America energy ESO market size surpassed USD 122.01 billion in 2024 and is expanding at a CAGR of 17.76% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global energy ESO market size was worth around USD 321.07 billion in 2024 and is anticipated to reach around USD 1,625.37 billion by 2034, growing at a CAGR of 17.61% from 2025 to 2034. The global environmental sanctions and the adoption of smart grids, and forecasting tools are leading to high demand in the energy ESO market.

Artificial intelligence (AI) algorithms help to generate increasingly accurate forecasts and also coordinate many participants in the virtual power plant. AI in energy power systems is better equipped to predict and identify system faults, improve real-time monitoring, improve power flow, and stabilize the grid. AI is helpful to improve the efficiency and reliability of reliability of electricity distribution. AI improves the decision-making process in the production. These factors help the growth of the energy ESO market.

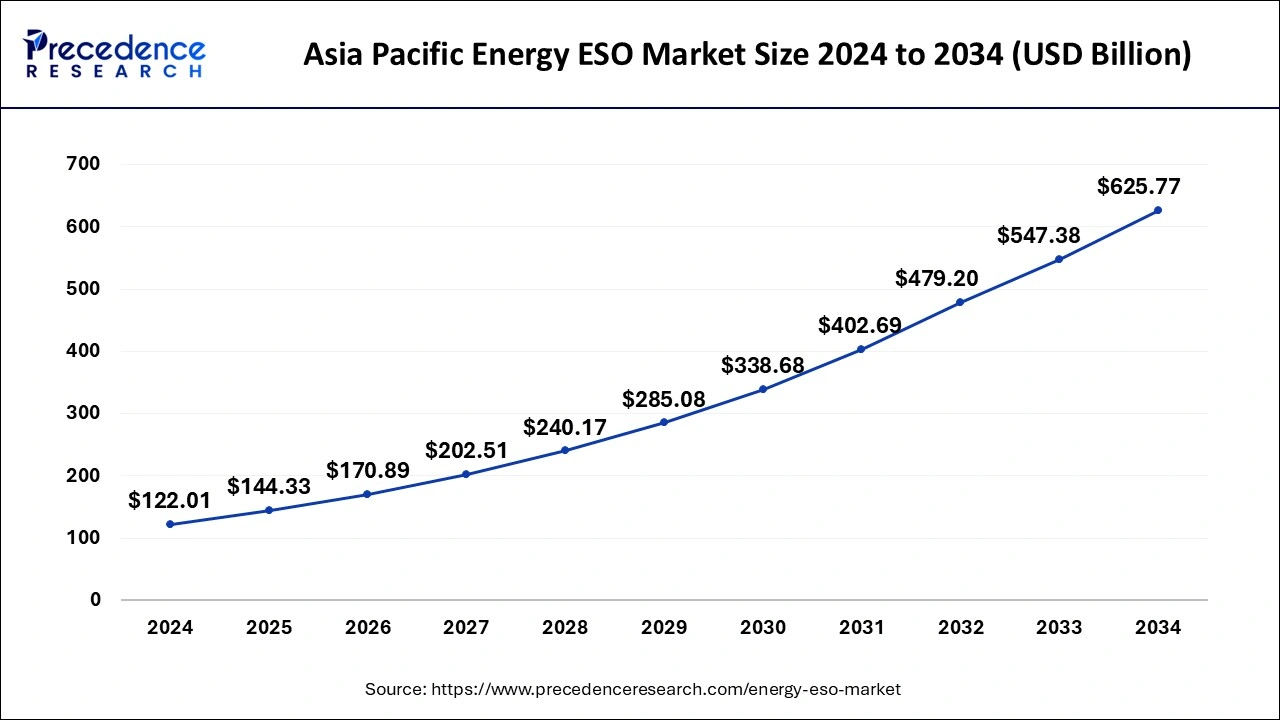

The Asia Pacific energy ESO market size was exhibited at USD 122.01 billion in 2024 and is projected to be worth around USD 625.77 billion by 2034, growing at a CAGR of 17.76% from 2025 to 2034.

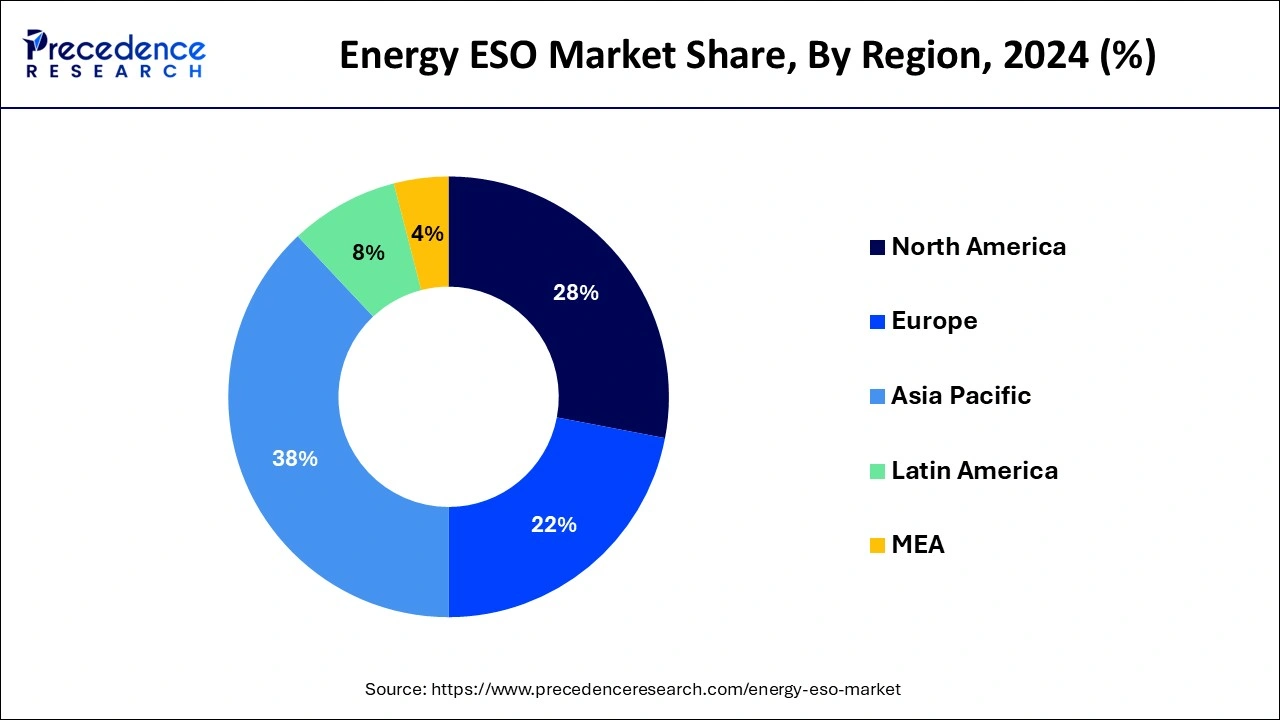

Asia Pacific region dominated the growth of the energy ESO market. The huge presence of skilled and talented engineers and the favorable government regulations has fostered the growth of the Asia Pacific energy ESO market. The availability of cheap labor is the major factor behind the market growth. Moreover, the rising investments in the green and clean energy are expected to further augment the market growth in the forthcoming years.

North America is estimated to witness the fastest-growth rate during the forecast period. The rising government and corporate investments towards the adoption of the renewable energy sources is significantly driving the market growth in North America. The higher adoption rate of the sustainable and advanced technologies in the region is expected to drive the growth of the North America energy ESO market during the forecast period.

| Report Coverage | Details |

| Market Size in 2025 | USD 379.82 Billion |

| Market Size by 2034 | USD 1,625.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.61% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Service, Location, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The non-renewable segment dominated the global energy ESO market, garnering a market share of around 56% in 2022. The increased consumption of non-renewable energy sources such as fossil fuels, coal, petroleum, and natural gas for the generation of energy across the globe has resulted in the dominance of this segment. The rising production of natural gas owing to the presence of abundant resources of natural gas such as coalbed methane, shale gas, and tight gas, is expected to fuel the growth of this segment in the nearby future.

On the other hand, the renewable is estimated to be the most opportunistic segment during the forecast period. The growing concerns regarding the deteriorating environmental condition, rising initiatives to reduces carbon footprint, and increasing investments towards shifting to the renewable energy sources is fueling the growth of this segment across the globe. The strong economic growth owing to rising industrialization and growing volume of economic activities is fueling the demand for the uninterrupted energy supply. The rising demand for efficient energy supply coupled with rising efforts to reduce greenhouse gases emission is driving the growth of the renewable segment.

Depending on the service, the structuring & layout segment accounted for a market share of around 36% and dominated the global energy ESO market in 2022. The engineering service providers provide structuring and layout services for various large infrastructure projects such as solar plants, wind plants, oil & gas, and mining plants. The increased adoption of the structuring and layout services from the engineering service providers has fostered the growth of this segment.

The R&D and designing is expected to be the fastest-growing segment during the forecast period. The growing demand for the real-time analytics across the energy sector is fueling the growth of this segment. Moreover, the rising needs for analyzing the large volumes of generated data in the energy generation and the real-time feedback from the smart grids is expected to fuel the growth. Furthermore, the rising government investments on the research & development activities relating to the energy are fostering the growth. For instance, as per the International Energy Agency, around 26 billion was spent by the governments all over the globe in 2018 on the energy R&D.

The onshore segment garnered a market share of around 57% and dominated the global energy ESO market in 2023. The privacy and the security are the major reason that forces the OEMs to outsource the onshore activities. The presence of the several local engineering service providers has resulted in the dominance of the onshore segment as the presence of the service providers in the home region is essential for the onshore related service activities. The increased concerns regarding the data privacy and data security is fueling the demand for the onshore services and hence this segment is expected to be the fastest-growing segment during the forecast period.

Segments Covered in the Report

By Source

By Service

By Location

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

August 2024