January 2025

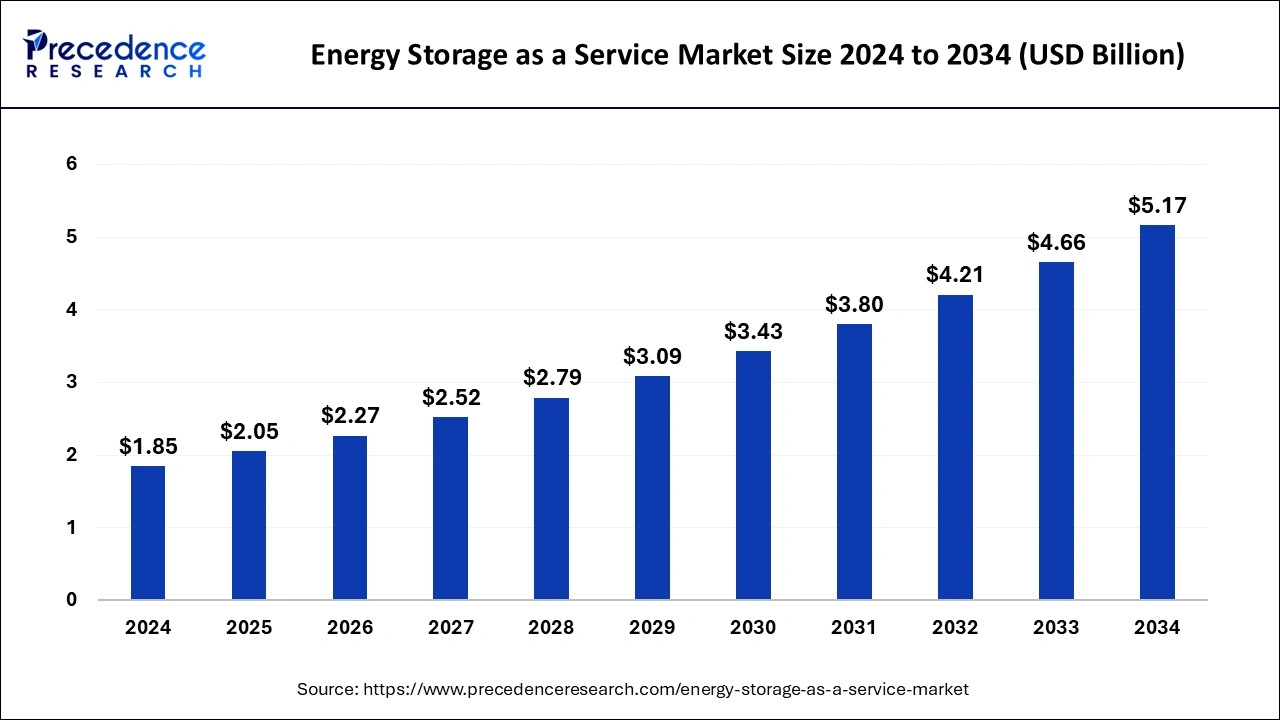

The global energy storage as a service market size is calculated at USD 2.05 billion in 2025 and is forecasted to reach around USD 5.17 billion by 2034, accelerating at a CAGR of 10.82% from 2025 to 2034. The North America market size surpassed USD 760 million in 2024 and is expanding at a CAGR of 10.96% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global energy storage as a service market size accounted for USD 1.85 billion in 2024 and is predicted to reach around USD 5.17 billion by 2034, expanding at a CAGR of 10.82% from 2025 to 2034. The essential features, such as backup power, grid stabilization, renewable energy integration, and reduced carbon footprint, drive the growth of the energy storage as a service market.

Integrating AI into energy storage offers smart energy use, cost, and resource savings. AI algorithms optimize energy management and improve battery storage systems. AI offers maintenance and cleaning, as well as monitoring inverter conditions and panel output. AI can monitor weather forecasts and calculate energy storage. AI makes possible energy production and energy consumption prediction by using weather and satellite data, statistical analysis, and numerical weather prediction models. With the help of AI, energy storage operators can immediately act for predictive maintenance. AI can detect anomalies and errors across electrical, thermodynamic, and chemical subsystems and inform operators before any failures.

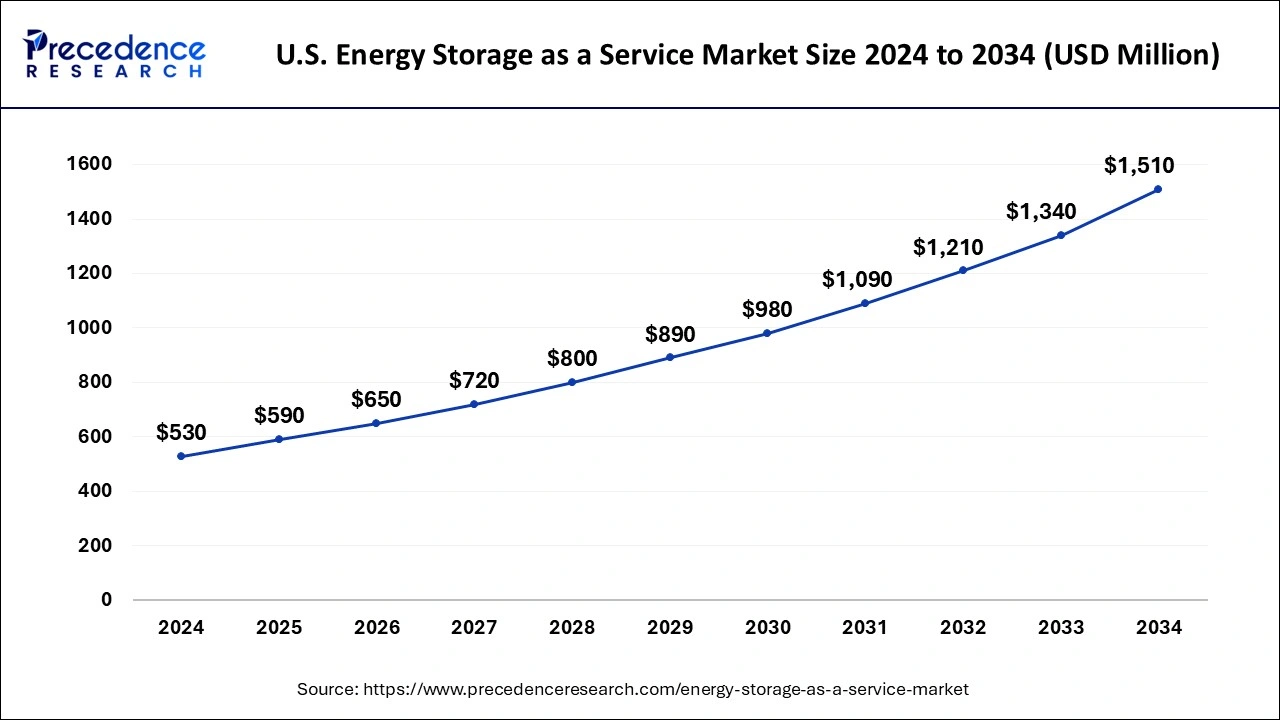

The U.S. energy storage as a service market size was exhibited at USD 530 million in 2024 and is projected to be worth around USD 1,510 million by 2034, growing at a CAGR of 11.04% from 2025 to 2034.

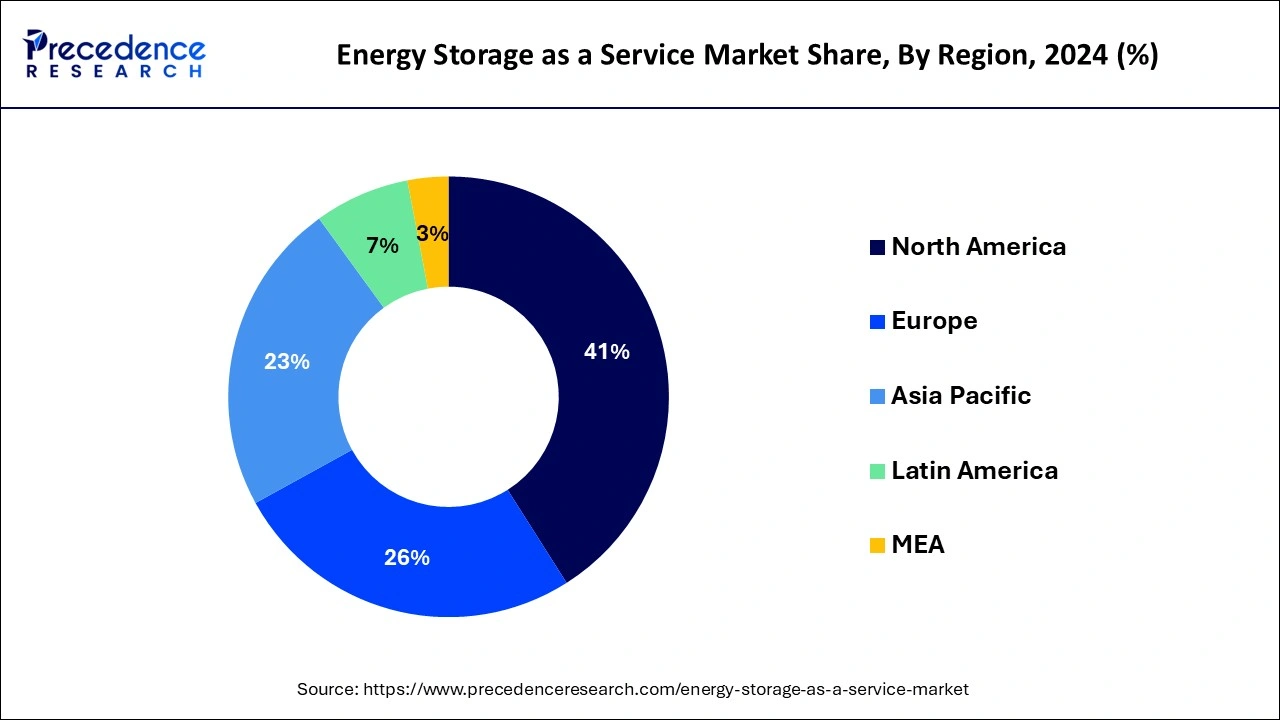

North America dominated the market with a revenue share of 41% in 2024. This is due to the growing need for smart buildings and building automation. The energy storage as a service market is developing due to rising demand for services such as offering demand energy response solutions and implementing energy efficiency projects as a result of the growing commercial industry.

The high energy consumption is due to the presence of several industries across the automotive, chemical, healthcare, and aerospace sectors. The growing demand for services such as peak load, black start, energy arbitrage, and demand charge management in residential, commercial, and industrial sectors contributes to the market’s growth in the North American region. The industrialists prefer to purchase energy storage systems for energy storage services for regular energy supply and to avoid blackouts.

Asia-Pacific is expected to develop at the fastest rate x% during the forecast period. This is attributed to the presence of a number of undiscovered markets as well as increased energy consumption in Asia-Pacific. Moreover, the region’s rapid industry, high energy use, and greater knowledge of renewable energy sources.

The increasing industrialization and rising energy consumption drive the market’s growth in the Asia Pacific region. The countries in India, South Korea, Japan, and China have strong presences of industries that focus on business models, which is expected to accelerate the adoption of energy storage systems. The increased utilization of these energy storage services in their system would boost their demand shortly. Deploying resilient and distributed microgrids with energy storage and renewables would also drive the market’s growth in this region.

Energy storage as a service is an essential part of the modern grid through which several economic models became accessible. The generated energy is used to offset the needed carbon-emitting manufacturing. It provides the load shifting capabilities and this contracted service is managed by a third party automatically. The facilities can allocate resources to control the energy profile and focus on primary activity. It ensures the reduction of expensive hours of electric consumption and cutting electricity bills at no cost to the building owners. The growing shift towards renewable energy generation and significant investments accelerates the growth of the energy storage as a service market. It became a critical part of power management systems due to the rising demand for energy storage devices based on time, days, and seasons. The economic markets of the world are trying to improve power generation and the utilization of renewable energy sources.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.05 Billion |

| Market Size in 2034 | USD 5.17 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.82% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Services, End User, Component, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The different types of energy storage systems for electricity such as pumped hydro storage, battery energy storage systems, compressed air energy storage, flywheels, thermal energy storage, etc. drive the growth of the market remarkably. The expansion of renewable energy and net-zero goals contribute to the rising demand for efficient energy storage systems. The countries like Spain, the United States, and the United Kingdom are developing plans to encourage long-duration energy storage (LDES).

High energy costs and short energy storage durations can be issues in the adoption of some energy storage systems. Energy storage systems with short durations supply energy for a few minutes.

The innovations in energy technologies can enable low-cost electric energy storage systems to supply power for 10 hours or more. These efforts could stabilize power supplies with the arrival of renewable energy sources in online forms.

In 2024, the customer energy management services segment accounted revenue share of 31%. In comparison to utility and energy supply firms, the energy storage as a service model is gaining favor in the industrial, commercial, and residential sectors. The microgrid systems make use of it.

The ancillary services segment is predicted to develop at the quickest rate 11.8% in the future years. Ancillary services including as black start, voltage support, and frequency management are projected to reduce reliance on fossil fuel generators and shift to renewable and battery energy storage.

The industrial, residential, and commercial segment dominated the market in 2022 with revenue share of 71%. Commercial buildings with higher energy usage have energy applications such as district energy systems and service.

The utility segment is expected to witness growth at a CAGR of 11.3% during the forecast period. The segment’s growth is being fueled by a decrease in reliance on traditional fossil fuel generators and a greater focus on sustainability.

The mergers and acquisitions, partnerships, new product development, business expansions, collaborations, supply contracts, agreements, and contracts are some of the important marketing strategies used by the major market players to maintain their market position.

By Services

By End User

By Component

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

August 2024