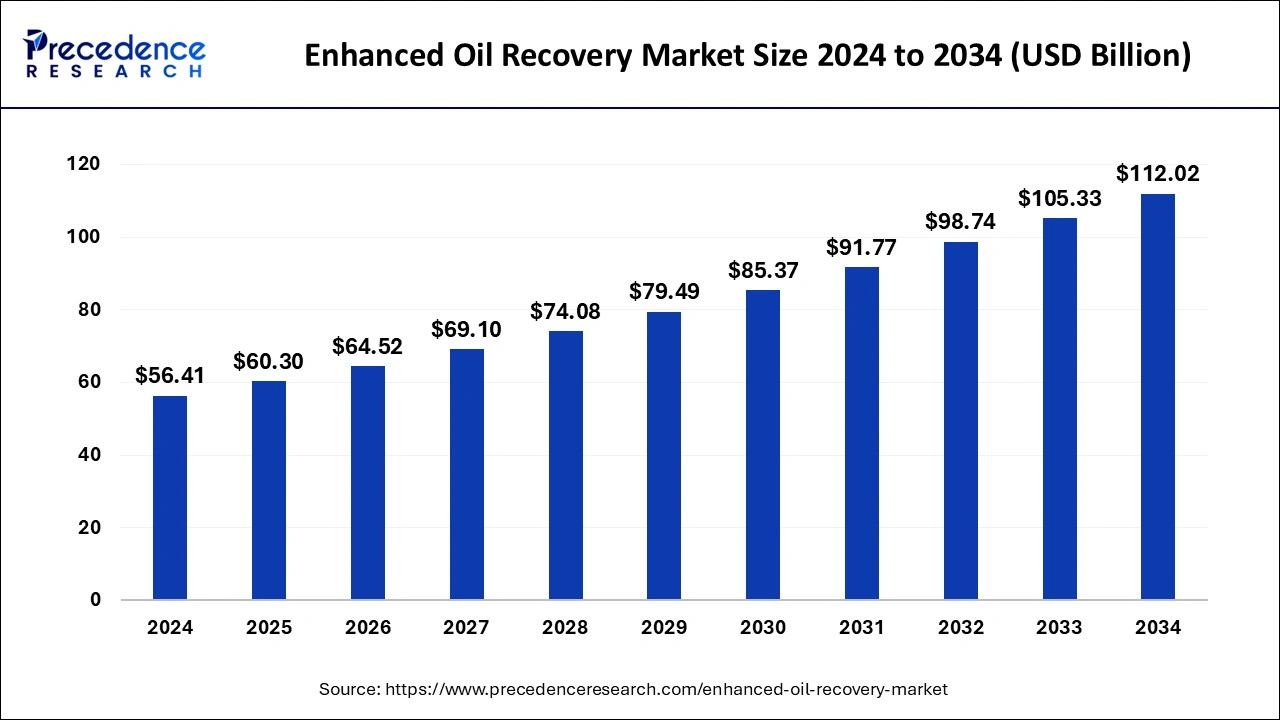

The global enhanced oil recovery market size is calculated at USD 60.3 billion in 2025 and is forecasted to reach around USD 112.02 billion by 2034, accelerating at a CAGR of 7.10% from 2025 to 2034. The North America enhanced oil recovery market size surpassed USD 22 billion in 2024 and is expanding at a CAGR of 7.24% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global enhanced oil recovery market size was worth around USD 56.41 billion in 2024 and is anticipated to reach around USD 112.02 billion by 2034, growing at a CAGR of 7.10% from 2025 to 2034. The global enhanced oil recovery market growth is attributed to the increasing focus on EOR techniques to expand their lifespan and increasing demand for oil and gas across the globe.

Artificial intelligence is revolutionizing various industries, and the enhanced oil recovery industry is no exception. By enabling more efficient, cost-effective, and precise operations, the integration of AI technologies has introduced a new dimension to enhanced oil recovery. AI, with its capabilities for data-driven decision-making, predictive analysis, and machine learning, can transform how oil fields are managed, particularly in terms of reducing operational uncertainties and optimizing recovery rates. Operators can analyze and process huge amounts of data from m reservoirs in real-time, minimize the risks associated with traditional EOR methods, and adjust recovery strategies dynamically, through the use of AI. In addition, the integration of AI improves the accuracy of forecasts, enhances recovery, allows for better resource allocation, and reduces downtime, owing to significant cost savings. These advanced trends are expected to revolutionize the growth of the enhanced oil recovery market in the coming years.

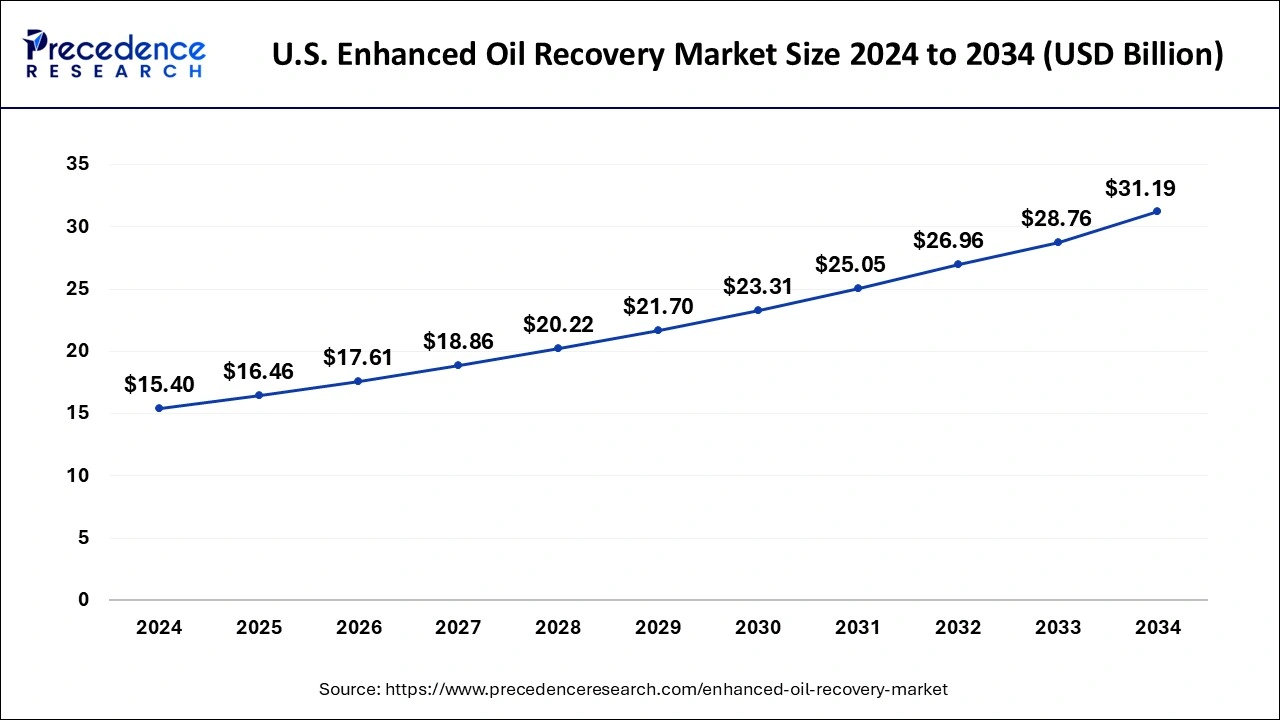

The U.S. enhanced oil recovery market size was exhibited at USD 22 billion in 2024 and is projected to be worth around USD 44.25 billion by 2034, growing at a CAGR of 7.24% from 2025 to 2034.

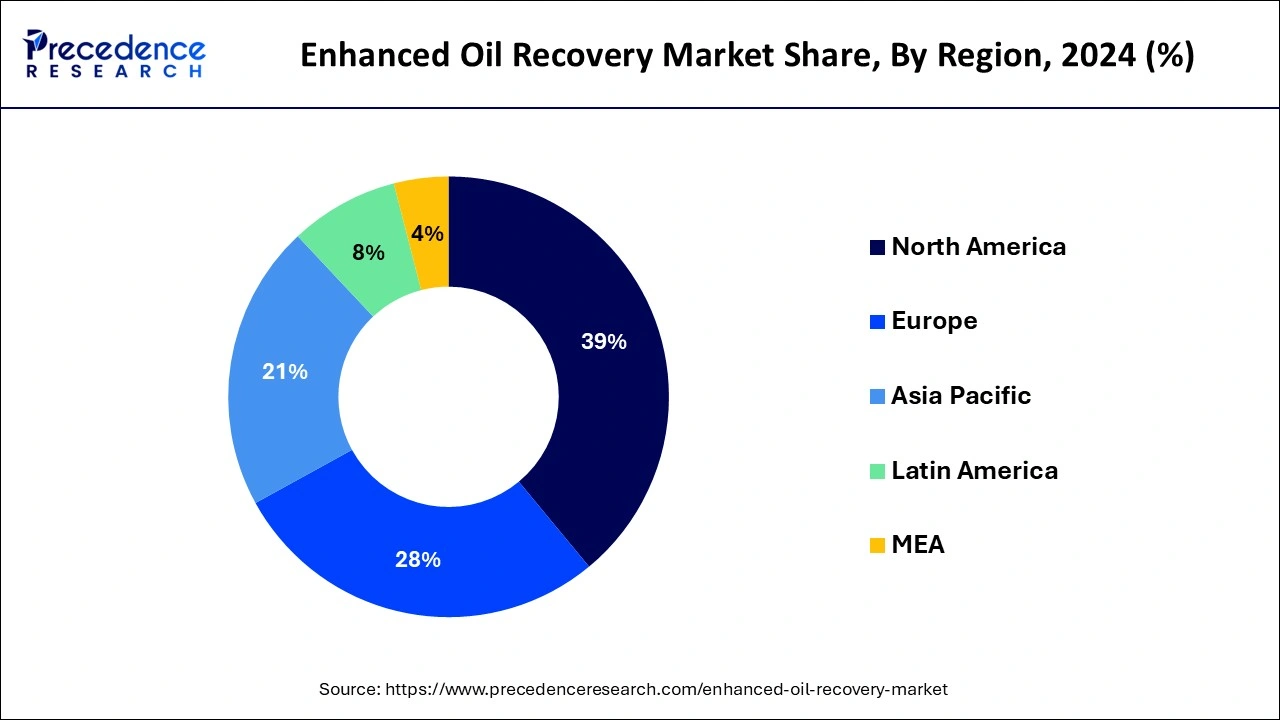

North America dominated the enhanced oil recovery market in 2024. The market growth in the region is attributed to the increasing advanced extraction technologies and the extensive oil reserves available in the region. In addition, the increasing presence of various unconventional matured fields and oil and gas resources in the U.S. are expected to drive the market growth. EOR technologies such as chemical flooding, gas injection and thermal recovery are rapidly equipped to extend the life of aging reservoirs and enhance production efficiency, as conventional oil reserves decline in the U.S.

Asia Pacific is anticipated to witness the highest CAGR during the forecast period, with China occupying the largest market share across the region. Rising oil and gas demand from the major economies including China and India along with the surged deployment of enhanced oil recovery in aged wells in order to meet the product targets are likely to boost the market growth in the Asia Pacific. However, Europe, North America, Asia-Pacific and LAMEA are the key regions included in the study of the enhanced oil recovery market.

| Report Coverage | Details |

| Market Size in 2025 | USD 60.3 Billion |

| Market Size by 2034 | USD 112.02 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.10% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Over few decades, the depletion of fossil fuels energies has contributed to the adding operation of enhanced oil recovery technologies in the oil and gas industry. The growing demand for oil has also been added to the rising enhanced oil recovery worldwide demand. Furthermore, several governmental bodies around the globe are taking enterprise to exercise oil extraction advanced technologies in order to achieve high profits from the existing fields of oil and gas. In addition, countries like India and China are offering fiscal impulses to attract transnational companies in order to invest more towards the market of enhanced oil recovery. In line with this, the different companies each over the world are engaging in research and development conditioning to ameliorate oil recovery. For case, British Petroleum has developed advanced ways that can prize oil using thermally actuated bitsy patches which expand deep into the force.

The ongoing COVID-19 epidemic has impacted the oil & gas industry encyclopedically. Owing to the scenario of COVID-19, various oil& gas companies across various regions closed or paused their manufacturing services and installations as various countries started practicing partial or full lockdown strategy in order to deal with the epidemic. Furthermore, the key players across the region further delayed or suspended the main oil & gas systems. Likewise, the epidemic has further impacted the prices of crude oil, well drilling and product conditioning, and the force chain of oil and gas. Owing to the dropdown in the product conditioning has also majorly impacted short/ medium term enhanced oil recovery market. In addition, the key market players around the globe are deploying innovative technologies for the development of enhanced oil recovery market.

By technology, the thermal technology segment is likely to hold the 40% market share in 2020. In addition, among thermal enhanced oil recovery, the steam is injected in order to improvise the mobility of oil through various reservoir and lower the viscosity. It is mainly utilized in reservoirs with heavy oil in order to recover billions of barrels comprising of heavy crude oil. In addition, the thermal enhanced oil recovery is also categorized further on the basis of type as combustion of steam, in-situ, and others. The steam segment is poised to grow at a fastest growth rate during the forecast period. Due to the growth of the mature oilfields and growth of discoveries of shale gas in the Gulf of Mexico are estimated to drive the enhanced oil recovery market.

By application, the onshore segment accounted revenue share of 90% in 2022 and is expected to grow at the fastest CAGR during the forecast period. This is attributed to the growing number of oil fields in the developed and developing regions such as Africa and North America. The oil fields in these regions help in the depletion of oil.

In addition, constant initiatives are taken by government and market players for the growth and development of the segment during the forecast period. Moreover, the key market players are investing in the onshore enhanced oil recovery segment. The onshore enhanced oil recovery helps in the cost savings as compared to offshore enhanced oil recovery.

Segments Covered in the Report

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client