August 2024

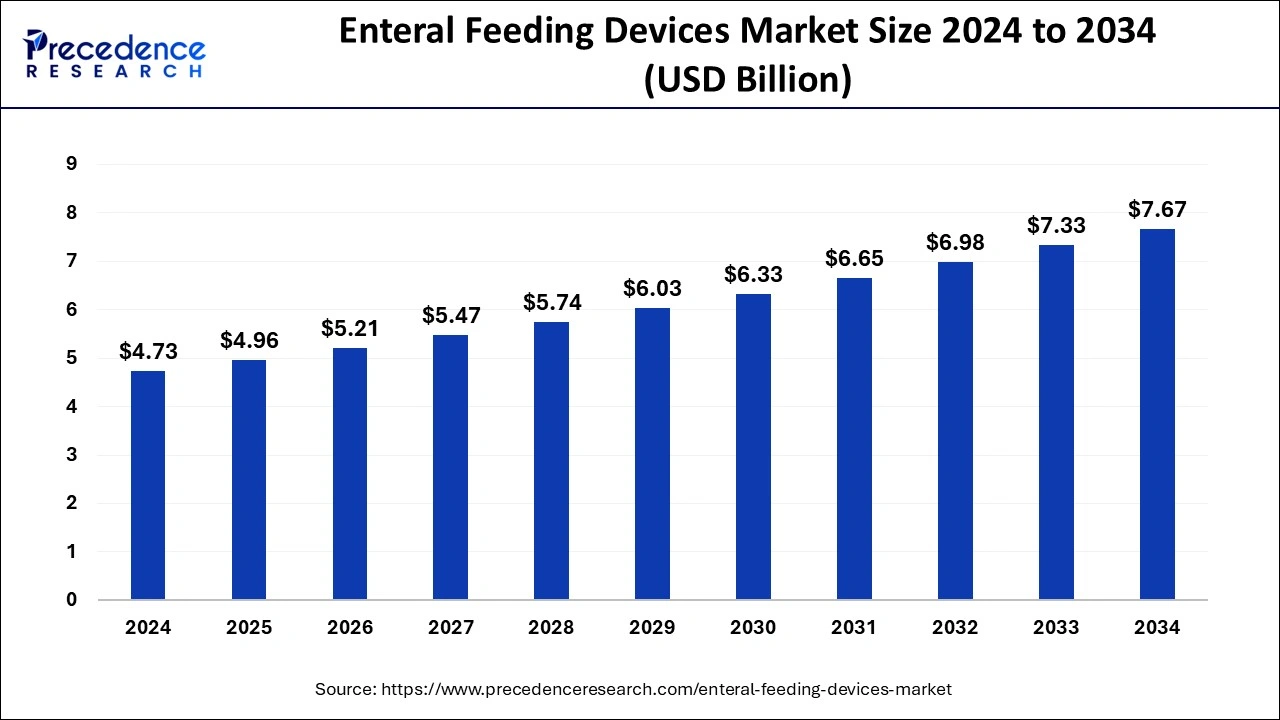

The global enteral feeding devices market size is calculated at USD 4.96 billion in 2025 and is forecasted to reach around USD 7.67 billion by 2034, accelerating at a CAGR of 4.95% from 2025 to 2034. The North America enteral feeding devices market size surpassed USD 1.80 billion in 2024 and is expanding at a CAGR of 4.98% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global enteral feeding devices market size accounted for USD 4.73 billion in 2024 and is predicted to reach around USD 7.67 billion by 2034, growing at a CAGR of 4.95% from 2025 to 2034. The increasing number of hospitalizations, the rapidly expanding healthcare sector, and technological advancements drive the market.

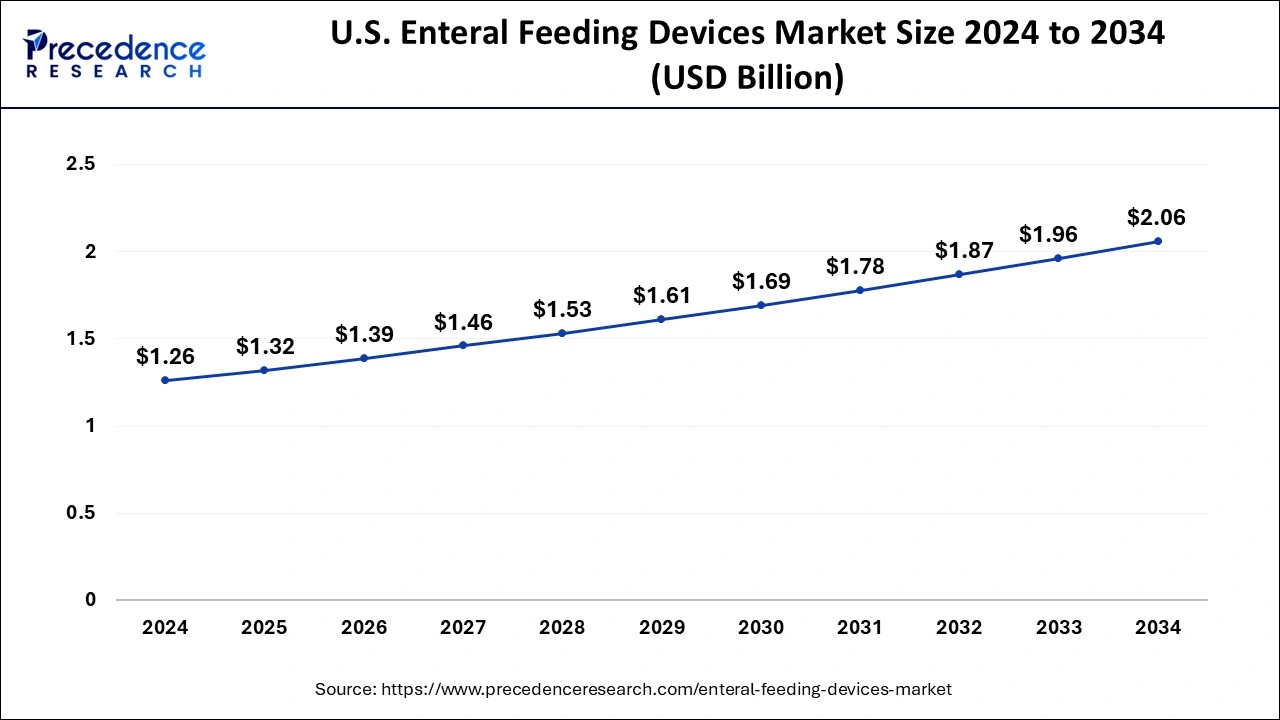

The U.S. enteral feeding devices market size was valued at USD 1.26 billion in 2024 and is expected to be worth around USD 2.06 billion by 2034, growing at a CAGR of 5.03% between 2025 and 2034.

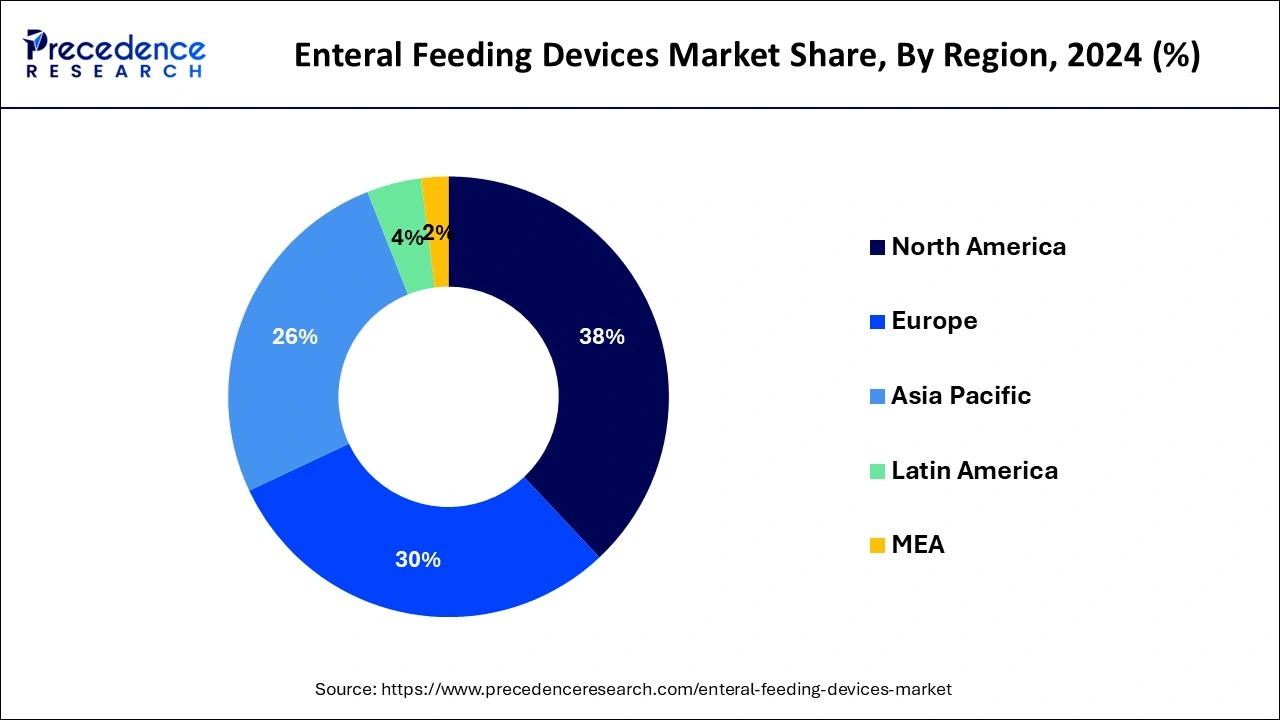

North America held the largest share of the market in 2024 due to the increasing health awareness, rising geriatric population, and rising healthcare expenditure, which supports the adoption of advanced medical devices such as enteral feeding devices. Moreover, a significant growth in premature births in the U.S. contributed to the market growth. As premature birth increases, the demand for pediatric enteral feeding devices increases, which is vital in delivering essential nutrition to premature babies.

As per the Population Reference Bureau, the number of Americans ages 65 or above is anticipated to increase from 58 million in 2022 to 82 million by 2050, a 47% increase.

According to the National Center for Health Statistics (NCHS), the rate of premature birth in the U.S. grew 12% from 2014 to 2022.

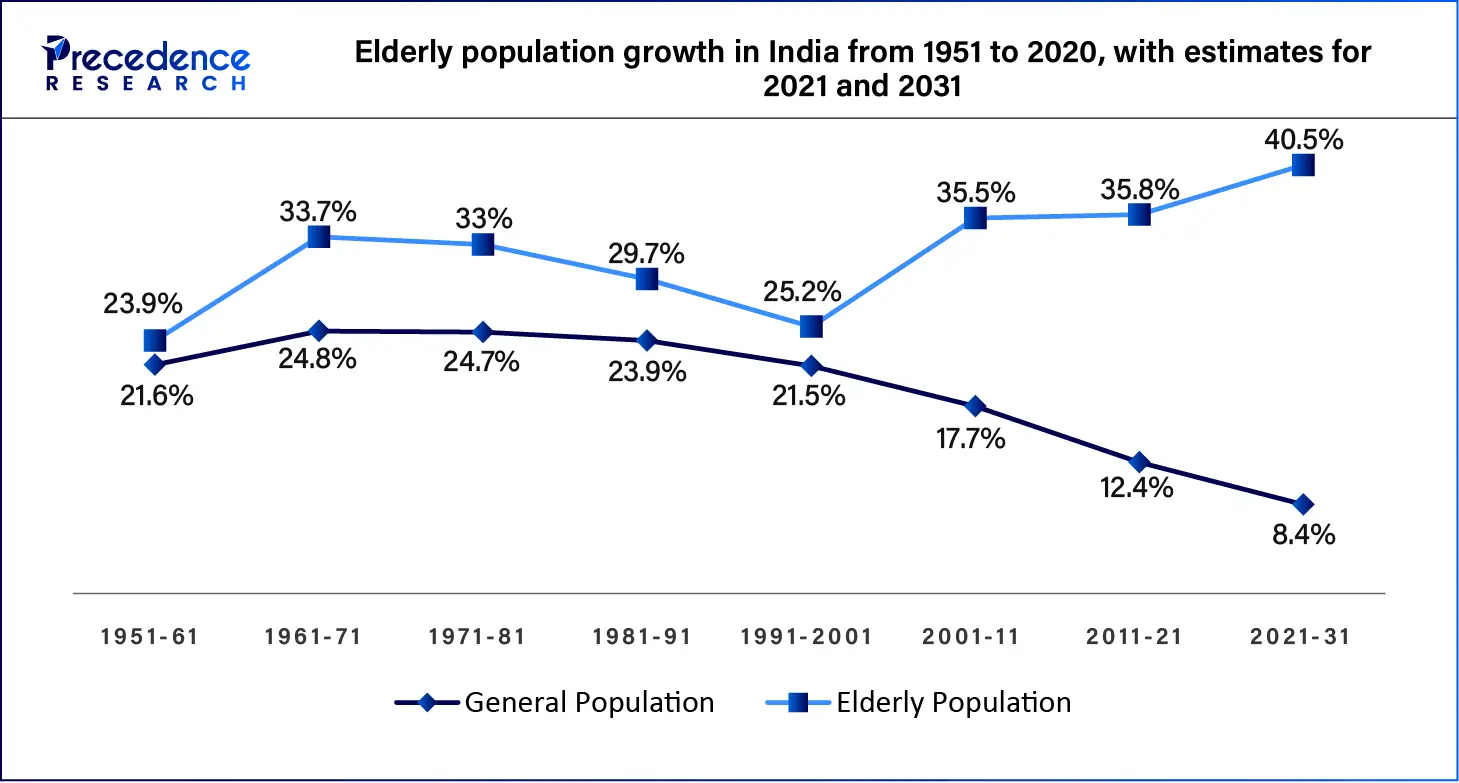

The market in Asia Pacific is anticipated to expand at the fastest CAGR during the forecast period due to the high prevalence of chronic diseases, such as diabetes, cancer, and chronic kidney disease (CKD). These diseases often require enteral feeding devices for dietary management. Furthermore, the growing geriatric population in countries such as India and Japan is projected to boost market growth.

Favorable reimbursement policies govern the market growth in the US. The US government-run health insurance programs Medicare and Medicaid cover enteral feeding devices from healthcare professionals. The US Food and Drug Administration requested an increase of $11.6 million to improve the medical device supply chain and shortage programs as part of the president’s FY 2024 budget.

The favorable trade policies in China for the import and export of medical devices augment market growth. According to the Observatory of Economic Complexities, China’s export of medical instruments increased by $183 million (24.2%), accounting for $938 million. While the import of medical instruments accounted for $862 million during the same period.

The Indian government announced the Rs. 500 crore scheme for the medical device sector to accelerate growth, reduce import reliance, and enhance India’s position as a leading exporter of medical devices.

Latest Announcement by Industry Leaders

Tomás Thompson, Founder and CEO of Rockfield Medical Devices, commented that numerous medical devices have significantly changed over the last 40 years, but very little innovation has been made for enteral (tube) feeding. However, it is literally key to survival for people. The company launched a novel lightweight, discreet, and quiet enteral feeding pump that can be worn under clothing and used in a person’s daily life.

Enteral feeding devices are medical devices used to deliver liquid nutrition directly to the stomach or intestines of those people who are unable to consume food orally due to some medical conditions or swallowing difficulties. Enteral feeding devices include feeding pumps, flexible tubes, and syringes. These devices help to administer liquid nutrition, medications, and supplements. These devices are placed through the nose or mouth or surgically implanted into the stomach. The global enteral feeding devices market has registered a significant growth over the years. There has been a significant increase in the demand for enteral feeding devices during the COVID-19 pandemic due to a large number of people requiring nutritional support, particularly those affected by COVID-19.

| Report Highlights | Details |

| Market Size by 2034 | USD 75.45 Billion |

| Market Size in 2024 | USD 31.49 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.13% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Age Group, Product, Application, End User, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Prevalence of Chronic Diseases and Rising Number of Surgeries

The growing prevalence of chronic diseases across the globe is expected to drive the market during the forecast period. Chronic diseases such as diabetes, cancer, chronic kidney disease (CKD), and Alzheimer’s disease often cause serious problems, such as swallowing difficulty. However, proper nutrition is important in many chronic diseases, preventing complications and improving health outcomes. Thus, as the number of patients with these conditions increases, so does the need for nutritional support, which significantly boosts the market.

As per the National Library of Medicine, about one in three adults worldwide suffer from multiple chronic conditions (MCCs).

Furthermore, the rising number of surgical procedures is expected to drive the market. Surgical procedures often cause difficulties with oral intake after surgery due to pain or reduced appetite. However, enteral feeding devices play a vital role in delivering essential nutrition to patients recovering from surgical interventions, promoting faster recovery.

According to the National Institute of Health (NIH), around 310 million major surgeries are performed worldwide every year.

Lack of awareness

The lack of awareness about the benefits and usage of enteral feeding devices among patients in underdeveloped regions hamper the market. If patients are unaware of the benefits of these devices in managing chronic conditions, their use becomes limited. Moreover, the lack of reimbursement policies for these devices deters some patients from adopting them.

Technological Advancements

The rising technological advancements in medical devices create lucrative opportunities in the market. Advancements in enteral feeding devices lead to user-friendly and portable devices, making them suitable for home care. Implementing real-time monitoring with these devices helps provide doctors with useful data about patient nutrition and feeding. Furthermore, the rising trend of self-medication and self-care propels the demand for these advanced devices.

The enteral feeding pump segment held a large share of the market in 2024. The segment growth is mainly attributed to the rising concern about overfeeding. Enteral feeding pumps offer accurate control over nutrition given to patients, guaranteeing precise delivery of nutrients or medications. This precision helps to prevent overfeeding, which may lead to complications. However, this accuracy is crucial in cancer treatment, as inaccurate nutrition levels may lead to complications that impede treatment effectiveness. These pumps offer flexibility to combine methods such as continuous feeding overnight and bolus feeding during the day to make the feeding process more tailored to the patient’s condition.

The enteral feeding tube segment is projected to grow rapidly during the forecast period. Enteral feeding tubes are available in a range of sizes. They are either inserted through the mouth or through the nose into the stomach. These tubes can be customized according to the patient’s needs and can also be used to remove stomach contents.

The adults segment held a major share of the market in 2024 due to the growing prevalence of age-related diseases, such as diabetes, dementia, chronic obstructive pulmonary disease, and gastrointestinal disorders. Moreover, the increasing instances of dysphagia in adults contributed to the segmental growth. Enteral feeding devices are required to supply nutritional supplements to people suffering from these ailments. For instance,

According to the National Institute of Health (NIH), dysphagia is common in adults. About 1 in 6 adults experience difficulty in swallowing.

The pediatrics segment is expected to register a significant growth rate in the coming. There has been a significant growth in the occurrence of malnutrition among children. This, in turn, boosts the demand for enteral feeding devices that are designed for infants, such as nasojejunal tubes, G-tubes, and jejunostomy tubes. As per the World Health Organization (WHO), around half of deaths among children under 5 years of age are linked to undernutrition. Moreover, the increasing instances of premature birth are expected to boost the segment. For instance,

According to the National Library of Medicine, over 400,000 babies are born prematurely every year in the U.S.

The cancer segment dominated the market in 2024. The segment is anticipated to expand at the fastest CAGR during the forecast period due to the rising cancer cases worldwide. Cancer treatment, such as chemotherapy and radiation therapy, often creates mouth sores or swallowing difficulties. This boosts the need for reliable solutions for delivering medications and nutrients to patients with such conditions, thereby driving the demand for enteral feeding devices. For instance,

As per the World Health Organization (WHO), nearly 20 million new cancer cases and 9.7 million cancer deaths were recorded worldwide in 2022. About 1 in 5 people develop cancer in their lifetime, and about 1 in 12 women and 1 in 9 men die from cancer.

The hospitals segment held a major share of the market in the enteral feeding devices market in 2024 due to the rising number of patients in hospitals requiring nutrition support. Moreover, factors such as easy accessibility to advanced medical devices, availability of skilled healthcare professionals, and the rising number of ICU admissions contributed to the market growth

Leading competitors contending in the global enteral feeding devices market are as follows:

Major Market Segments Covered:

By Product Type

By Age Group

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

April 2025

January 2025

January 2025