May 2024

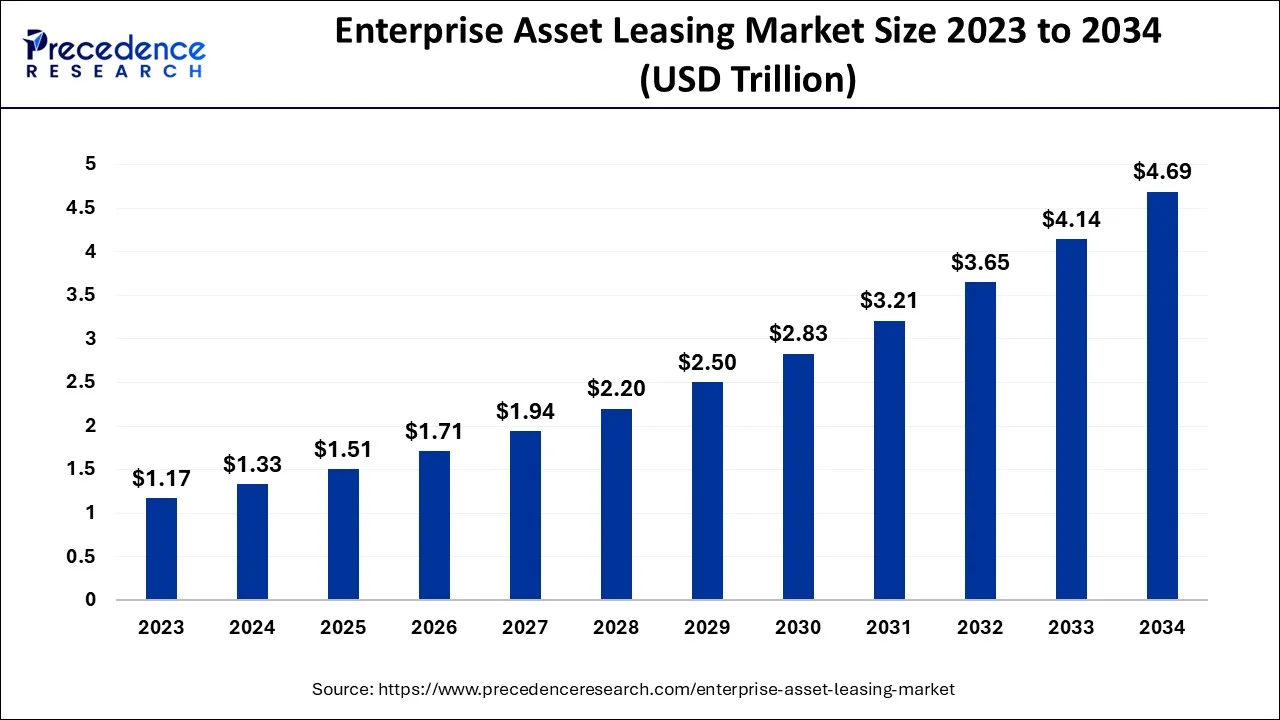

The global enterprise asset leasing market size accounted for USD 1.33 trillion in 2024, grew to USD 1.51 trillion in 2025 and is projected to surpass around USD 4.69 trillion by 2034, representing a healthy CAGR of 13.46% between 2024 and 2034.

The global enterprise asset leasing market size is estimated at USD 1.33 trillion in 2024 and is anticipated to reach around USD 4.69 trillion by 2034, expanding at a CAGR of 13.46% between 2024 and 2034.

An enterprise asset lease is a contract, or a clause within a contract, that transfers the right to use an asset (the underlying asset) for a specific amount of time in return for payment. For many years, leasing in all its forms has shown to be a reliable method for financing capital equipment at all stages of the business cycle. Many businesses lease assets including land, buildings, vehicles, ships, and manufacturing and construction machinery.

An organization can access assets through leasing while having less exposure to the hazards associated with asset ownership. Finance leases and operating leases are the two types of leases. Whether or not the risk and profit associated with the asset are shifted to the lessor determines how the two differ from one another. The growing demand for commercial vehicles along with the rising demand for flexible asset management solutions is anticipated to augment the growth of the enterprise asset leasing market during the forecast period.

Enterprise asset leasing is the need for businesses to save capital. Leasing assets allows companies to avoid the significant upfront costs associated with purchasing equipment and properties, which can be especially beneficial for startups and small businesses with limited resources. Leasing also allows businesses to spread out the cost of acquiring assets over time, making it easier to manage cash flow and budgeting.

Furthermore, the trend of outsourcing non-core activities is likely to increase the demand for enterprise asset leasing within the estimated timeframe. By leasing assets, companies can avoid the burden of managing and maintaining their own equipment and properties, allowing them to focus on their core operations. This trend has been especially prevalent in industries such as transportation, construction, and manufacturing, where leasing assets can help companies stay competitive and agile in a rapidly changing business landscape.

Additionally, technological advancements are also likely to contribute to the growth of the enterprise asset leasing market. As leasing companies leverage technology to improve asset tracking and management, they are able to offer higher quality and more efficient leased assets to their customers. For example, cloud-based asset management solutions allow businesses to track and manage their leased assets in real-time, making it easier to monitor usage, maintenance, and repairs.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.33 Trillion |

| Market Size by 2034 | USD 4.69 Trillion |

| Growth Rate from 2024 to 2034 | CAGR of 13.46% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Asset Type, By Leasing Type, By Organization Size, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing trend of outsourcing non-core activities

Outsourcing non-core activities is becoming increasingly popular as businesses look for ways to be more efficient and competitive. Through outsourcing activities such as IT infrastructure, logistics, and equipment maintenance, businesses can reduce their operating costs and free up resources to invest in their core operations. This trend is especially prevalent in industries such as transportation, and manufacturing, where companies need to maintain large inventories of equipment and properties to support their operations.

Furthermore, leasing companies are able to provide companies with the equipment and properties they need to support their non-core activities. Leasing companies offer a wide range of assets for lease, including IT equipment, vehicles, construction equipment, and real estate properties. By leasing these assets, businesses can avoid the initial costs associated with purchasing and maintaining their own equipment and properties, while still having access to the assets they need to support their operations. In addition to cost savings, leasing assets can also provide industries with greater flexibility and scalability. Leasing agreements can be customized to meet the specific needs of each business, allowing them to adjust their equipment and property needs as their operations evolve. This flexibility can be especially valuable for businesses in rapidly changing industries, where the ability to adapt quickly is critical to success. Consequently, this is likely to increase the demand for enterprise asset leasing within the estimated timeframe.

Rising competition in the market

The high level of competition has led to pricing pressures, as leasing companies compete to offer the most competitive pricing and terms to clientele. This is expected to result in reduced profit margins for leasing companies, which can make it difficult for them to invest in new technologies and expand their services. This competition is driven by factors such as the large number of players in the market and the relatively low barriers to entry. Many companies have entered the market in recent years, including startups and established players. This has led to increased competition for customers, with leasing companies vying to offer the most attractive pricing and terms to win business.

The pricing pressures in the market are exacerbated by the fact that many customers are highly price-sensitive when it comes to leasing assets. As a result, leasing companies must offer competitive pricing in order to gain business, even if this means accepting lower profit margins.

However, in order to address these challenges, leasing companies must focus on differentiating themselves from their competitors. This can involve offering specialized services, such as industry-specific leasing solutions or value-added services like maintenance and repair. Additionally, leasing companies can invest in new technologies, such as IoT and AI, to improve the efficiency and effectiveness of their operations and differentiate themselves from their competitors.

Rising demand for cloud-based asset management solutions

With the help of cloud-based software, customers may track and manage their assets remotely. This kind of software can be used to monitor the lifecycle of any asset, including stock, machinery, cars, and real estate. Asset tracking, asset upkeep, and asset reporting are just a few of the services that cloud-based asset management solutions often offer. To enhance asset visibility and maximize asset utilization, firms of all sizes can employ these technologies. Thus, with the use of cloud-based solutions, leasing companies can manage their assets remotely, without the need for on-premise servers or other hardware. This reduces the need for expensive IT infrastructure and support staff, allowing leasing companies to allocate resources more efficiently.

Further, cloud-based asset management solutions offer greater flexibility and accessibility. Leasing companies can access their asset management systems from anywhere, at any time, using a variety of devices, including smartphones, tablets, and laptops. This allows leasing companies to work more efficiently and effectively, and to respond more quickly to customer needs. The adoption of cloud-based asset management solutions is also driving innovation in the enterprise asset leasing market.

With the use of cloud-based solutions, leasing companies can leverage advanced technologies such as IoT and AI, which can improve the efficiency and effectiveness of their operations. For example, IoT sensors can be used to monitor the condition and location of leased assets, allowing leasing companies to optimize their maintenance schedules and improve asset utilization. This in turn is expected to support the growth of the market in the years to come.

On the basis of asset type, the commercial vehicles segment held the largest revenue share in 2023. Fleet operators can receive vehicles through leasing without the primary expenses and credit restrictions of ownership. Additionally, leasing eliminates the requirement for a down payment and permits fleet operators to expense the cost of the vehicle on a monthly basis as opposed to recording it as a liability on their balance sheet. More tax savings and more credit flexibility allow fleet operators to reallocate their money. These benefits offered are likely to support the segment growth of the enterprise asset leasing market during the forecast period. Furthermore, the growing logistics industry along with increasing demand for rental vehicles with advanced features is also expected to contribute to the segmental growth of the market within the estimated timeframe.

Based on industry verticals, the transportation and logistics segment held considerable shares in the global enterprise asset leasing market. The increasing number of organizations that rent or lease commuter cars and trucks is likely to support the segmental growth of the market. Furthermore, the growing necessity to strengthen distribution capabilities from interconnected stakeholders across the supply chain is also likely to support the segment growth of the enterprise asset leasing market during the forecast period. Additionally, increasing demand for data-driven tracking and intelligent temperature monitoring systems is also expected to contribute to the growth of the segment in the enterprise asset leasing market in the years to come.

North America held the largest revenue share in 2023. The US accounted for the largest share of the North America enterprise asset leasing market. This is attributable to the rapid shift towards novel and advanced commercial equipment to conduct business operations in this region. Further, the increasing adoption of advanced platforms incorporating solutions for the operative management of fleet operations, stock, permit, and compliance for the equipment across the region is also expected to support the growth of the market. Additionally, the availability of asset leasing services at economical interest rates is also likely to create immense growth opportunities for the market in the region.

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. In Asia Pacific region, China dominated the enterprise asset leasing market. This is owing to the extensive adoption of enterprise asset leasing services by various small and medium-sized enterprises in the region. Furthermore, rapid industrialization and urbanization in the developing economies such as China and India is also expected to support the regional growth of the market. Additionally, the growing adoption of advanced technologies is also likely to support the regional growth of the market growth during the forecast period.

Segments Covered in the Report:

By Asset Type

By Leasing Type

By Organization Size

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

November 2024

November 2024

November 2024