May 2024

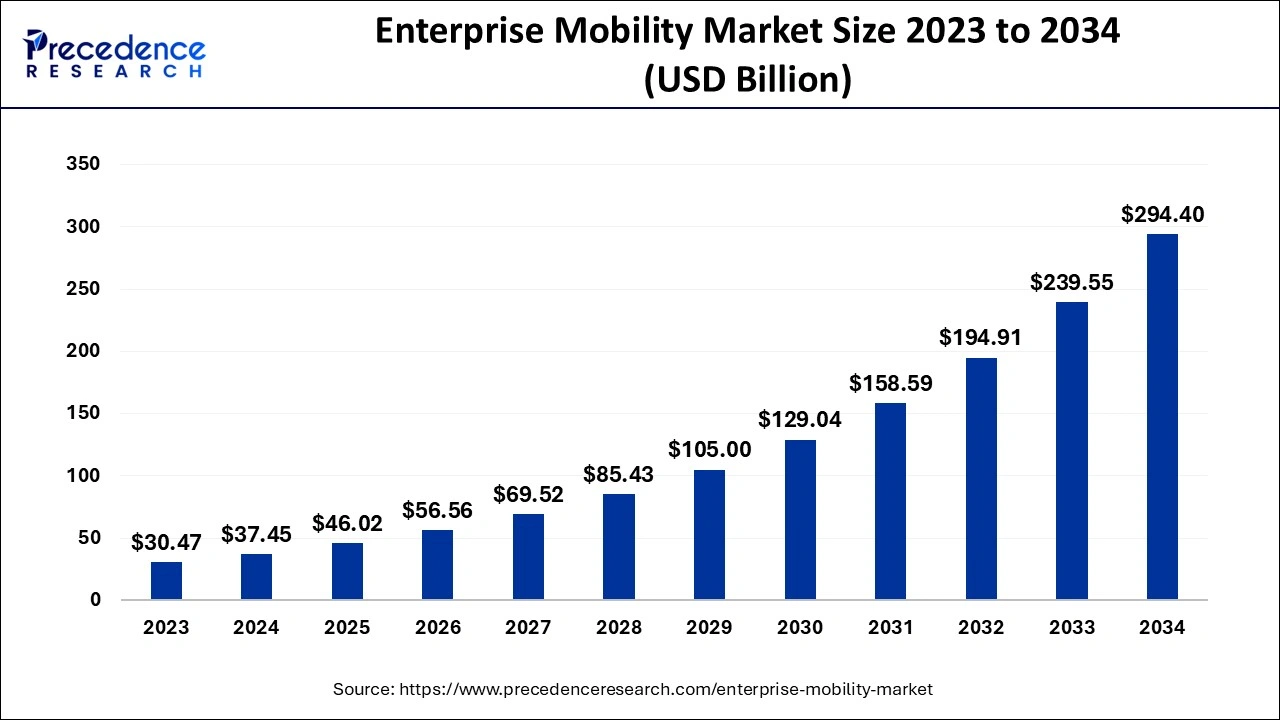

The global enterprise mobility market size accounted for USD 37.45 billion in 2024, grew to USD 46.02 billion in 2025 and is predicted to surpass around USD 294.40 billion by 2034, representing a healthy CAGR of 22.90% between 2024 and 2034. The North America enterprise mobility market size is calculated at USD 15.35 billion in 2024 and is expected to grow at a fastest CAGR of 23.04% during the forecast year.

The global enterprise mobility market size is estimated at USD 37.45 billion in 2024 and is anticipated to reach around USD 294.40 billion by 2034, expanding at a CAGR of 22.90% from 2024 to 2034.

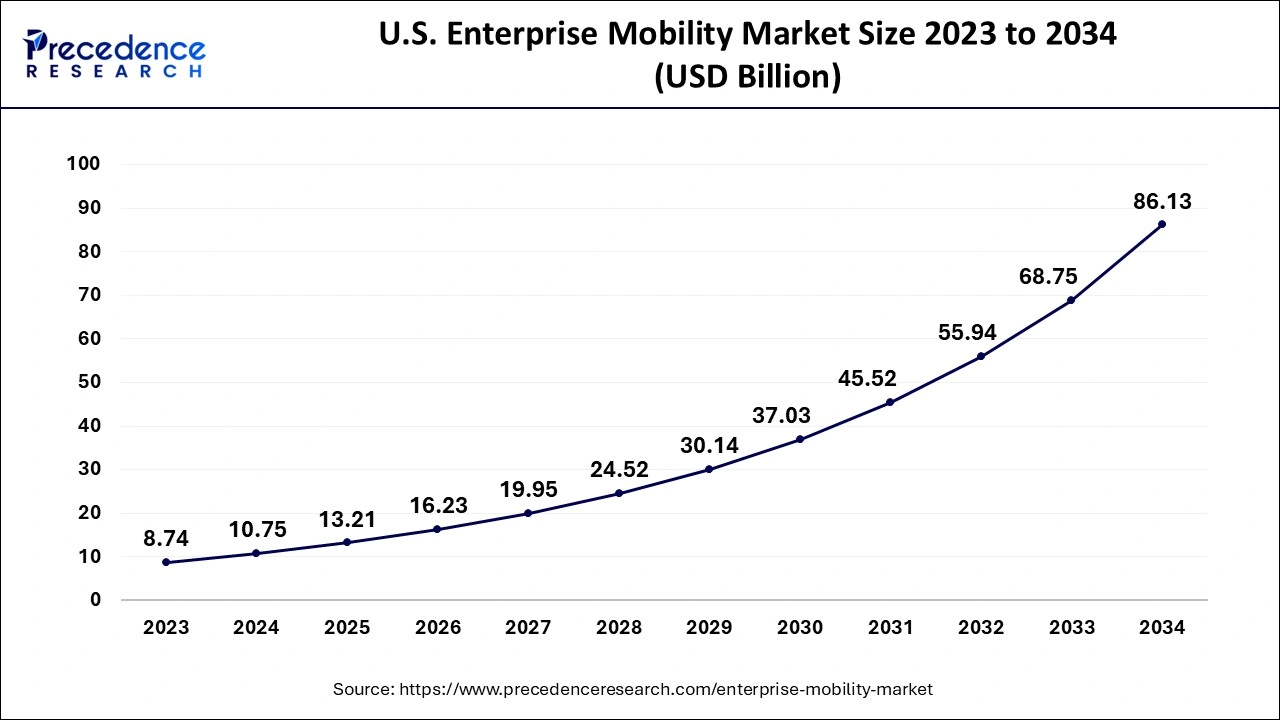

The U.S. enterprise mobility market size is evaluated at USD 10.75 billion in 2024 and is predicted to be worth around USD 86.13 billion by 2034, rising at a CAGR of 23.12% from 2024 to 2034.

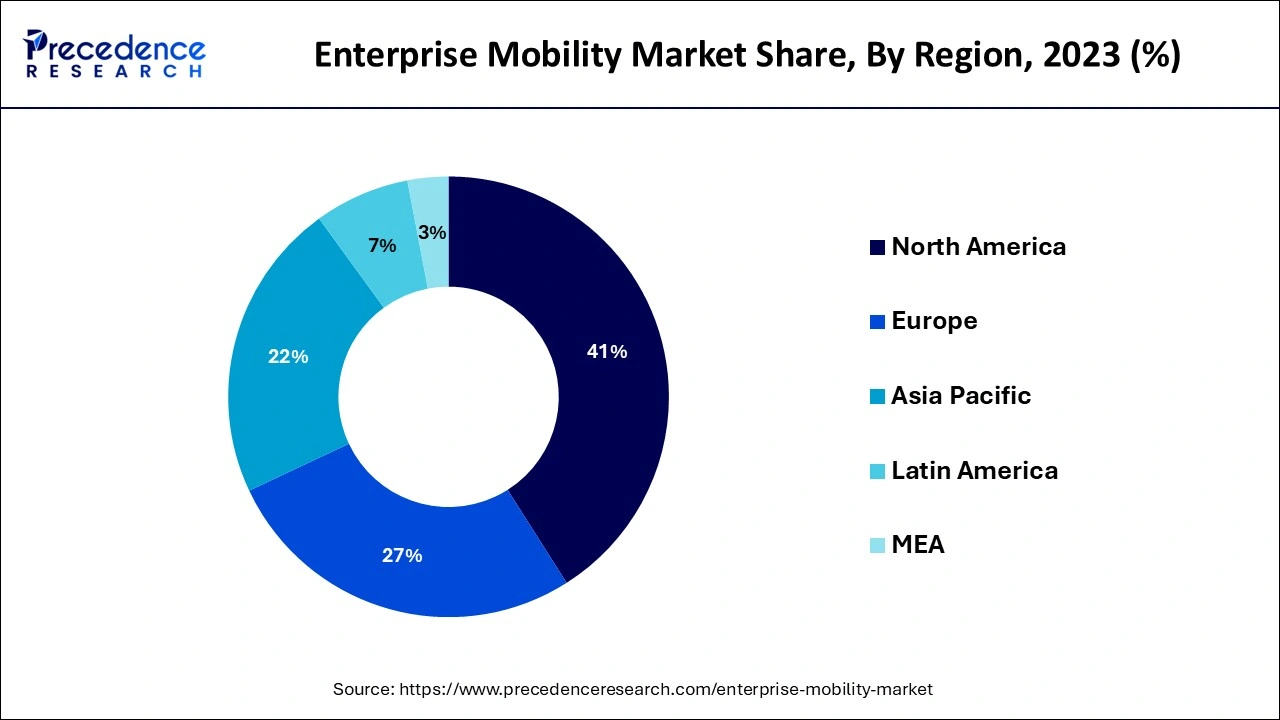

North America dominated the enterprise mobility market in 2023. The U.S. dominated the enterprise mobility market in North America region. The growth of North America enterprise mobility market is attributed to the existence of key market players in the region. Due to the fierce rivalry in the North American market, many market players aim for bigger sales and business expansions. To keep up with the latest technologies in the market, North American businesses concentrate on innovation. Verticals such as healthcare, retail, and life sciences in this region use enterprise mobility solutions for a variety of reasons, including more efficient day-to-day transaction management in the banking and financial services vertical, enhanced supply chain management, and improved ability of healthcare machines to track patient health.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the enterprise mobility market in Europe region. The UK is Europe's largest market for workplace mobility management. The country's key source of demand for mobility solutions is the high rate of adoption of these solutions in the banking, retail, manufacturing, and healthcare sectors. With the expanding use of big data analytics in the country's healthcare ecosystem, the healthcare business has a large potential for analytics. Over the projection period, this is expected to help enterprise mobility flourish in the country. Furthermore, prediction aids hospitals in lowering provider-payer expenses. The healthcare sector, with the help of enterprise mobility, ensures the productivity of doctors and other health personnel, resulting in improved clinical outcomes.

The growing mobile workforce and enterprise adoption of Bring Your Own Devices initiatives to improve worker productivity, permitting employees to work from anyplace, at any time, and admittance corporate information on the go, has surged the demand for enterprise mobility solutions. Furthermore, the rise of new mobile devices on the market inspires regions to connect mobile device management solutions. Security solutions are being developed by key companies in the corporate mobility market to deliver a similar or greater degree of knowledge to the market. In addition, to expand their products and market reach, competitors in the business mobility market are relying on inorganic growth tactics such as strategic alliances and mergers and acquisitions with technology partners.

| Report Coverage | Details |

| Market Size in 2024 | USD 37.45 Billion |

| Market Size by 2034 | USD 294.40 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 22.90% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Organization Size, Device Type, Deployment Modes, Application, and Geography |

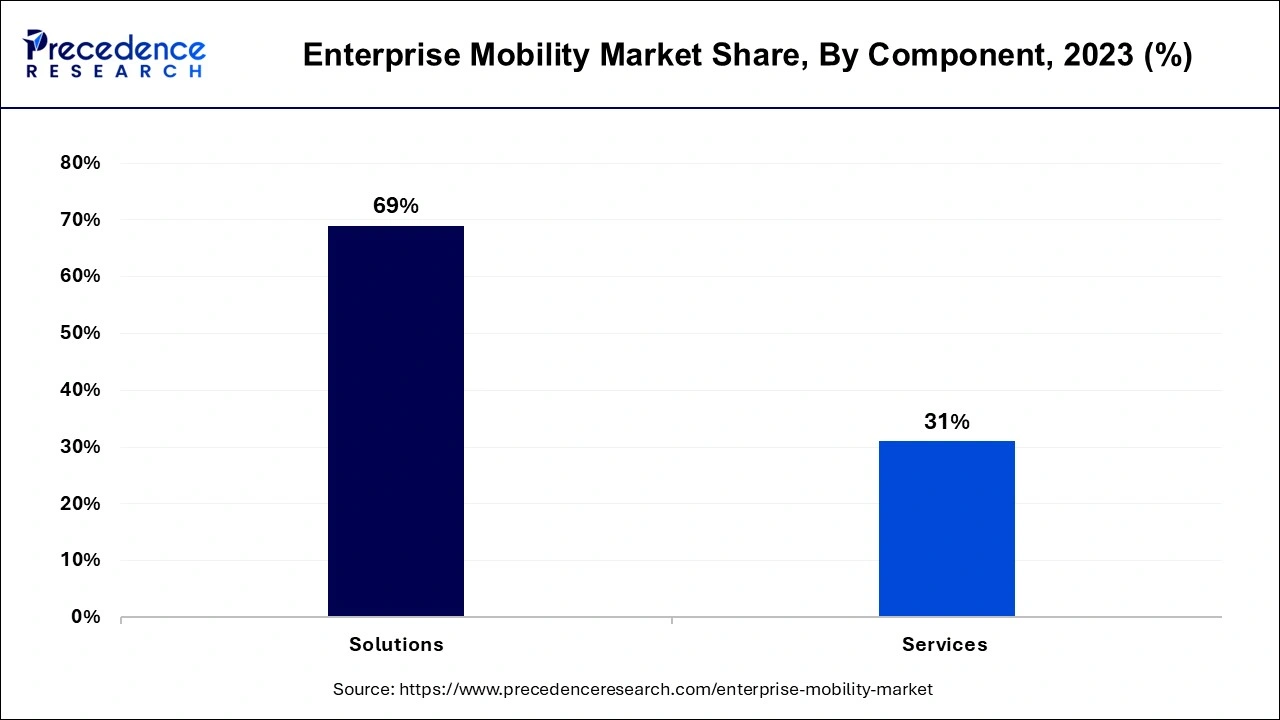

The solutions segment dominated the enterprise mobility market in 2023. Enterprise mobility solutions are being used by businesses to improve customer acquisition, retention, customer experience, and profitability. To increase productivity and ensure business continuity, businesses must handle their data efficiently and effectively. The market players have been pushed to implement corporate mobility solutions to help information technology teams simplify and manage their decision-making process due to the abundance of data that amounts to big data. Enterprise mobility solutions allow for the analysis of massive amounts of social media and sensor-based data in order to discover new insights about customer, product, and operational relationships and display them in an easy-to-understand format.

The services segment is the fastest-growing segment of the enterprise mobility market in 2022. Enterprise mobility helps organizations and clients in terms of consulting, support and maintenance, and deployment and integration. These services help organizations to save time and money. Thus, this segment is expected to grow at a rapid pace.

The cloud segment dominated the enterprise mobility market in 2023. The cloud is predicted to grow at a faster rate than the rest of the deployment segment over the projection period. Users can remotely access enterprise mobility solutions through the internet with cloud-based solutions that leverage the Software-as-a-Service concept. Enterprise mobility solutions are given through the internet under this deployment style. Flexibility, affordability, scalability, operational efficiency, and negligible expenditures are some of the benefits of using cloud-based enterprise mobility solutions.

The on-premises segment is the fastest growing segment of the enterprise mobility market in 2020. Lack of control over applications, tight government rules, and private content are some of the drawbacks of cloud-based enterprise mobility solutions. Thus, these limitations are driving the growth of on-premises enterprise mobility segment.

The BFSI segment dominated the enterprise mobility market in 2023. For secure data and regulatory compliance in their financial exchanges, banks and allies are pivoting to allow Bring Your Own Device and need enterprise mobility. The emergence of numerous operating systems, such as macOS and Windows 10, as well as devices and the internet of things, has expanded the mobile hardware context, allowing businesses to focus on enterprise mobility. In addition, the banking industry currently lacks a robust system for managing overall device inventory and tracking whether devices are online or offline. Banks must maintain track of any mobile devices used by their salespeople in the field and guarantee that they are not being misused.

The retail and ecommerce segment is the fastest growing segment of the enterprise mobility market in 2021. The retail industry generates massive volumes of data through numerous channel modalities such as social media, blogs, and applications. Despite the fact that it contains significant information, much of this unstructured data is useless. The retail industry entered the digital age with the implementation of e-commerce, giving retailers the ability to collect more information on their customers. Enterprise mobility is being used by leading retailers in retail services to improve user experience and shop performance.

By Component

By Organization Size

By Device Type

By Deployment Modes

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

November 2024

November 2024

February 2025