January 2025

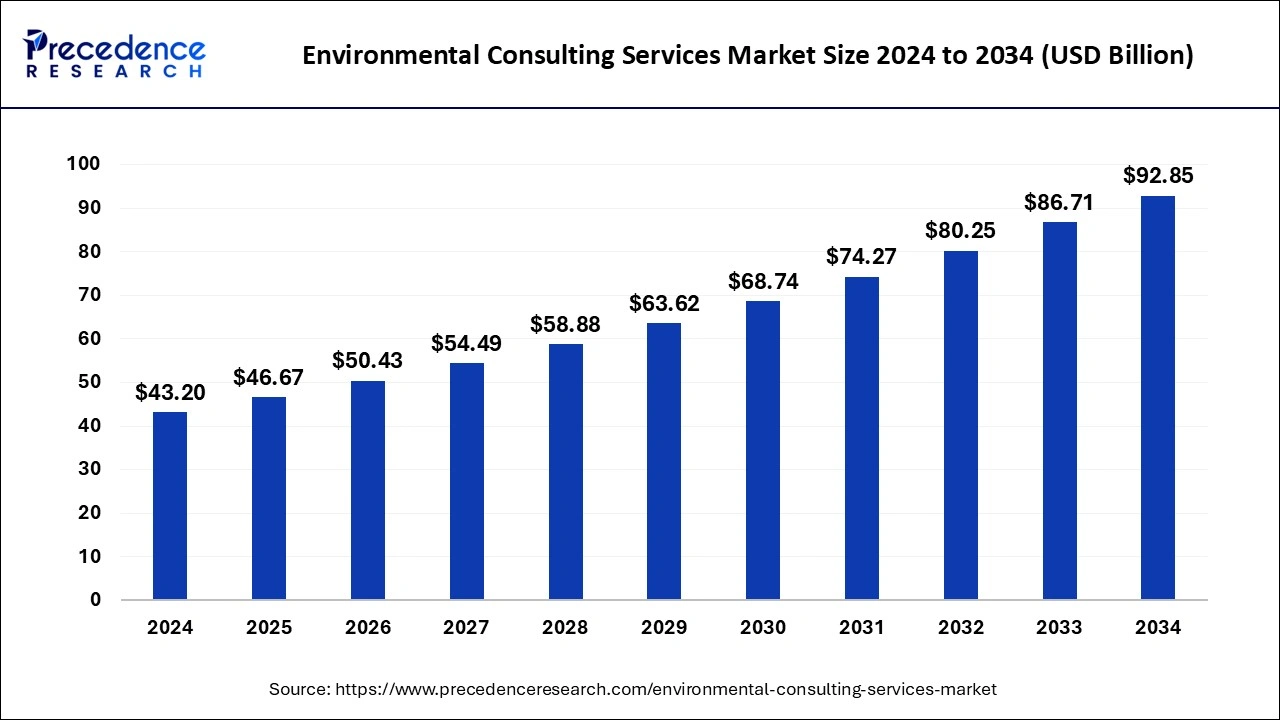

The global environmental consulting services market size is calculated at USD 46.67 billion in 2025 and is forecasted to reach around USD 92.85 billion by 2034, accelerating at a CAGR of 7.95% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global environmental consulting services market size was estimated at USD 43.20 billion in 2024 and is predicted to increase from USD 46.67 billion in 2025 to approximately USD 92.85 billion by 2034, expanding at a CAGR of 7.95% from 2025 to 2034. The growing urgency to address climate change to work on the greenhouse gas emissions reduction led a marketer to shift towards renewable energy sources are the driving factors of the market.

The environmental consulting services market continues to grow steadily as businesses and governments prioritize sustainability. With increasing regulations and public awareness about environmental issues, demand for consulting firms that offer expertise in areas such as environmental impact and its studies, sustainability planning with regulatory compliance continues to rise.

Key trends in the market include a growing focus on renewable energy projects, waste management and recycling initiatives, climate change adaptation, and water resource management. Additionally, emerging technologies such as artificial intelligence, remote sensing, and data analytics are being integrated into environmental consulting services to provide more accurate assessments and predictive modelling.

Major players in the industry range from large multinational firms to specialized boutique consulting companies. Competition is intense, with firms differentiating themselves based on expertise, service offerings, technological capabilities, and reputation. Looking ahead, the environmental consulting services market is expected to continue its growth trajectory globally.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.95% |

| Market Size in 2025 | USD 46.67 Billion |

| Market Size by 2034 | USD 92.85 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service Type, By Application, and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Post pandemic awareness

The COVID-19 pandemic has acted as a catalyst for heightened awareness about global warming and its impacts. As people around the world experienced the interconnectedness of global systems and witnessed the positive environmental effects of reduced human activity during lockdowns, there has been a notable shift in public perception towards climate change. This increased awareness has prompted individuals, businesses, and governments to prioritize environmental sustainability and take action to reduce the effects of global warming on the earth planet.

In response to this growing awareness, the demand for environmental consulting services has surged. Consulting firms specializing in environmental sustainability, climate resilience, and carbon footprint reduction are seeing increased interest from clients seeking expertise in implementing sustainable practices. These firms play a vital role in guiding organizations through the complexities of environmental regulations, helping them develop effective strategies to address climate change, and providing innovative solutions to reduce environmental impact.

High cost

The high cost of environmental consulting services poses a significant restraint on the market. Due to the specialized expertise, sophisticated technologies, and extensive resources required to deliver comprehensive environmental solutions to the clients. consulting firms often charge premium rates for their services from the. This can deter potential clients, especially small and medium-sized enterprises (SMEs) and organizations with limited budgets, from seeking professional environmental consulting assistance.

Additionally, the complexity of environmental projects, regulatory compliance requirements, and the need for deep assessments contribute to the overall cost of services. Clients may perceive environmental consulting fees as highly demandable hence, leading them to explore alternative solutions or attempt to manage environmental issues in-house, which could result in lesser interest by clients. Furthermore, in certain industries or regions where environmental regulation are less stringent, organizations may prioritize short-term cost savings over long-term environmental studies so that to reducing the high demand for consulting services.

Integration of AI tools

The emergence of artificial intelligence (AI) tools presents a significant future opportunity for the environmental consulting services market. AI technologies, such as machine learning algorithms, data analytics, and remote sensing capabilities, offer unprecedented potential to revolutionize environmental assessments, monitoring, and decision-making processes.

AI tools can analyse vast amounts of environmental data with speed and accuracy, enabling consultants to generate insights, identify patterns, and predict environmental trends more efficiently than ever before. This capability enhances the quality and reliability of environmental impact assessments, risk evaluations, and sustainability planning, thus providing clients with more robust solutions and recommendations.

Moreover, AI-powered tools can streamline workflows, automate repetitive tasks, and optimize resource allocation, resulting in cost savings and improved productivity for consulting firms. By leveraging AI technologies, environmental consultants can unlock new avenues for innovation, expand their services.

The monitoring and testing segment stand out as the dominant segment in the environmental consulting services market. This service type involves the systematic collection, analysis, and evaluation of environmental data to assess the quality of air, water, soil, and other natural resources. Monitoring and testing services are crucial for identifying environmental contaminants, assessing pollution levels, and ensuring compliance with regulatory standards.

Consulting firms specializing in monitoring and testing offer a wide range of services, including environmental sampling, laboratory analysis, field testing, and data interpretation. These services are in high demand across various industries, including manufacturing, energy, construction, and transportation, where there is a need to assess and mitigate environmental risks.

The dominance of monitoring and testing services reflects the ongoing importance of proactive environmental management and regulatory compliance. Hence, driving consulting firms to invest in advanced technologies and expertise to meet the growing demand for accurate and reliable environmental data.

The investment assessment and auditing segment emerges as a fast-growing segment within the environmental consulting services market. This service type involves evaluating the environmental risks and opportunities associated with investment projects, mergers, acquisitions, and corporate transactions. As businesses increasingly prioritize environmental sustainability and risk management in their decision-making processes, the demand for investment assessment and auditing services has surged.

Consulting firms specializing in this segment provide comprehensive evaluations of environmental solutions, regulatory compliance, and sustainability performance to support investment decisions. Additionally, they assist clients in identifying opportunities for enhancing environmental performance and maximizing returns on investment. The rapid growth of investment assessment and auditing services underscores the growing recognition of environmental factors as critical considerations in business strategy and investment decisions, driving consulting firms to expand their capabilities and expertise in this area.

The water management segment is poised to emerge as the dominant application area in the environmental consulting services market. Water management encompasses a wide range of services aimed at ensuring the sustainable use, conservation, and protection of water resources. This includes water quality assessment, wastewater treatment, stormwater management, groundwater monitoring, and water resource planning. Several factors contribute to the predicted dominance of the water management segment. increasing water scarcity and pollution concerns globally drive the demand for consulting services to address these challenges effectively.

Also, regulatory requirements related to water quality standards and environmental protection compel industries and municipalities to seek expert guidance to achieve compliance. Moreover, growing urbanization, industrialization, and agricultural activities intensify pressure on water resources. That need comprehensive water management solutions. Consulting firms specializing in water management offer expertise in hydrology, water treatment technologies, and regulatory compliance to help clients develop sustainable water management strategies tailored to their specific needs.

The waste management segment emerges as a notably growing segment in the environmental consulting services market. With increasing concerns about waste generation, pollution, and resource depletion, there is a heightened demand for consulting services to address these challenges effectively. Consulting firms specializing in waste management offer expertise in waste reduction, recycling, landfill management, and hazardous waste disposal. This segment's growth is driven by regulatory pressures, corporate sustainability initiatives, and public awareness campaigns promoting responsible waste management practices.

The energy and utilities segment has shown a significant growth and anticipated to register robust growth during the predicted timeframe in the environmental consulting services market. This vertical encompasses a diverse range of sectors including oil and gas, renewable energy, electricity generation, water utilities, and infrastructure development. Several factors contribute to the expected growth in this segment. the transition towards renewable energy sources such as solar, wind, and hydropower drives demand for consulting services in project planning, environmental impact assessments, and regulatory compliance.

Additionally, the oil and gas industry require expertise in environmental risk management, emissions reduction, and remediation to address environmental concerns and regulatory requirements. As energy and utilities companies increasingly prioritize environmental sustainability and regulatory compliance, the demand for specialized consulting services in this vertical is projected to grow significantly in the coming years.

North America held the largest share of the environmental consulting services market while promising a sustained position in the industry throughout the forecast period, encompassing countries such as the United States, Canada, and Mexico. Several factors contribute to the region's dominant position in the market. Stringent environmental regulations in North America drive the demand for consulting services to ensure compliance and mitigate environmental risks across various industries. The United States has robust environmental regulations enforced by agencies such as the Environmental Protection Agency, creating a substantial market for consulting firms.

Additionally, the region's advanced industrial infrastructure and extensive economic activities result in a wide range of environmental challenges, including pollution, waste management, and natural resource conservation. These further fuels the demand for consulting services to address these complex environmental issues effectively. Moreover, increasing corporate sustainability initiatives, growing public awareness about environmental issues, and investments in renewable energy projects contribute to the growth of the environmental consulting services market in North America.

Europe is poised to exhibit rapid growth in the environmental consulting services market. The region's proactive approach to environmental sustainability, coupled with stringent regulations and ambitious climate targets, drives demand for consulting services across various sectors. European countries prioritize environmental protection, renewable energy adoption, and sustainable development. Additionally, increasing investments in green technologies, circular economy initiatives, and infrastructure projects further contribute to the growth of the market. With a strong emphasis on environmental solutions and innovation, Europe is expected to emerge as a significant growth driver in the environmental consulting services sector.

Asia Pacific is positioned as a fast-growing region in the environmental consulting services sector, primarily due to the rapid pace of urbanization and industrialization across the region. As countries in Asia Pacific undergo significant economic development and urban expansion, there is a growing awareness of environmental issues and the need for sustainable solutions.

Urbanization brings forth challenges such as air and water pollution, waste management, and infrastructure development, driving demand for environmental consulting services. Moreover, the industrial sector in the region needs an expertise in environmental impact assessments, pollution control measures, and regulatory compliance.

Additionally, governments in the Asia Pacific region are increasingly prioritizing environmental protection and sustainability, implementing stricter regulations and investing in green technologies. Consulting firms specializing in environmental solutions are thus experiencing heightened demand particularly in the developed region.

By Service Type

By Application

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

March 2025

January 2025