January 2025

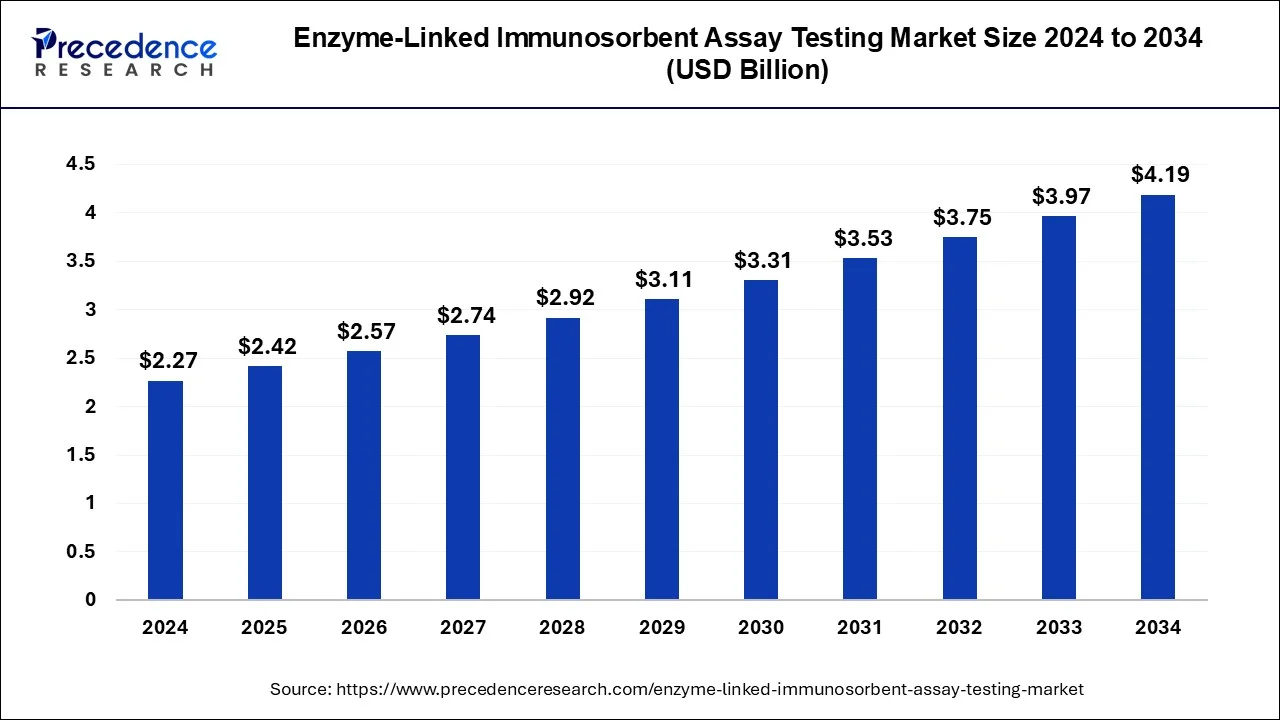

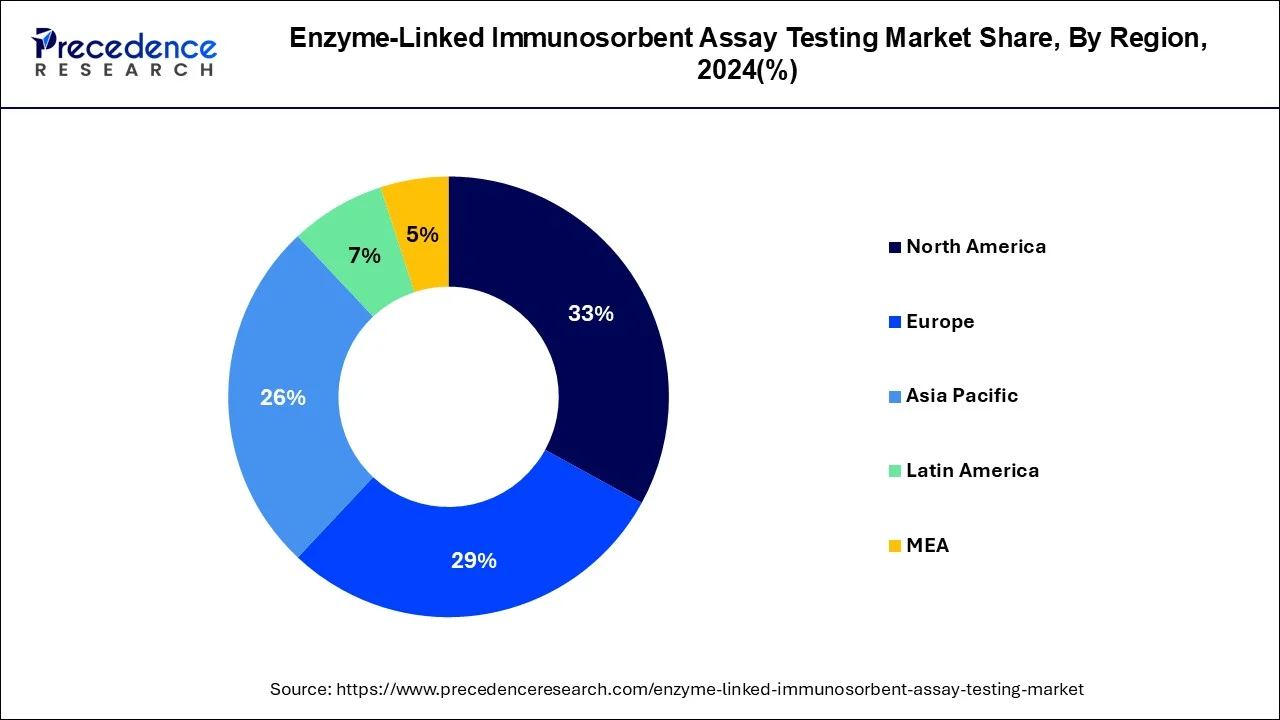

The global enzyme-linked immunosorbent assay (ELISA) testing market size is calculated at USD 2.42 billion in 2025 and is forecasted to reach around USD 4.19 billion by 2034, accelerating at a CAGR of 6.32% from 2025 to 2034. The North America enzyme-linked immunosorbent assay (ELISA) testing market size surpassed USD 750 million in 2024 and is expanding at a CAGR of 6.33% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global enzyme-linked immunosorbent assay (ELISA) testing market size was USD 2.27 billion in 2024, estimated at USD 2.42 billion in 2025 and is anticipated to reach around USD 4.19 billion by 2034, expanding at a CAGR of 6.32% from 2025 to 2034.

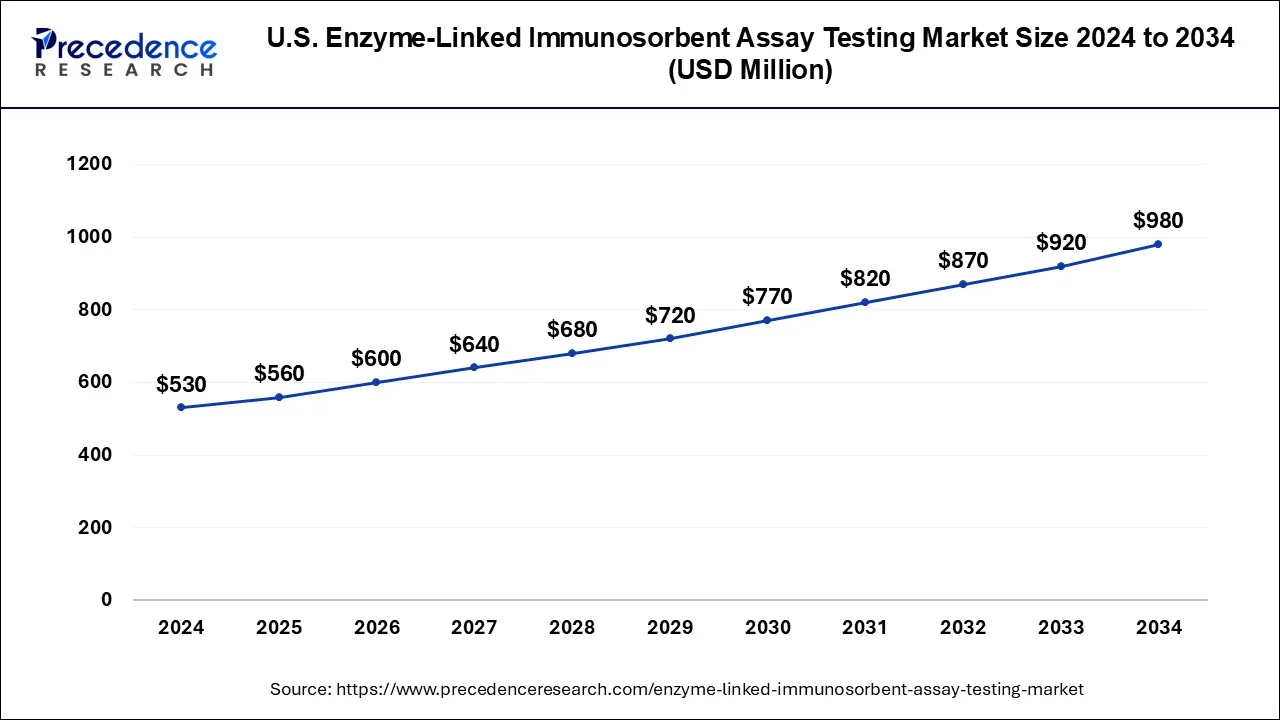

The U.S. enzyme-linked immunosorbent assay (ELISA) testing market size was valued at USD 530 million in 2024 and is expected to grow around USD 980 million by 2034, at a CAGR of 6.34% between 2025 and 2034.

North America dominated the global market in 2024 by holding the largest market share. The regional market growth is primarily attributed to the increasing investment in research and development activities coupled with the existence of skillful scientists. Furthermore, the rising geriatric population, increasing number of cancer cases, and increasing awareness about infectious diseases boost the demand for enzyme-linked immunosorbent assay testing in the region, thus boosting the market.

The market in Asia Pacific is anticipated to witness a rapid growth in the coming years. This is due to the increasing incidence of infectious disorders and the growing per-capita healthcare expenditure. Moreover, in this region, Japan is anticipated to witness the largest market opportunity due to the countries' developed healthcare infrastructure and growing healthcare expenditure credited to advancing healthcare policies. The region is also home to the major market players which can strengthen the position of the region as the fastest-growing region.

An enzyme-linked immunosorbent assay (ELISA) is a procedure that perceives and quantifies antibodies within the blood. It is a laboratory test that is commonly used to detect the presence of antibodies or antigens in a sample. ELISA testing is an important tool in various applications, such as protein quantification, determination of serum antibody concentrations in a virus test, food allergen detection, and presence of antigen or antibody in a sample. Thus, it is widely used in research applications, such as protein quantification during upstream and downstream processing of monoclonal antibodies (MAbs), biosimilar development, other protein therapeutics development, and biomarker selection.

The rising burden of infectious diseases, such as hepatitis, dengue, and HIV, is expected to boost the market. These diseases require reliable and effective diagnostic tools for early detection and management. However, ELISA is used to detect whether an individual has antibodies associated with certain infectious conditions. Moreover, the rising prevalence of neurological disorders, the growing geriatric population, and the rising incidence of non-communicable diseases further contribute to the market growth.

An enzyme-linked immunosorbent assay (ELISA), is a procedure that perceives and quantifies antibodies within the blood. ELISA is employed to regulate if an individual has antibodies connected to definite infectious conditions. The advent of cost-effective technologies and automation in laboratories for ELISA assay is anticipated to be the key driver for the worldwide enzyme-linked immunosorbent assay (ELISA) testing market. Furthermore, continuous advances in monoclonal antibodies (mABs) and biomarkers coupled with continuous growth in the drug discovery domain are anticipated to trigger the progress of worldwide ELISA testing industry in the near future. On the contrary, the threat of alternate testing methods using technologies such as multiplex proteomic array platforms may present a challenge to ELISA testing market. However, growing need for accurate and early ailment diagnosis owing to snowballing burden of chronic illnesses across the world along with growing geriatric populace is expected to act as prospects for ELISA testing market in close future.

ELISA testing is an important tool in various applications such as protein quantification, determination of serum antibody concentrations in a virus test, food allergen detection, presence of antigen or antibody in a sample and many more. ELISA technology offers high specificity and sensitivity for analyze detection and quantification and thus is widely used in research applications such as protein quantification during upstream and downstream processing of monoclonal antibodies (mABs), biosimilars development and other protein therapeutics development as well as biomarker selection. Worldwide, the burden of infectious diseases, cancer, HIV infection and other diseases is increasing at a rapid pace. Increasing number of cases of infectious diseases, cancer and other diseases and increasing health awareness has led to increasing demand for accurate and early disease diagnosis tools. Continuous development of innovative and novel product for early and accurate disease diagnosis is projected to open new growth opportunities for major market players in the enzyme-linked immunosorbent assay (ELISA) testing.

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.32% |

| Market Size in 2024 | USD 2.27 Billion |

| Market Size by 2034 | USD 4.19 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising R&D activities

The rising research and development activities in the biotech and pharmaceuticals industries are projected to boost the demand for ELISA testing. These assays are effective solutions for a range of research and diagnostic applications, as they offer high specificity and sensitivity for analysis detection and quantification.

Moreover, the increasing emphasis on personalized medicines and targeted therapies and the rising prevalence of cancer further contribute to the market expansion in the coming years.

Global cancer incidence 2022

Top five most prevalent cancer types

| Rank | Cancer | New cases (2022) |

| 1 | Trachea, bronchus and lung | 2,480,675 |

| 2 | Breast | 2,296,840 |

| 3 | Colorectum | 1,926,425 |

| 4 | Prostate | 1,467,854 |

| 5 | Stomach | 968,784 |

High cost and the availability of alternative methods

The high cost of ELISA assays is expected to hamper the market. Additionally, this procedure is time-consuming, which may limit their adoption in various R&D activities requiring quick results. Moreover, the easy availability of alternate methods, such as next-generation sequencing and PCR, can significantly hinder market growth throughout the forecast period.

Advancements in drug discovery and monoclonal antibodies

The advent of cost-effective technologies and automation in laboratories for ELISA assay fuel the market. Furthermore, continuous advances in monoclonal antibodies (mABs) and biomarkers coupled with continuous growth in the drug discovery domain are anticipated to trigger the progress of the worldwide ELISA testing industry in the near future. The growing need for accurate and early ailment diagnosis owing to the snowballing burden of chronic illnesses across the world, along with the growing geriatric populace, is expected to act as a prospect for the ELISA testing market in the near future.

The sandwich ELISA segment dominated the market by capturing the largest market share in 2024. This is due to its high usage in research & development activities, owing to its higher sensitivity compared to others. Moreover, the improvements carried out in the technology to make this test type more efficient and multiple benefits over other test types are major factors contributed to segmental growth.

The multiple and portable ELISA segment is projected to expand at the highest CAGR through the forecast period. This technique uses a multicatcher device with 8 or 12 immunosorbent protruding pins, which can be immersed in a collected sample. Furthermore, this technique is highly efficient and can be carried out without complicated sample pre-treatment. It allows simultaneous detection of multiple analytes within a single sample.

The infectious diseases segment dominated the Market in 2024, accounting for the largest market share. The segment's dominance is mainly attributed to the rising incidence of infectious disorders, such as Lyme disease, tuberculosis, meningococcal ailments, and salmonella infections. With the rising prevalence of infectious diseases, awareness about early detection and diagnostics is rising, which boosts the growth of the enzyme-linked immunosorbent assay (ELISA) testing market.

The cancer segment is expected to expand rapidly during the forecast period. ELISA-based techniques are used to diagnose and test for the early stages of cancers like ovarian and breast cancer. Also, ELISA-based techniques can detect TP53INP1, a protein that's overexpressed in prostate cancer and may be a predictor of relapse. The rising prevalence of cancer worldwide contributes to segmental growth.

In order to well recognize the present status of enzyme-linked immunosorbent assay (ELISA), and policies implemented by the foremost nations, Precedence Research projected the future progress of the enzyme-linked immunosorbent assay (ELISA) testing market. This research report bids quantitative and qualitative insights on enzyme-linked immunosorbent assay (ELISA) testing market and valuation of market size and progress trend for probable market segments.

By Test Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

March 2025