January 2025

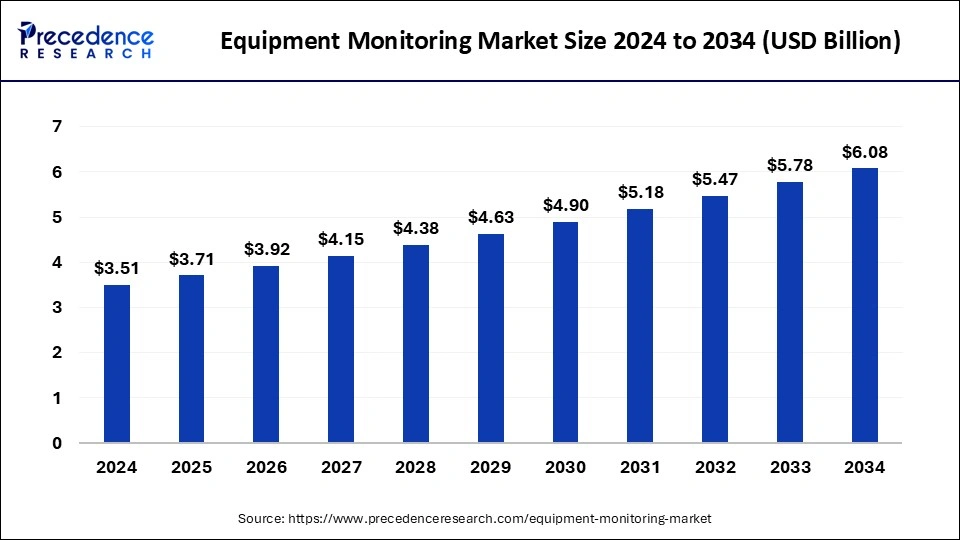

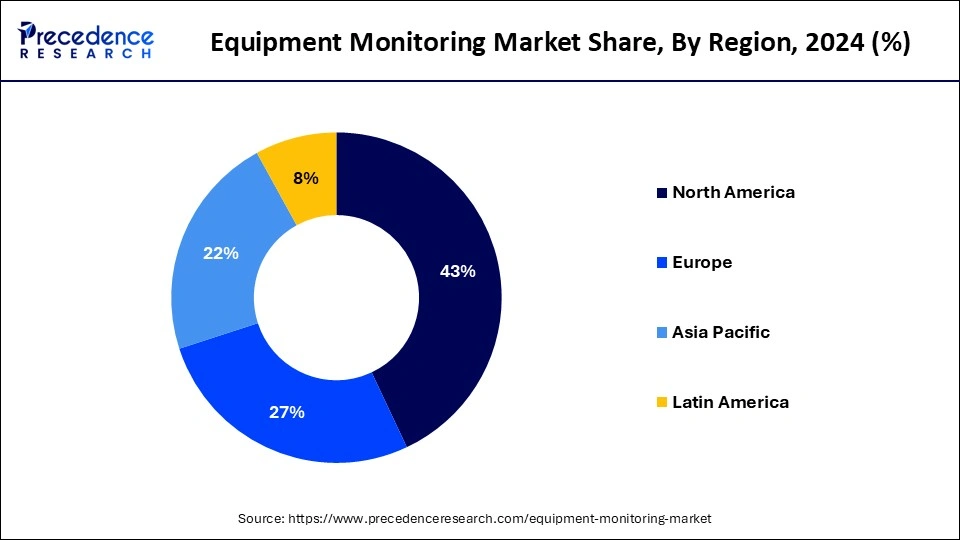

The global equipment monitoring market size is calculated at USD 3.71 billion in 2025 and is forecasted to reach around USD 6.08 billion by 2034, accelerating at a CAGR of 5.65% from 2025 to 2034. The North America equipment monitoring market size surpassed USD 1.51 billion in 2024 and is expanding at a CAGR of 5.62% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global equipment monitoring market size was estimated at USD 3.51 billion in 2024 and is predicted to increase from USD 3.71 billion in 2025 to approximately USD 6.08 billion by 2034, expanding at a CAGR of 5.65% from 2025 to 2034. Increasing concerns about safety and security have raised the demand for equipment monitoring, which is estimated to fuel the growth of the equipment monitoring market over the forecast period.

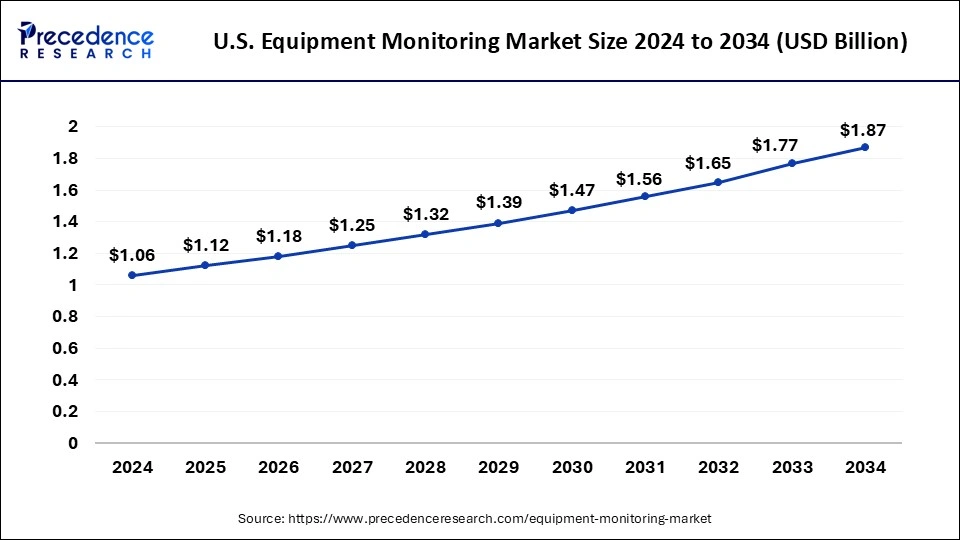

The U.S. equipment monitoring market size was exhibited at USD 1.06 billion in 2024 and is projected to be worth around USD 1.87 billion by 2034, poised to grow at a CAGR of 5.84% from 2025 to 2034.

North America dominated the equipment monitoring market in 2024. The increasing launch of new equipment monitoring tools by the key players and the shift of organizations towards advanced equipment monitoring is expected to drive the growth of the equipment monitoring market in North American. In April 2024, Microsoft, a corporation and technology company based in the U.S., announced the launch of new industrial artificial intelligence innovations from the cloud, which will assist the manufacturing industry in addressing concerns with industrial challenges.

The new AI-powered industrial solutions cloud creates a lucrative opportunity to assist the manufacturing industry in enhancing the optimization of factory and production costs to produce repeatable outcomes and bolster operations resilience. Microsoft is offering new artificial intelligence monitoring through cloud deployment and data solutions for manufacturers in an urge to optimize operations, boost worker productivity, foster innovation, and facilitate smarter manufacturing.

Asia Pacific is expected to grow at a significant rate in the equipment monitoring market during the forecast period. This growth is significantly driven by the increasing launch of advanced technology equipment monitoring tools. Asia Pacific is undergoing rapid industrialization and urbanization, which necessitates efficient equipment monitoring solutions to ensure optimal operation and maintenance of industrial machinery. Countries like China, India, and Southeast Asian nations are expanding their manufacturing and industrial sectors, leading to increased demand for equipment monitoring systems to minimize downtime and enhance productivity.

Europe holds a significant share of the global equipment monitoring market. The key market players operating in Europe are focused on launching new equipment monitoring tools and expanding their product portfolio, which is estimated to foster the growth of the equipment monitoring market in Europe. In June 2024, Henkel AG & Co. KGaA, a consumer goods and multinational chemical company headquartered in Germany, Europe, announced the introduction of smart pipes and tanks leak detection and smart rotating equipment monitoring and expansion of the industrial Internet of things (IIoT) solution Loctite Pulse portfolio of the Henkel AG & Co. KGaA company.

The smart pipes and tanks leak detection provides an advanced retrofit monitoring solution for initial-stage hydrocarbon leak detection. The smart rotating equipment monitoring assists in the simultaneous monitoring of six critical data parameters, from acoustic emissions and vibration to magnetic flux.

Equipment data such as status, usage, performance, and condition can be collected and analyzed in real-time using the Internet of Things (IoT) with the help of an equipment monitoring system. In manufacturing, construction, healthcare, oil and gas, electrical, mining, and other industries, the solution can maximize equipment operation and expedite equipment maintenance tasks. It can interact with accounting software, asset management software, ERP, and more for end-to-end data synchronization. Commercial or industrial equipment can be observed and tracked using an equipment monitoring system.

The equipment monitoring market is segregated into telematics devices/sensors, connectivity, and data processing. Telematics devices/sensors are global positioning system (GPS) equipment that enables tracking in real-time, engine diagnostic data, equipment utilization statistics, and other services are all provided via equipment telematics. The device-collected data must be seen after connectivity to an on-site server or cloud. Cellular, satellite, WiFi, and Bluetooth are common forms of connectivity. Data processing involves the analysis of raw data through analytics. End users are able to recognize patterns, comprehend usage trends, and identify any issues with its aid.

Combining all of these parts results in a network of devices that communicates across the Internet to exchange data with other systems and devices. The Internet of Things (IoT) is another name for this network. Alternatively, the Industrial Internet of Things (IIoT) is the term used to refer to this technology when it is used in an industrial setting. The ability to detect and monitor sensor data from equipment creates new opportunities for efficiency and helps save money and time. For instance, the likelihood of an unexpected breakdown is reduced if machinery and equipment are regularly inspected. If a problem code appeared or diagnostics revealed that the equipment wasn't operating at peak efficiency, you would be able to take immediate corrective action.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.08 Billion |

| Market Size in 2025 | USD 3.71 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.65% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Monitoring Type, Monitoring Process, Deployment Type, Service Offering, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Introduction of the new product

The increasing launch of new products in the market is estimated to fuel the growth of the equipment monitoring market over the forecast period. In January 2023, Dodge Industrial, Inc., a company focused on manufacturing and developing software, announced the launch of OPTIFY, a condition monitoring platform. The OPTIFY assists in condition monitoring that enables customers to remotely oversee their industrial activities in real-time, enhancing safety, reducing unscheduled downtime, and saving costs.

Challenges and limitations associated with equipment monitoring

The Internet of Things (IoT-based) real-time data collection and analysis of equipment status, usage, performance, condition, and other variables is made possible by an equipment monitoring system. Initial setup cost for equipment monitoring is high, the requirement of skilled professionals, regular maintenance of monitoring equipment, and excessive alerts leading to operational disruption are some limitations observed while utilizing equipment monitoring tools, which can hamper the growth of the equipment monitoring market over the forecast period.

One potential challenge is the dependability and stability of network connections. Environmental elements and weather conditions are typically the cause of poor or absent connectivity. Sensitive data is gathered and transmitted as part of the Internet of Things remote device monitoring, which makes it susceptible to security lapses. This covers financial information, personal information, and other private data. In order to defend against cyber threats, it is especially important for organizations and industries to put strong security standards in place.

Technology advancements

The market players are focused on innovating and launching advanced technology equipment monitoring tools and expanding their product offerings, which is expected to create lucrative opportunities for the growth of the equipment monitoring market over the forecast period. In July 2023, ABB Ltd., an automation company, announced the introduction of the ‘XIO’ input/output series (I/O series) to meet the digital monitoring demands of gas and oil fields. The newly launched ‘XIO’ utilizes an Ethernet-to-Serial passthrough application to provide real-time monitoring and control, enhance data integrity, and improve data accessibility. The enhanced site automation capabilities of the new XIO series contribute to the improvement of oil and gas operations' efficiency.

The vibration monitoring segment dominated the equipment monitoring market in 2024 on account of the increasing launch of new technology vibration monitoring kits and devices. In November 2023, Worldsensing, a software company based in Europe, revealed the introduction of the new vibration meter, which assists in automating data collection in long-term, continuous vibration monitoring projects. It increases the range of wireless monitoring gadgets that the technology Worldsensing company currently offers. The tool can assist engineering service providers in adhering to standards such as the British BS 7385-2, the German DIN 4140-3, and the ISO 2631-2 that address vibration effects on humans and building integrity.

The online equipment monitoring segment is expected to grow at a significant rate in the equipment monitoring market during the forecast period. The increasing introduction of innovative online equipment monitoring by the key players is estimated to drive the growth of the segment in the near future. In February 2024, Cisco Systems, Inc., a digital communications technology conglomerate corporation, unveiled the introduction of digital experience monitoring with real user monitoring. With the integration of session replay modules, this technology gives extensive insights into mobile and browser applications' performance and efficient resolution of session-level issues.

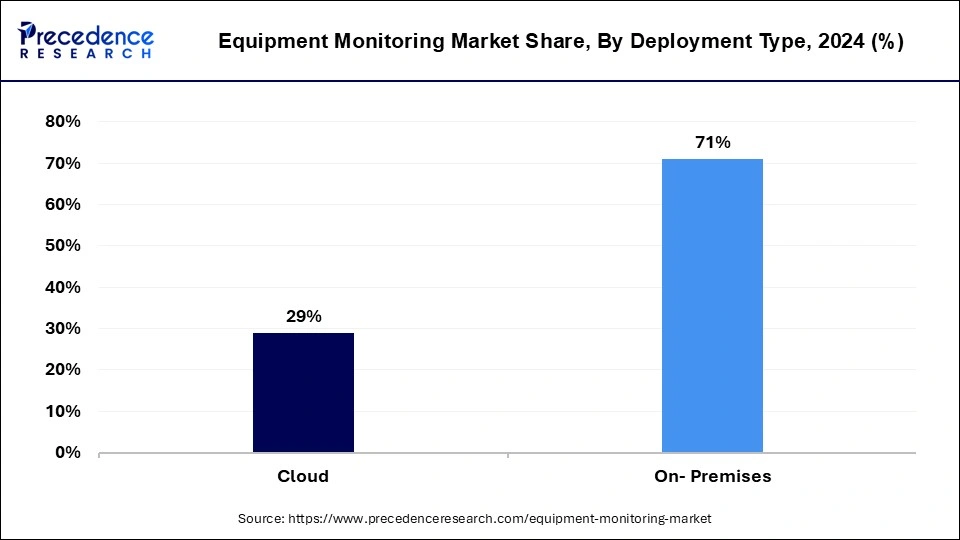

The on-premises segment dominated the equipment monitoring market in 2024. The increasing launch of new products for on-premises equipment monitoring is expected to drive the segment growth over the forecast period. Moreover, the cloud segment is expected to grow at the fastest rate over the forecast period. The increasing launch of cloud-based equipment monitoring is estimated to foster the growth of the segment over the forecast.

The oil & gas segment dominated the equipment monitoring market with the largest share in 2024 due to the increasing launch of new technology oil and gas monitoring systems by the key market players operating in the market. In May 2024, H2scan, a company that is focused on developing hydrogen sensing and industrial monitoring solutions, announced the launch of four innovative products developed to drive noteworthy efficiencies and performance enhancement in transformer monitoring and protection for industrial and utilities asset managers. The four new products form a comprehensive solution to improve durability, grid intellect, and flexibility: AO2 Control Hub, H2cloud Fleet Monitoring platform, Sentinel PRO IoT (Internet of Things) Module, and GRIDSCAN 6000 Multi-Sense Monitor Platform.

The only key-gas monitoring system in the industry that detects temperature, pressure, moisture content, and hydrogen all in one device is H2scan's new GRIDSCAN 6000. H2scan's AO2 Transformer Monitoring Controller greatly improves transformer monitoring options by providing thorough and simple supervision. Asset managers may access transformer fleet health data securely through the cloud with Sentinel PRO, giving them access to full grid analytics. H2cloud is a potent cloud-based technology that offers centralized intelligence in real-time for tracking and evaluating transformer fleet health. Data from H2scan's GRIDSCAN sensors is easily integrated, providing cyber-secure visibility into asset status across transformer fleets and warning owners of irregularities in transformer operation.

By Monitoring Type

By Monitoring Process

By Deployment Type

By Service Offering

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

September 2024