The global ESG investing market size surpassed USD 25.13 trillion in 2023 and is estimated to increase from USD 29.86 trillion in 2024 to approximately USD 167.49 trillion by 2034. It is projected to grow at a CAGR of 18.82% from 2024 to 2034.

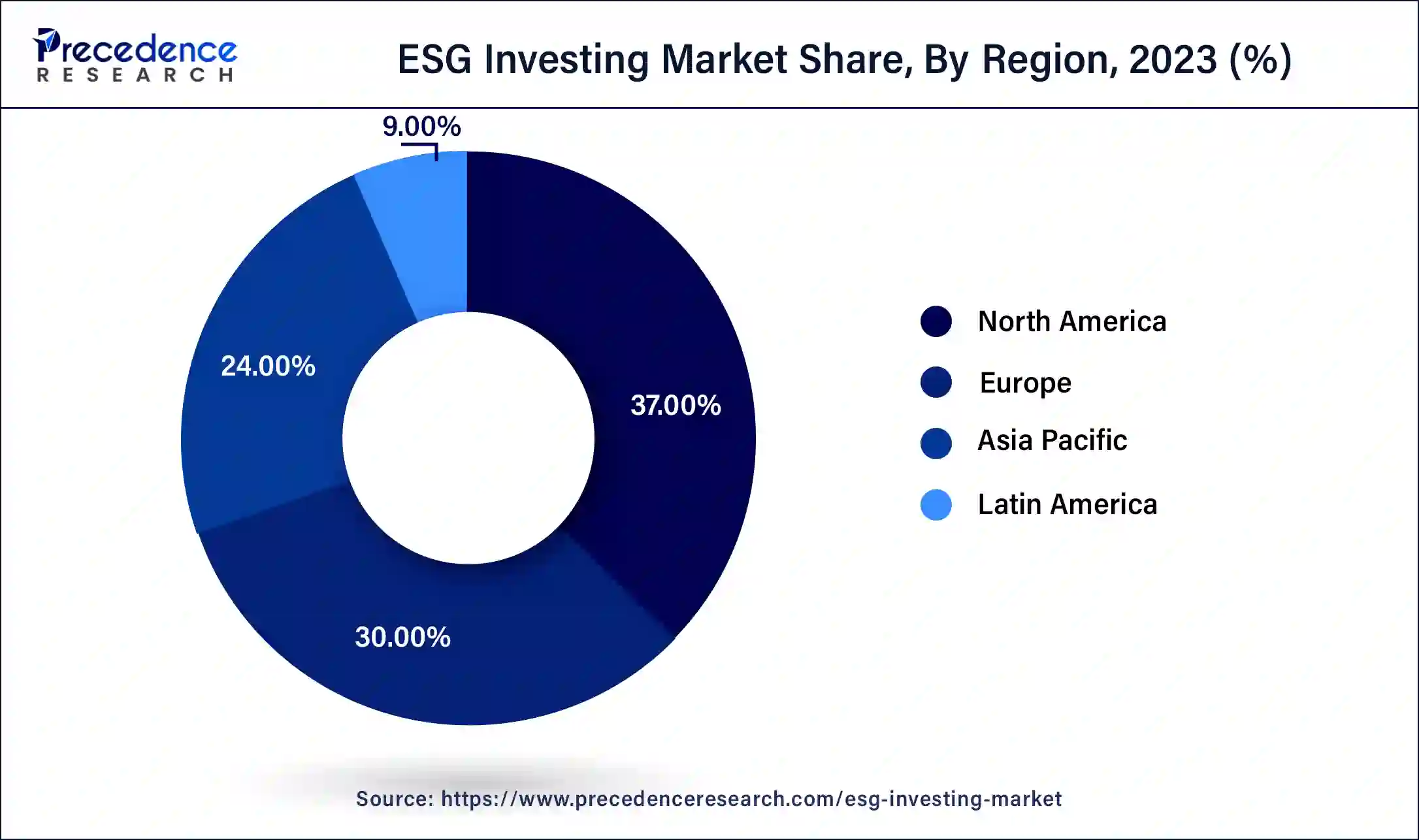

The global ESG investing market size is projected to be worth around USD 167.49 trillion by 2034 from USD 29.86 trillion in 2024, at a CAGR of 18.82% from 2024 to 2034. The North America ESG investing market size reached USD 9.30 trillion in 2023. Companies' rising awareness of environmental and social practices attracts investors, which drives the growth of the market. Governments across the globe have also developed SDGs in order to make the world more sustainable.

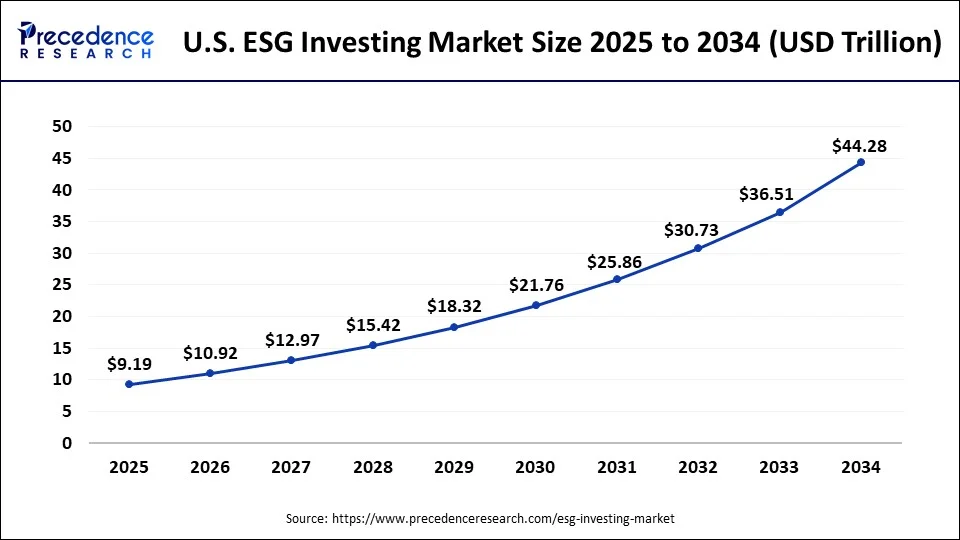

The U.S. ESG investing market size was exhibited at USD 6.51 trillion in 2023 and is projected to be worth around USD 44.28 trillion by 2034, poised to grow at a CAGR of 19.04% from 2024 to 2034.

North America dominated the market with the largest market share in 2023. The growth of the market is attributed to the rising interest in ESG investment among retail and institutional investors due to the higher return from it. The rising concern over sustainable products and services is driving investors in ESG investing, and the rising concern over sustainable practices in investment is collectively driving the growth of the market. Additionally, the increased availability of the major industries and the developed economies, including the U.S. and Canada, is collectively driving the growth of the ESG investing market across the region.

Asia Pacific is expected to have significant growth during the forecast period. The growth of the ESG investing market is owing to the rising economic development and the rising concern over the environment, as well as sustainable development, which drives the growth of the market. The rising population and industrialization result in increased cases of environmental challenges that create opportunities for sustainable products and services, which boosts the growth of the ESG investing market in the region.

ESG investing is the investment in the purpose of making the world a more sustainable and better place to live. ESG investing is an investment in companies with the purpose of increasing their performance and benefitting the environment. The ESG stands for the environmental, social, and governance. ESG investing is buying a share of a company that is willing to work in this field. This is the ethical type of investing by the investors with personal choices and values.

The criteria of ESG are how public companies maintain their environment and communities' work and ensure that management incorporated with governance meets high standards. The rising urbanization and economic development in the countries are driving pollution and negatively impacting global warming, which drives companies to act and implement projects.

How Can AI Impact the ESG Investing Market?

Artificial intelligence significantly impacts the overall management and performance portfolio of ESG investing positively. The integration improves the financial outcome and decision-making process. With the use of machine learning algorithms and advanced analytic data, AI helps investors analyze ESG datasets, extract actionable insights, and identify potential investment opportunities. AI helps investors to disseminate ESG-related data to make informed decisions regarding their investment that align with sustainability goals and values. AI helps to drive a positive impact on environmental and social investment while gaining significant financial returns. Thus, the integration of AI into ESG investing opens unprecedented opportunities to address complex ESG processes and achieve successful financial returns.

| Report Coverage | Details |

| Market Size by 2034 | USD 167.49 Trillion |

| Market Size in 2023 | USD 25.13 Trillion |

| Market Size in 2024 | USD 29.86 Trillion |

| Market Growth Rate from 2024 to 2034 | CAGR of 18.82% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Investor Types, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Benefits associated with ESG investing

The rising investment in ESG investing positively impacts environmental factors and sustainability. The ESG funds are accelerating the investment in clean energy development and other sustainable technologies. It helps enhance corporate diversity and inclusion, reduce industrial greenhouse gas emissions, navigate positive screening, and provide other benefits with the evaluation of ESG investing, which drives the awareness among investors to invest in ESG.

Lack of data availability

The insufficiency in the availability of standardized ESG data across industries and companies makes it difficult for investors to compare and analyze the ESG performance of different companies, limiting investment in the ESG companies that restrain the growth of the ESG investing market.

Emerging field that positively impacts the financial market

ESG investing is one of the significant evaluations in the financial market that helps investors enhance their financial return. ESG allows investors to generate potential financial returns by supporting the sustainable business. The adaptation of ESG investing increases reputation, reduces risks, and attracts and retains top talent. It is transforming the financial landscape, and rising concerns over the environmental, social, and governance criteria in the investors are driving the opportunity.

The ESG integration segment held the largest share of the ESG investing market in 2023. The increasing inclination towards ESG integration and the integration of ESG in decision-making provides several benefits, such as performance, risk management, reputation, and compliance. The ESG integration is suddenly gaining popularity due to the rising concern over the environmental, social, and governance factors that can financially affect the performance of a company and its risk profile. There are increased cases of investors focused on ESH integration into their decision-making and investment analysis process to increase return and mitigate risk more efficiently.

The green bonds segment is anticipated to have the fastest growth in the ESG investing market during the forecast period. The green bond is alternately known as the climate bond. The green bond issue organization issues debt security for financing and refinancing environmentally beneficial projects. The green bond offers attractive tax incentives to attract investors. Green bonds can used in financing several types of projects, including renewable energy projects, energy efficiency projects, natural resources and land management projects, pollution prevention and control projects, clean transportation projects, green building projects, and wastewater and water management projects.

The institutional investors segment dominated the ESG investing market in 2023. The institutional investor is the organization or firm that invests in certain projects on behalf of the individual person. It is often known as the Wall Street. Institutional investors significantly buy and sell blocks of bonds, stocks, and other securities. Insurance companies, pensions, and mutual funds are some of the examples of institutional investors. Institutional investors have a less regulatory framework and are considered easy as compared to the average investor.

The retail investors segment is expected to have significant growth in the ESG investing market during the predicted period. Retail investors are also known as individual investors who buy and sell funds, securities that consist of a wide range of securities like exchange-traded funds (ETFs) and mutual funds. Retail investors pay higher commissions or fees than institutional investors due to their smaller trades. Retail investors buy and sell funds in the form of bonds and equity with relatively smaller amounts than large institutional investors.

The environmental segment dominated the market with the largest ESG investing market share in 2023. The growth of the segment is attributed to the rising preference towards environmentally friendly products and services that are capturing the larger segment of the market. The rising concern over environmental pollution by the increasing carbon emission and carbon footprint by the several product consumptions is inclining the consumer towards the sustainable and naturally derived products and services that drive the ESG investors to invest in these types of firms to gain higher returns due to their growing nature.

The integrated ESG segment is projected to grow significantly in the ESG investing market during the forecast period. Integrated ESG helps in improving decision-making by offering a centralized platform that analyzes ESG data with financial data. This application helps investors to make more strategic investment decisions.

Segments Covered in the Report

By Type

By Investor Types

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client