August 2024

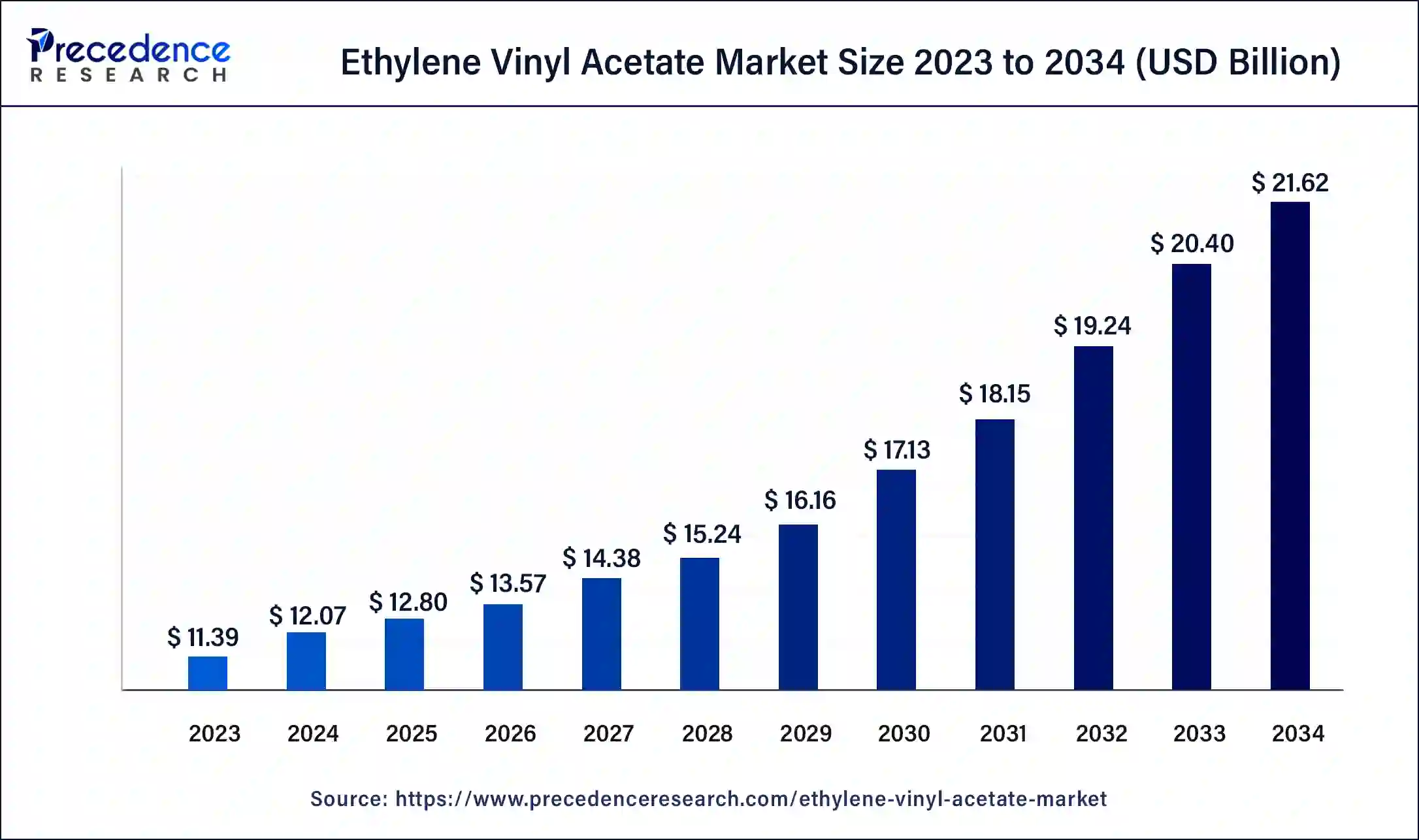

The global ethylene vinyl acetate market size accounted for USD 12.07 billion in 2024, grew to USD 12.80 billion in 2025 and is projected to surpass around USD 21.62 billion by 2034, representing a healthy CAGR of 6% between 2024 and 2034.

The global ethylene vinyl acetate market size is estimated at USD 12.07 billion in 2024 and is expected to be worth around USD 21.62 billion by 2034, growing at a healthy CAGR of 6% between 2024 and 2034.

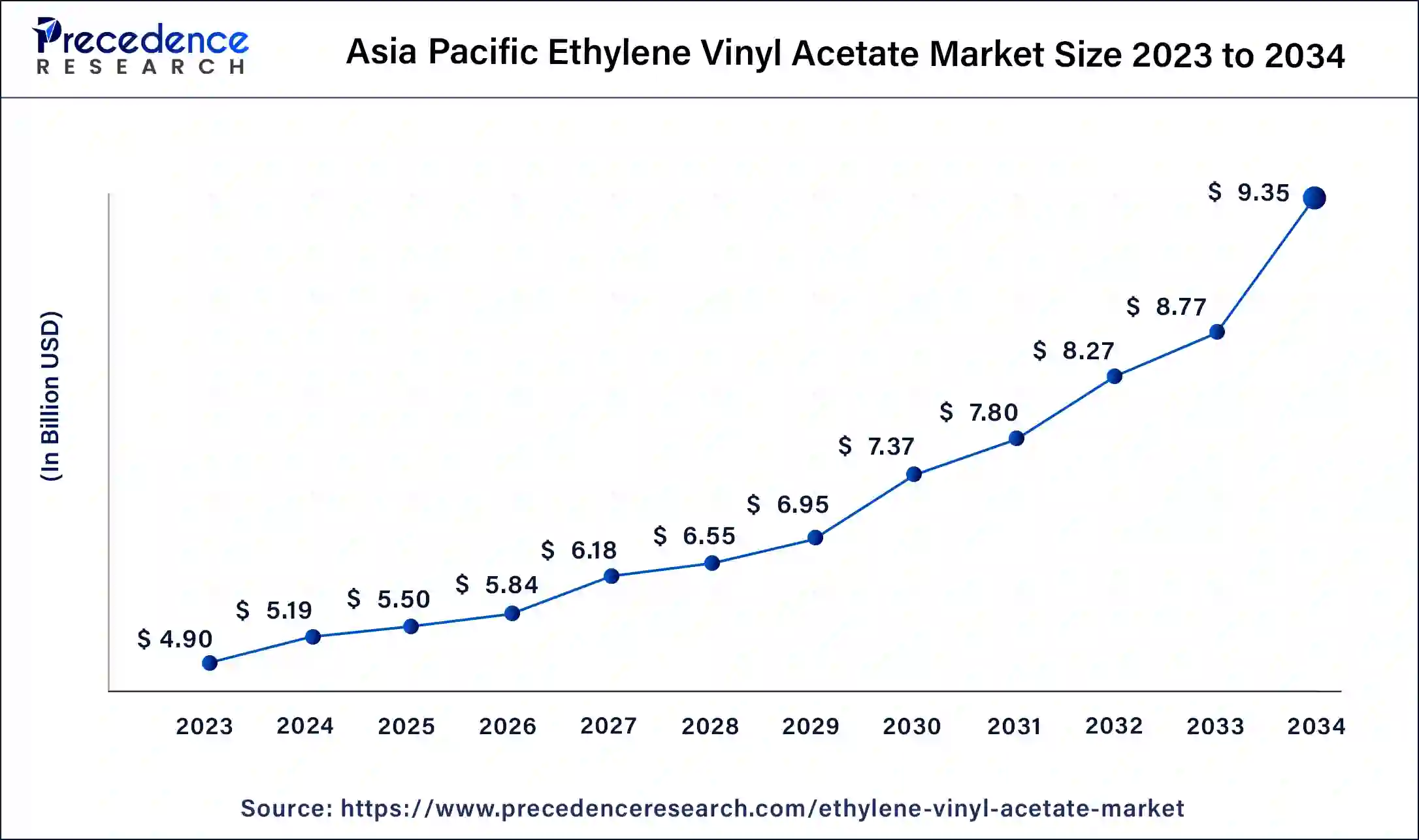

The Asia Pacific ethylene vinyl acetate market size was valued at USD 4.90 billion in 2023 and is expected to reach USD 9.35 billion by 2034, at a CAGR of 6.06% from 2024 to 2034.

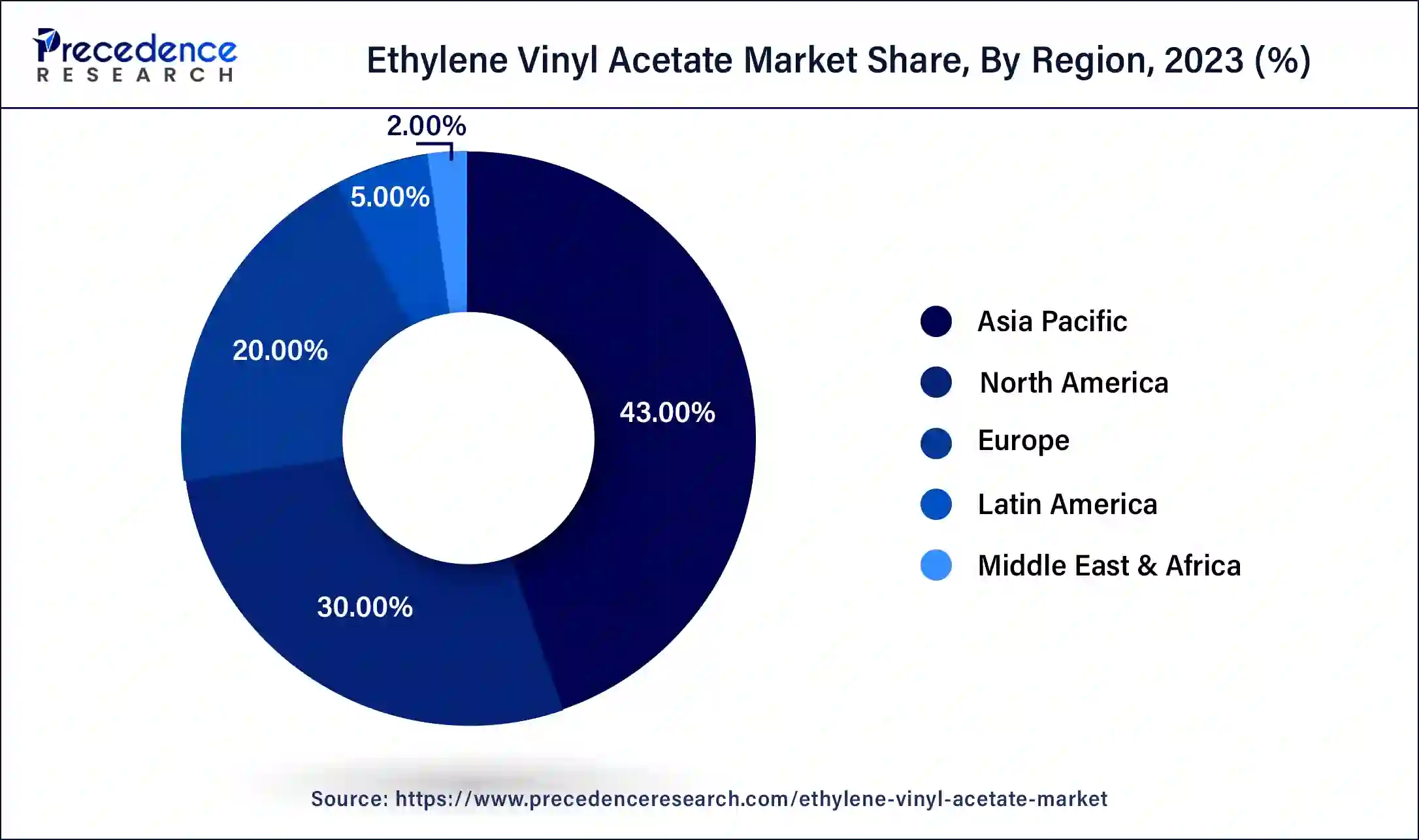

Asia Pacific has held the largest revenue share of 43% in 2023. Asia Pacific holds a major share in the ethylene vinyl acetate market due to robust industrial growth and widespread applications across diverse sectors. The region's burgeoning manufacturing industries, particularly in China and India, drive substantial demand for EVA in footwear, packaging, construction, and automotive applications. Additionally, the increased focus on renewable energy projects in countries like China contributes to the growing utilization of EVA in the solar energy sector. The region's economic dynamism, coupled with its expanding end-use industries, solidifies Asia-Pacific's prominent position in the EVA market.

North America is estimated to observe the fastest expansion. North America holds a major share in the ethylene vinyl acetate market due to several factors. The region benefits from a robust demand for EVA in industries such as footwear, packaging, and automotive manufacturing. Additionally, the presence of key market players, technological advancements, and a well-established infrastructure contribute to the dominance of North America. The region's focus on sustainability and innovation further propels the demand for EVA in applications such as solar energy and medical devices, solidifying its significant market share in the EVA industry.

Ethylene vinyl acetate (EVA) is a flexible and durable copolymer formed by combining ethylene and vinyl acetate. This versatile material finds widespread application across industries due to its elastic nature and varied properties, determined by the proportion of vinyl acetate in its composition. EVA is commonly utilized in the production of foam-based products like shoe soles, athletic padding, and packaging materials.

Its lightweight character, excellent shock absorption, and resistance to UV rays make it an ideal choice for these purposes. Beyond foams, EVA is employed in the creation of films, wires, cables, adhesives, and molded products. Its unique blend of flexibility at low temperatures and resilience at high temperatures contributes to its extensive use in the industrial, consumer, and medical sectors. EVA stands out for its adaptability, cost-effectiveness, and eco-friendly profile as a recyclable material, solidifying its pivotal role in contemporary manufacturing practices.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6% |

| Market Size in 2024 | USD 12.07 Billion |

| Market Size by 2034 | USD 21.62 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Grade, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expanding packaging applications and construction sector growth

The ethylene vinyl acetate market experiences a significant surge in demand due to expanding applications in packaging and the growth of the construction sector. In packaging, EVA's versatility as a material for foams and protective packaging solutions responds to the increasing demand for sustainable and efficient packaging across diverse industries. The lightweight and durable nature of EVA makes it ideal for ensuring product safety during transportation, thus driving its adoption in various packaging applications.

Simultaneously, the construction sector's expansion contributes to the heightened demand for EVA, particularly in sealants, adhesives, and insulation materials. The flexibility and adhesive properties of EVA make it valuable in construction applications, meeting the evolving needs of the industry. As construction activities grow globally, so does the utilization of EVA in enhancing the performance and durability of construction materials, further fueling the market demand for ethylene vinyl acetate.

Volatility in raw material prices

The volatility in raw material prices significantly restrains the growth of the ethylene vinyl acetate market. EVA production relies on ethylene and vinyl acetate monomers, and fluctuations in their prices directly impact manufacturing costs. Rapid and unpredictable changes in raw material prices make it challenging for EVA producers to establish stable pricing structures and can lead to reduced profit margins. This volatility also hampers long-term planning and investment decisions within the industry, affecting overall market growth.

Moreover, the sensitivity of EVA prices to changes in ethylene and vinyl acetate costs can create uncertainties for both manufacturers and end-users, influencing purchasing decisions. As a result, the EVA market is not only exposed to the economic factors affecting raw material prices but also to the inherent challenges associated with managing this volatility, making it essential for industry participants to implement effective risk management strategies to mitigate the impact on market dynamics.

Rising demand in the renewable energy sector

The ethylene vinyl acetate market is experiencing significant opportunities through the increasing demand in the renewable energy sector, specifically in solar technology. EVA plays a pivotal role in encapsulating photovoltaic modules within solar panels. As the global focus on sustainable energy solutions intensifies, there is a growing requirement for advanced materials that can enhance the longevity and effectiveness of solar panels. EVA's distinctive attributes, including flexibility, lightweight properties, and resilience to environmental elements, position it as an optimal material for the encapsulation of photovoltaic modules.

With the ongoing expansion of renewable energy initiatives and continual advancements in solar technologies, the demand for EVA in the production and enhancement of solar panels is poised to escalate. This presents a noteworthy opportunity for the EVA market to contribute to the progression and efficacy of renewable energy solutions, aligning with worldwide efforts for a cleaner and more sustainable future.

The medium-density segment had the highest market share of 41% in 2023. In the ethylene vinyl acetate market, the medium density segment refers to EVA products with a moderate vinyl acetate content. These grades offer a balanced combination of flexibility, durability, and cost-effectiveness, making them suitable for various applications. Trends in the medium-density EVA segment include increased utilization in footwear production, particularly for midsole components, as well as growth in the packaging industry where these grades find applications in foam sheets and protective packaging materials. The medium-density segment is characterized by its adaptability and widespread use across diverse industries.

The high-density segment is anticipated to expand at a significant CAGR of 7.2% during the projected period. In the ethylene vinyl acetate market, the high-density segment refers to EVA products with a higher proportion of vinyl acetate content. These grades exhibit enhanced properties such as increased toughness, better elasticity, and improved chemical resistance compared to lower-density counterparts.

Trends in the high-density segment include growing demand for these specialized EVA grades in industries like automotive, where their superior properties find application in components requiring durability and resilience. Additionally, advancements in high-density EVA formulations cater to evolving needs in the packaging, construction, and industrial sectors.

According to the application, the adhesives has held 35% revenue share in 2023. Within the ethylene vinyl acetate market, the adhesives segment pertains to the incorporation of EVA in adhesive formulations. EVA's outstanding adhesive characteristics, combined with its flexibility, position it as a favored option in construction, packaging, and automotive applications. A notable trend in this segment involves the ongoing innovation of EVA-based adhesives to meet changing performance expectations, particularly in response to the need for more robust, sustainable, and environmentally conscious bonding solutions across diverse industries.

The film segment is anticipated to expand fastest over the projected period. In the ethylene vinyl acetate market, the films segment refers to the production and utilization of EVA films. These films find applications across various industries, including agriculture, solar panels, and laminated glass. In recent trends, there is a growing preference for EVA films in the packaging industry due to their favorable optical, thermal, and mechanical properties. Additionally, EVA films are witnessing increased demand in the solar energy sector for encapsulating photovoltaic cells, reflecting a trend toward sustainable and efficient energy solutions.

Segments Covered in the Report

By Grade

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

November 2024

March 2025