January 2025

Europe End-of-Line Packaging Market (By Technology: Automatic, Semi-automatic; By Order Type: Customized, Standard; By Function: Stand Alone, Integrated; By End-user: Pharma Industry, Food Industry, Bio Factory, E-Commerce, Electronics and Semiconductors, Others) - Regional Outlook and Forecast 2025 to 2034

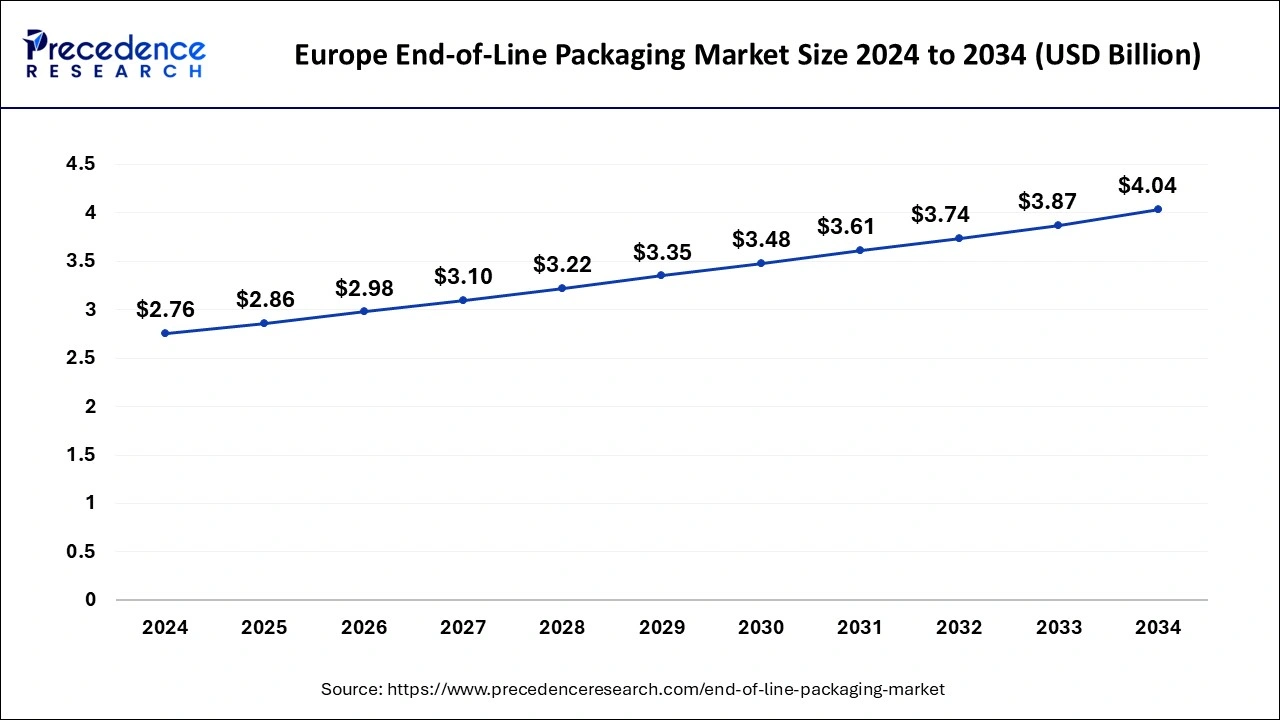

The Europe end-of-line packaging market size was valued at USD 2,378.42 million in 2023 and is anticipated to reach around USD 3,795.06 million by 2033, growing at a CAGR of 4.73% from 2024 to 2033. The Europe end-of-line packaging market is driven by the growing need for automation.

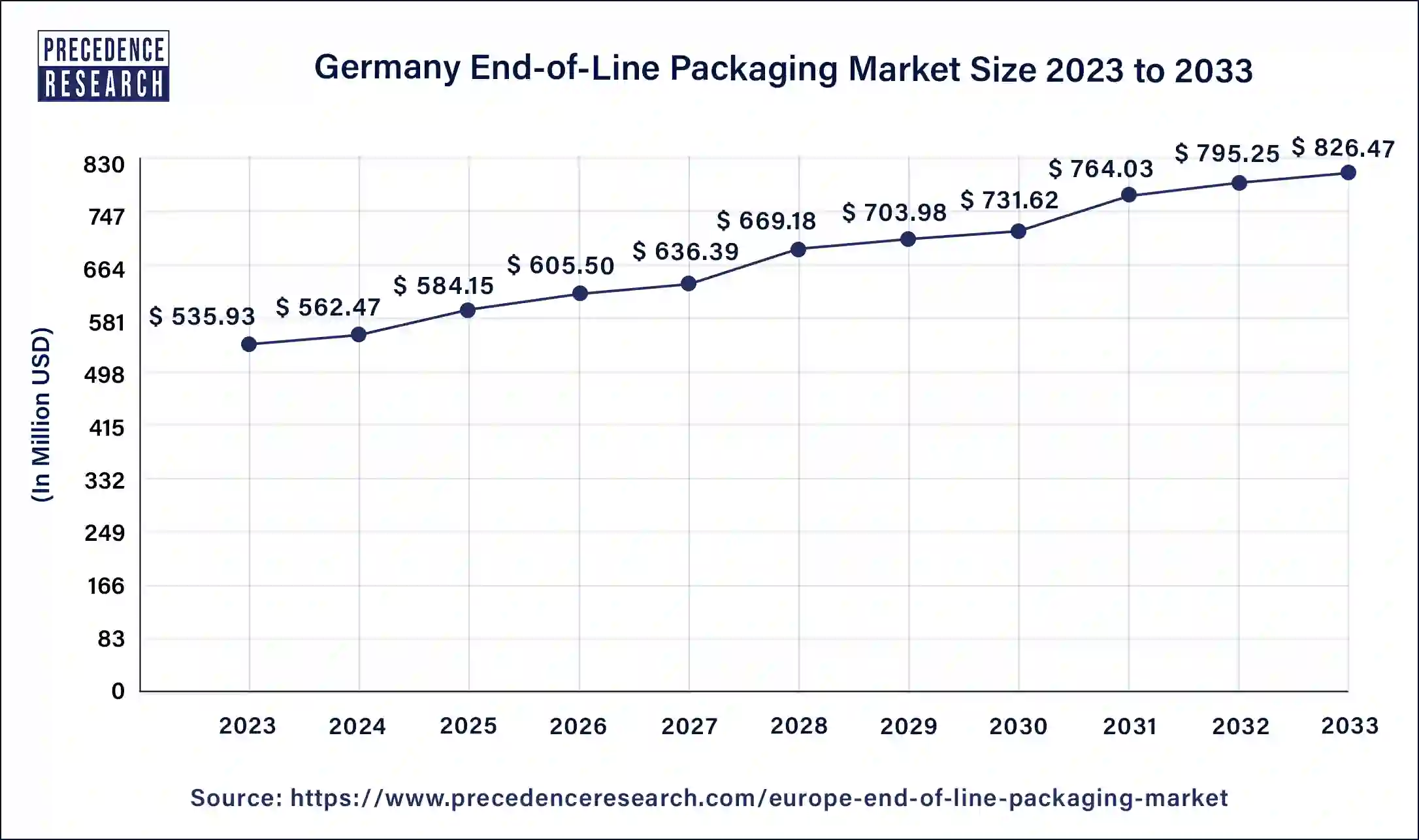

The Germany end-of-line packaging market size was estimated at USD 535.93 million in 2023 and is predicted to be worth around USD 826.47 million by 2033 with a CAGR of 4.37% from 2024 to 2033.

The increasing food and beverage industry is increasing demand for end-of-line packaging solutions in countries such as Spain and Italy. Packaging designs are influenced by traditional craftsmanship and handcrafted goods, with a growing emphasis on branding and aesthetics. Economic obstacles may impede rapid technical growth, yet the gradual use of automation increases productivity. Economical solutions are given precedence, which results in a predilection for semi-automatic packing supplies and machinery. A growing integration with supply chains in Western Europe influences packaging standards and quality criteria.

Europe End-of-Line Packaging Market Overview

The area of the packaging business that deals with the last packing phase, when goods are ready for distribution and sale, is known as the European end-of-line packaging market. Case sealing, palletizing, labeling, and other procedures required to prepare goods for shipping are all part of end-of-line packing. It is noteworthy because it is essential to maintaining the product's effectiveness, security, and appeal in transit and on retail shelves.

Effective end-of-line packaging procedures can assist businesses in cutting expenses, minimizing product damage, improving brand perception through eye-catching presentation, and adhering to legal requirements.

| Report Coverage | Details |

| Europe End-of-Line Packaging Market Size in 2023 | USD 2,378.42 Million |

| Europe End-of-Line Packaging Market Size in 2024 | USD 2,503.29 Million |

| Europe End-of-Line Packaging Market Size by 2033 | USD 3,795.06 Million |

| Europe End-of-Line Packaging Market Growth Rate | CAGR of 4.73% from 2024 to 2033 |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, Order Type, Function, and End-user |

Driver: Rising demand for sustainable packaging solutions across various industries

Many businesses are adopting CSR efforts that prioritize protecting the environment and incorporating sustainability into their corporate ethos. End-of-line packaging solutions that support these ideals are becoming increasingly popular, helping businesses improve their reputation and win over ecologically sensitive customers. Many organizations understand the long-term cost advantages associated with reduced material usage, waste disposal costs, and possible incentives for adopting environmentally friendly practices, even though an initial investment may be necessary to switch to sustainable packaging solutions. Consequently, the market for end-of-line packaging in Europe is seeing growth in the affordability of sustainable packaging options. This is propelling the growth of the Europe end-of-line packaging market.

Restraint

Susceptible to supply chain disruptions

The packaging industry's end-of-line operations are dependent on complex supply chains that encompass raw materials, equipment, and distribution channels. These supply chains are so interconnected that any interruption at any point might have repercussions for the whole operation. Product quality assurance and the operation of complex packing machinery require skilled expertise. Nonetheless, the sector has trouble drawing in and keeping qualified personnel. Production can be hampered by any disruption brought on by work stoppages, shortages, or skill deficiencies.

Opportunity: Increasing demand for packaged goods across various industries

Europe's retail scene has changed due to the growth of e-commerce. The increasing number of online consumers has increased the demand for effective packaging solutions that guarantee product security throughout transportation while optimizing the unboxing experience. Packaging at the end of the line is essential to getting goods ready for shipping, which increases the need for packaging supplies and equipment. Automation, robots, and artificial intelligence are just a few of the fast-moving technical innovations that have completely changed the end-of-line packaging business.

These technologies allow packaging processes to operate more efficiently, with higher precision and faster production rates. Businesses investing in state-of-the-art technologies might get a competitive advantage by providing creative packaging solutions that satisfy their clients' changing needs. Thereby, expanding the Europe end-of-line packaging market.

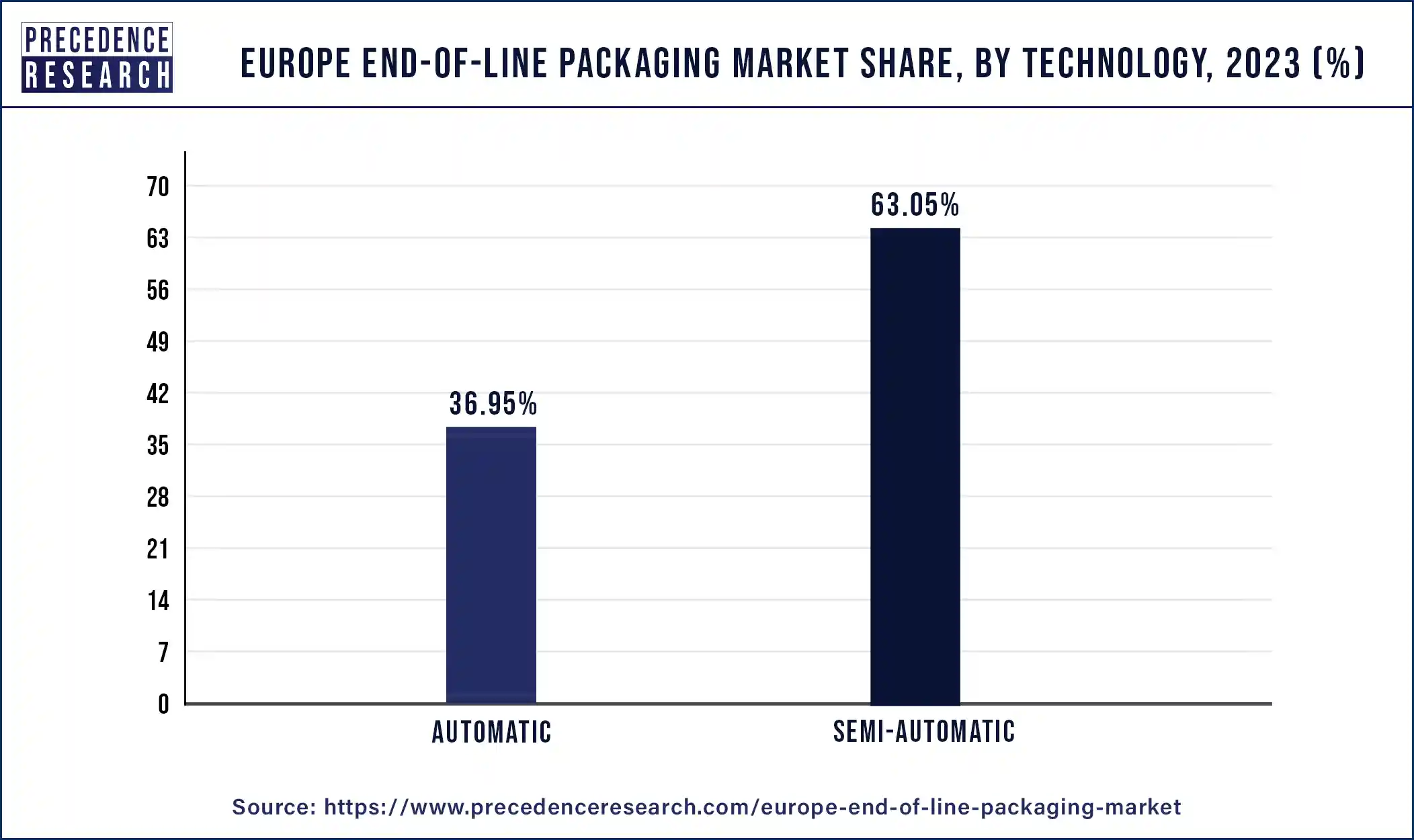

The semi-automatic segment dominated in 2023 with a 63.05% market share in the Europe end-of-line packaging market. Semi-automatic devices are generally easier to operate and maintain than fully automatic systems, which may require specialized training. They frequently have simple controls and intuitive interfaces, making it easy for users to pick up the basics and quickly operate the machinery. Because of its ease of operation, this packing method is streamlined and requires less highly skilled staff.

Semi-automatic packaging equipment is renowned for its dependability and toughness, with sturdy construction and premium parts guaranteeing dependable operation over time. Because of its dependability, organizations may successfully satisfy client demand and maintain unbroken production schedules while minimizing downtime and maintenance expenses.

Europe End-of-Line Packaging Market Revenue ($ Million), by Order Type

| Order Type | 2020 | 2021 | 2022 | 2023 |

| Customized | 692.15 | 773.85 | 835.64 | 892.19 |

| Standard | 1,239.44 | 1,353.03 | 1,426.29 | 1,486.23 |

The standard segment dominated in 2023 with a 62.49% market share in the Europe end-of- line packaging market. Many European suppliers offer standard end-of-line packaging materials and equipment. Because of its accessibility, businesses are guaranteed many options, promoting healthy competition and spurring market innovation. Furthermore, because standard solutions are widely accessible, companies can quickly obtain the tools and supplies they need, cutting down on lead times and guaranteeing the continuous operation of their packaging processes.

The customized segment is significantly growing in the Europe end-of-line packaging market during the forecast period. The requirement for tailored packaging solutions to serve market groups is rising as consumer tastes become more complex and varied. With customized packaging, businesses can showcase their goods in a way that best suits their target market's specific needs and tastes. Advancements in technology, such as digital printing and packaging automation, have made producing bespoke packaging in lower numbers easier and more affordable for businesses. This helps companies offer customized packaging solutions without paying high overhead expenses and react swiftly to shifting consumer preferences and market trends.

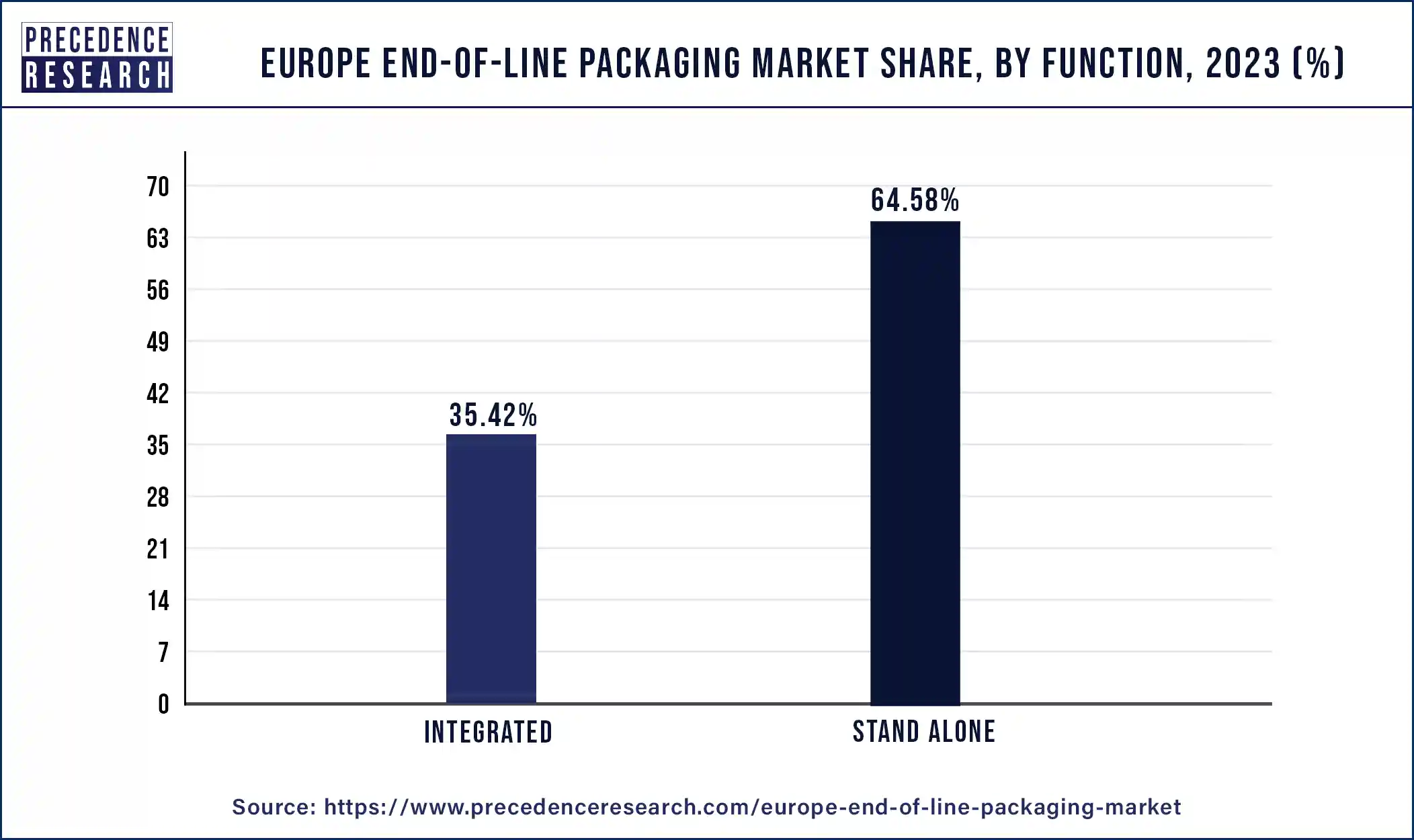

The stand-alone segment dominated in 2023 with a 64.58% market share in the Europe end-of-line packaging market. More customization and adaptation to various packaging needs is possible with stand-alone end-of-line packaging machinery. This flexibility is highly valued in the European market, where customer tastes are varied and ever evolving. With their sophisticated control systems and precise engineering, stand-alone packaging machines guarantee reliable performance and premium packing. This is especially crucial for the pharmaceutical and food manufacturing sectors that have high quality criteria.

The integrated segment is significantly growing in the Europe end-of-line packaging market during the forecast period. Sustainability is now a crucial factor for businesses everywhere, even in Europe. Eco-friendly materials and procedures are frequently incorporated into integrated end-of-line packaging solutions, supporting sustainable supply chain practices. These integrated solutions, which minimize packaging waste and maximize resource use, align with the sustainability objectives of European companies, which encourage market acceptance and growth.

Europe End-of-Line Packaging Market ($ Million), by End User 2020 to 2023

| End User | 2020 | 2021 | 2022 | 2023 |

| Pharma Industry | 358.18 | 399.03 | 429.35 | 456.77 |

| Food Industry | 751.41 | 825.55 | 876.03 | 919.10 |

| Bio Factory | 140.67 | 156.51 | 168.18 | 178.68 |

| E-Commerce | 219.59 | 244.38 | 262.69 | 279.18 |

| Electronics & Semiconductors | 181.31 | 194.44 | 201.40 | 206.25 |

| Others | 280.43 | 306.97 | 324.29 | 338.44 |

The food industry segment dominated in 2023 with a 38.64% market share in the Europe end-of-line packaging market. There's a growing emphasis on sustainable packaging options within the food business due to worries about plastic contamination and environmental awareness. European customers favor environmentally friendly packaging solutions that reduce waste and carbon emissions. In response to this change, end-of-line packaging technologies have developed, providing recyclable materials, biodegradable films, and lightweight packaging designs. Since the food industry's embrace of sustainable packaging practices aligns with broader societal and governmental trends toward environmental responsibility, it further secures its dominance in the end-of-line packaging sector.

The pharma industry segment is the second largest in 2023 with 19.20% market share in the Europe end-of-line packaging market during the forecast period. Prescription pharmaceuticals, over-the-counter medications, biologics, vaccines, and medical devices are just a few of the goods that fall under the umbrella of the pharmaceutical sector. Specific packaging needs for each category of pharmaceutical products may arise from factors such as dose form, shelf-life, stability, and regulatory considerations. Due to the variety of products offered, different end-of-line packaging options customized to fulfill requirements are required. Pharmaceutical companies frequently look for scalable packaging options for various product types and container arrangements. The pharmaceutical sector of the European end-of-line packaging industry is expanding due to the need for flexible and adaptive packaging machinery.

Segments Covered in the Report

By Technology

By Order Type

By Function

By End-user

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

January 2025