July 2024

Europe Logistics Automation Market (By Type: Sales Logistics, Production Logistics, Recovery Logistics; By Component: Hardware, Software, Services; By Organization Size: Small and Medium Enterprises, Large Enterprises; By Mode of Freight Transport: Air, Road, Sea; By Application: Transportation Management, Warehouse and Storage Management; By End-user) - Regional Outlook and Forecast 2025 to 2034

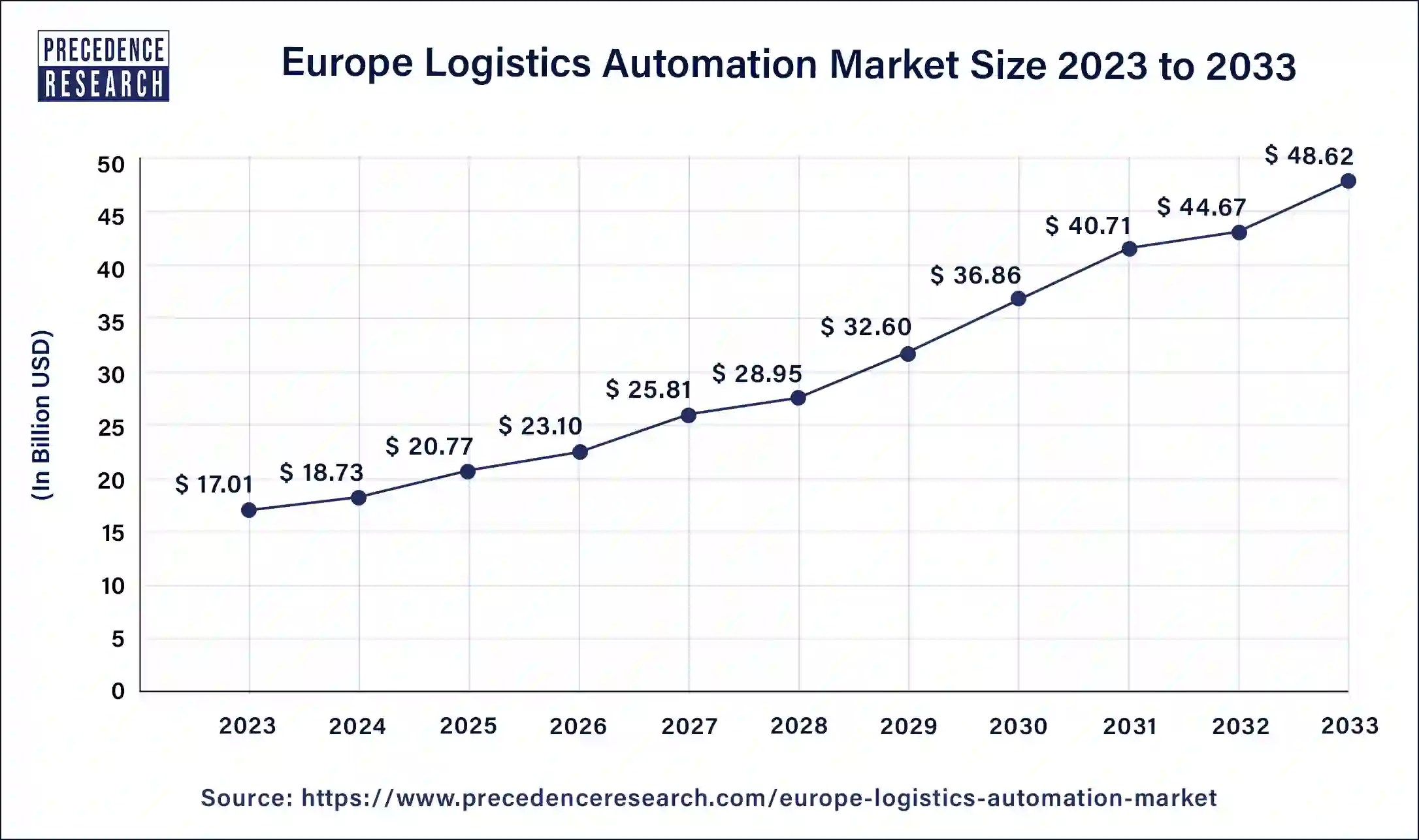

The Europe logistics automation market size was valued at USD 17.01 billion in 2023 and is anticipated to reach around USD 48.62 billion by 2033, growing at a CAGR of 11.18% from 2024 to 2033. The Europe logistics automation market is driven by the fast growth in both the retail and e-commerce industries.

Europe Logistics Automation Market Overview

The part of the logistics industry that focuses on using automated methods and technologies to streamline and optimize various operations involved in the transfer of goods is the logistics automation revenue. These procedures cover order fulfillment, inventory control, shipping, and warehousing. Automation makes processes faster and more accurate by reducing the need for manual labor. As a result, logistics operations operate more efficiently and with higher throughput.

Better order processing, on-time delivery, accurate tracking, and real-time shipment visibility improve the overall customer experience. Certain automation technologies, such as energy-efficient warehousing systems and route optimization algorithms, can lessen their total environmental impact and carbon emissions.

One of the biggest revenueplaces in Europe is Germany. In addition, this nation has one of the world's most alluring logistics revenues. However, not only the location in central Europe is the primary cause. Germany is known for its highly advanced infrastructure, cutting-edge technology, and superior quality and size of warehouses compared to most other European nations. Because of this, logistics play a crucial role in the German economy.

| Report Coverage | Details |

| Europe Logistics Automation Market Size in 2023 | USD 17.01 Billion |

| Europe Logistics Automation Market Size in 2024 | USD 18.73 Billion |

| Europe Logistics Automation Market Size by 2033 | USD 48.62 Billion |

| Europe Logistics Automation Market Growth Rate | CAGR of 11.18% from 2024 to 2033 |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Component, Organization Size, Mode of Freight Transport, Application, and End-user |

Driver

Shortage of labor force

Europe has a comparatively high labor cost compared to other locations. This makes hiring and retaining employees financially difficult for logistics companies. Because automation reduces the need for human labor and lowers operating costs over time, it presents a financially viable option. Significant cost reductions can result from investments in automation technology like automated guided vehicles (AGVs), drones, and warehouse management systems. Human error can result in expensive blunders in the logistics process, including delayed deliveries, misplaced goods, and inaccurate shipments.

Automation reduces these errors by employing precise algorithms and machines that carry out extremely accurate and reliable activities. Technologies like barcode scanners, RFID systems, and machine learning algorithms make accurate inventory tracking and management possible, improving dependability and customer satisfaction. Thereby, driving the Europe logistics automation revenue.

Restraint

High initial costs

Implementing automation technologies in logistics operations costs a lot of money up front. This covers the price of investing in automation machinery such as robotic arms, conveyor systems, sorting systems, automated guided vehicles (AGVs), and warehouse management software. The first capital investment can be intimidating for logistics organizations, which are comparatively smaller or medium-sized businesses with constrained financial resources. Automation can simplify processes and eliminate the need for human labor in some situations, but maintaining and operating automated systems frequently calls for specialized workers.

Businesses might need to hire expert technicians and engineers with experience in automation technology or invest in training programs to upskill their employees. Furthermore, a workforce reorganization brought on by the shift to automation may necessitate severance payments or reassignment expenses for fired workers.

Opportunities

Growth of e-commerce

The increasing demand for same-day and next-day delivery is making it difficult for conventional logistics systems to keep up. Automated solutions give merchants the speed and accuracy they need to satisfy these demands, allowing them to process orders more quickly and effectively. In today's very competitive industry, the customer experience is crucial. Faster order processing, precise tracking, and on-time delivery are made possible by automated logistics solutions, increasing customer happiness and encouraging loyalty.

Improving customer experience

Customers nowadays expect deliveries of items that are quicker and more effective. Logistics organizations may improve efficiency, shorten processing times, and provide faster delivery by using automation technologies like robotic process automation (RPA), automated guided vehicles (AGVs), and autonomous drones. When packages arrive at their destinations on time and meet or exceed expectations, this increases customer satisfaction. Scalability and flexibility are provided via automation systems to satisfy changing client needs.

Automated systems can swiftly modify processes and capacity levels in response to revenue trends or peak season demand fluctuations. Because of their agility, logistics companies can maintain excellent customer experiences by upholding high service standards even in the face of growing demand. This eventually expands the Europe logistics automation revenue.

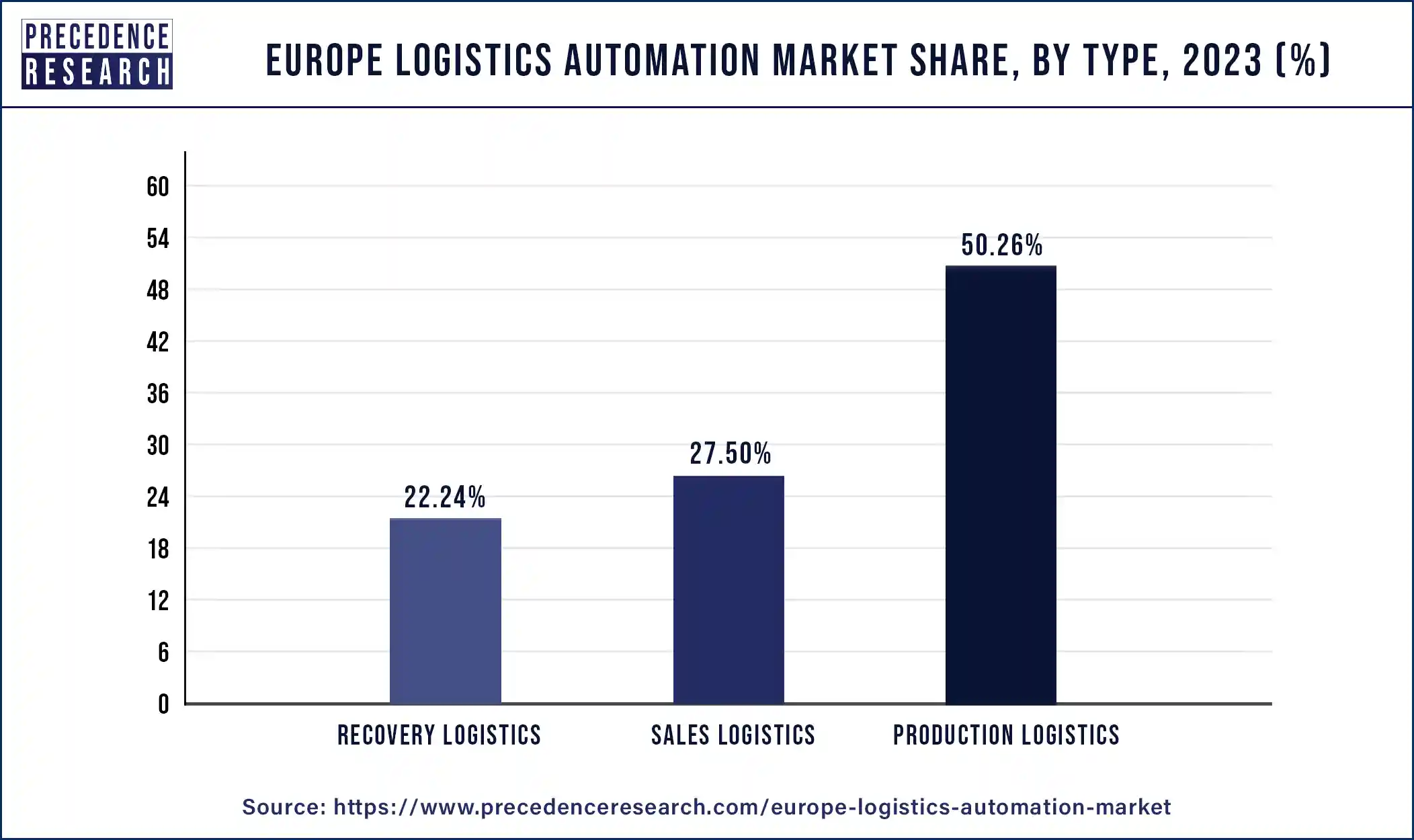

The production logistics segment dominated in 2023 with a 50.26% revenue share in the Europe logistics automation revenue. Production logistics have been revolutionized by cutting-edge technology like robotics, AI, and the Internet of Things (IoT). To maximize material handling and inventory management, automated guided vehicles (AGVs), robotic arms, and intelligent conveyor systems have become essential components of contemporary production lines. Demand forecasting and predictive maintenance are two critical functions of artificial intelligence and machine learning in industrial logistics.

European regulations place a strong emphasis on environmental sustainability and operational efficiency. Companies can adhere to these rules by using automated logistics systems, guaranteeing accurate control over production processes and minimizing waste.

The sales logistics segment was the second largest in 2023 with a 27.50% share in the Europe logistics automation revenue during the forecast period. The demand for effective sales logistics solutions has expanded dramatically due to the rapid expansion of e-commerce throughout Europe. Businesses need sophisticated logistics systems to handle many orders and guarantee precise and on-time delivery as more and more customers purchase online. Because of this change, sales logistics must be automated to manage inventories, process complex orders, and provide last-mile delivery.

Effective warehouse operations play a critical role in sales logistics. Order fulfillment procedures run more quickly and accurately when automated guided vehicles (AGVs), conveyor systems, and automated storage and retrieval systems (AS/RS) are integrated into warehouses.

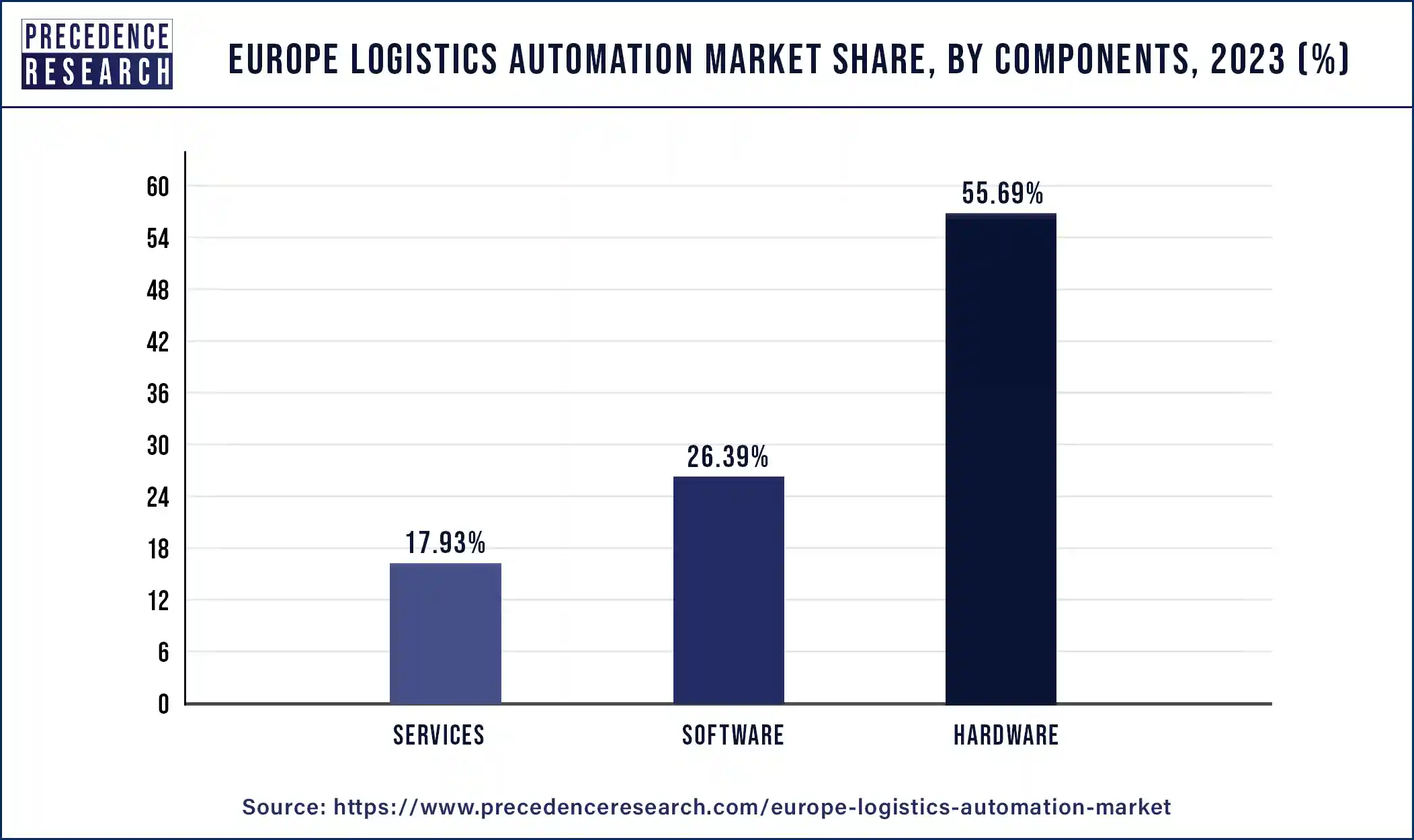

The hardware segment dominated in 2023 with a 55.69% revenue share in the Europe logistics automation revenue. Technological advancements have dramatically propelled the revenue for logistics automation in Europe. Automated guided vehicles (AGVs), robotic arms, conveyor systems, and automated storage and retrieval systems (AS/RS) are examples of hardware components that are becoming essential for improving labor costs and operating efficiency. These technologies' ongoing advancement and widespread use have been crucial to preserving the hardware segment's leadership position.

The software segment is observed to be the fastest growing in the Europe logistics automation revenue during the forecast period. In today's fast-paced corporate world, having access to real-time data and insights is essential for making wise decisions. Businesses may monitor their operations in real-time with the help of logistics software, which offers extensive analytics features. This includes monitoring inventory levels, tracking shipment statuses, and calculating transportation expenses. Logistics companies may better serve their customers, react swiftly to shifting revenue conditions, and increase efficiency and profitability by using real-time data analytics to make proactive decisions. The adoption of logistics software is significantly influenced by the capacity to derive meaningful insights from data.

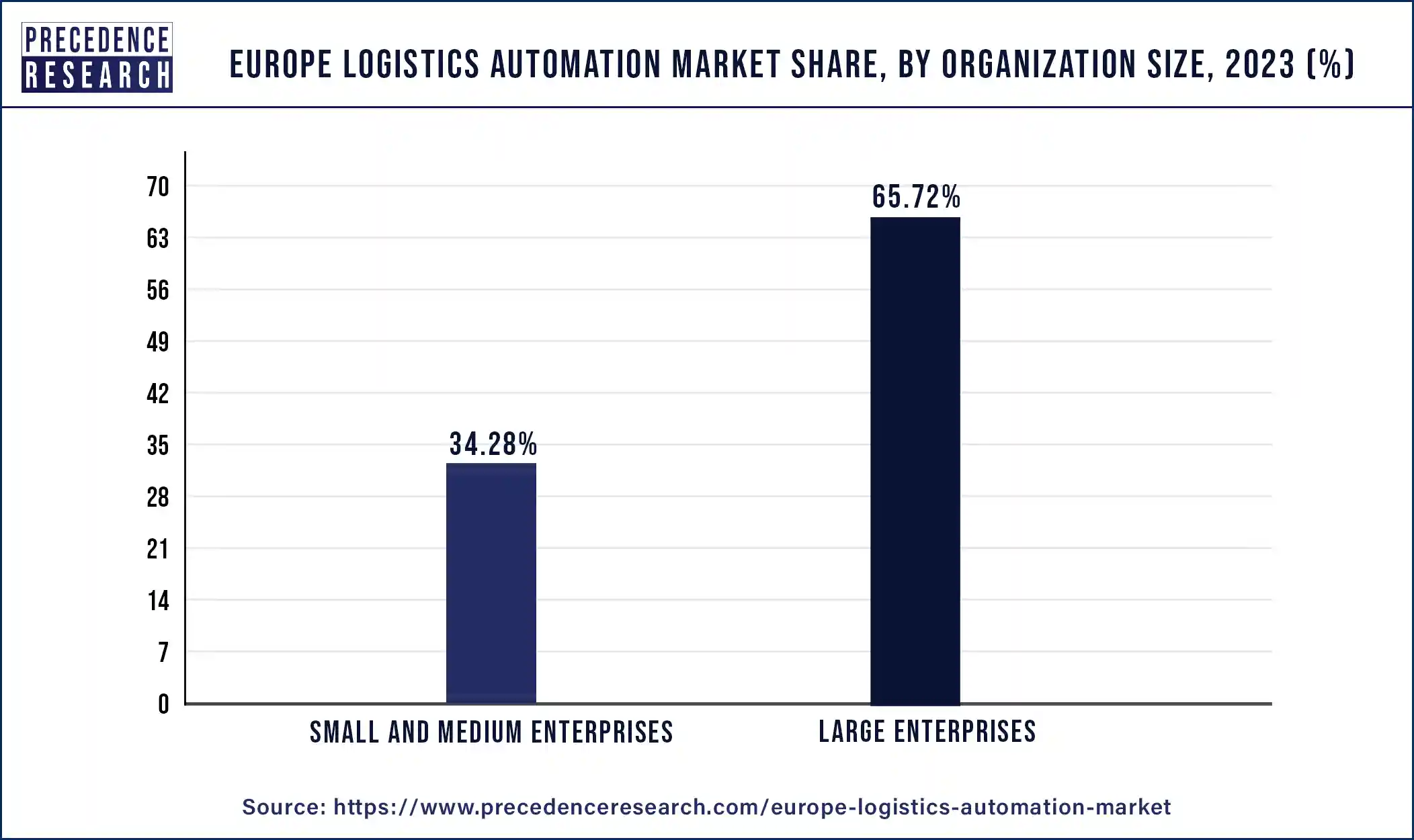

The large enterprises segment dominated in 2023 with a 65.72% revenue share in the Europe logistics automation revenue. Due to their often-abundant financial resources, large businesses can make significant investments in highly advanced logistics automation technologies. These investments cover hiring personnel training, purchasing cutting-edge technologies, integrating these systems into their operations, and continuing upkeep. Larger businesses are better equipped to handle high upfront costs and the ongoing need for updates and assistance. Since many big companies have global operations, it is necessary to integrate logistics across several geographic locations.

Logistics automation ensures smooth operations and coordination across several geographic areas by facilitating the seamless integration of diverse supply chain components, from suppliers to distribution hubs to end customers.

Europe Logistics Automation Market Revenue (US$ Bn), By Mode of Freight Transport 2020 to 2023

| By Mode of Freight Transport | 2020 | 2021 | 2022 | 2023 |

| Air | 1.2 | 1.38 | 1.5 | 1.64 |

| Road | 6.78 | 7.8 | 8.53 | 9.36 |

| Sea | 4.44 | 5.08 | 5.51 | 6.01 |

The road segment dominated in 2023 with a 55.04% revenue share in the Europe logistics automation revenue. Road transportation is frequently more affordable than air or train for short- to medium-distance travel. Road logistics is now a financially appealing choice due to lower operating expenses brought about by declining fuel prices and improvements in fuel economy. Rapid and dependable delivery services are in high demand due to the growth of e-commerce. The road transport's adaptability and capacity for last-mile delivery make it ideally suited to satisfy this need.

The sea segment is observed to be the fastest growing in the Europe logistics automation revenue during the forecast period. Sea logistics are changing because of advancements in maritime technologies. Automation-related technologies are increasing, including self-navigating ships, automated cargo terminals, and sophisticated tracking systems. The marine segment is now more appealing for investment and expansion because of these technologies, which also increase productivity, decrease human error, and save operating expenses. Sea logistics automation can save a lot of money. Automated systems minimize downtime, cut personnel expenses, and streamline processes. Companies that want to stay competitive in the global revenue must achieve these cost savings, which will increase investment in automation technologies.

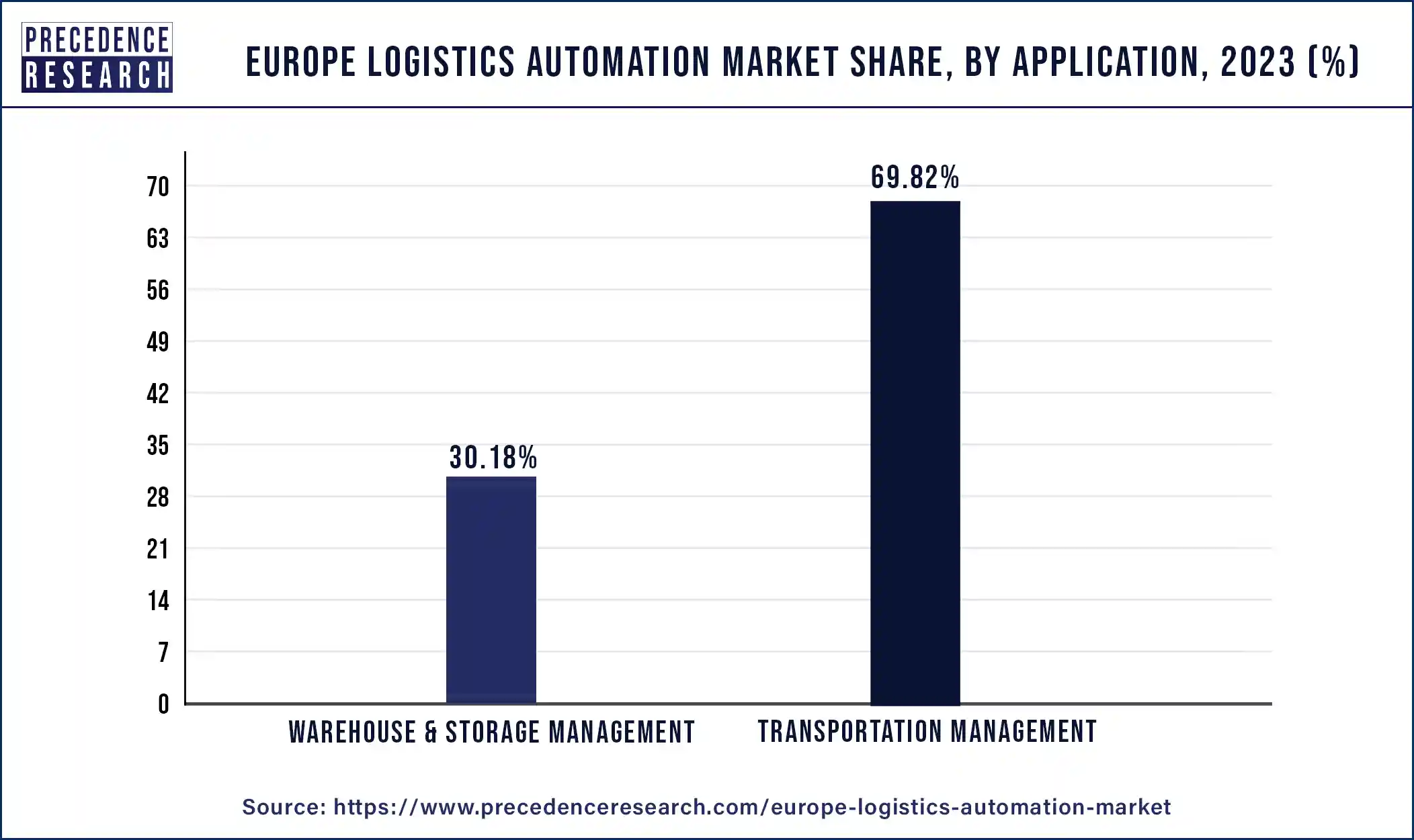

The transportation management segment dominated in 2023 with a 69.82% revenue share in the Europe logistics automation revenue. By streamlining loads, decreasing empty miles, and optimizing routes, transportation management systems dramatically lower transportation costs.

The adoption of TMS in the European revenue is largely motivated by its cost-effectiveness, as transportation costs account for a substantial amount of overall logistics costs. Real-time data and historical patterns are utilized to identify the most efficient routes, thereby reducing fuel consumption and transit times.

Europe Logistics Automation Market Revenue (US$ Bn), By End User 2020 to 2023

| By End User | 2020 | 2021 | 2022 | 2023 |

| Manufacturing | 1.71 | 1.96 | 2.12 | 2.32 |

| Healthcare and Pharmaceuticals | 1.07 | 1.22 | 1.33 | 1.45 |

| Fast Moving Consumer Goods | 0.91 | 1.05 | 1.14 | 1.26 |

| Retail and E-Commerce | 2.12 | 2.44 | 2.68 | 2.95 |

| Automotive | 3.69 | 4.27 | 4.7 | 5.2 |

| Others | 2.93 | 3.32 | 3.56 | 3.84 |

The automotive segment dominated with a 30.56% revenue share in 2023 in the Europe logistics automation revenue. Automotive suppliers and manufacturers require highly specialized logistics solutions for various parts and components. Systems for logistics automation are flexible enough to accommodate a wide range of sizes, weights, and handling requirements. Autonomous mobile robots (AMRs) and guided vehicles (AGVs) are two examples of technology that provide the flexibility required in automobile logistics.

Safety is of utmost importance in the automotive sector for production and shipping. The risk of mishaps and injuries related to manually handling large and intricate automobile parts is decreased by automation. Furthermore, automated systems have a high degree of dependability and the capacity to work nonstop without getting tired, which results in steady performance and less downtime.

The retail and e-commerce segment significantly growing in the Europe logistics automation revenue during the forecast period. Retailers can implement automation to meet customer demands for speedier delivery, such as same-day or next-day delivery. Automated systems provide real-time order status updates, improving openness and client satisfaction. With the help of advanced logistics technologies, retailers can enhance the overall customer experience by providing personalized services, such as tailored delivery timings and locations.

Segments Covered in the Report

By Type

By Component

By Organization Size

By Mode of Freight Transport

By Application

By End-user

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

July 2024

October 2024

October 2024