January 2025

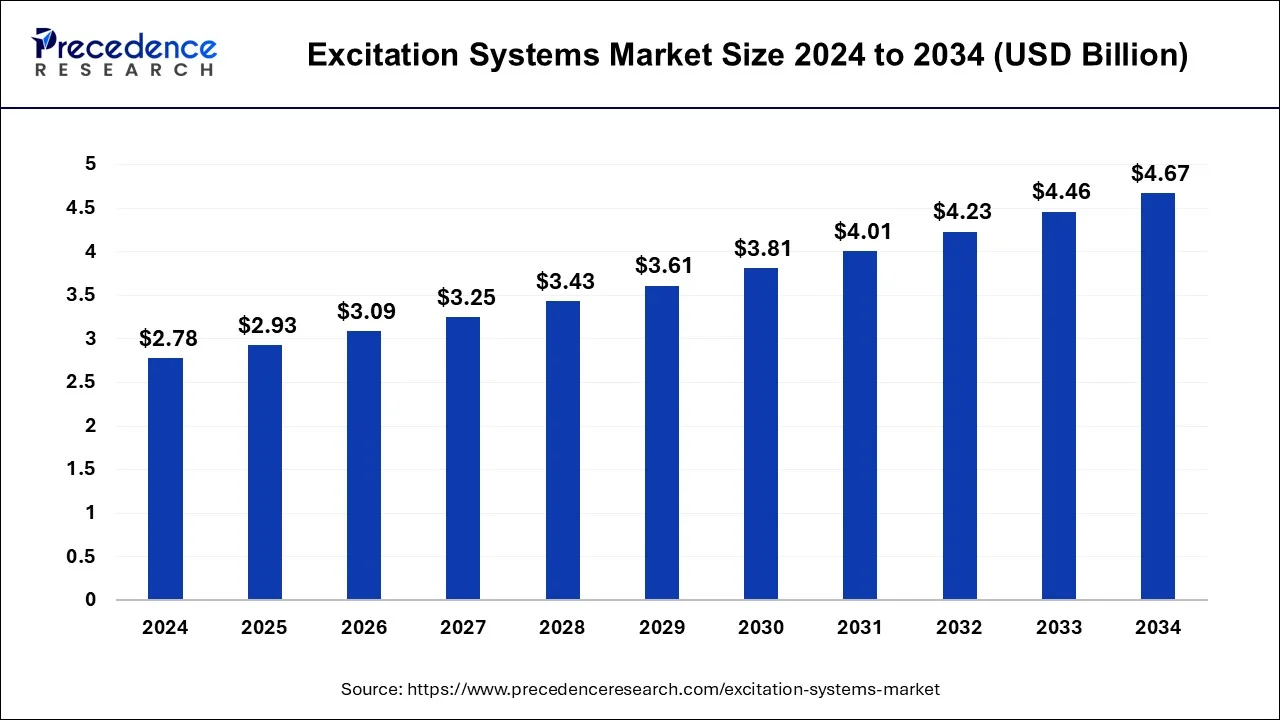

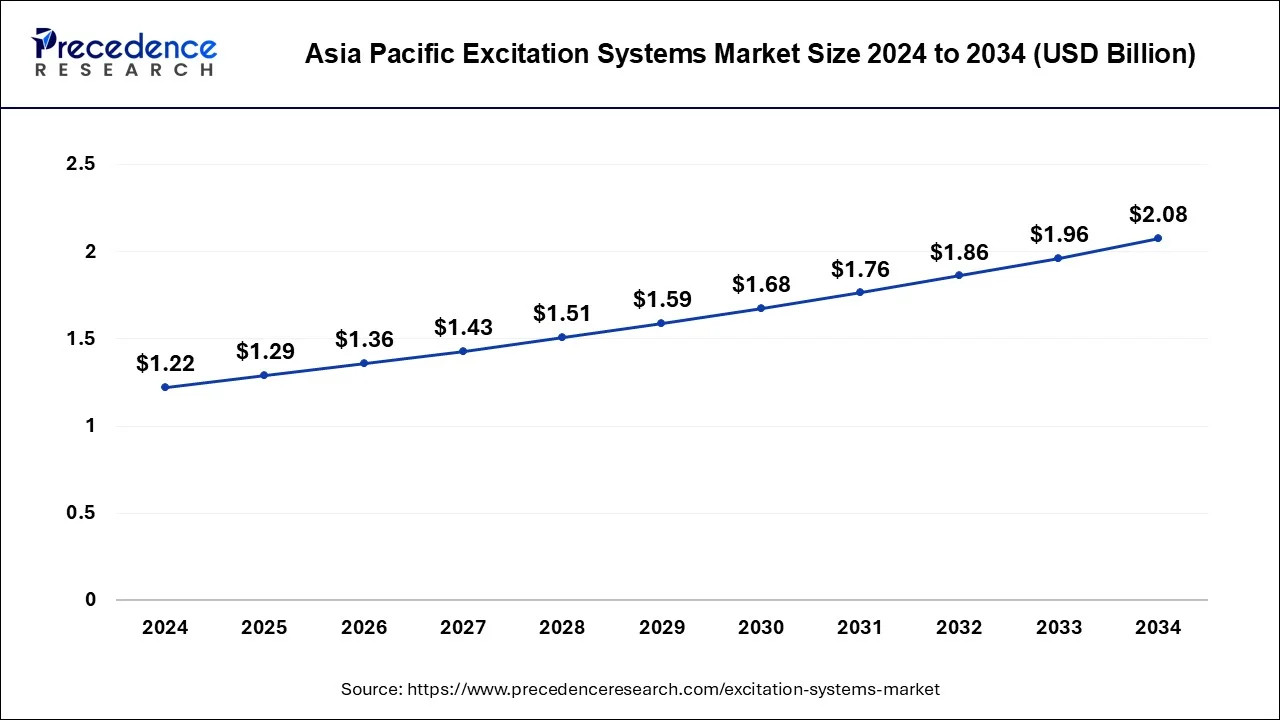

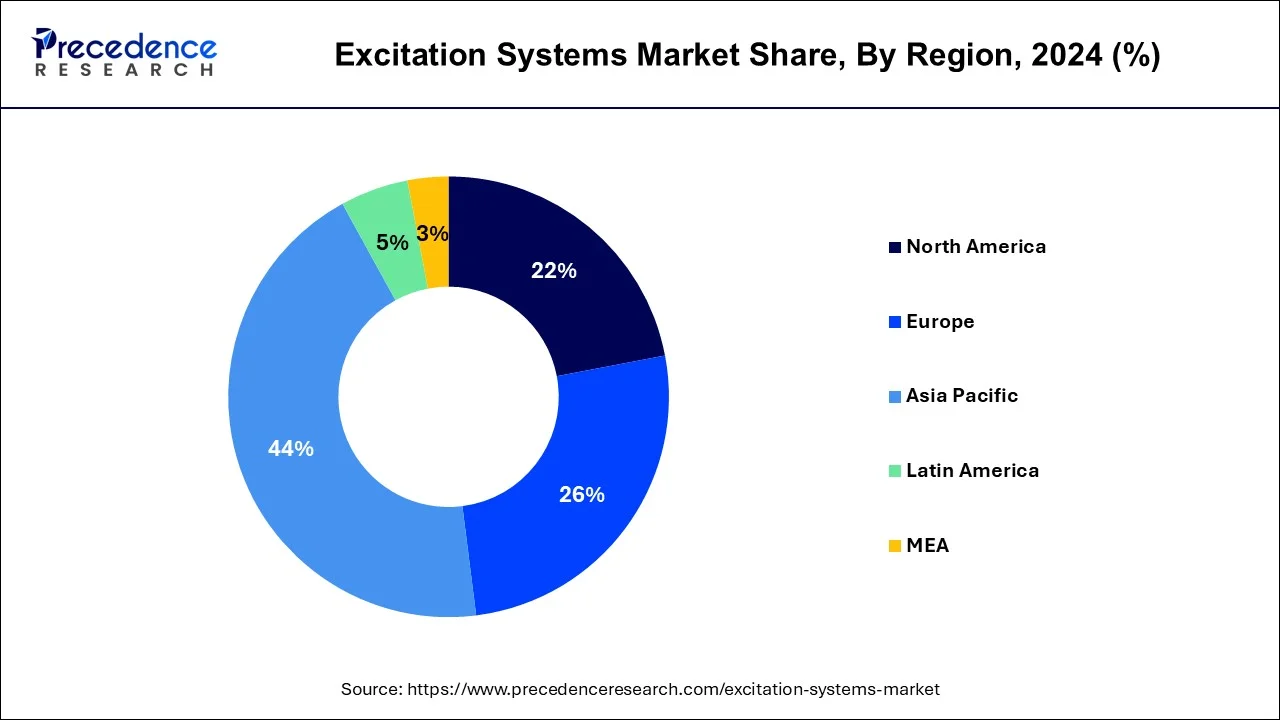

The global excitation systems market size is accounted at USD 2.93 billion in 2025 and is forecasted to hit around USD 4.67 billion by 2034, representing a CAGR of 5.32% from 2025 to 2034. The Asia Pacific market size was estimated at USD 1.22 billion in 2024 and is expanding at a CAGR of 5.48% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global excitation systems market size accounted for USD 2.78 billion in 2024 and is expected to exceed around USD 4.67 billion by 2034, growing at a CAGR of 5.32% from 2025 to 2034.

The Asia Pacific excitation systems market size was exhibited at USD 1.22 billion in 2024 and is projected to be worth around USD 2.08 billion by 2034, growing at a CAGR of 5.48% from 2025 to 2034.

The Asia Pacific region has a critical requirement for excitation systems on the grounds that to the fast increment of environmentally friendly power sources and the expansion of limit with regards to networks and transmission because of the ascent of the modern area in nations like India, China, and others.

Following Asia-Pacific, North America and Europe regions environmentally friendly power activities and energy-productive areas to associate the fundamental framework with the sustainable power source, on the side of jolt and transportation of electric stock across the locale, which might affect the excitation framework market to satisfy need. Critical development in end-use areas like oil and gas, power, mining, synthetics, mash and paper, and others is helping interest for simultaneous machines, which is probably going to fuel the development of the excitation systems market. This is because of an expansion in the necessity for responsive ability to make up for the slacking power factor brought about by inductive burdens in the previously mentioned enterprises.

Moreover, an expansion sought after for excitation systems in simultaneous machines for matrix dependability applications from electric utilities, for example, power creation plants, transmission, conveyance, and different utilities in creating economies is driving business sector development universally. In any case, the central issue hindering overall market development is the plan of mind boggling excitation systems, which has brought about difficulties in support exercises.

Simultaneous machines, which are used for both steady and variable speed applications, further develop energy usage and lower upkeep costs. Brushless DC generators get a good deal on support. Coordinated machines' essential benefits incorporate energy investment funds and power factor change abilities, which have added to their developing fame. Excitation systems have filled being used as coordinated machines have filled in unmistakable quality. The proceeding with COVID-19 pestilence worldwide affects the power business. Because of the ongoing circumstance, different device makers from across the world have needed to close down their creation offices and administrations as states carried out fractional or complete lockdown systems to manage the pandemic.

The COVID-19 plague has extraordinarily brought down power use. Notwithstanding, state run administrations all through the world had to reduce business movement to restrict the danger of Covid. Excitation systems have been harmed in the close to term because of the drop in business activities. The excitation framework is an essential part of the coordinated machine that performs security and control capabilities as a strengthening input by creating motion and sending current to the simultaneous machine's rotor winding. Excitation is required in light of framework requests; the more excitation expected in a framework where the heap current is high. Under all help circumstances, a very much planned excitation framework gives constancy, basic controls, soundness, and fast transient reaction, as well as direct upkeep.

The ascent popular for power factor revision and power framework solidness from power purchasers all around the world is a critical driver driving the worldwide excitation systems market during the projected period. Besides, the quick development of environmentally friendly power joining contributes extensively to the development of the overall excitation systems market from 2024 to 2033. Be that as it may, the trouble in keeping up with excitation systems because of their confounded plan is projected to globally smother market extension.

Worries about a dangerous atmospheric devation, fossil fuel by products, and developing contamination have provoked legislatures to move toward environmentally friendly power sources. Legislatures are setting up plans to address these natural worries.

Renewables will supplant coal as the world's driving wellspring of energy age in 2025, as per the International Energy Agency. Renewables are anticipated to supply 33% of the politically influential nation's at that point. Hydropower will keep on giving almost 50% of the world's inexhaustible power. Conversely, specialized improvements in excitation systems, as well as an ascent popular for simultaneous machines from HVDC organizations and the quick development of the sustainable power industry, are probably going to produce imminent development opportunities for the market's driving rivals.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.93 Billion |

| Market Size by 2034 | USD 4.67 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.32% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Controller Type, Application, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

In terms of type, because the excitation current is supplied to a synchronous machine without slip rings or carbon brushes, the static segment held a large number of market shares in 2023 owing to various advantages such as good reliability, excellent system response, operation flexibility, lower losses, small size and high performance, which fueled demand during the analysed time period. Furthermore, rising energy demand from developing nations has resulted in increasing investment in power production, transmission, and distribution infrastructure, which is likely to fuel the market.

Brushless excitation systems supply field current to coordinated machines without the utilization of slip rings or carbon brushes. Since these frameworks don't need carbon brushes, contact opposition misfortunes are limited, bringing about low support when contrasted with static excitation systems. Subsequently, the diminished upkeep cost of brushless excitation systems contrasted with static excitation systems is probably going to drive market development. Since these frameworks don't utilize carbon brushes, they have lower contact obstruction misfortune and lower upkeep costs than static excitation systems, which drives the market development.

As far as income, the computerized portion has the most noteworthy offer and is probably going to hold its predominance during the projection time frame. This increment may be attributed to an expansion sought after for excitation systems that guarantee reliable and consistent working of coordinated apparatus like simultaneous generators and simultaneous engines. Moreover, an expansion in innovative work exercises pointed toward improving advanced regulators for use in excitation systems is supposed to fuel market extension all through the examined time period.

The market is separated into two classes: synchronous generators and synchronous machines. In 2023, the simultaneous generator class had the most piece of the pie by application. This is because of an expansion sought after for simultaneous generators from various power plants like atomic, warm, wind, and hydropower, as well as modern purposes. Besides, the expanded utilization of coordinated generators for consistent speed applications and power factor revision applications is supposed to drive the development of the market somewhere in the range of 2024 and 2033. The Synchronous generators area has a significant piece of the pie in light of the fact that coordinated generators are expected to communicate DC, which is consequently directed in generator mode, to the turbine generators field windings. Generator frameworks contain various practical frameworks, for example, power circuits, robotized controllers, security and control frameworks, and the rising requirement for generators in hydropower, which is the reason that has raised the market development of the market.

Subsequently, the simultaneous machine is exclusively utilized for the age, transmission, and circulation of electric power, which is viewed as an essential driving component for excitation systems and overwhelms the market area. The expanded requirement for coordinated machines in many power producing units for protected, trustworthy, and stable tasks with nonstop power supply and viable plant activities is one of the essential market drivers for the excitation framework industry. The effectiveness of the power plant is reliant upon the support exercises of the framework gear, which can bring about unforeseen occasions and framework breakdowns on the off chance that the excitation framework isn't kept up with on time, which goes about as a market limitation for the market.

By end client, the power age area represented the most noteworthy portion of the excitation systems market in 2023, attributable to rising requirement for energy from both arising and created economies, which drove more sought after for coordinated machines. Besides, rising energy utilization alongside cleaner power age is probably going to drive the development of the sustainable power creating area, thusly pushing the market forward in the next few years. Moreover, rising energy request joined with cleaner power age is probably going to fuel the extension of the sustainable power creating fragment, supporting business sector development later on years.

By Type

By Controller type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2022

January 2025

December 2024