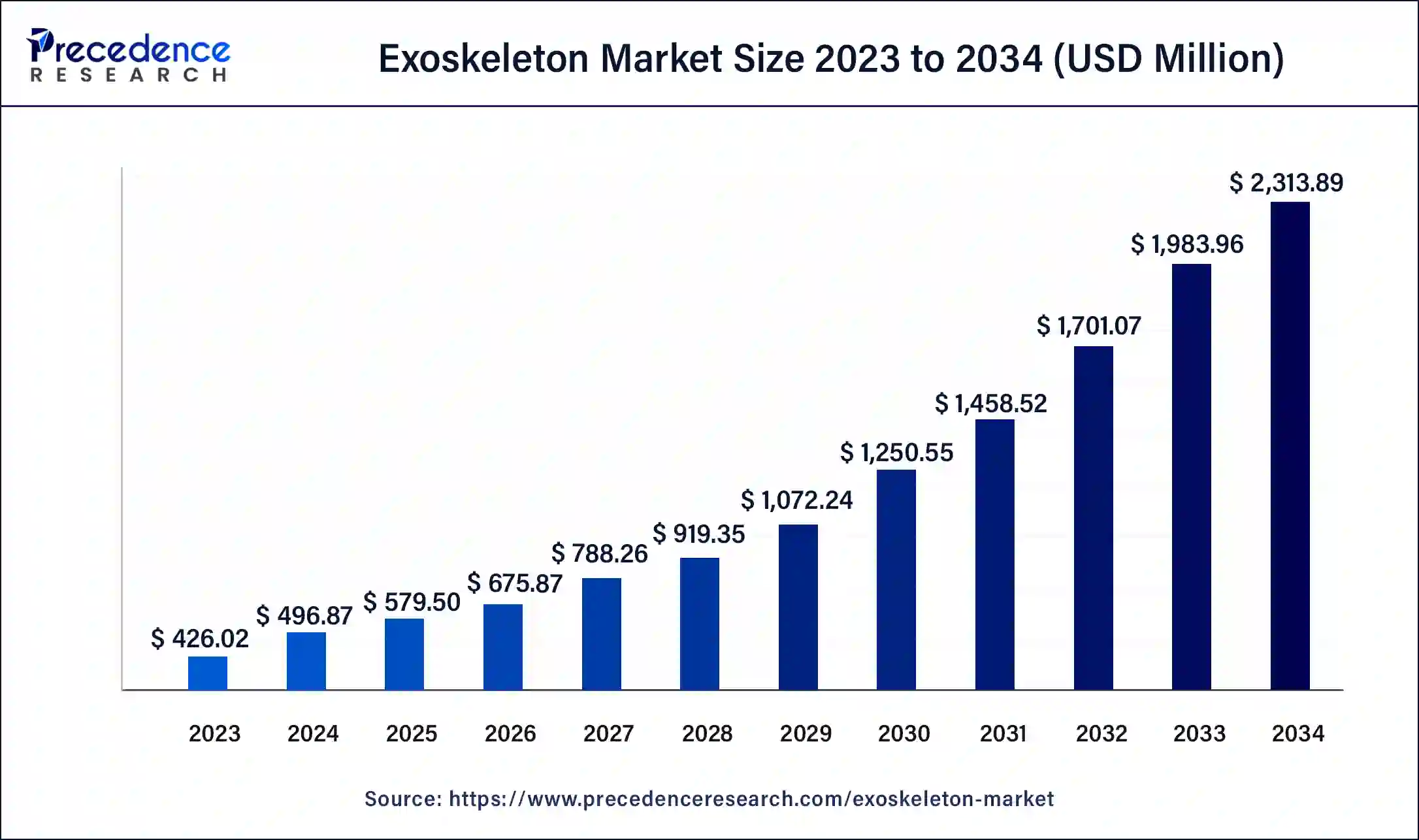

The global exoskeleton market size was USD 426.02 million in 2023, calculated at USD 496.87 million in 2024 and is expected to be worth around USD 2,313.89 million by 2034. The market is slated to expand at 16.63% CAGR from 2024 to 2034.

The exoskeleton market volume is 14,919.99 units in 2024 and is projected to cross around 36,371.81 units by 2034, expanding at a solid CAGR of 9.32% between 2024 and 2034. The rising use of robotic exoskeletons in military and defense contributes to the growth of the market.

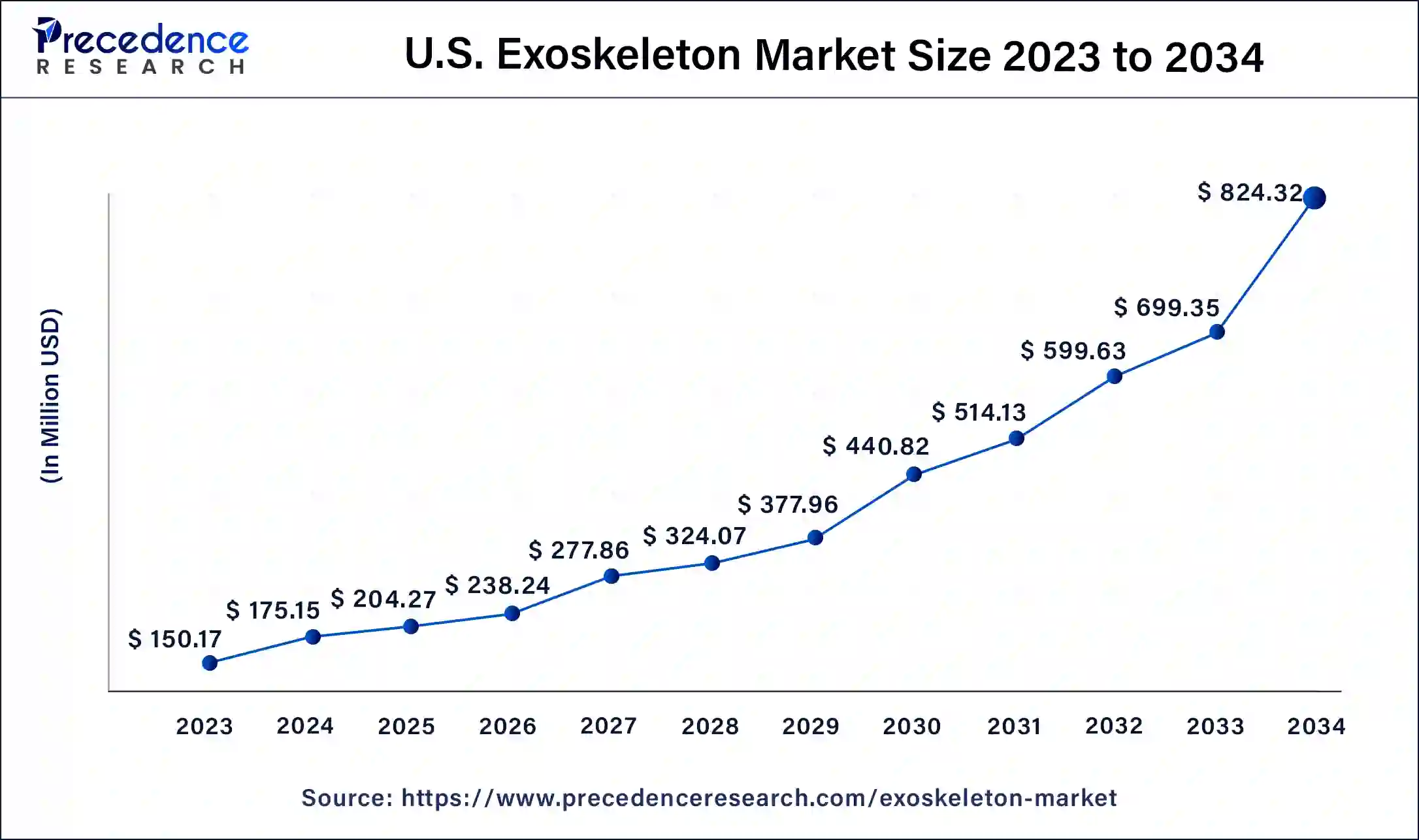

U.S. Exoskeleton Market Size and Growth 2024 to 2034

The U.S. exoskeleton market size was exhibited at USD 150.17 million in 2023 and is projected to be worth around USD 824.32 million by 2034, poised to grow at a CAGR of 16.74% from 2024 to 2034.

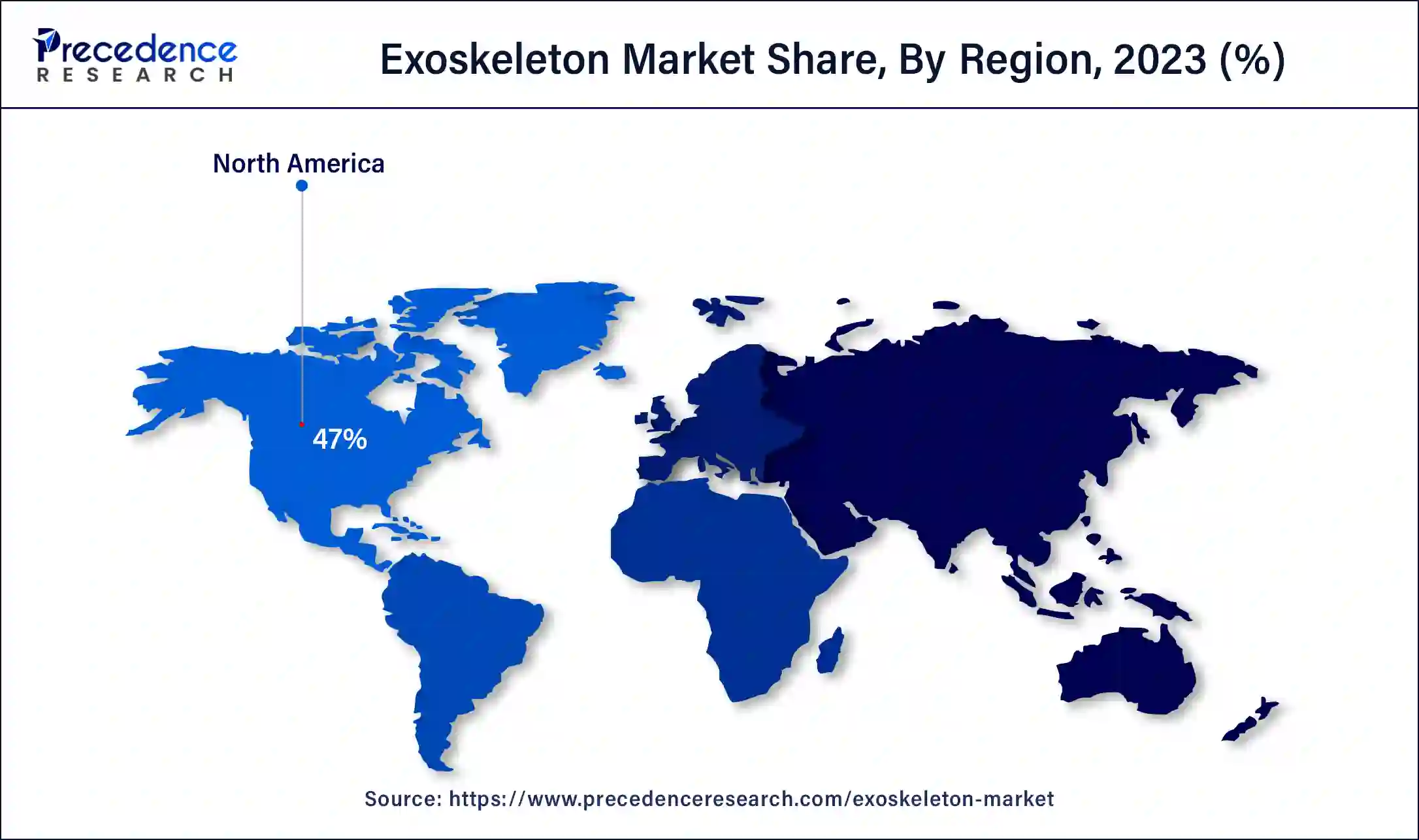

North America dominated the exoskeleton market in 2023. The increasing public & private support, availability of advanced technology products, increasing number of collaborations & partnerships with key players, and increasing investment in research activities contribute to the growth of the market. The availability of private investors, the increasing human augmentation in military and services, the broad presence of key players in the market, the rapidly increasing senior population, and the increasing disposable income help to grow the market in the Asia Pacific region.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2033. The increasing number of patients requires rehabilitation support, which contributes to the growth of the exoskeleton market in the Asia Pacific region. Advancing and developing healthcare infrastructure and the availability of government funding and support are driving the Asia Pacific region’s growth of the market. Continuous economic development in countries like India, China, and Japan helps the growth and development of the market.

The exoskeleton market includes the complete industry involved in the manufacturing, developing, and commercializing of exoskeletons specially designed to enhance individuals' physical disabilities. The exoskeleton is a rigid covering found on many animals, mainly invertebrates like mollusks and invertebrates. Exoskeletons have many benefits, including promoting a high level of diversity, promoting strength & longevity, protecting organisms from desiccation & acting as a barrier, preventing dehydration and getting too wet, etc., contributing to the growth of the market.

What are the benefits of AI in the Exoskeleton?

The integration of artificial intelligence (AI) in exoskeletons contributes to the growth of the exoskeleton market, mainly in the fields of robotics and healthcare. The advantages of an exoskeleton include improved surgical precision. AI can help surgeons to perform critical orthopedic surgeries with high precision. It also includes the benefits of reduced healthcare costs and enhanced efficiency of medical services. AI-based exoskeletons provide rehabilitation and recovery for patients, predictive maintenance, personalized treatment plans, and improved diagnostics that contribute to the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,313.89 Million |

| Market Size in 2023 | USD 426.02 Million |

| Market Size in 2024 | USD 496.87 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 16.63% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Mobility, Technology, Extremity, Structure, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing road accidents and military demand for exoskeletons

The exoskeleton is like a body’s architectural scaffolding, which is important. Exoskeleton applications in rehabilitation and treatment. The exoskeleton plays an important role in support and movement, which helps the exoskeleton market grow. The exoskeleton acts as a bodyguard. It protects organs like the liver, heart, and lungs. From physiotherapy to emergency services and in the military, exoskeletons may enhance the physical capabilities of warfighters and enable them to lift heavier objects, run faster, and reduce strain on the body at the time of physical operations.

Risks of Exoskeleton

The risks of the exoskeleton include structural limitations, energy expenditure, development and growth limitations, limited protection, vulnerability to injury, and high costs of product acquisition and R&D. It provides outstanding protection to the main organs and does not provide much protection to the other body areas. These factors can hamper the growth of the exoskeleton market.

Research & advanced technologies of exoskeleton

The exoskeletons are the internal frameworks that play an important role in many organisms and are subject to research and technological advancements. The advantages of the exoskeleton include force transmission, muscle attachment sites, and growth flexibility. It helps to enhance the running and walking economy with an exoskeleton; innovations like human exoskeleton interface design, mechatronic designs, off-board actuators, physiologically informed joint targeting, etc., are the opportunities for the growth of the exoskeleton market in the future.

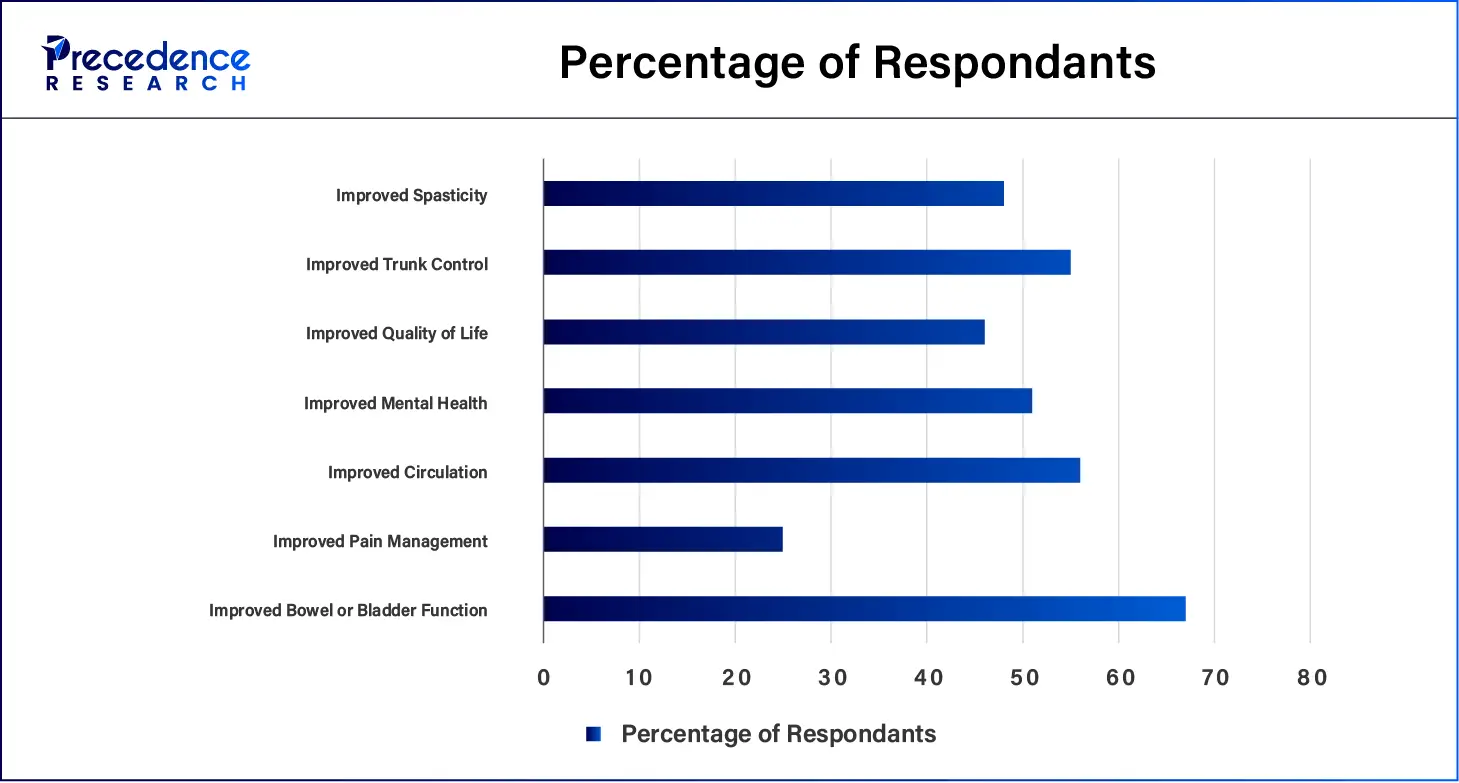

Health benefits by using the exoskeleton of ReWalk Robotics

Studies and user surveys have shown that regular exoskeleton-assisted walking programs result in a range of health advantages for people who suffer from spinal cord injury.

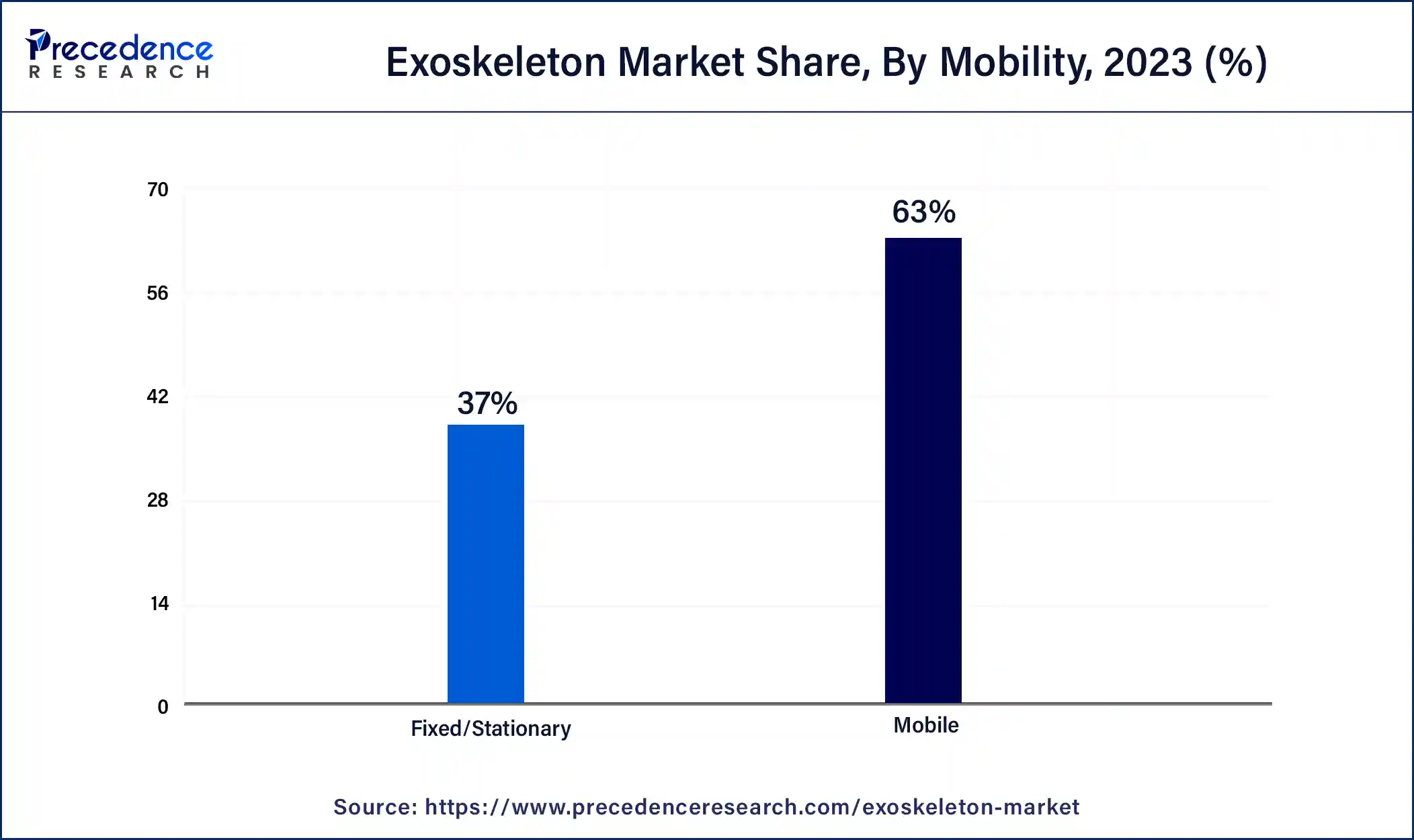

The mobile segment dominated the exoskeleton market in 2023 and is expected to be the fastest-growing segment during the forecast period. The benefits of a mobile exoskeleton include streamlined workflow and productivity, active patient engagement, and infection control. Mobile exoskeletons are wearable robotics designed for movement and freedom. Mobile exoskeletons enable users and exoskeletons to move around freely. Exoskeletons provide a boost for recovering from injury and dealing with mobility challenges. Mobile exoskeletons are battery-powered awesomeness, autonomy, and independence, and work smarter.

The powered segment dominated the exoskeleton market in 2023. The powered skeleton is an early version of the Iron Man suit, correcting posture, dispersing weight, and improving stability to enhance endurance and increase productivity at the time of eliminating injuries. The application of exoskeleton in the supply chain and manufacturing. The powered exoskeleton helps to increase productivity, enhance worker safety, and eliminate fatigue.

Active or powered exoskeletons need some form of energy, like a battery pack, for activating pneumatics, hydraulics, or motors. Key components in powered exoskeletons include elastic fabrics, metal, and carbon fiber, which are common building materials for comfort and mobility without sacrificing strength. Powered exoskeletons also require control strategies, algorithms, mechanical structures, actuators, and sensors to explain users’ intentions and support or initiate actions. They use 3 modules comprising sense, execution, and decision to actuate, analyze data, and gather data on the exoskeleton according to the desired tasks.

The non-powered segment is anticipated to be the fastest-growing during the forecast period. The benefits of passive or non-powered exoskeletons include increased employee productivity, reduced number of days taken off work due to injuries, reduced healthcare use, and decreased occupational injury incidences. Non-powered exoskeletons are normally less complex, lighter, and do not require an external power source. They may be used to alleviate fatigue, improve posture in repetitive tasks, and reduce strain in certain body parts.

The lower body segment dominated the exoskeleton market in 2023. The growing adoption of exoskeleton products, the increase in lower body disability incidences, and the increase in investments have helped the growth of the market. The growing adoption of exoskeleton products by paralyzed patients and senior populations for mobility and weight-bearing capabilities. Additionally, military and defense personnel use lower-body solutions to help soldiers and enhance their motion and speed. The benefits of the lower body exoskeleton include muscle power and injury prevention, bone health and metabolism, enhanced performance, core stability, and posture, and it helps with heart health and blood circulation.

The upper body segment is estimated to be the fastest-growing during the forecast period. The benefits of the upper body exoskeleton include performance boost, recovery support, cross-training with upper body exercises boost efficiency, and also reduced risk of injury. It also includes the benefits of warm-up efficiency, core strength, range of motion, muscle attachment, and support and protection for our upper body, which helps the growth of the exoskeleton market.

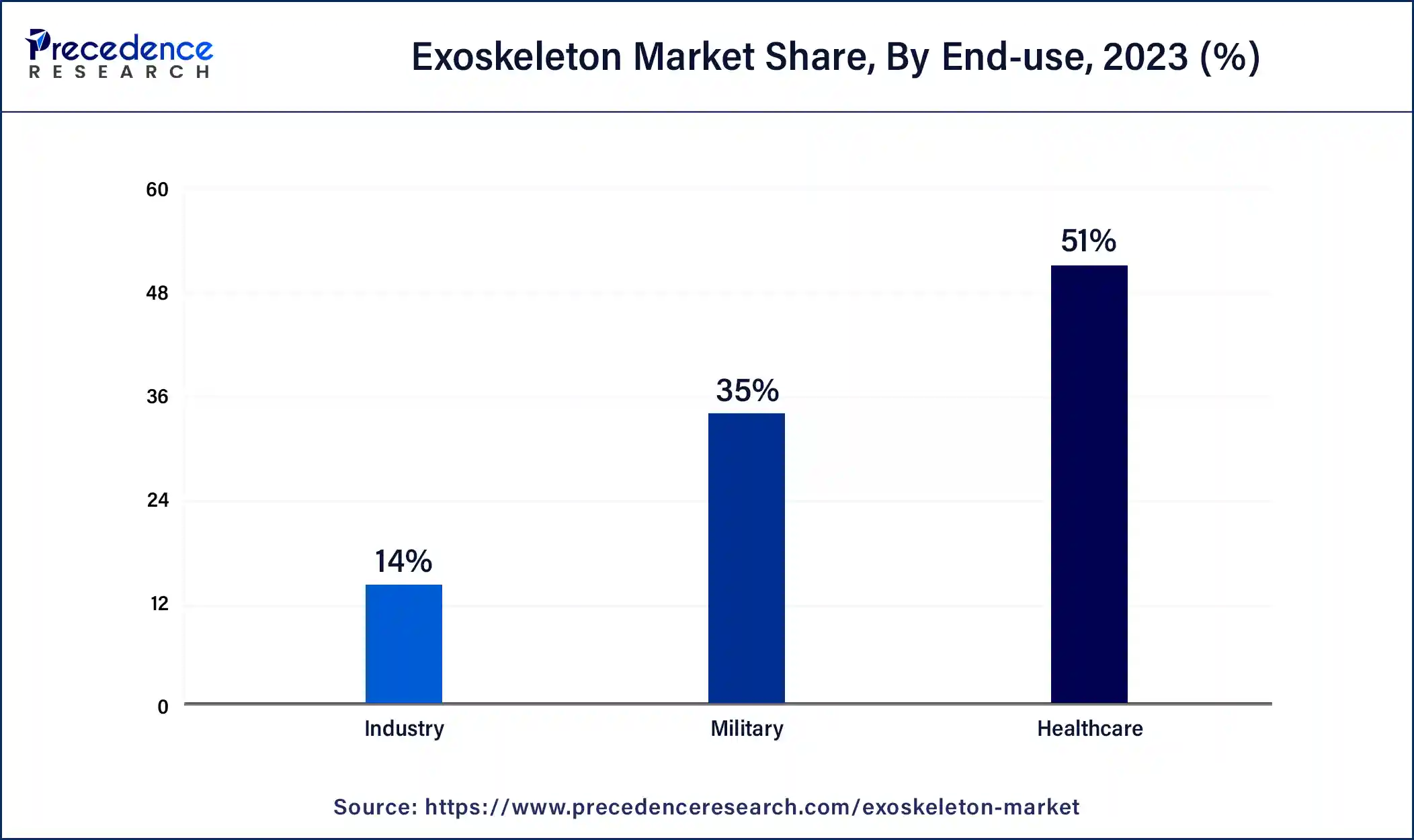

The healthcare segment dominated the exoskeleton market in 2023. In the healthcare sector, several studies exist that help to examine many exoskeletons to provide back support to healthcare professionals. Benefits of the exoskeleton in healthcare include structural support, growth, and protection of internal organs like the liver, kidneys, heart, and lungs from accidental knocks and bumps.

The industry segment is anticipated to be the fastest-growing during the forecast period. The benefits of industrial exoskeletons include safety, human augmentation, muscle magic, strength & size, etc., contributing to the growth of the exoskeleton market. The increasing rate of injuries and increasing awareness of exoskeleton technologies in many industrial applications contribute to the growth of the market.

Segments Covered in the Report

By Mobility

By Technology

By Extremity

By Structure

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client