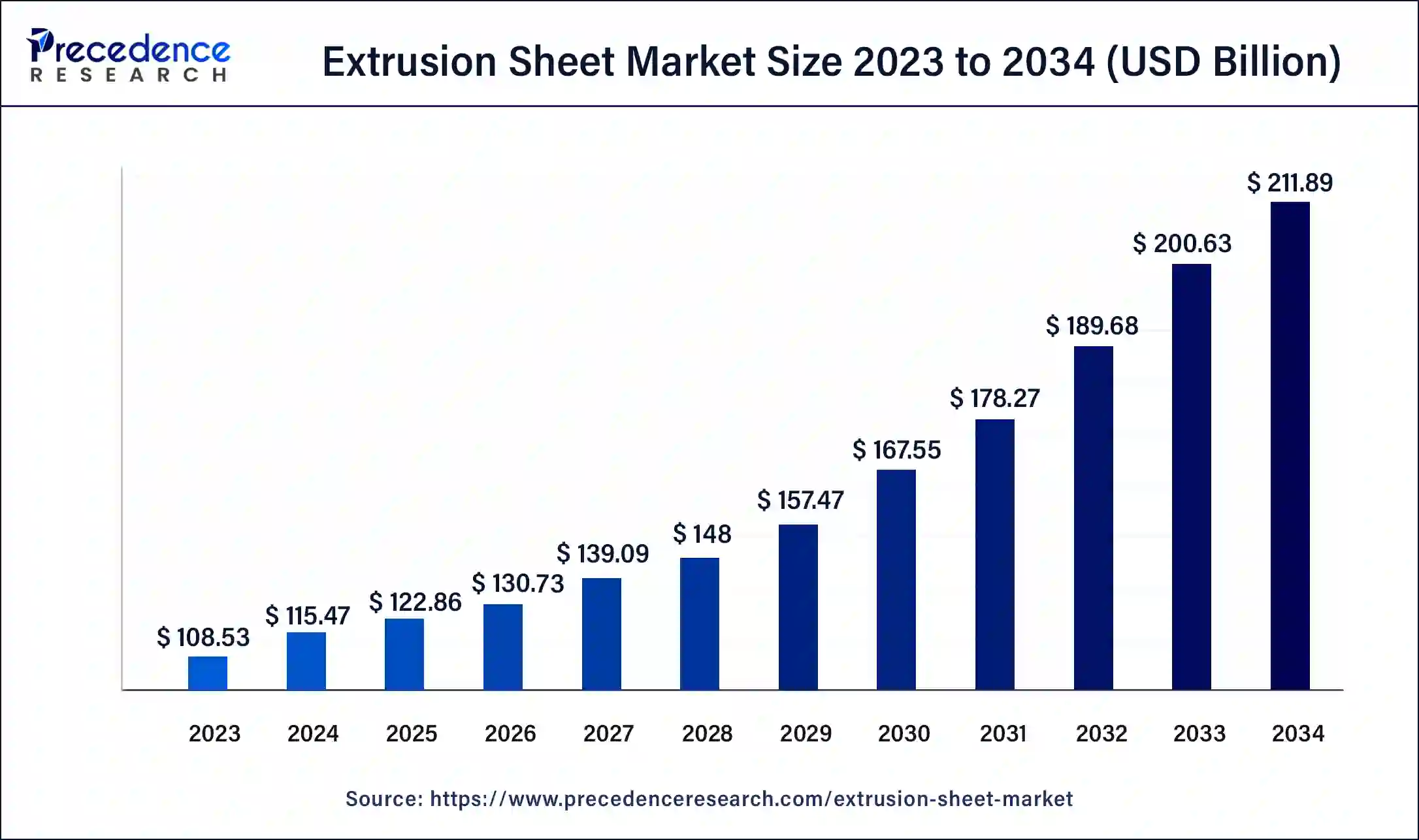

The global extrusion sheet market size was USD 108.73 billion in 2023, calculated at USD 115.91 billion in 2024 and is projected to surpass around USD 219.63 billion by 2034, expanding at a CAGR of 6.6% from 2024 to 2034.

The global extrusion sheet market size accounted for USD 115.91 billion in 2024 and is expected to be worth around USD 219.63 billion by 2034, at a CAGR of 6.6% from 2024 to 2034. Rapid industrialisation across the globe is creating huge demand for the extrusion sheets and driving growth of the global extrusion sheets market.

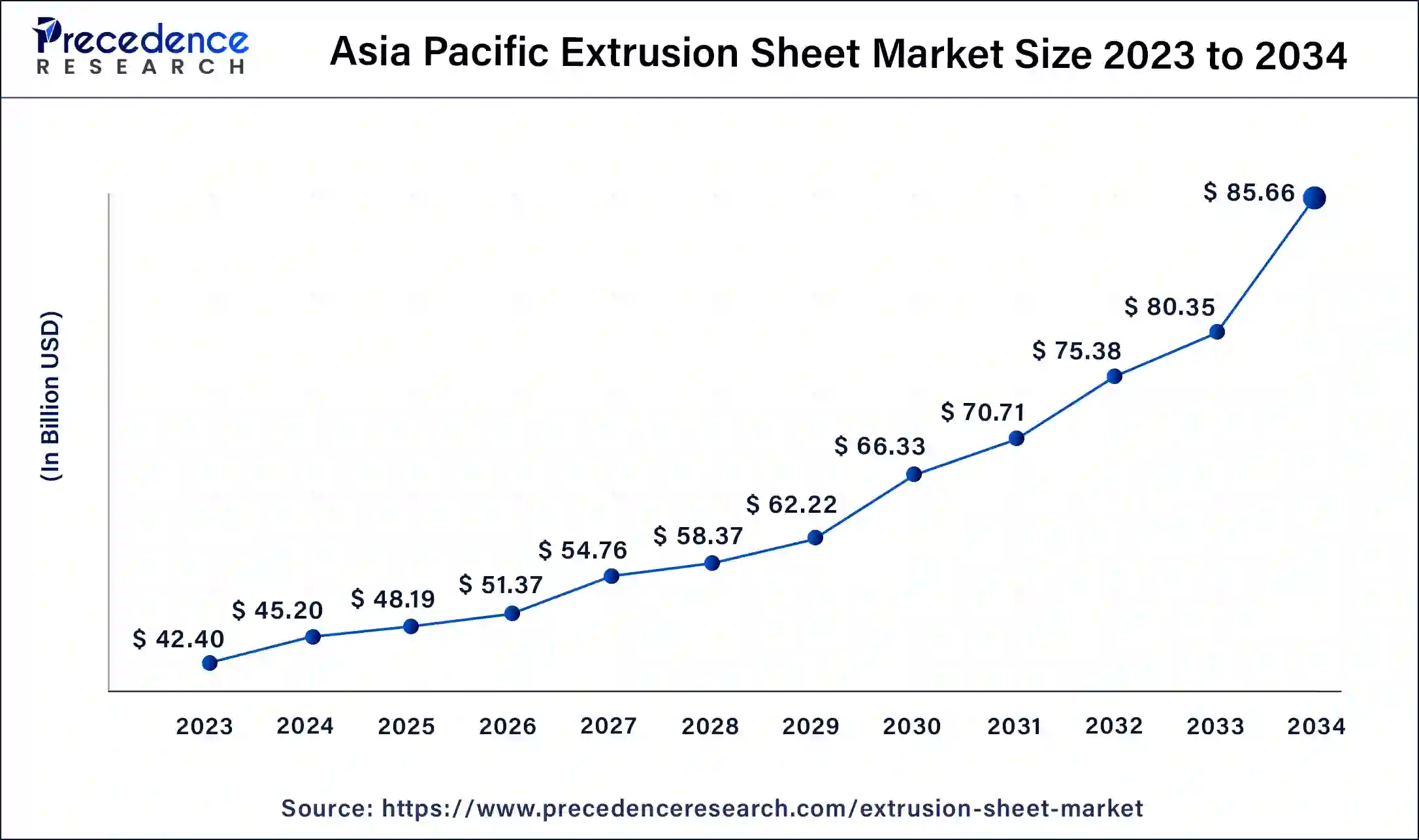

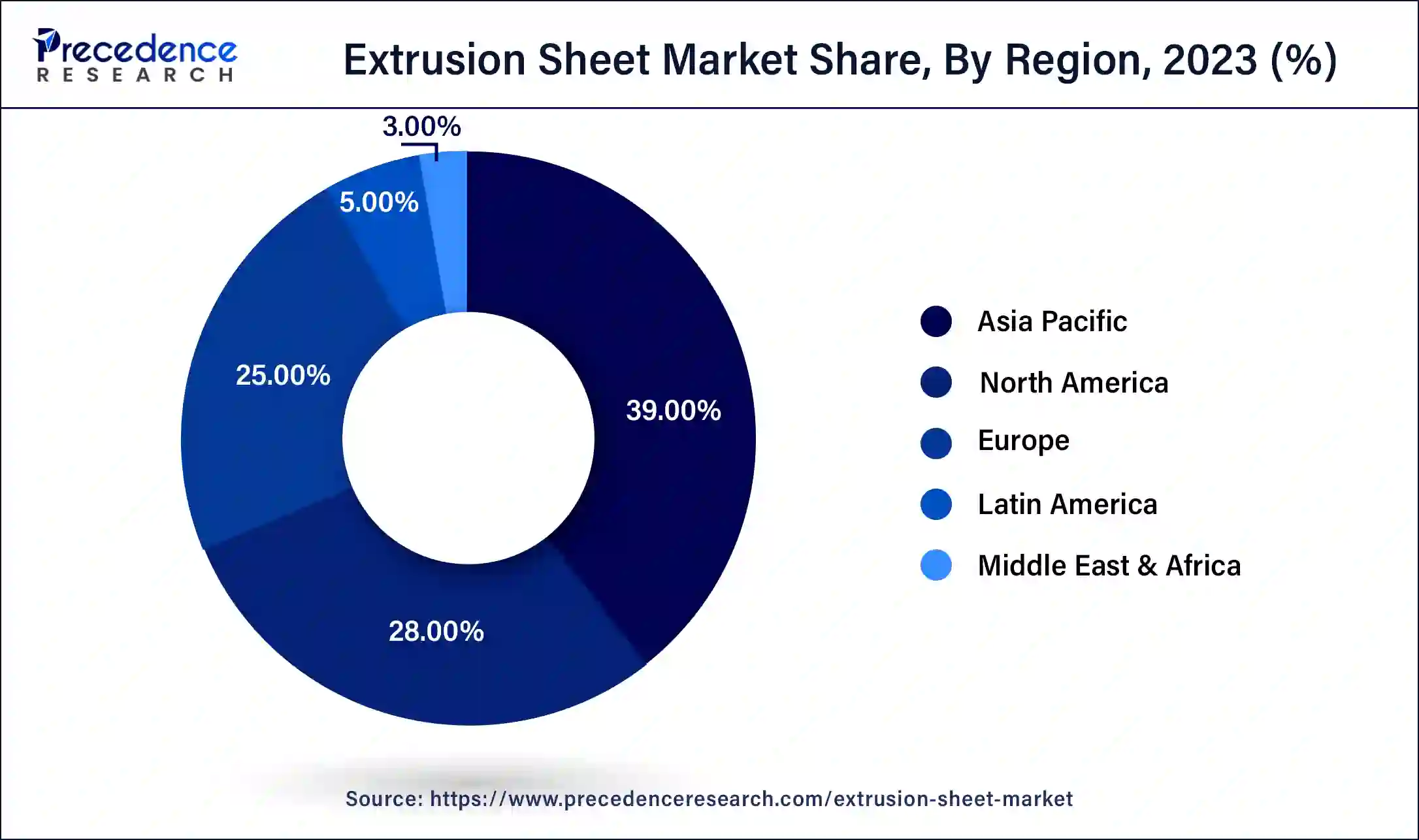

The Asia Pacific extrusion sheet market size was estimated at USD 42.40 billion in 2023 and is predicted to be worth around USD 85.66 billion by 2034, at a CAGR of 6.8% from 2024 to 2034.

Asia Pacific dominated the market in 2023, accounting for the largest market share. The growth of the market in the region is primarily attributed to the expansion of the packaging industry. The increasing construction activities in emerging countries, such as India and China, boosted the demand for extrusion sheets for various applications. Moreover, the rapid industrialization and the growing manufacturing activities contributed to market expansion.

The market in North America is expected to expand at the fastest growth rate during the forecast period. The regional market growth is attributed to the increasing usage of extrusion sheet in the automotive and packaging industries. The increasing investments by regional market players to develop advanced extrusion sheets and increasing production of vehicles further boosts the market growth in North America.

Extrusion sheet refers to a manufacturing process in which a material, often a thermoplastic or metal, is forced to create a continuous, flat sheet or film of uniform thickness. This process is known as extrusion, and it is commonly used to produce plastic sheets, metal sheets, and other types of sheet materials. The global extrusion sheet market is experiencing significant growth due to a myriad of factors, such as increasing demand for lightweight materials, rising applications in various industries, and a growing emphasis on sustainability. Extrusion sheets have become a versatile solution for various applications, from packaging to construction. Their lightweight, high tensile strength, increased corrosion resistance, flexibility, and high-temperature endurance make them suitable for various industrial applications.

The burgeoning construction and building renovation activities across the globe are expected to propel the market in the coming years. Extrusion sheets are replacing traditional materials, like wood, in the construction industry due to their corrosion and moisture resistance properties. Moreover, their strength-to-weight ratio suits them for applications like cladding, roofing, doors, and windows. Rapid industrialization in emerging economies has boosted construction activities, which can positively impact the global extrusion sheet market. Moreover, the rising adoption of extrusion sheets in the manufacturing of medical devices and electronic appliances fuels the market.

Future of Global Extrusion Sheet Market

Key companies of the target industry such as SABIC, DS Smith Plc. are focusing in the business growth by adopting strategies such as capacity expansion, innovative product launches and heavy investments in the production in their facilities that is expected to flourish the global extrusion sheet market growth in the near future. This trend is expected to continue and will augment growth of the global extrusion sheet industry in the next 10 years. Further, increasing end use applications of extrusion sheet and rising construction as well as automotive industry are boosting growth of the extrusion sheet industry in the coming years.

| Report Highlights | Details |

| Market Size in 2023 | USD 108.73 Billion |

| Market Size in 2024 | USD 115.91 Billion |

| Market Size by 2034 | USD 219.63 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.6% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Material, Structure, Application |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Increasing demand from various end-use industries

Due to their flexibility, lightweight, and high tensile strength, the demand for extrusion sheets is increasing in various end-use industries, like automotive, packaging, and healthcare. Extrusion sheets are used in various end-use industries, such as automotive, electronics, packaging, and construction. PET, PP, and PVC extrusion sheets are widely used in food and pharmaceutical packaging, while PVC, ABS, and PP extrusion sheets are used in the furniture industry.

The healthcare industry also demands extrusion sheets to manufacture medical bags for applications such as fluid collection and medical device containment. Moreover, extrusion is increasingly used in the packaging industry to create plastic films, sheets, and containers. The rising demand for sustainable and lightweight packaging solutions increases the usage of biodegradable plastic extruded sheets, which are made from renewable resources. Packaging companies also focus on customizable and sustainable packaging solutions, thereby boosting the market.

Strict regulations and intense completion

The market is highly fragmented, with a large number of players competing to hold a significant share and stay ahead of the competition. Thus, intense competition from established market players creates barriers for new companies to enter the market. Moreover, strict regulations regarding the use of certain materials may hamper market growth.

Advancements in material science

Advancements in material science led to the development of high-performance polymers and composites. Their improved properties, such as excellent strength, flexibility, and temperature resistance, boost their adoption in various industries. Moreover, continuous improvements in extrusion technology, including precision control, automation, and energy efficiency, contribute to the competitiveness of extruded sheet products. Enhanced manufacturing processes lead to high-quality products and increased production efficiency. Moreover, major companies competing in the market are adopting various business strategies, such as partnerships, acquisitions, and mergers, to boost production capacity and develop innovative products.

The polystyrene segment dominated the global market, with the largest share in 2023. Extruded polystyrene sheets exhibit excellent thermal insulation and resistance to moisture, making them suitable for food packaging. Furthermore, polystyrene has advantages over other plastics, such as durability and long-lasting performance, which contributed to segmental growth.

The virgin material segment led the market in 2023. This is due to virgin polymers' consistency, high quality, and reliability, which are important in end-use applications where material performance is necessary. Moreover, industries like food packaging, medicine, and aerospace predominantly depend on virgin materials to meet regulatory demands.

The reprocessed segment is expected to grow at a significant pace during the projected period. The segment's growth is attributed to rising environmental concerns and the push for circular economies in production practices. Reprocessed materials are widely used in construction materials, outdoor furniture, and automotive components. The rising production of vehicles and construction activities further propels the segment.

The solid & textured segment led the market in 2023 by holding a substantial market share. This is due to the rising adoption of solid & textured sheets in various industries, like automotive, construction, and furniture, as they require durable and visually appealing surfaces. Additionally, these sheets are preferred for their capability to mimic textures like stone and wood, contributing to the segmental growth.

The packaging segment dominated the market in 2023. The dominance of the segment is attributed to the increasing adoption of extrusion sheets in the packaging industry. Extrusion sheets are widely used in clamshell packaging, blister packs, and trays, which are indispensable in consumer goods packaging. Moreover, extrusion sheets made up of PET, PP, and PVC are widely used in food packaging as well as in pharmaceutical blister packaging. The rising demand for protective packaging in the food & beverages and pharmaceuticals industry further contributed to segmental growth.

The automotive segment is anticipated to grow significantly over the studied period. The automotive industry values extrusion sheets for their ability to reduce vehicles' overall weight while contributing to performance enhancements and fuel efficiency. These key properties of extrusion sheets encourage their adoption in automobiles. The rising demand for lightweight materials and the increasing production of vehicles significantly boost the segment.

Major Market Segments Covered

By Type

By Material

By Structure

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client