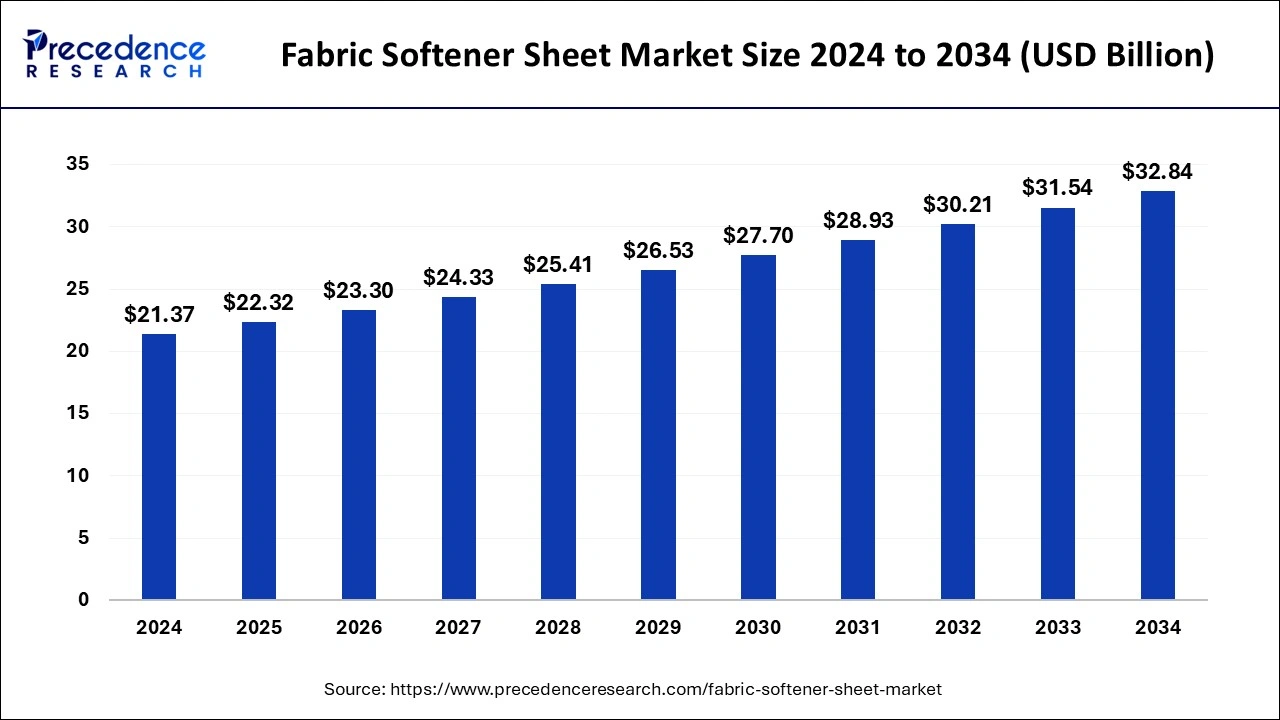

The global fabric softener sheet market size is calculated at USD 22.32 billion in 2025 and is forecasted to reach around USD 32.84 billion by 2034, accelerating at a CAGR of 4.39% from 2025 to 2034. The North America fabric softener sheet market size surpassed USD 8.33 billion in 2024 and is expanding at a CAGR of 4.52% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global fabric softener sheet market size was estimated at USD 21.37 billion in 2024 and is predicted to increase from USD 22.32 billion in 2025 to approximately USD 32.84 billion by 2034, expanding at a CAGR of 4.39% from 2025 to 2034. The fabric softener sheet market is driven by growing interest in sustainable and environmentally friendly options.

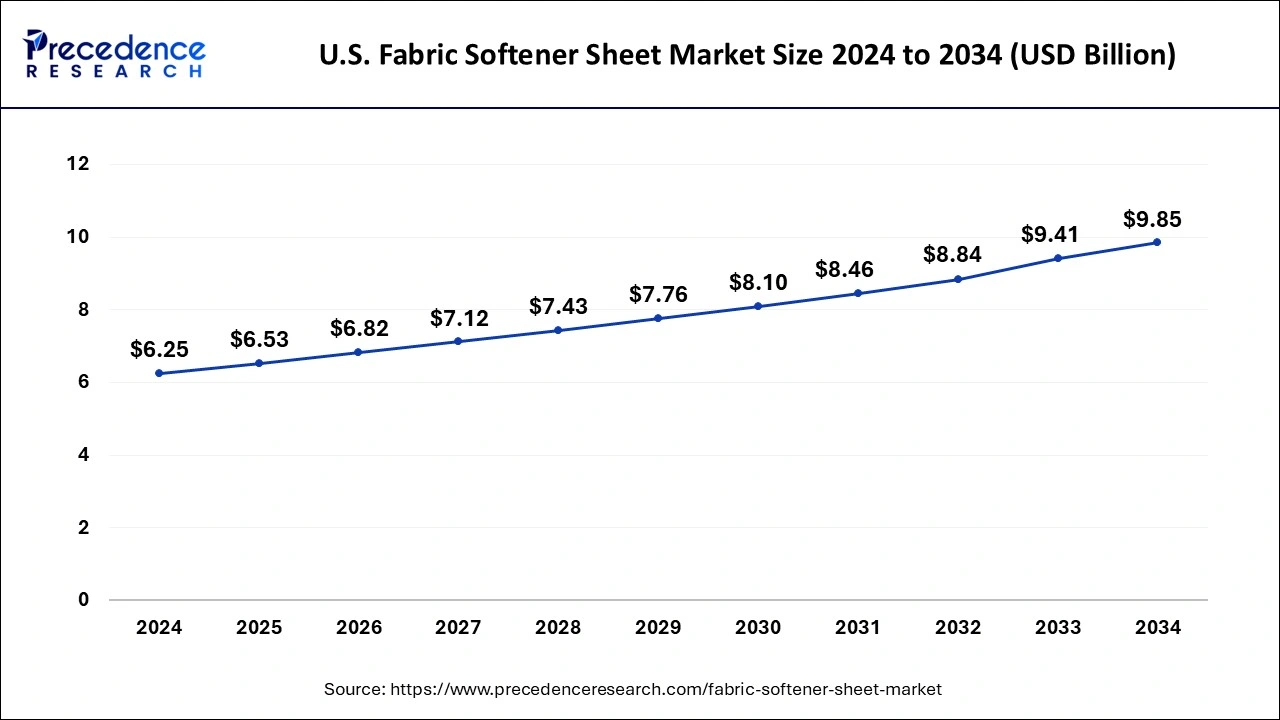

The U.S. fabric softener sheet market size was valued at USD 6.25 billion in 2024 and is predicted to be worth around USD 9.85 billion by 2034, growing at a CAGR of 4.65% from 2025 to 2034.

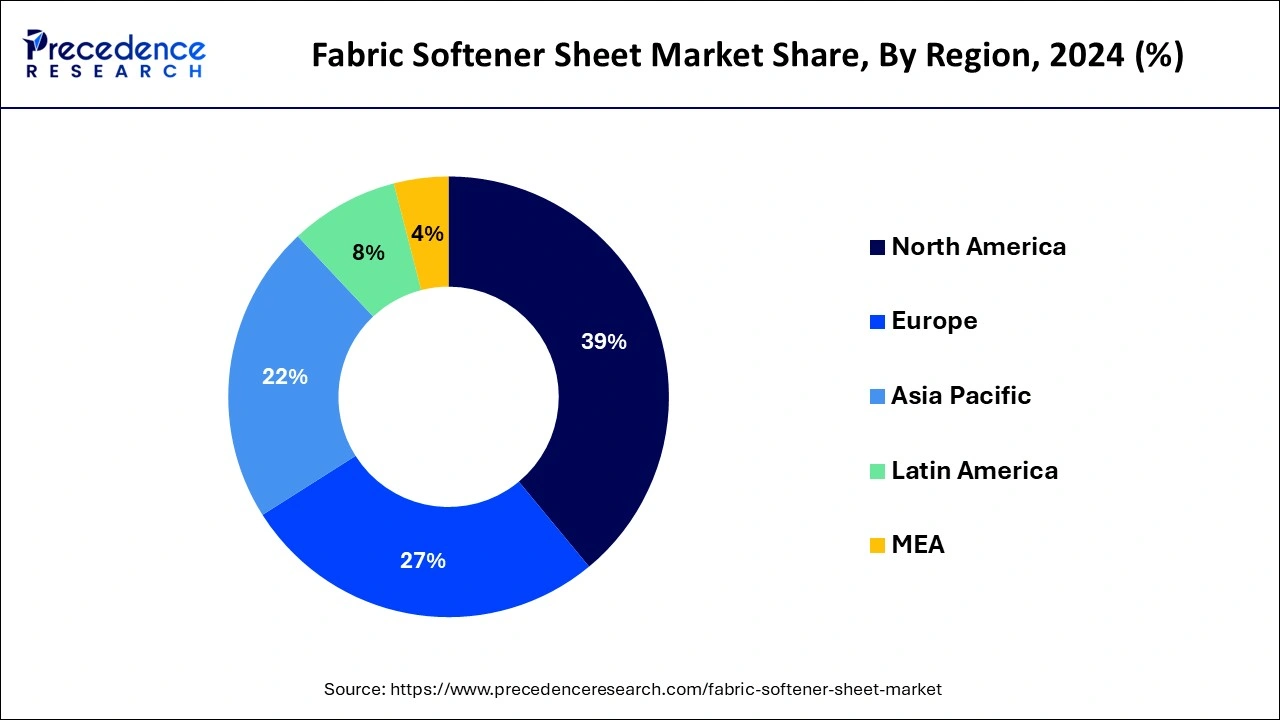

North America dominated the fabric softener sheet market in 2024. North American firms have paved the way in the development of fabric softener sheets. They keep investing in R&D to improve their products' sustainability, variety of scents, and effectiveness. With eco-friendly formulas, hypoallergenic alternatives, and multifunctional sheets that do more than just soften, these developments meet changing customer expectations.

Asia- Pacific is the fastest growing in the fabric softener sheet market during the forecast period. Convenient and time-saving solutions are in higher demand due to the rising urbanization and changing lifestyles. Fabric softener sheets are especially popular too busy urbanites since they provide a hassle-free solution to obtain soft, perfumed washing without the need to measure or pour liquid softeners. Demand for fabric softener sheets is largely driven by cultural factors as well.

Cleanliness and keeping oneself presentably presented are highly valued in many Asian cultures, especially in nations such as South Korea and Japan. This emphasis also extends to the maintenance of textiles and apparel. The region's consistent need for fabric softener sheets is partly attributed to this cultural preference for hygiene and personal grooming.

The market for fabric softener sheets, also called dryer sheets, is the industry segment that produces, distributes, and sells these sheets. Usually made of tiny fabric, these sheets are loaded with chemicals to soften clothes, lessen static cling, and add a pleasant scent while clothes are drying in a clothes dryer.

Many fabric softener sheets have scents that give clothes a nice scent while they dry. This makes laundry more enjoyable and leaves garments with a fresh scent. The market for fabric softener sheets is continuously changing with new products like biodegradable sheets, hypoallergenic alternatives, and sheets infused with natural essential oils. This illustrates how the industry has responded to consumer requests for more environmentally responsible, skin-friendly products.

| Report Coverage | Details |

| Market Size in 2025 | USD 22.32 Billion |

| Market Size by 2034 | USD 32.84 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.39% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Packaging, Formulation, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing use of primarily expensive and more sensitive forms of apparel

Wealthier consumers tend to purchase finer apparel composed of pricey materials like cashmere, silk, and high-thread-count cotton. Frequently, more attention is needed to preserve these materials' texture, color, and general quality. Static cling and creases are more common in fine, delicate materials. Static electricity is efficiently reduced with fabric softener sheets, and wrinkles are minimized, preserving the look and feel of clothing between washes. Companies are using focused advertising efforts to emphasize the advantages of fabric softener sheets for pricey and delicate clothing. These advertisements directly target customers who purchase high-end apparel by emphasizing delicate care, protection, and improving fabric quality. This drives the growth of the fabric softener sheet market.

Growing awareness about personal hygiene

Manufacturers are creating fabric softener sheets with extra benefits in response to consumer demand for improved cleanliness standards. These consist of sheets with hypoallergenic formulations, improved aroma duration, and antibacterial qualities. Awareness of one's own and the environment's health drives a trend toward natural and environmentally friendly products. To appeal to consumers concerned about their health, brands are creating fabric softener sheets using natural components instead of harmful chemicals.

The convenience of fabric softener sheets caters to modern consumers' busy lifestyles. They can be quickly added to laundry without requiring the measurement of liquids or powders. They are an appealing alternative because of their convenience and efficacious outcomes.

Availability of alternative

Sheets of fabric softener are frequently replaced with liquid versions. They are introduced during the wash cycle but have comparable advantages, including softening clothes and lowering static cling. Because they are thought to be more efficient and provide a more even dispersion of softening ingredients, some customers like liquid softeners. Single-use items like fabric softener sheets add to household waste. Dryer balls and liquid softeners in recyclable packaging are examples of products that are more appealing to consumers when sustainability is becoming a more critical concern.

Allergies or sensitivities to the chemicals used in fabric softener sheets

The market is starting to be divided into conventional and natural/hypoallergenic product categories. Businesses are expanding their product range to serve both markets. Manufacturers are spending money on R&D to develop novel formulations that are effective and devoid of common allergies and irritants. Investigating natural substitutes for man-made chemicals is part of this. To appeal to health-conscious consumers, businesses are emphasizing transparency, natural components, and product safety. This limits the growth of the fabric softener sheet market.

Increasing awareness about fabric softener sheets

Growing awareness may require specialty fabric softener sheets, including those made for sportswear or baby garments, or with extra features like color or wrinkle protection. Customers frequently look for customized goods. Offering more customizable fragrance options or broadening the selection of smells offered can appeal to a wider range of tastes and grow market share.

Raising awareness can lead to new revenue sources in emerging regions where fabric softener sheets are not commonly used. Convenience and benefit awareness campaigns can accelerate market penetration. By customizing marketing tactics to suit regional sensibilities and cultural preferences, fabric softener sheets can be more enticing in a variety of locations.

The fragranced segment dominated in 2024 in the fabric softener sheet market. Customers frequently connect a pleasant aroma with freshly laundered clothes. This inclination fuels the market for scented fabric softener sheets, which give clothing a pleasant, new scent. According to surveys and market studies, scent is a major consideration when selecting laundry goods, especially fabric softener sheets.

Large companies spend a lot of money on marketing campaigns that showcase their fabric softener sheets' distinctive and enticing scents. Strong brand recognition and loyalty result from this. Marketing tactics frequently highlight the extra advantages of scented sheets, such as prolonged freshness and odor removal, to further entice customers.

The unscented segment shows a significant growth in the fabric softener sheet market during the forecast period. Modern household items such as fabric softener sheets are becoming increasingly popular as new countries grow. As consumers in these locations learn more about the advantages of hypoallergenic and less chemically demanding products, there will probably be an increase in demand for unscented varieties. Manufacturers are spending money on advertising and educational initiatives to draw attention to the advantages of scent-free fabric softener sheets. These initiatives, which inform the public about the possible hazards connected with scented products and the benefits of choosing unscented, are essential in changing consumer views and stimulating demand.

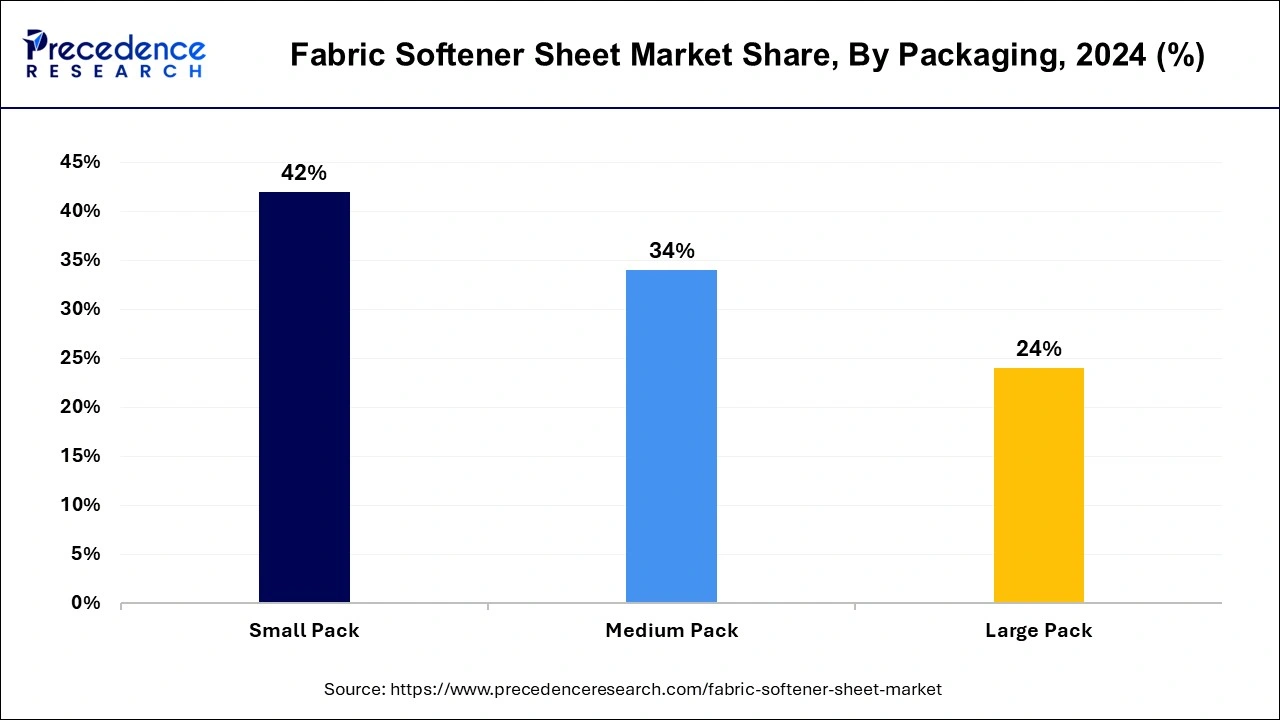

The small pack segment dominated in 2024 in the fabric softener sheet market. Pricewise, small packets are frequently less expensive than bigger package solutions. Because of their low cost, a broader spectrum of customers can purchase them, such as those on a tight budget or those who want to test a new product before committing to a bigger amount. Small packs frequently offer various choices, such as various formulas, fragrances, and packaging styles. The compact pack segment's demand is further fueled by manufacturers' ability to produce items that appeal to certain target populations and accommodate a wide range of consumer preferences.

The medium pack segment is the fastest growing in the fabric softener sheet market during the forecast period. Due to economies of scale, medium packs often have cheaper per-sheet costs than smaller packs, making them a better value option overall. Because of this, they appeal to customers on a tight budget who want both cost and quality. Additionally, medium packs give customers flexibility in their purchasing selections by enabling them to buy in bulk without committing to large amounts. Typically, medium packs are evenly dispersed over various retail outlets, such as supermarkets, hypermarkets, convenience stores, and internet sites. The extensive availability of medium-sized packs improves customer accessibility by making it simple for them to locate and buy them wherever they shop.

The large pack segment shows a notable growth in the fabric softener sheet market during the forecast period. Bulk or large pack sales of household necessities, such as fabric softener sheets, are becoming increasingly popular among consumers. The desire for cost-effectiveness, ease, and the impression of better value for money drives this tendency. Consumers are choosing larger pack sizes more frequently to guarantee they have enough fabric softener sheets on hand and to cut down on the number of shopping excursions.

Furthermore, producers and brands in the market for fabric softener sheets actively react to this trend by providing a greater selection in larger pack sizes. These businesses are successfully profiting from their customers' changing tastes by satisfying their increasing desire for large purchases.

The liquid segment dominated in 2024 in the fabric softener sheet market. As liquid fabric softeners are so versatile, consumers tend to favor them. They are compatible with various materials and can simultaneously be used in front-loading and top loading washing machines. Customers value that they can tailor the amount of softener used to the size and nature of the load by controlling how much is used in each wash.

Customers who value the smell of their laundry will find liquid fabric softeners intriguing because they typically come in various aromas. Their popularity is also influenced by the idea that their fresh aroma lingers longer.

The laundromats segment dominated the fabric softener sheet market in 2024. Fabric softener sheets' ability to soften clothing and add a nice scent is a major selling factor for laundromat patrons. Consumers favor sheets over other fabric softeners because they recognize the instant benefits of soft, perfume-filled clothes after drying. Fabric softener sheets make laundry facility maintenance and administration easier from an operational standpoint. Machine residue buildup from liquid softeners may necessitate more frequent cleaning and maintenance. Conversely, there is less chance of residue accumulation with sheets, which means less downtime and maintenance expenses for the laundromats.

The supermarkets and hypermarkets segment dominated in 2024 in the fabric softener sheet market. Supermarkets and hypermarkets stock a wide range of goods, such as different brands and types of fabric softener sheets. This selection appeals to various consumers, satisfying varying budgets and tastes. Large-scale inventory management guarantees that these merchants rarely experience stockouts, increasing client loyalty and dependability. Due to their enormous purchasing power, these retail behemoths can bargain for lower pricing from suppliers. They can use competitive pricing to transfer these cost savings to customers. Furthermore, fabric softener sheets become more reasonable thanks to regular promotions, discounts, and loyalty programs offered by supermarkets and hypermarkets, encouraging bigger sales volumes.

By Product

By Packaging

By Formulation

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client