July 2024

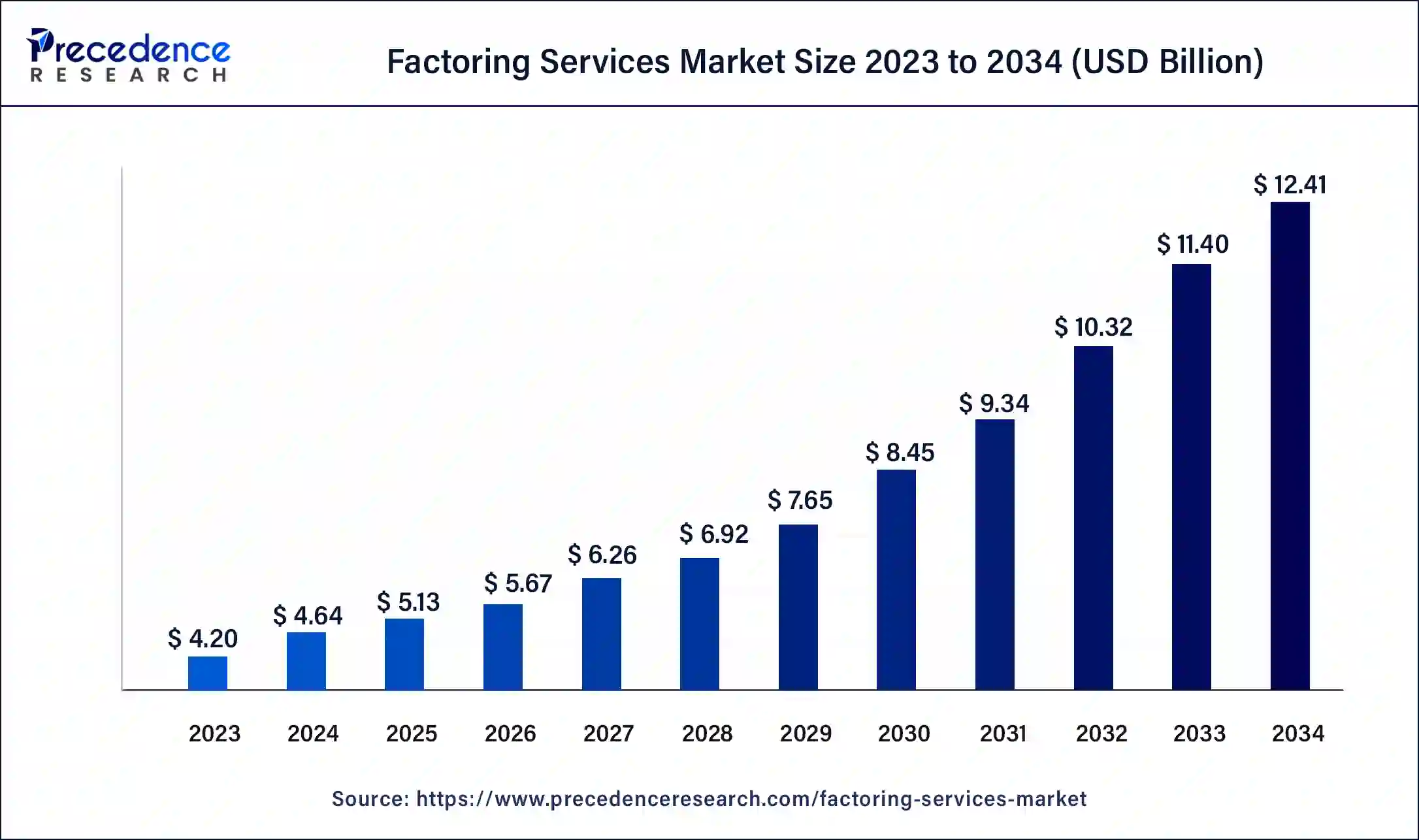

The global factoring services market size was USD 4.20 billion in 2023, estimated at USD 4.64 billion in 2024 and is anticipated to reach around USD 12.41 billion by 2034, expanding at a CAGR of 10% from 2024 to 2034.

The global factoring services market size accounted for USD 4.64 billion in 2024 and is predicted to hit around USD 12.41 billion by 2034, growing at a CAGR of 10% from 2024 to 2034.

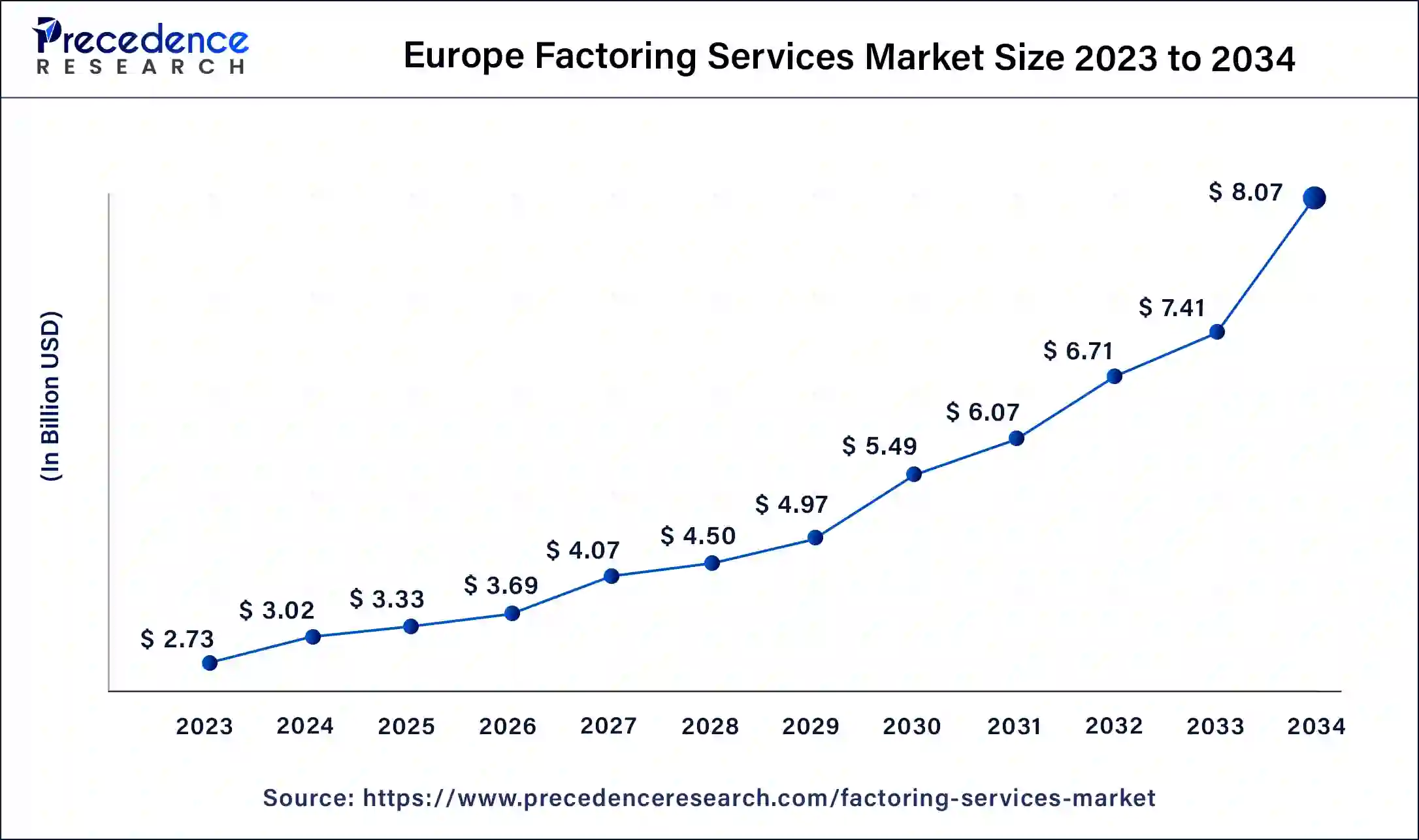

The Europe factoring services market was valued at USD 2.73 billion in 2023 and is expected be worth around USD 8.07 billion by 2034, at a CAGR of 10.34% from 2024 to 2034.

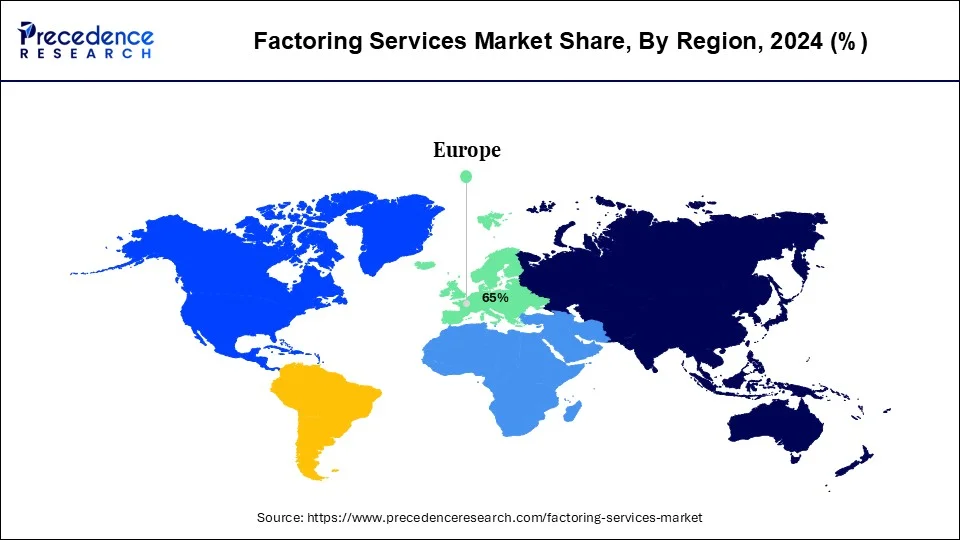

Based on the region, the Europe segment dominated the global factoring services market in 2023, in terms of revenue and is estimated to sustain its dominance during the forecast period. More than two-thirds of the regional market is accounted by the UK, Italy, Germany, Spain, and France. The strategic relevance of receivables funded by commercial banking might be ascribed by the growth. The factoring services are high in demand in the Europe region due to current trade policies inside the European Economic Zone and the rising trade with fast-growing markets in Eastern Bloc nations.

On the other hand, the Asia-Pacificis estimated to be the most opportunistic segment during the forecast period. Due to rapid rise of economies in the Asia-Pacific region, as well as infrastructural and industrial growth, the region is expected to emerge as the fastest-growing regional market. China and India are the two populous countries of Asia-Pacific region, that have a larger need for factoring services among small and medium enterprises (SMEs) in the region.

The factoring is a financial service in which a company sells its bill receivables at a discount rate to a third party in order to raise funds. It’s not the same as invoice discounting. The invoice discounting is the process of having an invoice discounted at a given rate in order to obtain funds, although factoring is a larger notion. Factoring is the process of selling all account receivables to a third party.

Factoring guarantees a predictable cash flow pattern. The credit department is virtually eliminated with continuous factoring. Because of the distinct advantage of flexibility that factoring provides to the borrowing firm, receivable financing is gaining popularity as a beneficial form of financing short-term finance requirements of business organizations. The seller’s bills receivables may continue to be funded in a semi-automated manner. If the company’s revenues grow or shrink, the financing can be adjusted accordingly.

The increase in open account trade and the quick expansion of businesses in Asia, led by China, the increase in cross-border factoring, and the rapid growth and development of factoring services in the developing regions are some of the factors contributing to the growth of the factoring services market during the forecast period.

The growth of the factoring services market can be attributed to rising public knowledge of financial technology advancements, such as government and factoring organization advocacy and initiatives, cryptocurrency, increased use of digital platforms, and an increase in cross-border transactions.

Furthermore, the use of crypto-solutions has increased the accuracy of transactions and secured both parties’ important and confidential information preventing financial fraud. However, the factoring services market growth is being hampered by an increase in data breaches and data privacy violations. In addition, the increased implementation of machine learning, natural language processing (NLP), and artificial intelligence (AI) is expected to generate profitable growth prospects for the factoring services market in the near future.

| Report Coverage | Details |

| Market Size by 2034 | USD 12.41 Billion |

| Market Size in 2023 | USD 4.20 Billion |

| Market Size in 2024 | USD 4.64 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 10% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Category, Type, Component, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

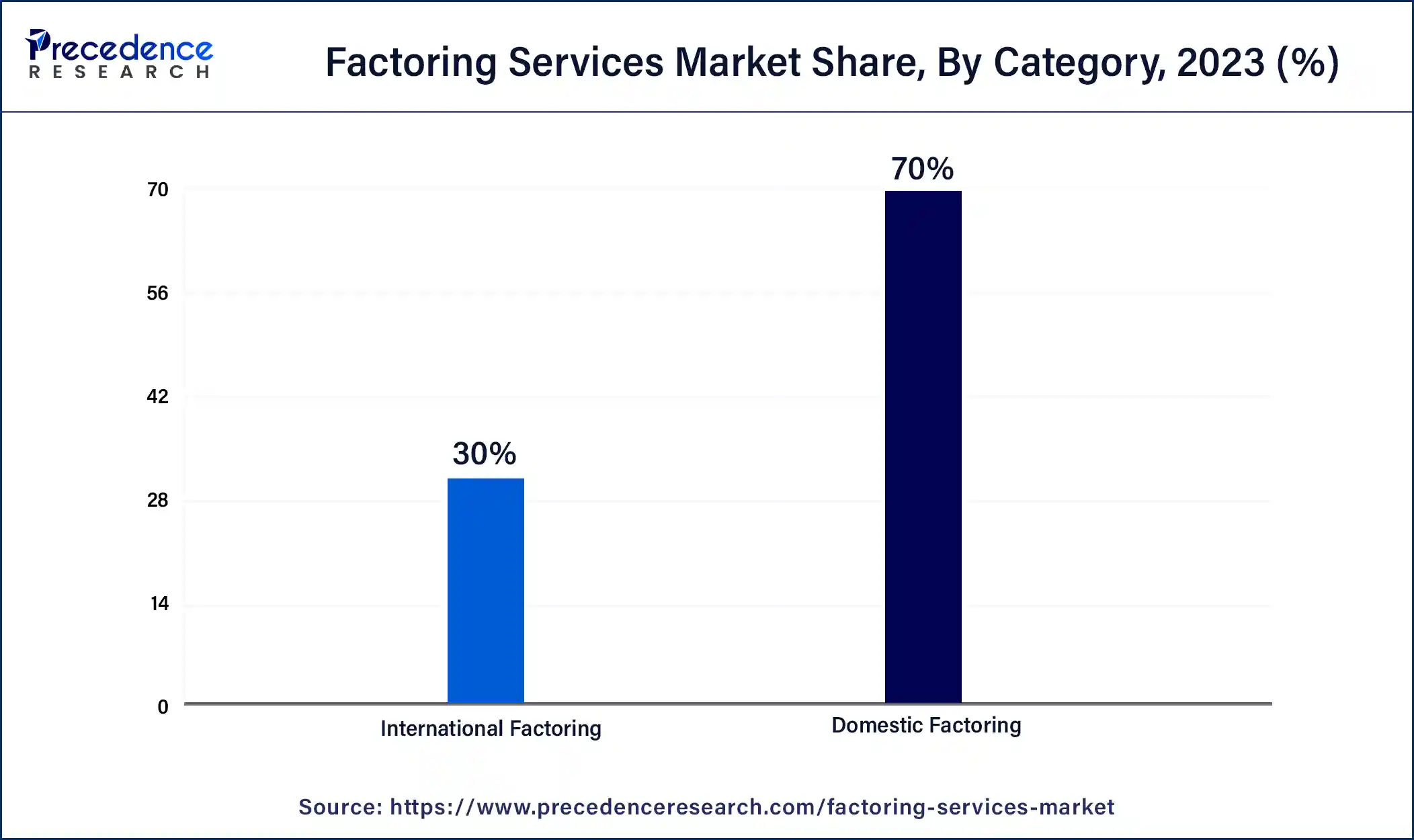

Based on thecategory, the domestic factoring segment accounted highest share of 70% in 2023. The domestic factoring is carried out within a country. Domestic factoring refers to the acquisition, funding, management, and collection of short-term accounts receivable deriving from the supply goods and services to domestic customers. The goods are distributed on a 180-day open account credit basis.

On the other hand, the international factoring is the fastest growing segment during the forecast period. For businesses involved in the import and export of goods and services, international factoring is a must-have service. Importers frequently demand account trade and longer payment terms from companies engaged in international trade, regardless of their size or industry. This entails receiving money several weeks after the invoice date.

Based on the type, recourse factoring led the market with highest share in 2023. Recourse factoringis agreement between a customer and a factor in which the client agrees to buy back the factor’s unpaid accounts receivable. As a result, in the event of non-payment by the debtor, the credit risk remains with the client.

On the other hand, non-recourse factoring is expected to grow at a faster rate during the forecast period. The customer and the factor enter into a non-recourse factoring agreement in which the factor assumes responsibility for absorbing any unpaid bills receivables. As a result, the unpaid invoices have no impact on the firm.

Based on the application, the small and medium enterprises (SMEs) is likely to dominate the factoring services market in 2023. As small and medium enterprises (SMEs) are the primary adopters of this financing facility, and the interest rates for both recourse and non-recourse factoring are almost same around the world, the global factoring services is anticipated to be dominated by small and medium enterprises (SMEs).

On the other hand, the large enterprises segment is expected to grow at a fast rate during the forecast period. The large enterprises’ increased need for non-recourse borrowing is likely to promote short-term financing in emerging nations, ensuring debt security, employment, and growth possibilities.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting different marketing strategies, such as new product launch, investments, partnerships, and mergers & acquisitions. The companies are also spending on the development of improved products. Moreover, they are also focusing on competitive pricing.

In December 2019, the China Construction Bank (CCB) launched the platform for factoring services and trading.

The various developmental strategies such as business expansion, investments, new product launches, acquisition, partnerships,joint venture, and mergers fosters market growth and offers lucrative growth opportunities to the market players.

Segments Covered in the Report

By Category

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

January 2025

September 2024

January 2025