December 2024

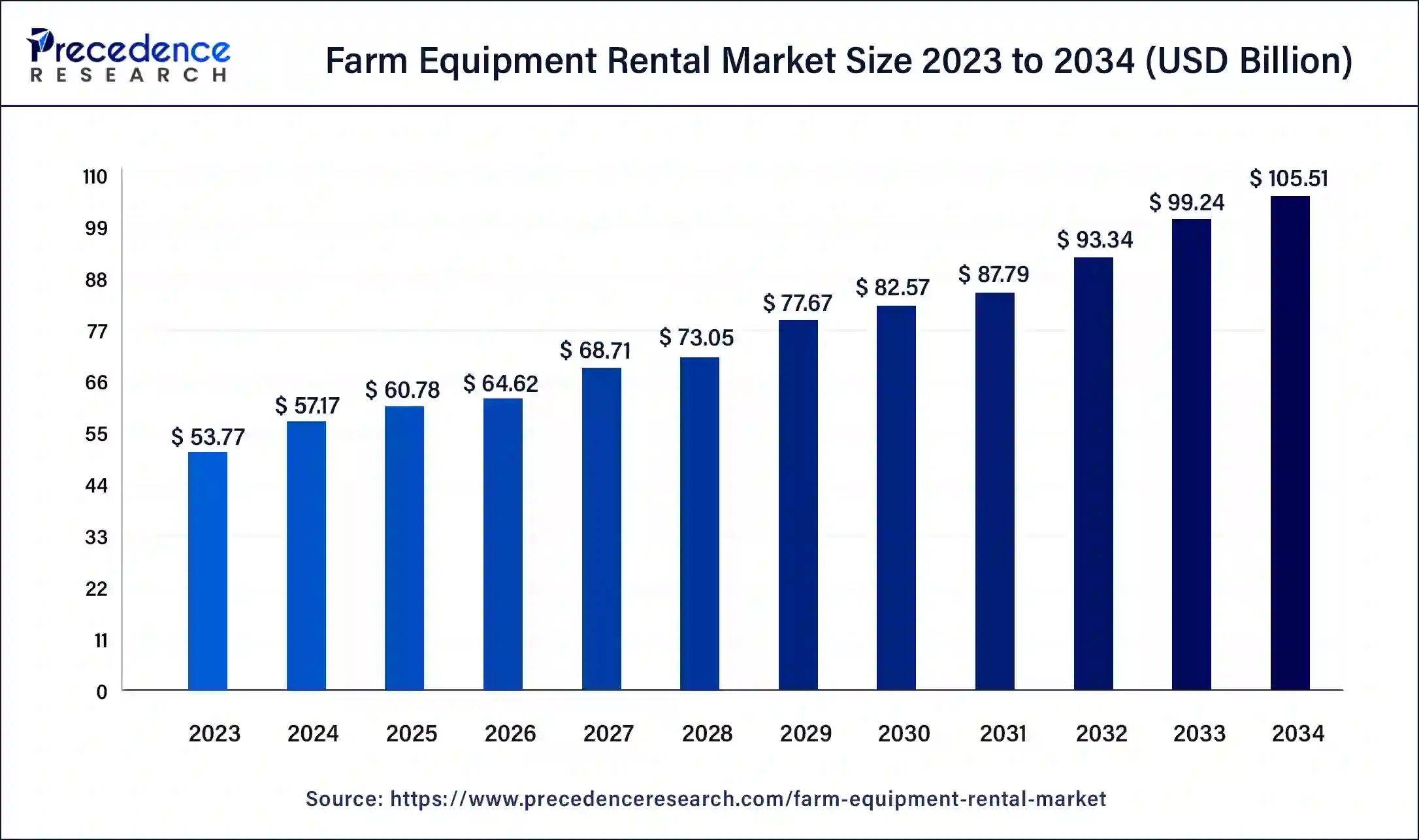

The global farm equipment rental market size was USD 53.77 billion in 2023, calculated at USD 57.17 billion in 2024 and is expected to be worth around USD 105.51 billion by 2034. The market is slated to expand at 6.32% CAGR from 2024 to 2034.

The global farm equipment rental market size is worth around USD 57.17 billion in 2024 and is anticipated to reach around USD 105.51 billion by 2034, growing at a CAGR of 6.32% over the forecast period 2024 to 2034. Increasing the upfront costs to purchase high-end farming equipment like tractors and harvesters, which makes low-scale farmers unable to buy these products, along with increasing awareness for agri-tech farming and farming as a services (FaaS) solution, is fuelling the farm equipment rental market.

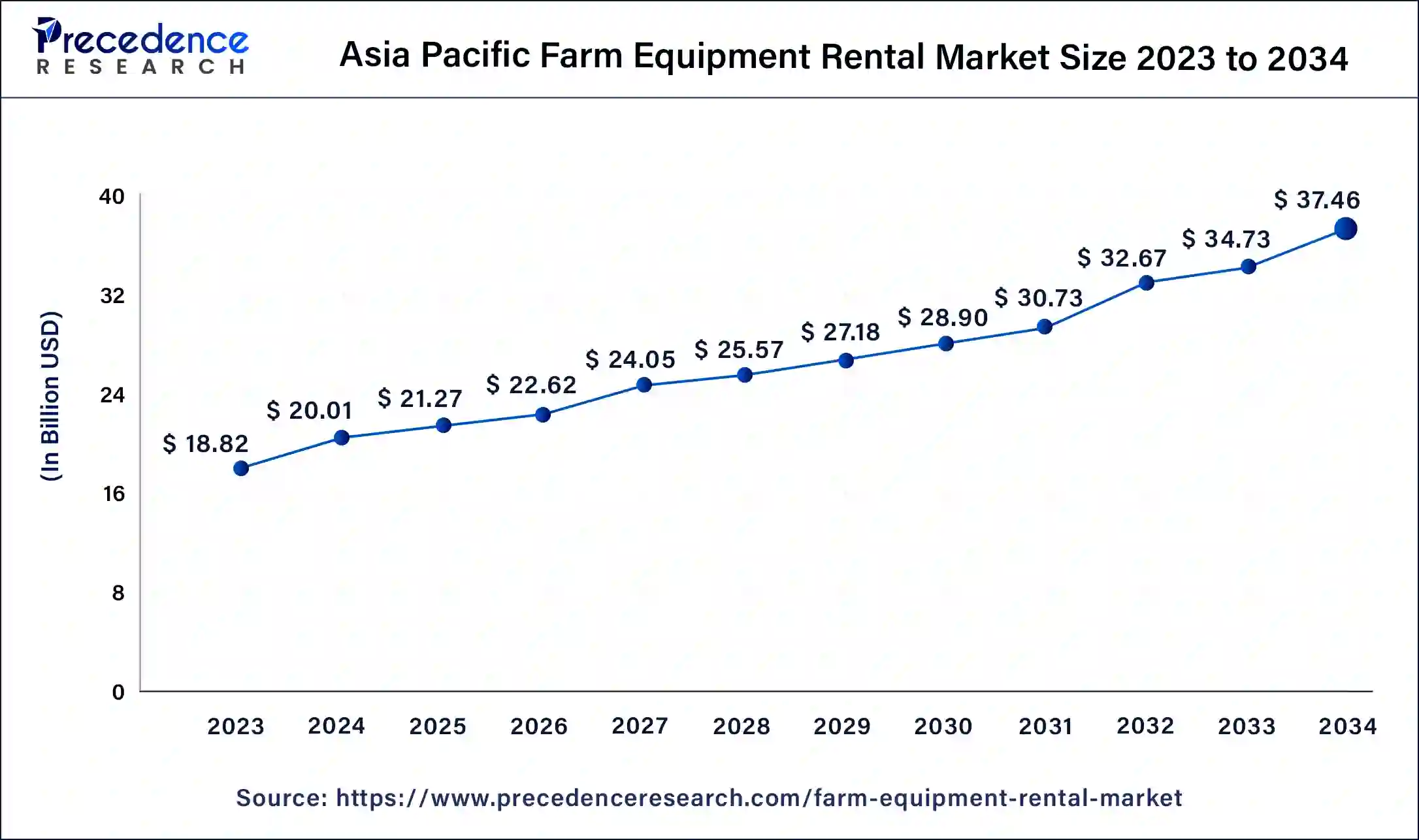

The Asia Pacific farm equipment rental market size was exhibited at USD 18.82 billion in 2023 and is projected to be worth around USD 37.46 billion by 2034, poised to grow at a CAGR of 6.45% from 2024 to 2034.

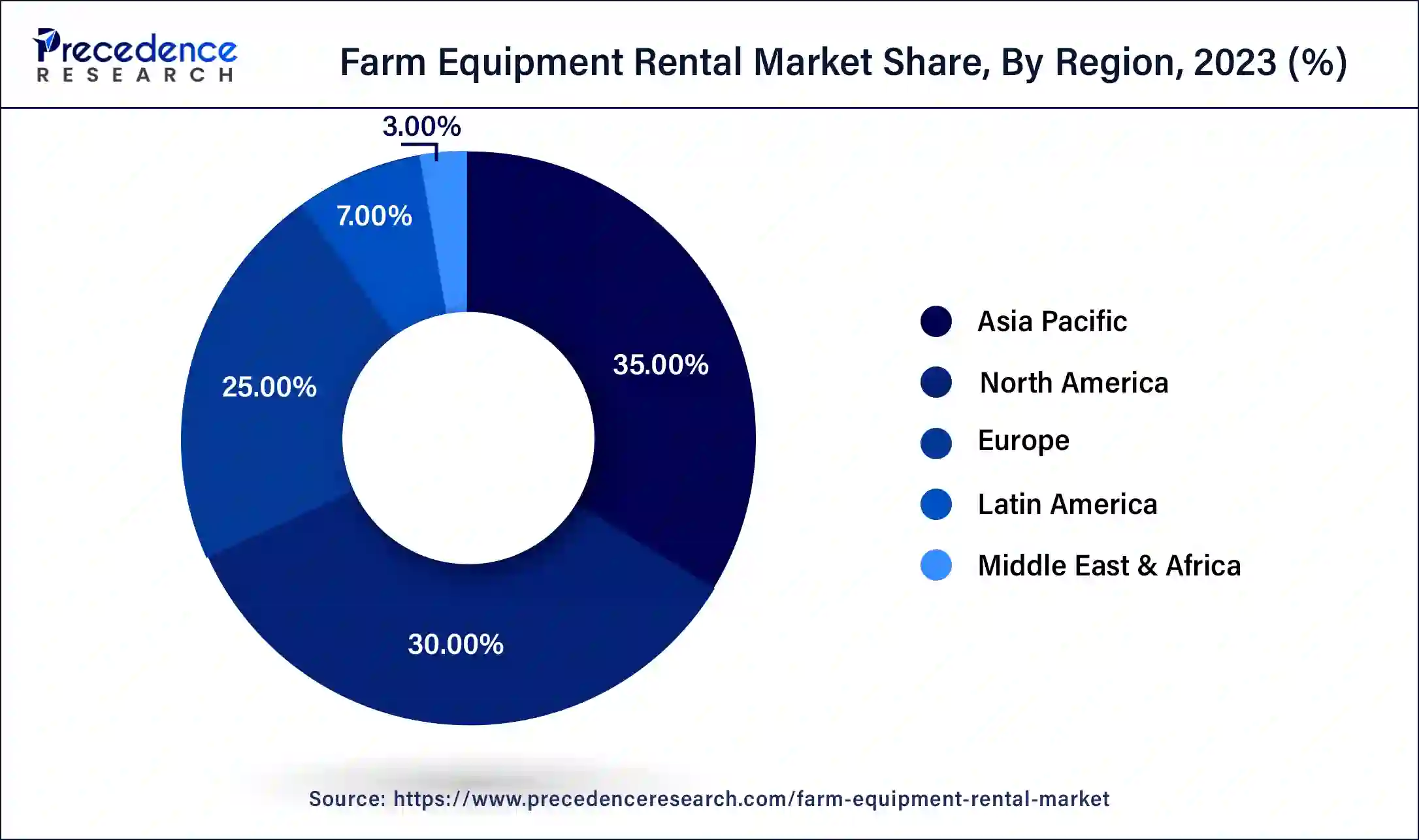

Asia Pacific accounted for the largest share of the farm equipment rental market in 2023. The growth of this region is attributed to factors like rising demand for a variety of tractors and rental farm equipment like sprayers and harvesters. In urban cities of India, this rental equipment is easily available, although small-town farmers need some support to leverage the rental equipment for farming.

Also, rising demand for mechanization in farming and low maintenance for the rental fleets is anticipated to gain traction of many large and medium-scale farmers in the Asia Pacific, fuelling the region's growth further. Government initiatives to reduce the financial burden on farmers and engaging activities by major key players are notable driving factors in the Asia Pacific.

North America is expected to witness the fastest growth in the farm equipment rental market during the forecasted years. The growth of this region is attributed to various factors, like technological advancements in the farming sector in North America, along with the government's strong support for hi-tech farming. Increasing adoption of technologies such as automated machinery and precise farming tools, including accurate sensing ability to forecast the environmental status.

In North America, major growth factors are due to the significant progress observed in the United States for the farm equipment rental market. Rental equipment providers belonging to the U.S. provide tools with cutting-edge technologies, GPS systems, and variable rate application tools, including automation in machinery, fuelling the market growth further with technically advanced farming practices.

Europe holds a notable presence in the global farm equipment rental market. Efficient and affordable farming practices are adopted by the farmers in Europe, and these practices are supported by the various framing authorities and the Ministry of Agriculture in Europe, fuelling the region's growth. CAP is the common Agricultural policy invented and made effective by the European government to support farmers financially while conserving resources and reducing carbon emissions as per the strict environmental rules followed in Europe.

The farm equipment rental market is expanding owing to factors like increasing mechanization in agriculture and high upfront costs required to purchase farming equipment, which is not possible for low- and medium-scale farmers. For them, farm equipment rental services are cost-effective and efficient for farming and producing maximum yield. Renting farming equipment offers reliable solutions and better financial alternatives and provides necessary machinery without the need to invest substantial costs.

The rise in agricultural start-ups with technological advancement and digital platforms is fuelling the farm equipment rental market further in a revolutionizing way. Mobile applications and online platforms provide details about farming equipment and are able to make transactions related to it, making it an easy option to adopt for better farming. Moreover, these solutions are equipped with technically advanced systems like IoT, advanced analytics, big data analytics, ML/AI, and real-time monitoring, making them more appealing and in-demand solutions for the agriculture sector.

AI Impact on the farm equipment rental market

AI is significantly impacting the farm equipment rental market with the help of ML algorithms and advanced data analytics. Algorithms are used to analyze huge amounts of generated data with historical patterns and to gain insights from it, which further helps to proliferate market growth. Rental companies can predict the market's inclination more accurately with the help of AI and provide customized packages for farmers. It also helps in inventory management, which is a crucial factor for cost-effective operations. Machine learning further helps identify potential threats before they manifest by using patterns and predictive maintenance, which, in turn, reduces downtime and provides more reliable solutions for consumers.

| Report Coverage | Details |

| Market Size by 2034 | USD 105.51 Billion |

| Market Size in 2024 | USD 57.17 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.32% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Equipment, Power Output, Drive Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Farming as a service evolution

The significant driving factor for the farm equipment rental market is the evolution of farming as a service and the increasing need for mechanization for agriculture tasks instead of manual help. The import and export of cereals are also major causes of market expansion. Increasing start-ups to provide farming equipment on rent has given rise to the market. Moreover, owning farming machinery requires solid upfront costs, which is not possible to invest by small and medium-scale farmers. For them, farming as a service culture is truly a boon as it helps them to save their unnecessary spending on farming and gives them huge returns.

Possible unavailability during peak seasons

A major restraint faced by the farm equipment rental market is the all-time dependency on the equipment providers, which leads to shortages of necessary farming equipment during the peak season, causing huge losses for farmers who opt for rental equipment instead of buying their own. Heightened demand during rainy seasons or peak seasons for farming leads to limited farming equipment availability or equipment not being in a proper position to work due to breakdowns and other issues regarding the machinery.

Technically well-equipped tractors and services

The major opportunity that the farm equipment rental market holds is the increasing development of various rental services for tractors with different horsepower as per requirements, fuelling the market notably on a global level. The increasing farmers' inclination for tractors with more than 40 horsepower creates a lucrative opportunity for farm equipment rental providers to strengthen their roots in the market by providing highly advanced and technically well-equipped tractors like utility tractors and row crop tractors. Furthermore, government initiatives should provide tractors with different ranges to mitigate financial burdens on the farmers.

The tractors segment accounted for the largest share of the farm equipment rental market in 2023. The tractor segment holds its dominance due to the variety of fundamental tasks related to agriculture that depend upon tractors. The power and versatile nature of tractors help with tasks like planting, plowing, and harvesting, along with goods transportation from one place to another.

The harvesters segment is expected to witness rapid growth in the farm equipment rental market over the studied years. Farmers are looking for cost-effective solutions to perform repetitive tasks in the agriculture sector, such as mechanization of the process instead of hiring laborers for tasks. Renting harvesters seasonally can help farmers manage their expenses while managing the ownership more effectively. Using the equipment on rent only when it is required avoids unnecessary wastage of initial investments and yearly maintenance.

The 41 HP to 100 HP segment dominated the global farm equipment rental market in 2023. Horsepower means HP plays a crucial role in determining the ability of tractors to work. These types of horsepower are used for heavy-duty tasks and large farm work for extended periods. The Kubota M4 series and Massey Ferguson 4700 are prime examples of this range of horsepower tractors. It's generally used for commercial farming processes and for heavy-lifting objects.

The 100HP segment is expected to witness the fastest growth in the farm equipment rental market during the forecasted years. The growth of this segment is due to the qualities and features of 100HP tractors, which are advantageous for medium-sized farming. Since 100 HP tractors are versatile, powerful, handlining complex terrains, and efficient enough to allow a balance between affordability and capability.

HP ranges and their features

| Horsepower | Type of Work | Tractor Example |

| 15-20 HP | Small-scale tasks, lawn mowing, gardening | John Deere 1025R |

| 21-35 HP | Medium-duty tasks, small farm work | Yanmar SA324 |

| 36-60 HP | Heavy-duty tasks, larger farm work | Kubota M4 Series |

| 61-100 HP | Commercial farming, heavy lifting | Massey Ferguson 4700 |

| 100-200 HP | Large-scale farming, advanced tasks | Case IH Maxxum Series |

| 200+ HP | Industrial farming, demanding tasks | New Holland |

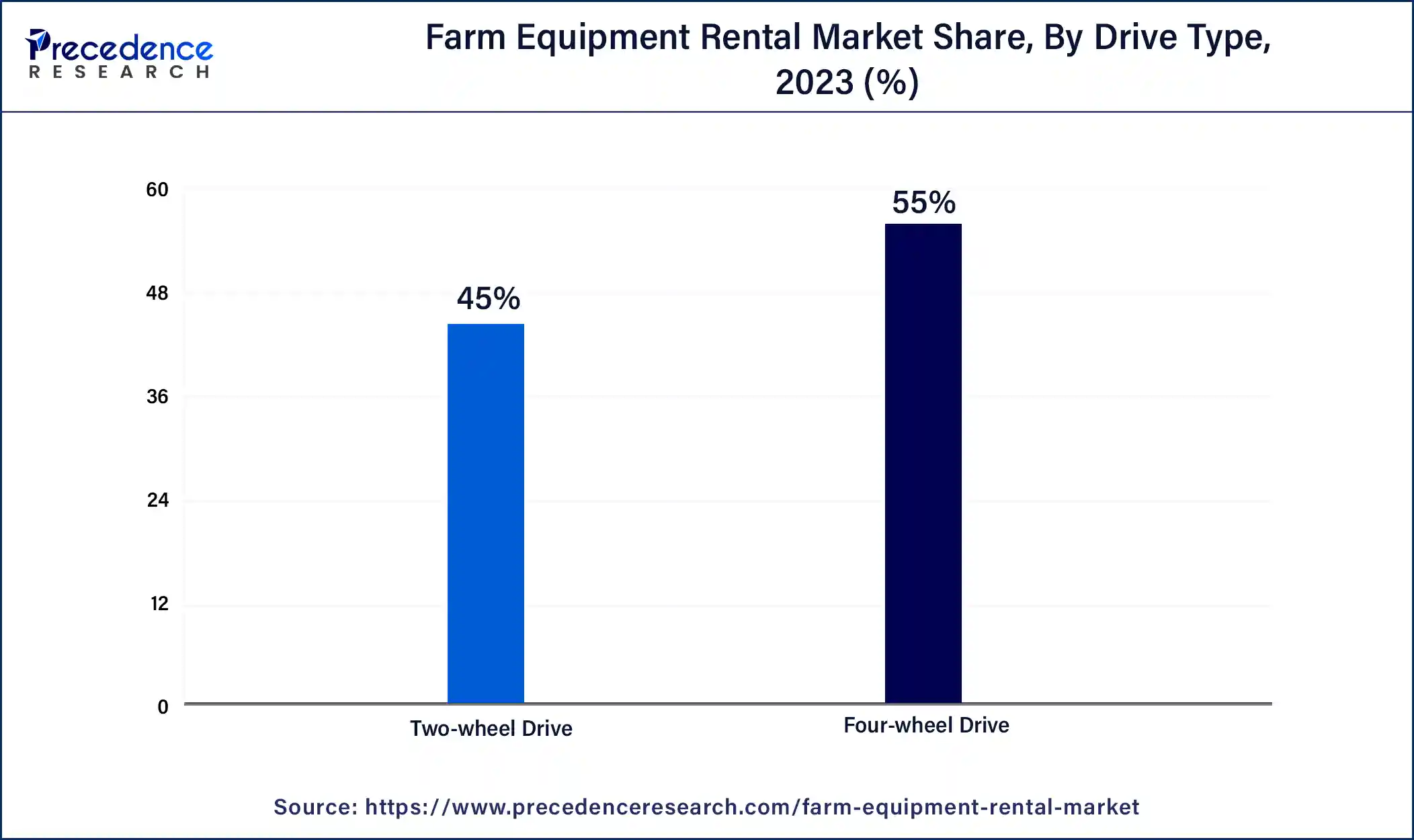

The four-wheel drive segment led the global farm equipment rental market. Four-wheeler drive in agriculture provides better fuel efficiency and carrying capacity due to its robust nature, versatility for tasks, and enhanced safety features, fuelling the adoption of four-wheel drive in the market. Also, while operating in mud, the four-wheel drive provides a better grip.

The two-wheel drive segment is expected to witness significant expansion in the farm equipment rental market during the forecast period. Cost saving is the significant benefit provided by the two-wheel drive for the farm equipment rental market. These tractors are more comfortable to handle manually than four-wheel drives. Two-wheel drive-type tractors are better options for farmyards, gardens, and around trees and city areas.

Segments Covered in the Report

By Equipment

By Power Output

By Drive Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

February 2025

January 2025