January 2025

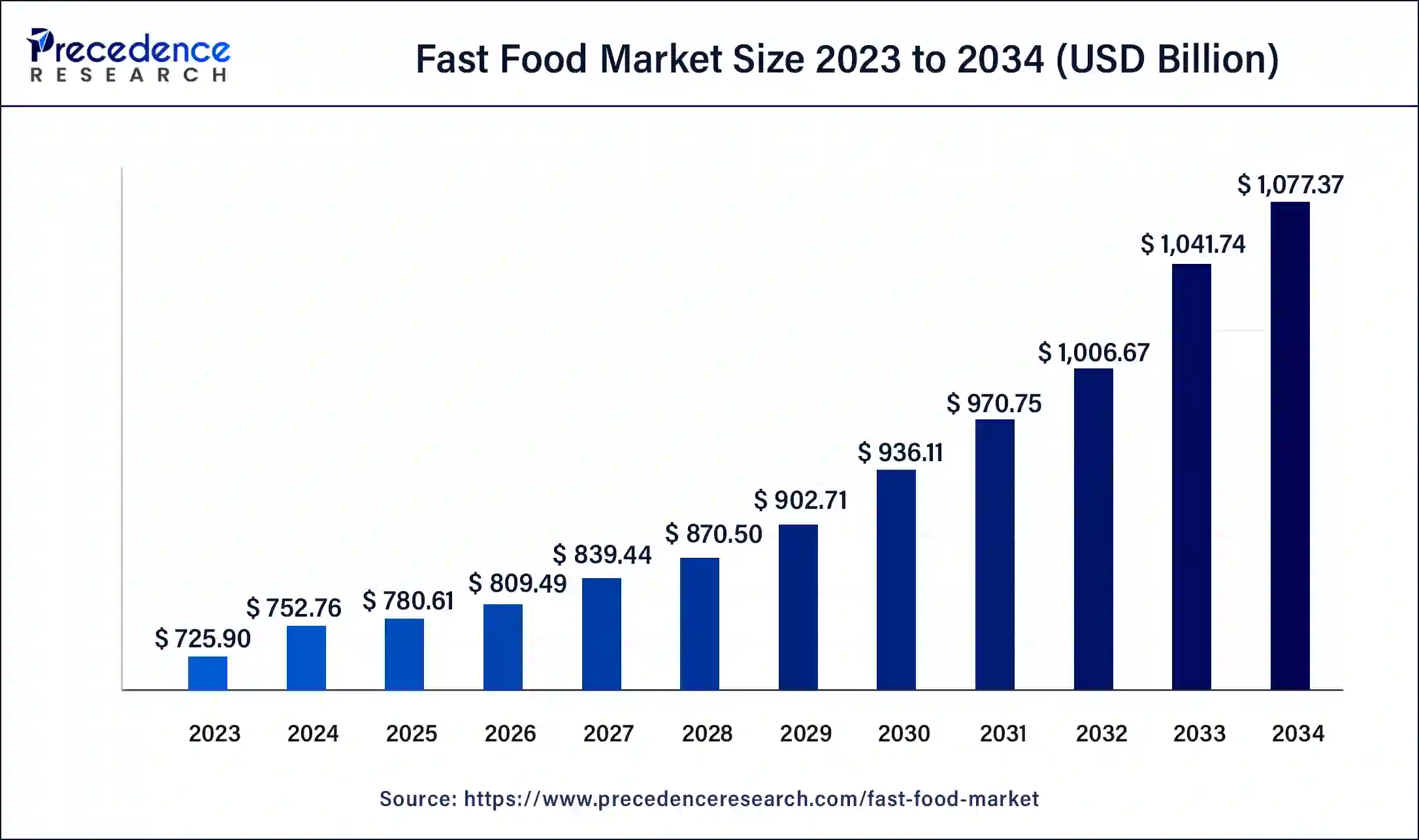

The global fast food market size is estimated at USD 780.61 billion in 2025 and is predicted to reach around USD 1,077.37 billion by 2034, accelerating at a CAGR of 3.65% from 2025 to 2034. The North America fast food market size surpassed USD 210.77 billion in 2024 and is expanding at a CAGR of 3.83% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global fast food market size was calculated at USD 752.76 billion in 2024 and is expected to reach around USD 1077.37 billion by 2034, expanding at a CAGR of 3.65% from 2025 to 2034.

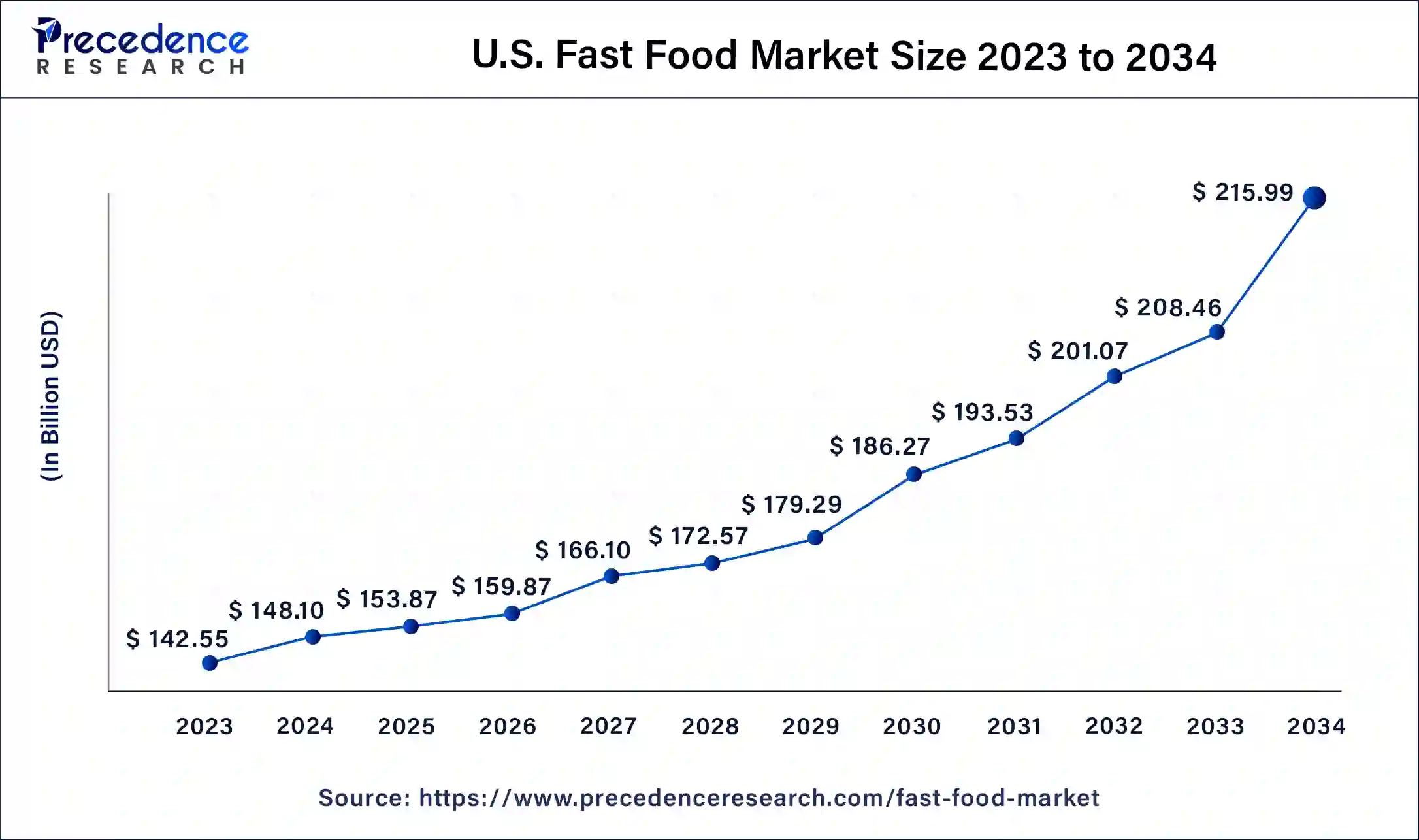

The U.S. fast food market size was valued at USD 148.10 billion in 2024 and it is predicted to reach USD 215.99 billion by 2034 with a CAGR of 3.85% from 2025 to 2034.

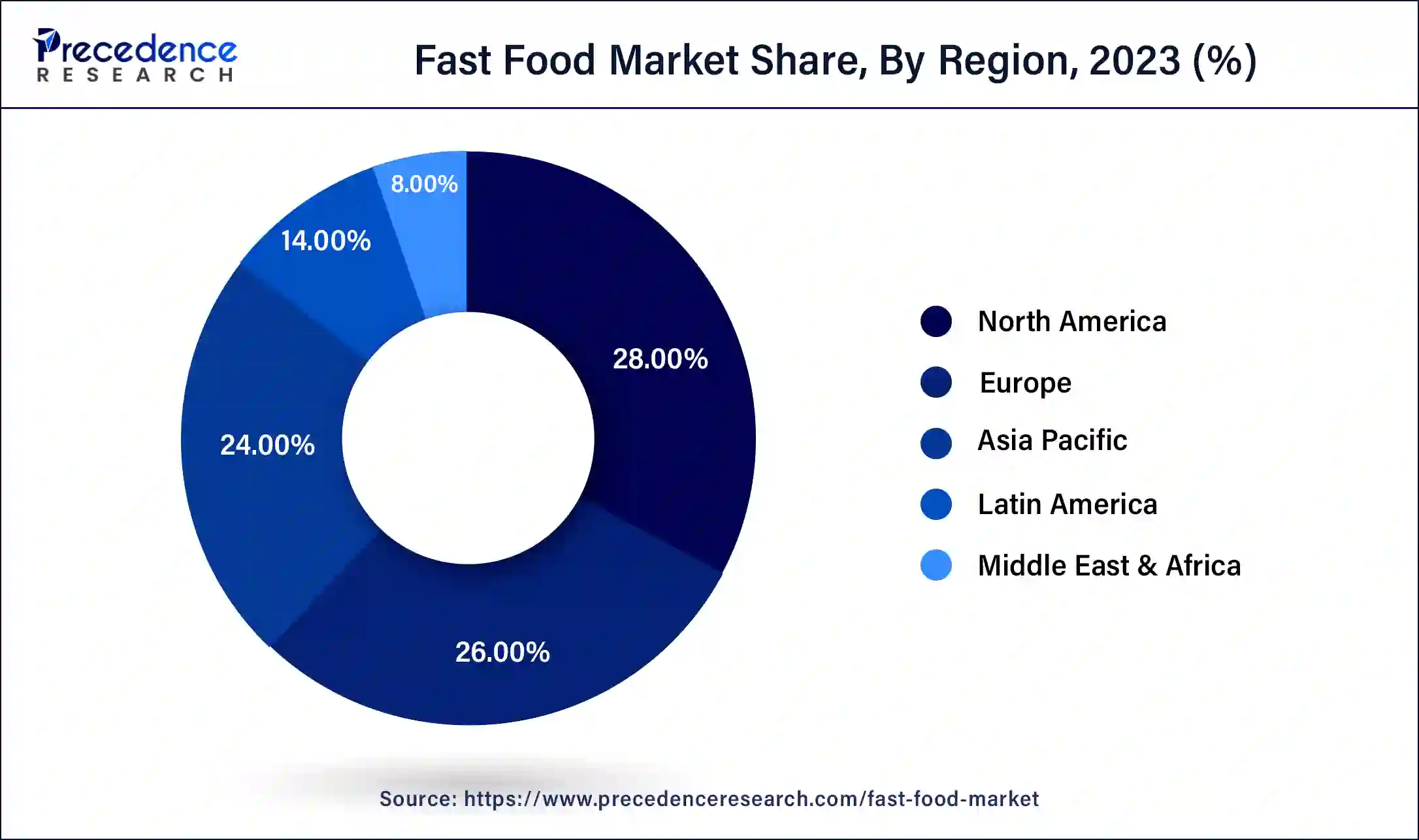

North America dominated the fast food market in 2024 with revenue share of 28%. The growth of North America fast food market is attributed to the growing consumer expenditure on fast food. In addition, the shift in consumer taste and preference is driving the demand for fast food in regional market. The introduction of new flavors is also driving the growth and expansion of fast food market in North America region.

Asia-Pacific is expected to develop at the fastest rate during the forecast period. India, China, and Japan dominate the fast food market in Europe region. The factors are growing population, rising disposable income and changing consumer preferences. Furthermore, the fast food produced with natural ingredients is boosting the growth and development of Asia-Pacific fast food market.

One of the significant factors driving the growth of global fast food market is the growing number of working women globally. The female employment rate in the U.S. in 2019 was 46%, as per the U.S. Department of Labor. Consequently, women’s employment rates in South Africa and China were around 45% and 43.7% respectively. In addition, the growing number of hotels and restaurants is also driving the expansion of global fast food market.

The fast food market is continuously developing due to rising demand for on the go snacks, convenience foods, and ready meals. The busy lifestyle of millennials and the worldwide rise of working people had an impact on the fast food consumption. This will almost certainly help the fast food industry expand globally. The consumer spending on food eaten away from home has increased over the last few years. The increase in employment rates around the world adds to this. Thus, it is now easier to consume on the go cuisine.

Another factor contributing towards the growth of global fast food market is rapid industrialization and urbanization. In addition, rising disposable income is also driving the global fast food market. The growing demand for ready to eat food and beverages is boosting the demand for fast food in the global market. Moreover, the expansion of food and beverage industry is supporting the expansion of worldwide fast food market over the projected period.

The other factors driving the expansion and development of global fast food market is the growing adoption of online sales channel as a distribution channel. The restaurants and hotels are selling their food products through e-commerce platforms, which is contributing towards the growth and development of global fast food market over the forecast period.

The fast food market’s major players have well developed global distribution networks. To meet evolving consumer tastes, companies in the global fast food market are updating their menus and services. Furthermore, an increase in the number of quick service restaurants in the fast food market is assisting businesses in increasing sales. To broaden their presence globally, the market players are actively investing in media and collaborations with content providers. In addition, the corporation has introduced an application that allows employees to select their preferred career paths. All such strategies are driving the growth of global fast food market.

| Report Coverage | Details |

| Market Size by 2034 | USD 1077.37 Billion |

| Market Size in 2025 | USD 780.61 Billion |

| Market Size in 2024 | USD 752.76 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.65% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The burgers/sandwich segment accounted revenue share of around 43% in 2024. The demand for burgers/sandwich is growing at rapid pace in the global market. The consumers consume about 50 billion burgers each year, according to the United States Department of Agriculture. The demand for convenience food is driving demand for burgers/sandwich. In addition, the growing trend of ready to eat food products is also propelling the expansion of segment.

The Asian/Latin American segment is projected to reach at the fastest rate over the forecast period. The expansion of this segment is fueled by rising demand for wide range of food products. The demand for Mexican food is increasing in the U.S., due to an increase in the Hispanic population. According to the Simmons National Consumer Survey and the U.S. Census Bureau, about 110 million Americans ate tortillas in 2017.

The quick service restaurants segment accounted largest revenue share 45% in 2024. The quick service restaurants serve cuisine that requires little preparation time and is served quickly. The quick service restaurants often offer a restricted menu of fast food items that can be prepared in a shorter amount of time with the least amount of diversity. Many fast food businesses have implemented hospitality point of sale systems to allow for speedy service while also ensuring security and reliability. This allows kitchen staff members to see real time orders placed at the front counter or through the drive through. The wireless technologies enable cashiers and cooks to take orders given at drive through speakers. Thus, technological advancements are driving the growth of the quick service restaurants segment.

The fast casual restaurants segment is expected to witness strong growth from 2023 to 20302. The fast casual restaurants provide customers with freshly cooked, high-quality meals in a relaxed setting with counter service to keep things moving quickly. The fast casual restaurant, which is mostly located in the U.S. and Canada, does not provide full table service but promotes high quality meals with less processed or frozen ingredients than fast food restaurants. It’s a hybrid of fast food and informal dining.

By Product

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2025

September 2024

January 2025