January 2025

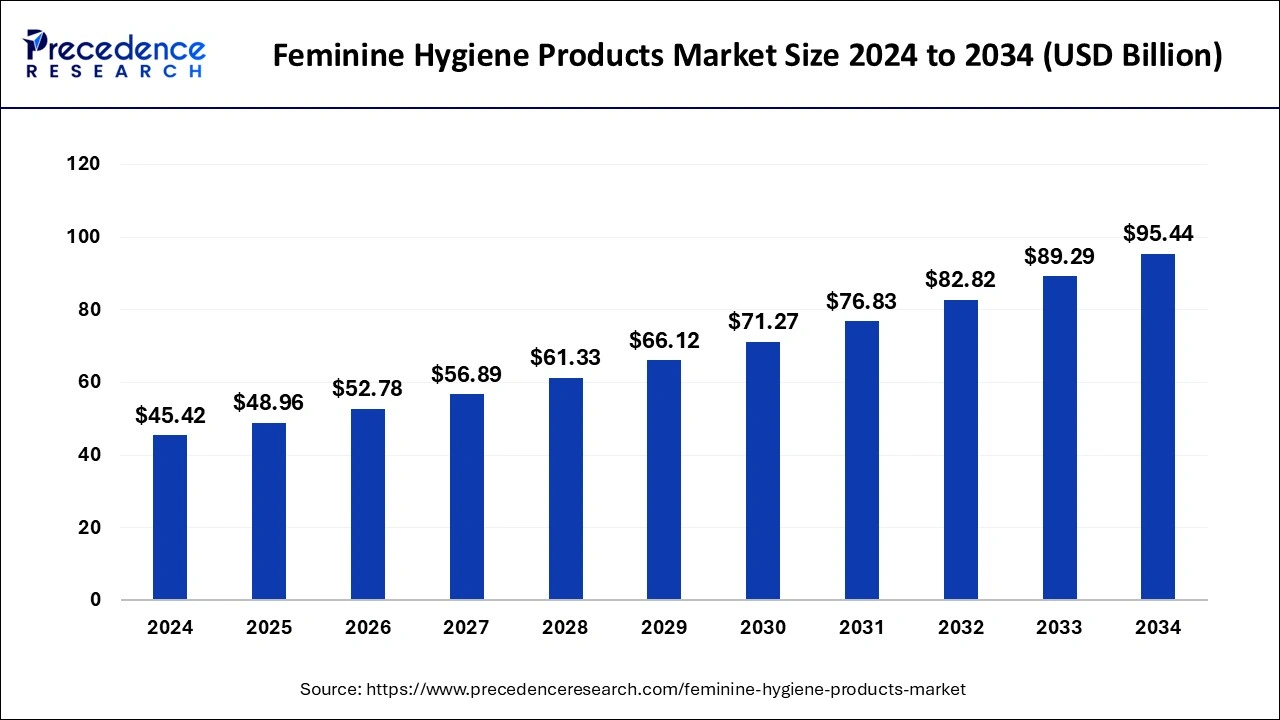

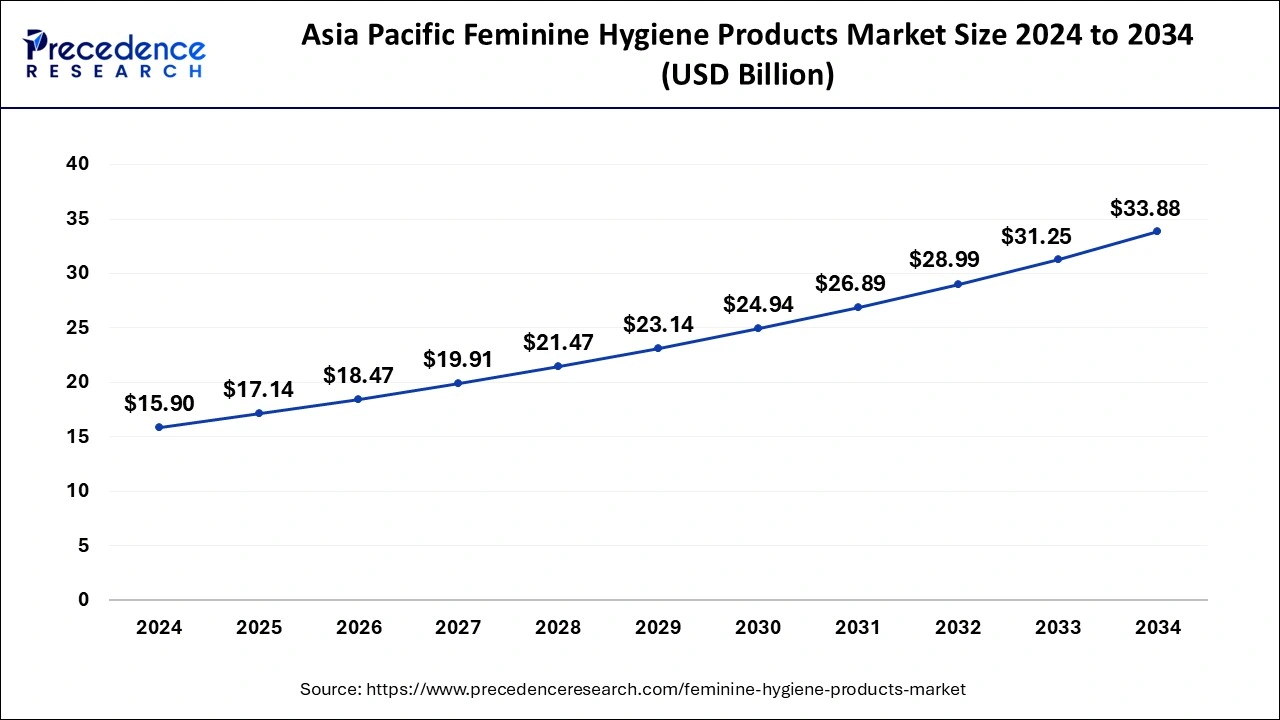

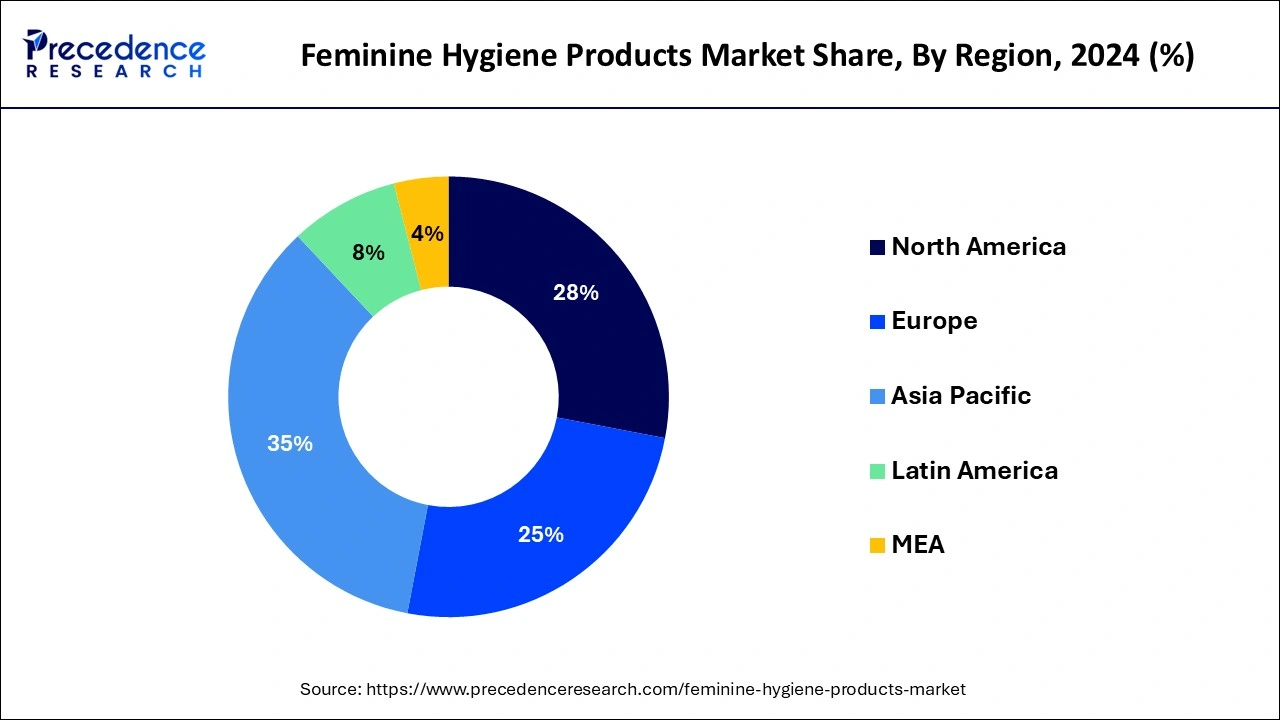

The global feminine hygiene products market size is calculated at USD 48.96 billion in 2025 and is forecasted to reach around USD 95.44 billion by 2034, accelerating at a CAGR of 7.71% from 2025 to 2034. The Asia Pacific feminine hygiene products market size surpassed USD 17.14 billion in 2025 and is expanding at a CAGR of 7.86% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global feminine hygiene products market size was estimated at USD 45.42 billion in 2024 and is predicted to increase from USD 48.96 billion in 2025 to approximately USD 95.44 billion by 2034, expanding at a CAGR of 7.71% from 2025 to 2034. Rising literacy about intimate and menstrual health is driving the market's growth.

The Asia Pacific feminine hygiene products market size was estimated at USD 15.90 billion in 2024 and is predicted to be worth around USD 33.88 billion by 2034 with a CAGR of 7.86% from 2025 to 2034.

Asia Pacific led the feminine hygiene products market with the largest market share in 2024. The growth of the market in the region is increasing due to the evolving population, especially the women population in the region, and the rising awareness regarding feminine hygiene that drives the growth of the market. The changing lifestyle increased disposable income, and rising urbanization are driving the demand for luxury and hassle-free lifestyles. The surge in investment in living standards and the higher availability of several competitor products with different price categories drive the adoption of feminine hygiene products in the market in the region.

North America is expected to witness the fastest growth during the forecast period. The region is showing significant growth in the market due to the rising women population that anticipated the higher demand for feminine hygiene products. The rising cases of hygiene-related problems among women in regional countries are driving the demand for female hygiene products in the market. The increased presence of the major market players in women's hygiene is also propelling the expansion of the feminine hygiene products market in the region.

In the North American region, countries like the U.S. and Canada promote the growth of the market. The U.S. is a highly developed country and is a hub for various hygiene products companies such as Johnson & Johnson, Procter & Gamble, Kimberly-Clark, Natracare LLC, First Quality Enterprises, Inc., and so on. They are known for launching new and better products, which not only improve female hygiene but also improve sustainability and reduce negative environmental impact.

The feminine hygiene products market provides various hygiene products needed for better hygiene, especially during teenage and adulthood. Some feminine hygiene products include menstrual care products (pads, tampons, menstrual cups, and period pants), intimate cleansers (panty liners and others), moisturizers, pain relief products, and others. Feminine hygiene products are found in both the disposable and reusable categories. Feminine hygiene products are an important part of women's lives.

They help manage various hygiene and health-related aspects. The rising awareness about menstrual health drives the demand for various menstrual products like sanitary pads, tampons, and others to manage the blood flow during menstruation and maintain intimate hygiene. The increasing literacy about healthcare and intimate health in women, rising urbanization, and availability of products are driving the growth of the feminine hygiene products market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.71% |

| Market Size in 2025 | USD 48.96 Billion |

| Market Size by 2034 | USD 95.44 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising concern about intimate hygiene

The rising female population globally and the increasing literature rate, urbanization, and modernization are causing higher awareness about intimate hygiene. The rising prevalence of hygiene-related issues in women is driving the demand for feminine hygiene products. The shift in lifestyle and the rising disposable income are driving the sales rate of feminine hygiene products. The rising awareness about menstrual hygiene is driving the demand for hygiene products like sanitary pads, menstrual cups, tampons, and others to maintain intimate hygiene during the menstrual cycle, which is contributing to the growth of the feminine hygiene products market. The increasing awareness about menstrual hygiene is due to the rising cases of urinary tract infections, reproductive tract infections, and genital rashes during menstrual cycles.

Unawareness and social stigma in underdeveloped and rural areas

Unawareness and social stigma are some of the major challenges associated with the expansion of feminine hygiene products in underdeveloped countries and rural areas. The social stigma about menstruation and intimate hygiene is limiting from adopting the hygiene products and accessing the information about the products. Government initiatives to create awareness and provide information regarding basic and advanced feminine hygiene via schools and communal programs can help mitigate this challenge.

Evolution of feminine hygiene products

The ongoing evolution in feminine hygiene products in terms of sustainability, technological integration, customization, and others is driving the opportunity for market growth. The rising demand for sustainable, environmentally friendly hygiene products is due to the rising awareness about environmental pollution and carbon footprints in the atmosphere. The increasing demand for sustainable hygiene products drives manufacturers to produce products that meet the standards of sustainability and consumer expectations.

Additionally, technological integration into feminine hygiene products enhances the consumer experience with more efficiency, comfort, and safety. Revolutionary changes in the material from the traditional material improve comfort and absorbency, and smart products are used to manage menstrual health. The rising demand for personalized products is also attracting consumers and driving the demand for feminine hygiene products in the feminine hygiene products market.

The menstrual care products segment dominated the feminine hygiene products market in 2024. Menstrual care products are one of the major feminine hygiene products. The increasing awareness regarding menstrual hygiene is due to the rising menstrual education and literacy rate among the population. Menstrual care products like sanitary pads, tampons, panty liners, and others manage menstrual discomfort and provide safety and comfort during the menstrual cycle. Sanitary pads are one of the most selling products worldwide for managing menstrual cycles.

Sanitary napkins or pads are the most effective and hassle-free menstrual products. Tampons are another type of menstrual hygiene product made with cotton tightly packed into a tent or cylindrical shape. It is inserted into the vaginal canal and absorbs the blood flow into the vaginal canal; it is removed by pulling the attached string that hangs out for pulling out the tampon. Panty liners, menstrual cups, and period underwear are some examples of menstrual care products. The evolution and ongoing research on menstrual product development and launch are driving the growth of these products in the feminine hygiene products market.

The supermarkets/hypermarkets segment is projected to have the largest share in the feminine hygiene products market in 2024. The growth of the segment is attributed to the higher availability of a wide range of female hygiene products with attractive pricing and discounts. It is the one-stop solution for females to buy hygiene products like pads, tampons, intimate hygiene wash, and other hygiene products in bulk at discounted prices. Tampons and sanitary pads are generally higher in price and are not affordable for middle-class or lower-income people. The supermarket provides the best quality products with different offers and discounted prices. The rising urbanization in the counties results in the increased presence of supermarkets/hypermarkets in the cities, which drives the higher adoption of these segments for purchasing hygiene and other products.

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

January 2025

January 2025