July 2024

Fetal Monitoring Market (By Product: Ultrasound, Electronic Fetal Monitoring (EFM); By Method: Invasive, Non-invasive, By Portability: Portable, Non-portable; By Application: Intrapartum fetal monitoring, Antepartum fetal monitoring; By End user: Others, Hospitals and maternity hospitals, Clinics) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

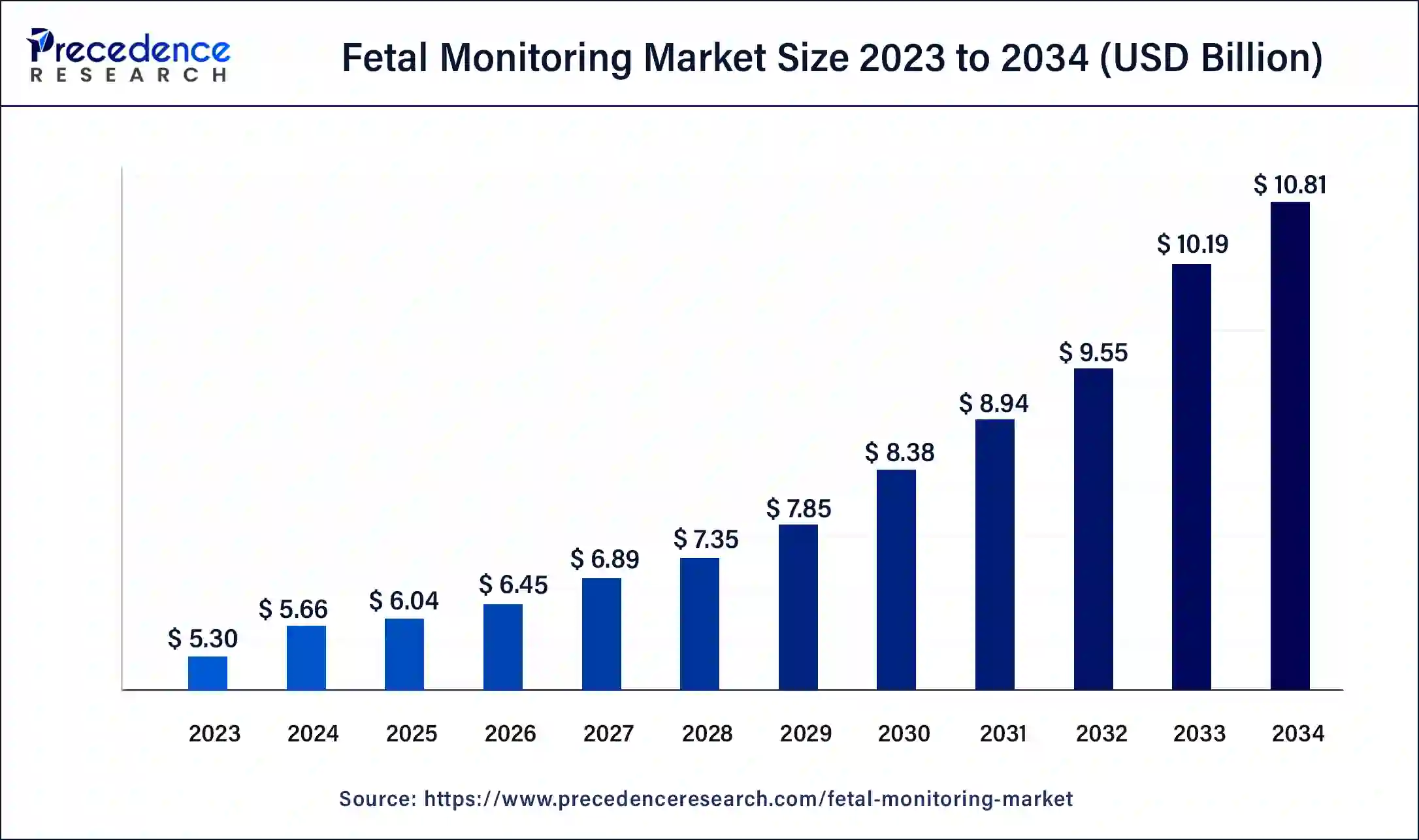

The global fetal monitoring market size was USD 5.30 billion in 2023, calculated at USD 5.66 billion in 2024, and is expected to reach around USD 10.81 billion by 2034, expanding at a CAGR of 6.7% from 2024 to 2034. Increasing precision and effectiveness of monitoring methods and developments in fetal monitoring technology, such as the creation of non-invasive and portable monitoring devices, are propelling market expansion.

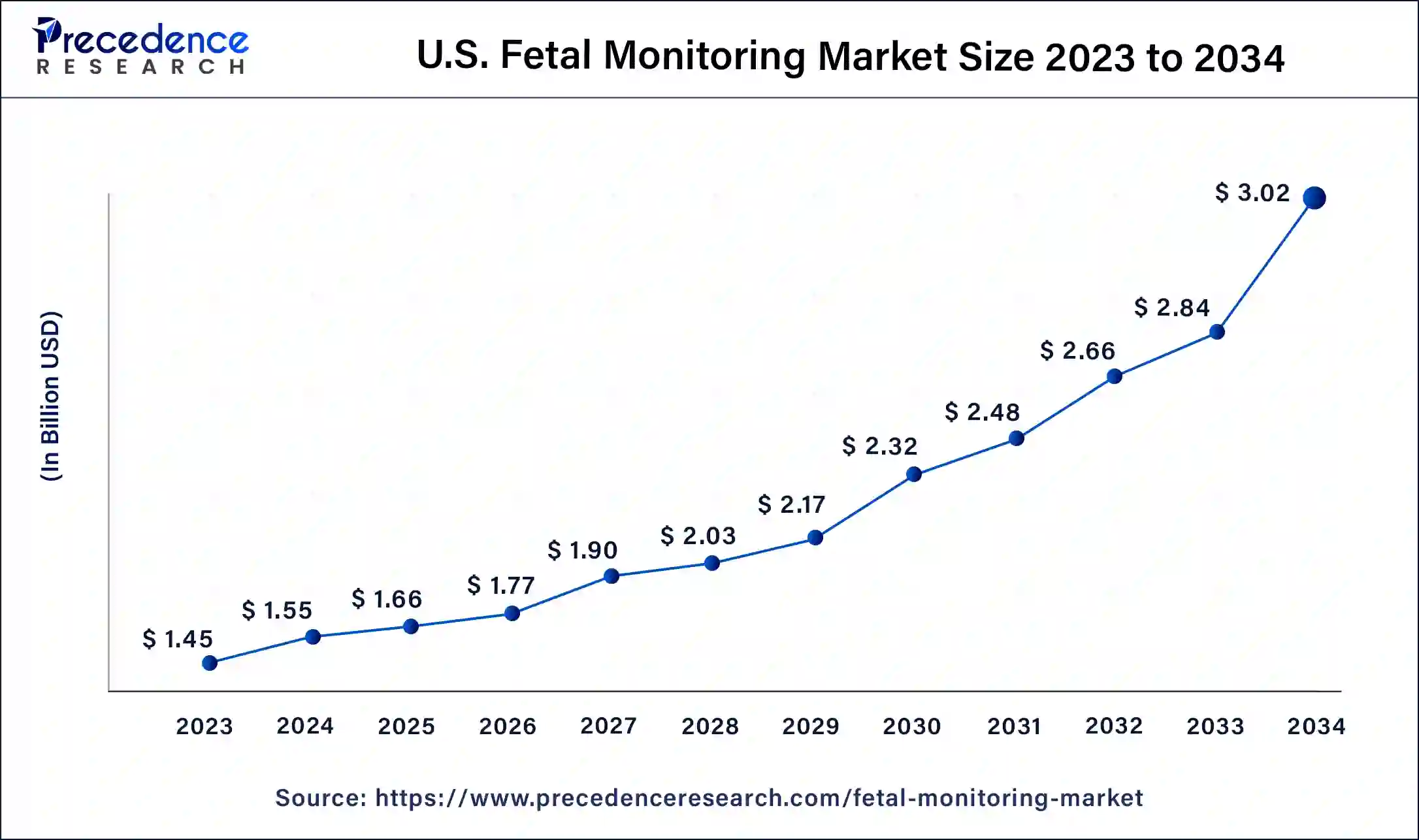

The U.S. fetal monitoring market was estimated at USD 1.45 billion in 2023 and is expected to be worth around USD 3.02 billion by 2034 at a CAGR of 6.90% from 2024 to 2034.

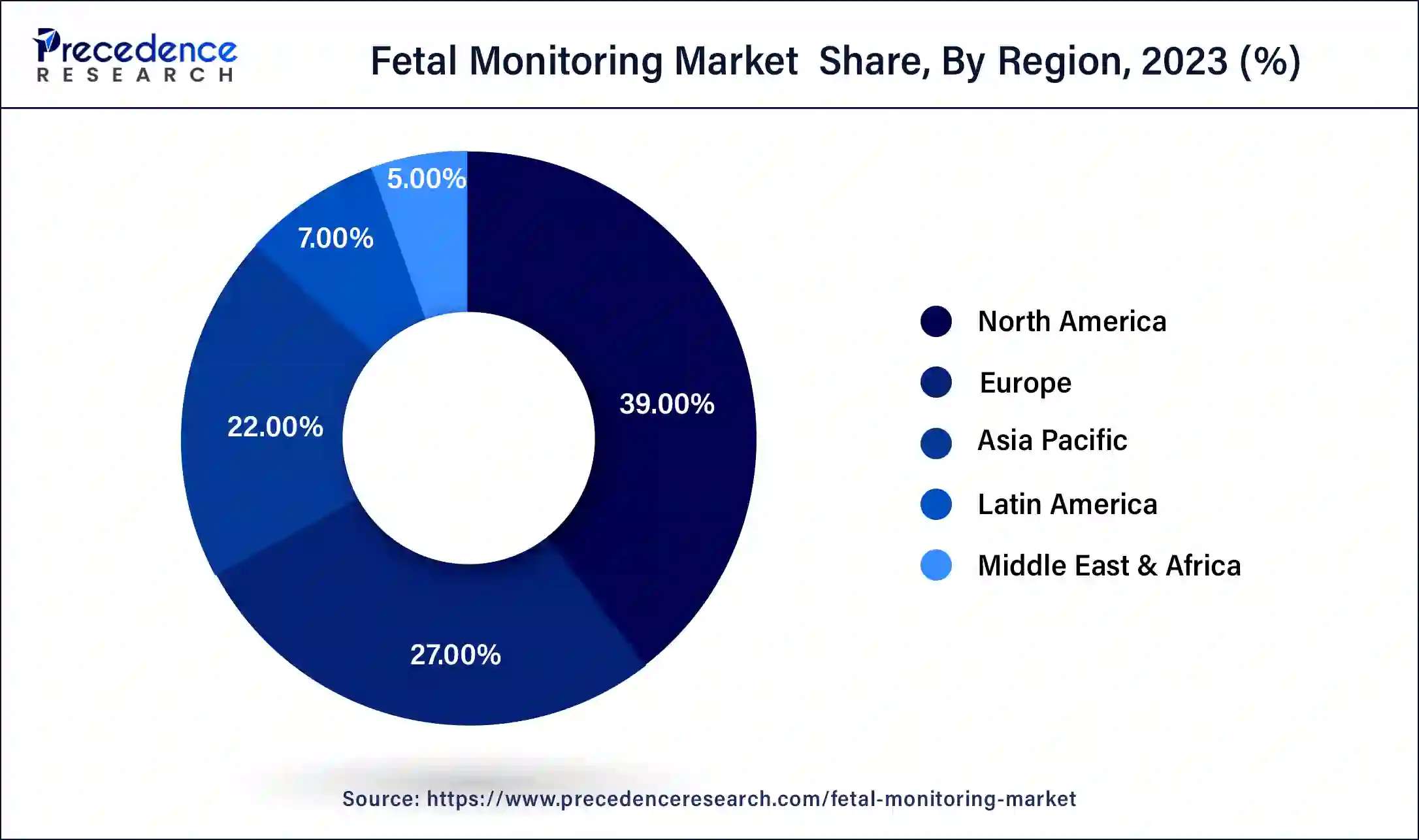

North America dominated the fetal monitoring market in 2023. Its well-established healthcare infrastructure and high healthcare spending encourage the adoption of advanced medical technologies, including fetal monitoring devices. The region's rising number of high-risk pregnancies, older expectant mothers, and increased awareness about fetal monitoring's benefits drive device demand.

North America hosts many leading players in the medical device industry, constantly introducing cutting-edge fetal monitoring technologies. Favorable reimbursement policies and government efforts to enhance maternal and neonatal care also contribute to market growth.

Asia-Pacific is expected to experience the highest growth rate in the fetal monitoring market during the forecast period. This growth can be attributed to the presence of medical device companies in the region and the increasing purchasing power of densely populated countries like China and India.

Advancements in healthcare and a rise in pregnancy cases contribute to market expansion. Given the high population density in Asia Pacific, particularly in India and China, the large population size and increasing pregnancy cases are expected to further drive growth in the fetal monitoring market in this region.

Fetal monitoring devices are essential tools to track the heart rate and movements of the fetus and the mother's contractions. This monitoring is crucial in ensuring the well-being of the unborn baby and a safe delivery. It involves measuring the baby's heart rate, typically during the later stages of pregnancy and labor, to ensure both mother and baby remain healthy and safe. These devices are also utilized to monitor various conditions such as chronic mental retardation, hypothermia, lung diseases, neonatal diseases, vision and hearing problems, and jaundice.

Fetal monitoring is typically conducted using either a handheld Doppler device or an electronic fetal monitor. It becomes particularly important during labor, when complications may arise, or when certain medical interventions like epidurals or oxytocin are needed to induce or augment labor. There are two methods for fetal monitoring: external and internal. It is especially beneficial for women with high-risk pregnancies, particularly those with conditions like high blood pressure or diabetes.

| Report Coverage | Details |

| Global Market Size by 2034 | USD 10.81 Billion |

| Global Market Size in 2023 | USD 5.30 Billion |

| Global Market Size in 2024 | USD 5.66 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.70% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Method, Portability, Application, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increase incidence of pregnancy-related complications

The rise in pregnancy-related complications like gestational diabetes, hypertension, and preterm labor has made fetal monitoring crucial for closely monitoring the baby's health and identifying any potential problems early. This monitoring enables timely interventions and proper management of complicated pregnancies. This drives the growth of the fetal monitoring market.

New fetal monitoring solutions, including software-based and telemetry solutions, are becoming increasingly popular in developing and underdeveloped countries. Looking ahead, as India and China experience economic growth, healthcare spending in these nations is expected to increase, further driving the growth of the fetal monitoring market.

High cost of fetal monitoring devices

Advanced fetal monitoring devices can be expensive to purchase and maintain. The initial investment, along with ongoing maintenance and calibration costs, can create a significant financial challenge for healthcare facilities, especially in areas with limited resources. The high cost may discourage some healthcare providers from adopting or upgrading their fetal monitoring technology, which can hinder the growth of the fetal monitoring market.

During times of economic instability, pharmaceutical companies, governments, and research institutions often encounter financial limitations and reduced funding. Consequently, this can negatively impact research budgets, which can further affect the demand for fetal monitoring devices. As a result, study projects may be delayed or even canceled, leading to a decrease in the number of studies requiring animal models.

Rise in government and non-government initiatives

The global fetal monitoring market is being propelled by increasing government and non-government initiatives to raise awareness about fetal health. Factors such as rising cases of post-term pregnancy, multiple pregnancies, and premature deliveries will significantly influence market growth.

Increased investment in fetal monitoring development and the growing incidence of preterm births and birth rates are also driving market expansion. Furthermore, changing lifestyles and higher healthcare infrastructure spending are major drivers boosting the fetal monitoring market. Manufacturers' increasing focus on adopting advanced technologies will further contribute to the market's growth rate.

Increasing awareness about maternity and wellbeing

The growing worldwide attention to maternal and fetal healthcare is a major factor driving the expansion of the fetal monitoring market. Governments and healthcare institutions are increasingly acknowledging the significance of early detection and monitoring of fetal health to minimize complications during pregnancy and delivery.

The increasing occurrence of pregnancy-related issues like preterm birth, pre-eclampsia, and fetal growth restriction has also fueled the demand for advanced fetal monitoring technologies. Furthermore, expectant mothers are becoming more aware of the advantages of fetal monitoring in ensuring the health of their babies, which is further contributing to the fetal monitoring market’s growth.

The ultrasound segment dominated the fetal monitoring market in 2023. This is attributed to the high adoption of ultrasound devices for monitoring fetal health during labor and pregnancy. These devices offer safe and noninvasive monitoring, which allows healthcare professionals to detect probable abnormalities and complications, leading to improved pregnancy outcomes, which also supports segment growth.

In the fetal monitoring market, the electronic fetal monitoring segment is anticipated to grow substantially during the forecast period. This system offers real-time monitoring of uterine condition and fetal heart rate patterns. This further helps healthcare professionals identify potential complications during delivery.

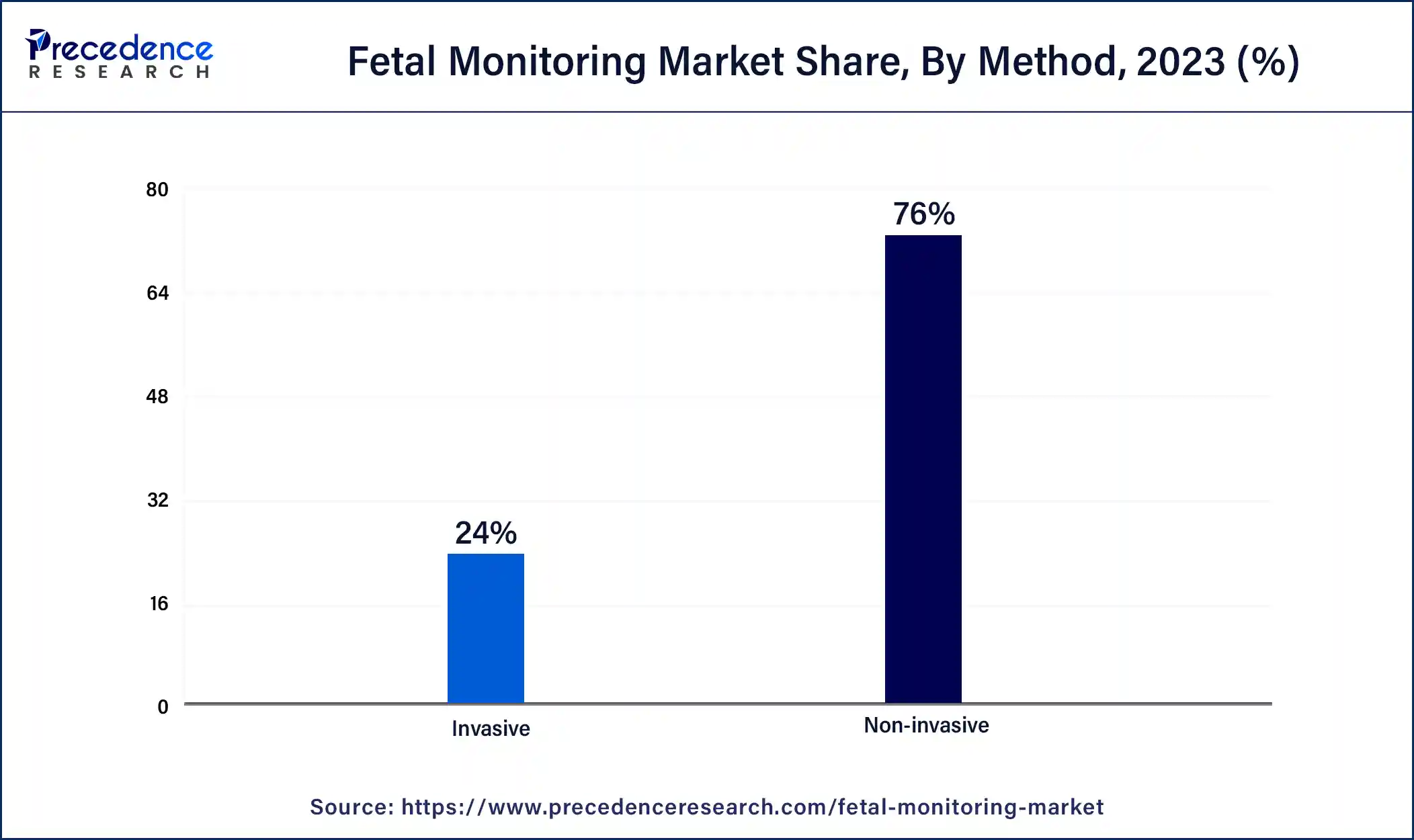

The non-invasive segment held the largest share of the global fetal monitoring market in 2023. This is because healthcare providers and expectant mothers increasingly prefer non-invasive monitoring methods. Techniques like ultrasound devices and fetal electrocardiography (FECG) have become popular due to their safety, ease of use, and ability to provide valuable information about the fetus without posing any risk to the mother or baby. These factors are driving the growth of the non-invasive segment.

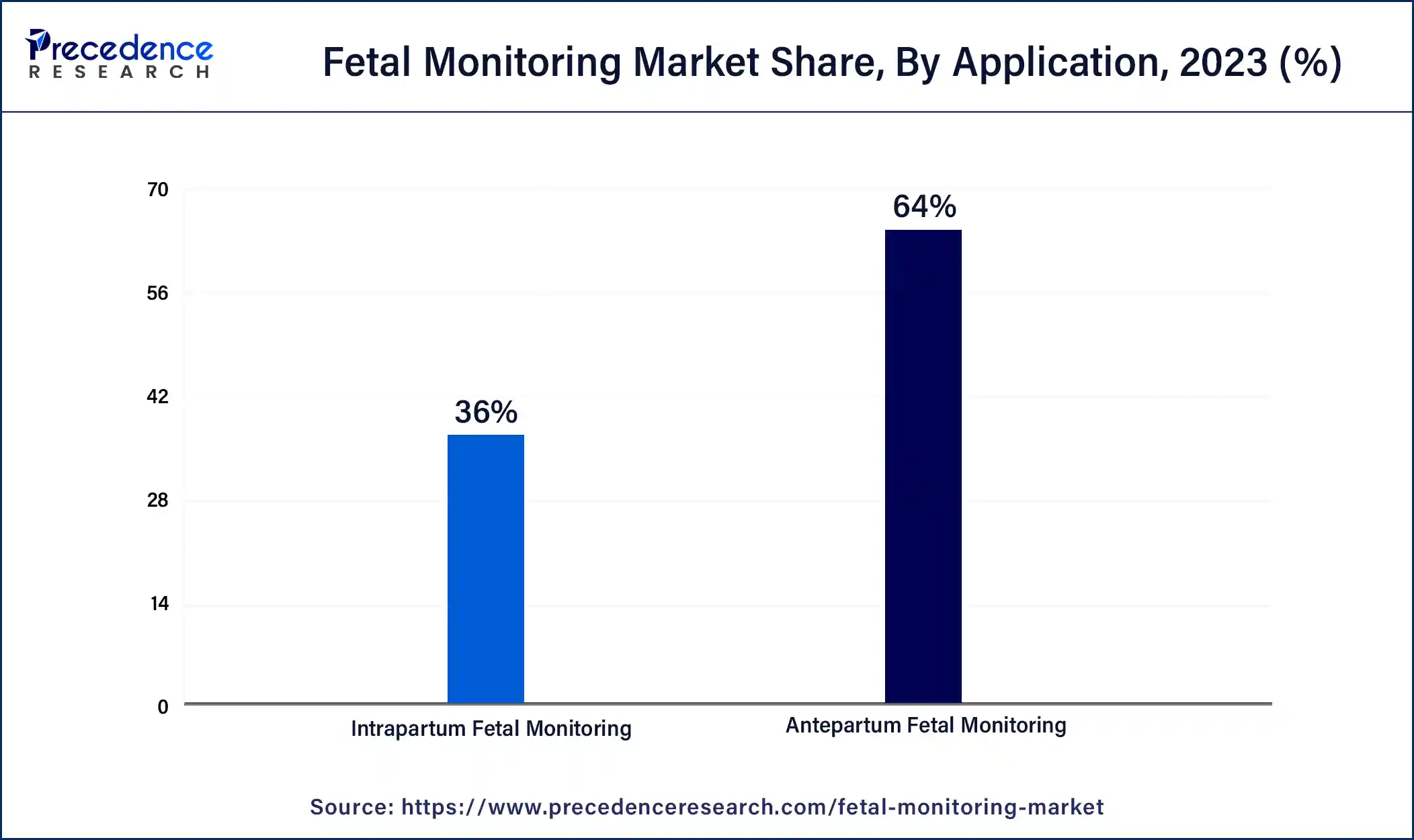

The dominating sector in the fetal monitoring market was the antepartum monitoring segment in 2023, playing a vital role in ensuring safe and successful deliveries. This segment empowers healthcare professionals to make timely interventions based on fetal conditions during labor by reducing complications and enhancing birth outcomes.

On the other hand, the intrapartum fetal monitoring segment is expected to experience the highest growth in the fetal monitoring market during the projected period. Advancements in fetal monitoring technologies drive this anticipated expansion, an increased emphasis on perinatal care, and the increasing prevalence of high-risk pregnancies.

The hospitals and maternity hospitals segment held the largest share of the fetal monitoring market in 2023 and is anticipated to sustain this position throughout the forecast period. This is linked to hospitals' adeptness in handling high-risk pregnancies necessitating comprehensive fetal monitoring. Equipped with specialized equipment and facilities, hospitals excel in managing complex cases, granting them a competitive advantage over other healthcare settings when addressing challenging situations.

Segments Covered in the Report

By Product

By Method

By Portability

By Application

By End user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

January 2025

January 2025

October 2023