October 2024

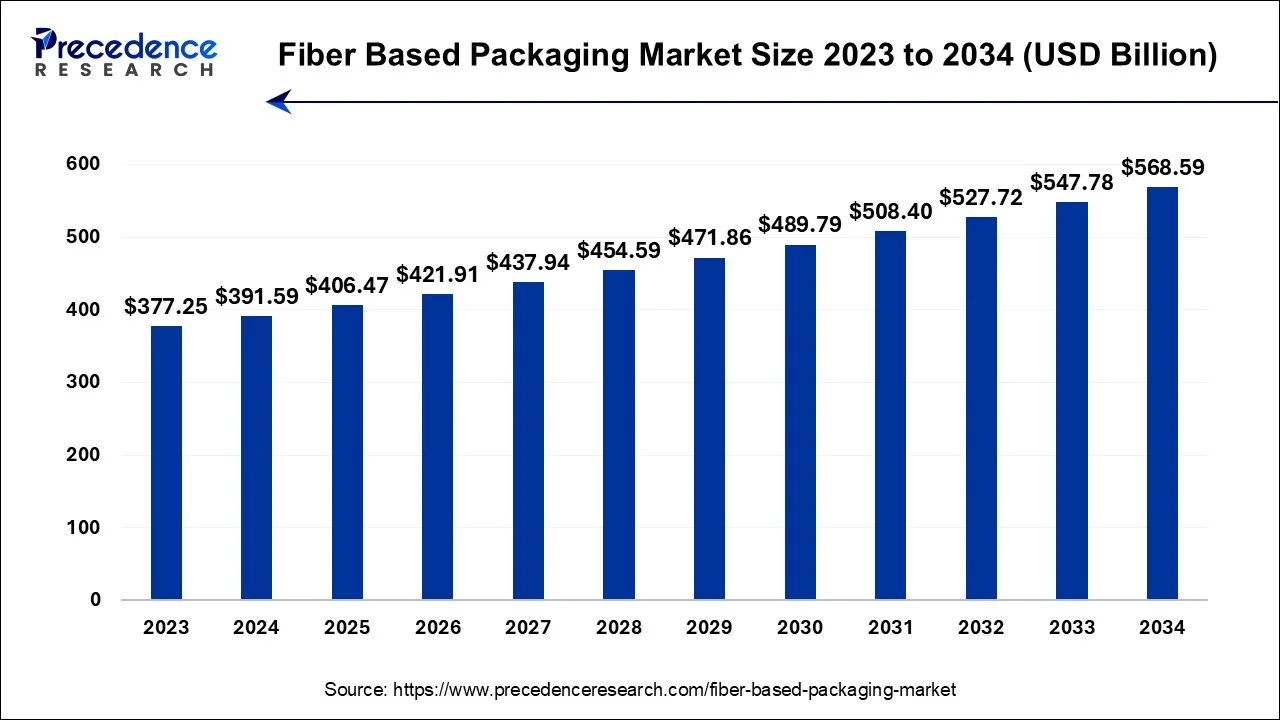

The global fiber based packaging market size accounted for USD 391.59 billion in 2024, grew to USD 406.47 billion in 2025 and is projected to surpass around USD 547.78 billion by 2034, growing at a CAGR of 3.80% between 2024 and 2034.

The global fiber based packaging market size is calculated at USD 391.59 billion in 2024 and is expected to be worth around USD 547.78 billion by 2034, growing at a CAGR of 3.80% between 2024 and 2034.

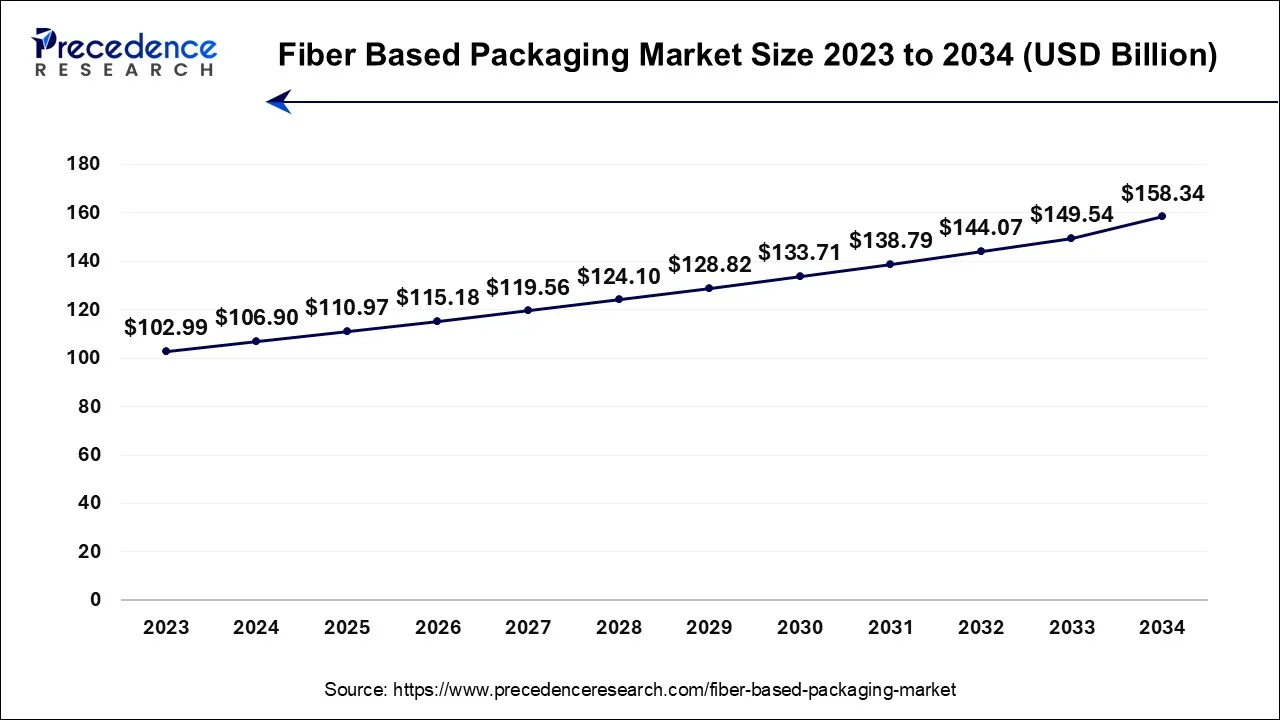

The U.S. fiber based packaging market size accounted for USD 106.90 billion in 2022 and is predicted to reach around USD 149.54 billion by 2034, growing at a CAGR of 4% from 2024 to 2034.

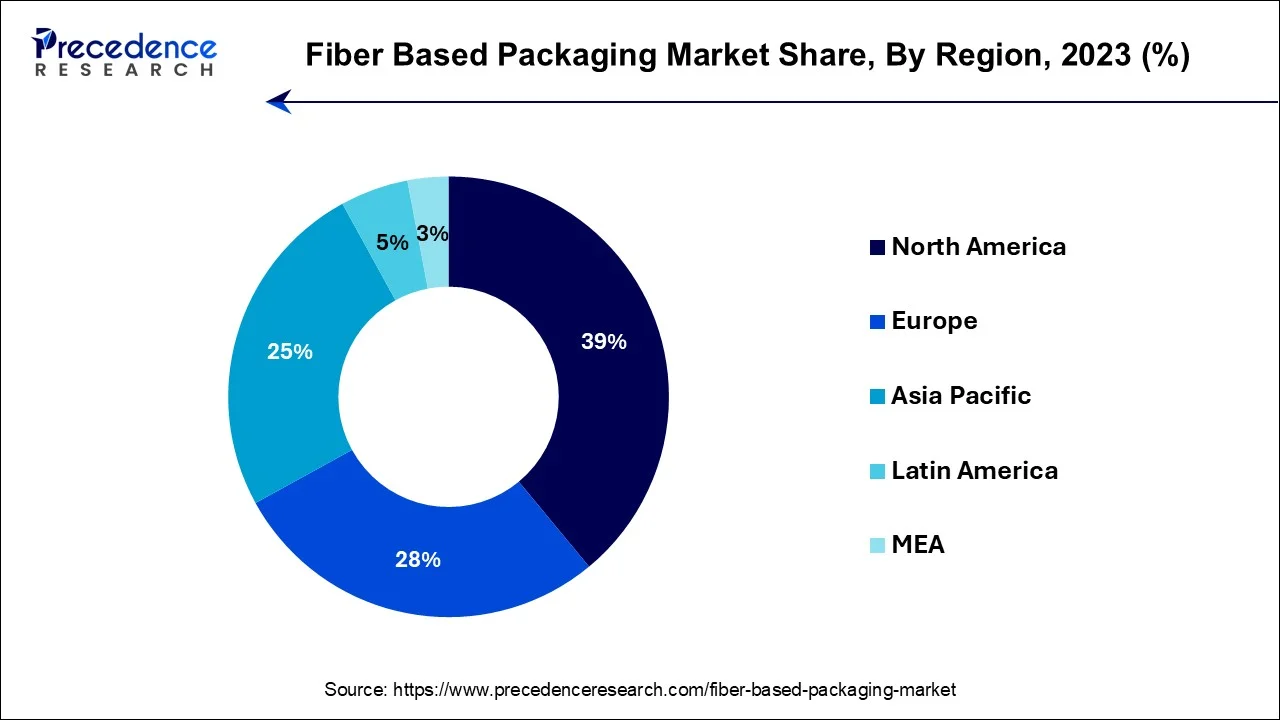

North America has held largest revenue share 39% in 2023. In North America, the fiber-based packaging market is witnessing several noteworthy trends. Sustainability remains a primary focus, with increasing demand for eco-friendly packaging solutions as consumers and businesses prioritize environmental responsibility. E-commerce growth continues to drive demand for fiber-based packaging materials, reflecting changing consumer shopping habits.

Moreover, regulatory support and initiatives promoting sustainable packaging choices are shaping the market, making fiber-based options an attractive choice for businesses seeking to meet compliance requirements and cater to environmentally conscious consumers.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the fiber-based packaging market is witnessing notable trends. Rapid urbanization and increasing consumer awareness of environmental issues are driving the demand for sustainable packaging solutions. Growing e-commerce activities and changing consumer preferences are also boosting the adoption of fiber-based packaging.

Additionally, governments in the region are implementing stricter regulations to curb plastic use, further propelling the market. As a result, the Asia-Pacific region is experiencing significant growth in the fiber-based packaging sector, with an emphasis on eco-friendly and innovative solutions.

Fiber-based packaging, often called cardboard or paperboard packaging, is a sustainable and versatile material used for various product packaging applications. It is manufactured from wood pulp or recycled paper fibers, making it environmentally friendly. Fiber-based packaging offers excellent strength and rigidity while being lightweight, making it ideal for protecting and transporting goods.

It is customizable through printing and can take various forms like boxes, cartons, and containers, serving industries from food and beverages to electronics and cosmetics. Its recyclability and biodegradability make it a preferred choice for companies and consumers seeking eco-friendly and practical packaging solutions.

Fiber-based packaging has emerged as a prominent and sustainable material choice for a wide array of product packaging applications. This eco-friendly packaging option is typically crafted from wood pulp or recycled paper fibers, combining strength and lightweight properties to offer a versatile solution. It is characterized by its ability to effectively protect and transport goods while aligning with the increasing environmental awareness of both businesses and consumers.

The growth drivers propelling the fiber-based packaging market are noteworthy. First and foremost, its commitment to sustainability aligns perfectly with the escalating environmental concerns. As consumers become more eco-conscious, businesses are compelled to adopt greener packaging options, boosting the demand for fiber-based alternatives.

Furthermore, the boom in e-commerce has amplified the need for robust, protective packaging, where fiber-based materials are increasingly preferred over plastic. Additionally, stringent regulations curbing plastic use and promoting responsible waste disposal further stimulate the adoption of fiber-based packaging. Several industry trends are shaping the fiber-based packaging landscape. Continuous innovation in design and technology is enhancing the durability and functionality of these materials, expanding their application potential.

Moreover, the customization capabilities of fiber-based packaging are becoming increasingly attractive. Personalized branding and design options not only add aesthetic appeal but also foster consumer engagement and brand loyalty.

However, a significant hurdle is the cost factor, as fiber-based packaging can sometimes be more expensive than its plastic counterparts. This cost consideration can pose challenges for businesses looking to balance sustainability with budget constraints.

Additionally, the sensitivity of fiber-based materials to moisture can limit their use in certain applications, necessitating the development of moisture-resistant coatings. Despite these challenges, there are compelling business opportunities within the fiber-based packaging market. Investing in circular economy initiatives, such as recycling and responsible waste management for fiber-based materials, can lead to sustainable growth. Furthermore, strategic partnerships with sustainable suppliers and the adoption of innovative practices can set businesses apart in a market that values environmental responsibility.

| Report Coverage | Details |

| Market Size in 2024 | USD 391.59 Billion |

| Market Size by 2034 | USD 406.47 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3.80% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Material, By Product Type, and By End Users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regulatory initiatives and environmental concerns

Regulatory initiatives, aimed at reducing plastic waste and promoting sustainable practices, have significantly boosted demand for fiber-based packaging. Stringent laws, bans on single-use plastics, and packaging requirements force businesses to seek eco-friendly alternatives. Complying with these regulations not only ensures legal compliance but also enhances corporate sustainability profiles, appealing to environmentally conscious consumers.

As a result, fiber-based packaging is increasingly favored by companies seeking to align with these regulatory standards and capitalize on the growing demand for sustainable packaging solutions, thereby surging its market demand. Moreover, environmental concerns have surged market demand for fiber-based packaging due to heightened eco-consciousness. Consumers and businesses increasingly prioritize sustainable, eco-friendly alternatives to plastic. Fiber-based packaging, being renewable, recyclable, and biodegradable, aligns with these concerns.

As plastic pollution and environmental degradation escalate, regulatory measures promote eco-friendly packaging solutions. This heightened awareness, along with a desire to reduce environmental footprints, has propelled the fiber-based packaging market forward as a responsible choice that meets both consumer expectations and global sustainability goals.

Moisture sensitivity and availability of raw materials

Moisture sensitivity is a critical limitation affecting the fiber-based packaging market. Fiber-based materials, such as cardboard and paperboard, are highly susceptible to moisture damage. In applications where exposure to moisture is common, such as refrigerated or frozen products or humid environments, the effectiveness and integrity of fiber-based packaging can be compromised. This limitation restrains market demand as businesses seek packaging solutions that can maintain product quality and structural integrity under diverse environmental conditions, leading some to opt for alternative packaging materials with better moisture resistance.

Moreover, the availability of raw materials can act as a significant restraint on the fiber-based packaging market. As the demand for sustainable packaging materials like paper and cardboard increases, there can be fluctuations in the supply of wood pulp or recycled paper fibers. Factors such as climate-related events affecting forestry, limited recycling infrastructure, and competition for these resources from other industries can lead to price volatility and potential shortages. These challenges in securing a consistent supply of raw materials can hinder the market's growth and stability.

E-commerce growth and sustainability focus

The surge in E-commerce has significantly bolstered demand for fiber-based packaging. As online shopping continues to expand, there is an escalating need for secure and eco-friendly packaging solutions to protect products during shipping. Fiber-based packaging offers the strength and durability required for safe transportation, while also aligning with the eco-conscious preferences of E-commerce consumers. Its sustainable attributes make it a favored choice for businesses looking to enhance customer satisfaction and meet environmental responsibility standards, driving the market's growth in response to the E-commerce boom.

Moreover, the surge in market demand for fiber-based packaging can be attributed to a heightened focus on sustainability. As consumers and businesses increasingly prioritize eco-friendly practices, fiber-based packaging offers a renewable, recyclable, and biodegradable alternative to plastic. This aligns with sustainability goals and regulatory requirements, driving the adoption of fiber-based solutions. Furthermore, it enhances brand reputation and meets consumer preferences for environmentally responsible choices. As a result, the market experiences robust growth, driven by a collective commitment to reducing environmental impact and promoting a greener future.

Impact of COVID-19

The COVID-19 pandemic had a mixed impact on the fiber-based packaging market. Initially, there was disruption in the supply chain due to lockdowns and transportation restrictions. However, as the pandemic continued, the demand for fiber-based packaging surged. This was mainly driven by the e-commerce boom, as consumers shifted to online shopping, necessitating robust packaging for safe product delivery. Additionally, heightened hygiene concerns led to increased demand for single-use fiber-based packaging in the food service and takeout sectors.

Furthermore, the pandemic underscored the importance of sustainability, prompting businesses to prioritize eco-friendly packaging materials like fiber-based options. As a result, many companies accelerated their transition away from plastic, driving growth in the fiber-based packaging market. Overall, COVID-19 reshaped consumer behavior and supply chain dynamics, ultimately boosting the adoption of fiber-based packaging in various industries.

According to the material, the paper segment has held 59% revenue share in 2023. Paper, a primary material in fiber-based packaging, is a versatile and sustainable substrate made from wood pulp. In the fiber-based packaging market, paper continues to dominate as a preferred choice due to its eco-friendly nature, recyclability, and biodegradability. Recent trends focus on innovation, introducing paper-based packaging with enhanced strength, moisture resistance, and barrier properties to expand its applications. Customization, branding, and sustainable sourcing are also key trends, catering to consumer demands for environmentally responsible packaging solutions.

The pulp segment is anticipated to expand at a significantly CAGR of 4.8% during the projected period. Pulp, in the context of the fiber-based packaging market, refers to the raw material derived from wood fibers or recycled paper. It serves as the foundational substance for manufacturing various types of cardboard, paperboard, and other fiber-based packaging materials. In recent trends, there is a growing emphasis on sustainable and responsibly sourced pulp, as well as innovations in pulping techniques to reduce environmental impact. Additionally, the use of alternative fibers like agricultural residues and bamboo is gaining traction to diversify pulp sources and enhance sustainability in packaging production.

Based on the product type, cartons held the largest market share of 29% in 2023. Cartons, a prevalent product type in the fiber-based packaging market, are rigid, box-like containers made from paperboard. These cartons are versatile and used for a wide range of applications, including food, beverages, pharmaceuticals, and cosmetics. Current trends in the market show a growing preference for sustainable, lightweight, and creatively designed cartons. As consumers demand eco-friendly packaging, manufacturers are innovating with recyclable materials, reduced packaging waste, and unique branding, aligning carton production with evolving environmental and consumer expectations.

On the other hand, the bags and pouches segment is projected to grow at the fastest rate over the projected period. In the fiber-based packaging market, bags and pouches refer to versatile packaging solutions crafted from paper-based materials. Fiber-based bags and pouches are experiencing increased popularity due to their sustainable and flexible nature. The latest market trends reveal a rising inclination toward these packaging solutions, largely fueled by the rising demand for eco-friendly packaging across various industries, including food, retail, and consumer goods. Customizable designs, enhanced barrier properties, and innovative closures are emerging trends, catering to evolving consumer needs for convenience and eco-conscious choices.

In 2023, the food & beverages segment had the highest market share of 37% on the basis of the installation. Food & Beverages represent a key end-user segment in the fiber-based packaging market. This sector demands packaging solutions that ensure product freshness, safety, and eco-friendliness. Recent trends in this segment include a shift towards sustainable fiber-based packaging to meet consumer demand for environmentally responsible options. Customized packaging designs, enhanced barrier properties, and innovative shapes are also prevalent trends, as companies seek to differentiate their products and improve overall consumer experiences in the food and beverage industry.

E-commerce is anticipated to expand at the fastest rate over the projected period. In the fiber-based packaging market, the term "E-commerce" refers to online retail businesses. E-commerce has become a prominent end-user segment, driven by trends such as increased online shopping. As consumers embrace digital retail, the demand for sturdy and sustainable packaging solutions has surged. Fiber-based packaging meets these demands, offering protection for products during transit while aligning with environmental concerns. Customizable designs and branding on fiber-based packaging also cater to E-commerce's need for a distinctive and visually appealing packaging experience.

Segments Covered in the Report

By Material

By Product Type

By End Users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

July 2024

April 2025

January 2025