November 2024

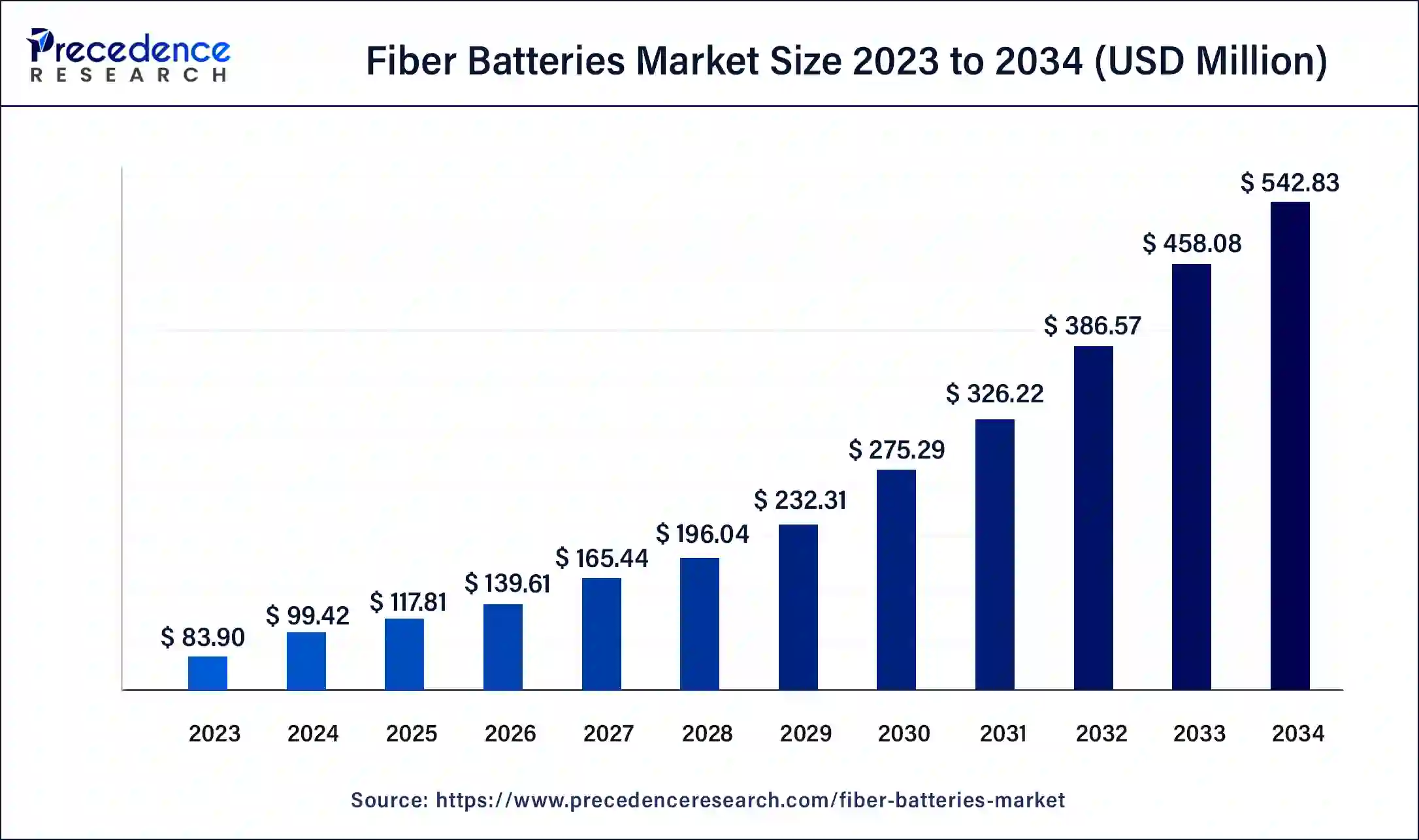

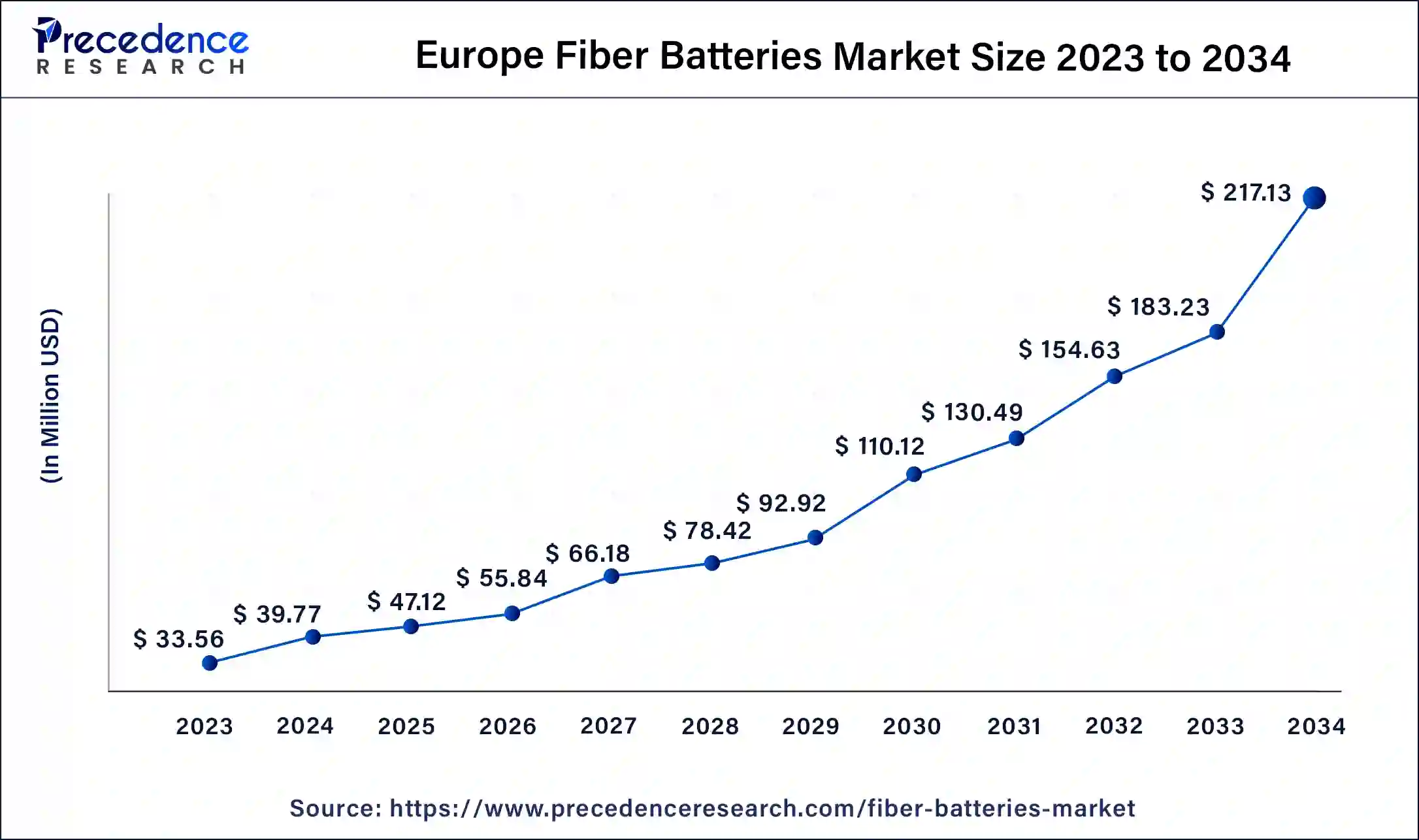

The global fiber batteries market size accounted for USD 99.42 million in 2024, grew to USD 117.81 million in 2025, and is projected to surpass around USD 542.83 million by 2034, representing a healthy CAGR of 18.5% between 2024 and 2034. The Europe data center infrastructure market size is calculated at USD 39.77 million in 2024 and is expected to grow at the fastest CAGR of 18.8% during the forecast year.

The global fiber batteries market size is expected to be valued at USD 99.42 million in 2024 and is anticipated to reach around USD 542.83 million by 2034, expanding at a CAGR of 18.5% over the forecast period 2024 to 2034.

The Europe fiber batteries market size is calculated at USD 39.77 million in 2024 and is projected to be worth around USD 217.13 million by 2034, poised to grow at a CAGR of 18.8% from 2024 to 2034.

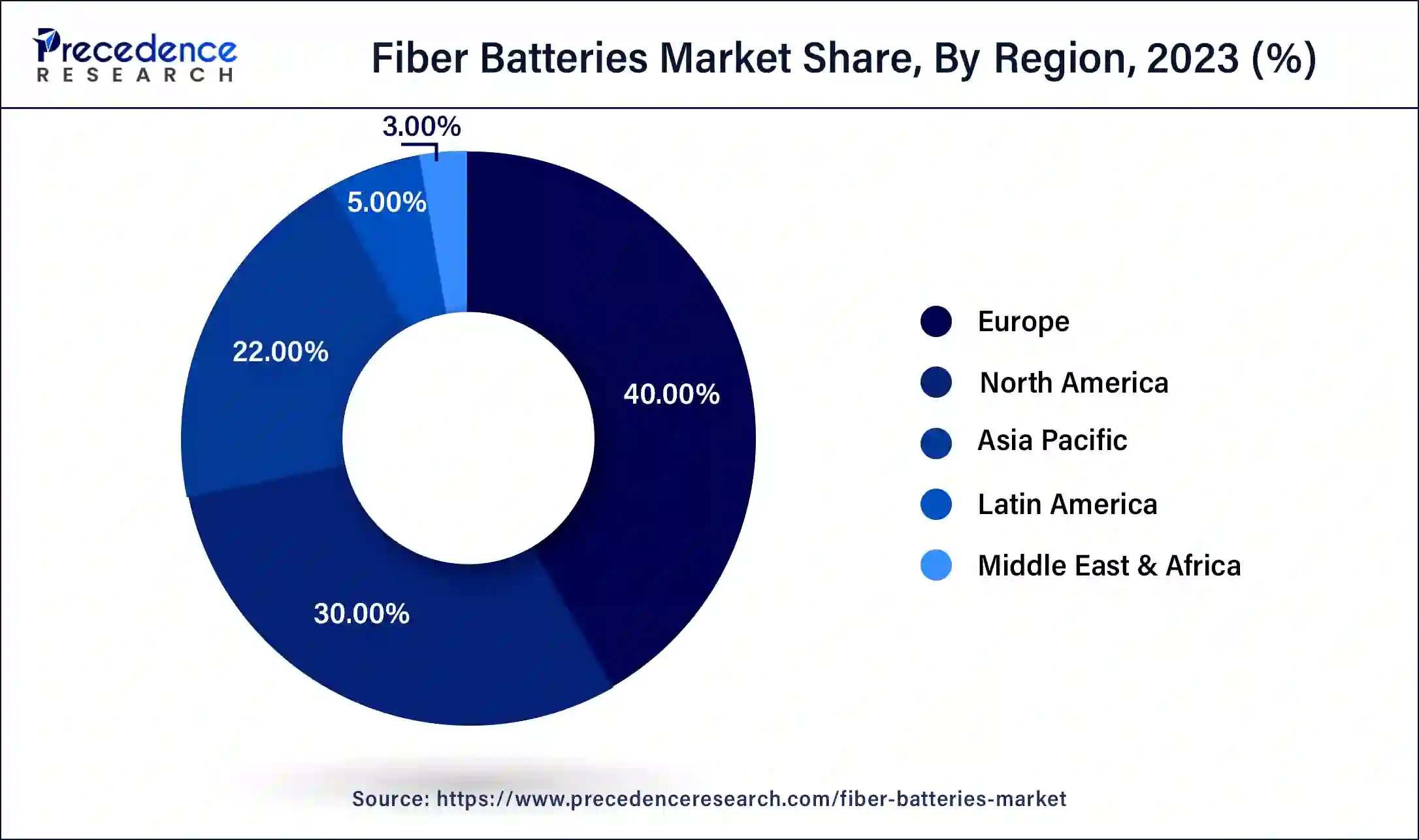

Europe has held the largest revenue share of 40% in 2023. In Europe, the fiber batteries market is witnessing significant growth driven by the continent's strong focus on sustainability and renewable energy. Governments and industries are investing in green initiatives, spurring demand for fiber batteries as efficient energy storage solutions. European countries are increasingly integrating these batteries into smart architectural projects, contributing to smart city developments. Additionally, collaborations between technology and fashion industries are fueling the adoption of fiber batteries in stylish and functional wearable tech, further propelling market growth.

Asia Pacific is estimated to observe the fastest expansion. The region’s innovation and technology adoption, make it a fertile ground for the fiber batteries market. The rapid proliferation of IoT devices and wearable technology in countries like China and Japan is creating a robust demand for compact, reliable power sources, driving the market's expansion. Moreover, the region's strong emphasis on space exploration and its growing presence in the aerospace sector are opening up new avenues for fiber batteries, with lightweight and durable power solutions in high demand for satellites and spacecraft.

The fiber batteries market represents a revolutionary approach to energy storage. These batteries incorporate fiber-shaped materials, often woven into textiles, to harness and store energy. Fiber batteries represent a breakthrough in energy storage technology. These batteries are crafted from lightweight, flexible materials that seamlessly integrate into clothing, accessories, and structures.

They find diverse applications, particularly in wearable electronics, smart textiles, and Internet of Things (IoT) devices. Their flexibility and versatility open doors for compact, on-the-go power solutions, making them a promising answer for portable and wearable technology. Additionally, they contribute to the development of energy-efficient and sustainable solutions across various industries.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 18.5% |

| Market Size in 2024 | USD 99.42 Million |

| Market Size by 2034 | USD 542.83 Million |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Rechargeability, By Capacity, By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Wearable technology adoption and smart architecture integration

The growing adoption of wearable technology, encompassing smartwatches, fitness trackers, and health monitoring devices, has significantly elevated the demand for Fiber batteries. Consumers increasingly seek portable and lightweight power sources to support their wearable gadgets. Fiber batteries offer a compelling solution, as their flexible, lightweight, and energy-efficient nature perfectly aligns with the needs of these devices. This surge in wearable technology adoption has created a substantial market for fiber batteries, catering to diverse applications in the healthcare, fitness, and consumer electronics sectors.

Moreover, the integration of fiber batteries into smart architecture is reshaping the demand landscape. Smart buildings and cities rely on innovative power solutions for lighting, sensors, environmental control systems, and more. Fiber batteries, with their capacity to seamlessly blend into architectural structures, provide a unique and sustainable energy source. This integration empowers architects and urban planners to create energy-efficient and interconnected urban environments. The demand for fiber batteries is surging as cities worldwide embark on the path to becoming smarter and more sustainable, thus revolutionizing the way we power our urban spaces and infrastructure.

Cost of production and standardization

The technology behind fiber batteries involves the development of specialized materials, intricate manufacturing processes, and quality control measures. These factors contribute to higher production costs, making fiber batteries more expensive than traditional battery options. The cost of production is a significant concern for both manufacturers and consumers, impeding broader adoption of fiber batteries. To address this challenge effectively, the industry must focus on enhancing production efficiency, sourcing more cost-effective materials, and streamlining the manufacturing process. These measures can make fiber batteries more affordable, fostering wider acceptance and utilization in various applications.

Moreover, a significant challenge is the lack of standardized guidelines for fiber batteries. Given the diverse applications of these batteries in wearable technology, smart textiles, IoT devices, and more, the absence of universally accepted industry standards creates hurdles in interoperability and quality assurance. The lack of standardization can lead to compatibility issues and concerns regarding safety and performance. To address this restraint, industry stakeholders must collaborate to establish common standards that ensure the reliability, safety, and functionality of fiber batteries across various applications, promoting consumer trust and market growth.

Green energy storage and space exploration

The fiber batteries market is experiencing a surge in demand driven by its role in green energy storage. As the world seeks sustainable alternatives to traditional power sources, Fiber batteries offer a promising solution. Fiber batteries, with their lightweight and flexible design, excel at efficiently storing and discharging renewable energy. This makes them an ideal choice for harnessing power from sources like solar panels and wind turbines. They offer reliable and eco-friendly energy storage solutions suitable for homes, businesses, and even grid-level applications. Their versatility in green energy storage is a key driver of their growing demand and adoption. Fiber batteries are becoming pivotal in enhancing the overall sustainability of energy systems, which is essential for a greener future.

Fiber batteries are finding their way into the realm of space exploration, further boosting market demand. Their lightweight and durable nature makes them ideal for aerospace applications. Spacecraft, satellites, and spacesuits can benefit from fiber batteries as reliable power sources in the challenging and weight-sensitive conditions of space. The need for advanced power solutions in space missions is driving innovation in fiber battery technology, expanding their use beyond Earth's atmosphere. This intersection of technology and exploration opens new horizons for the fiber batteries market.

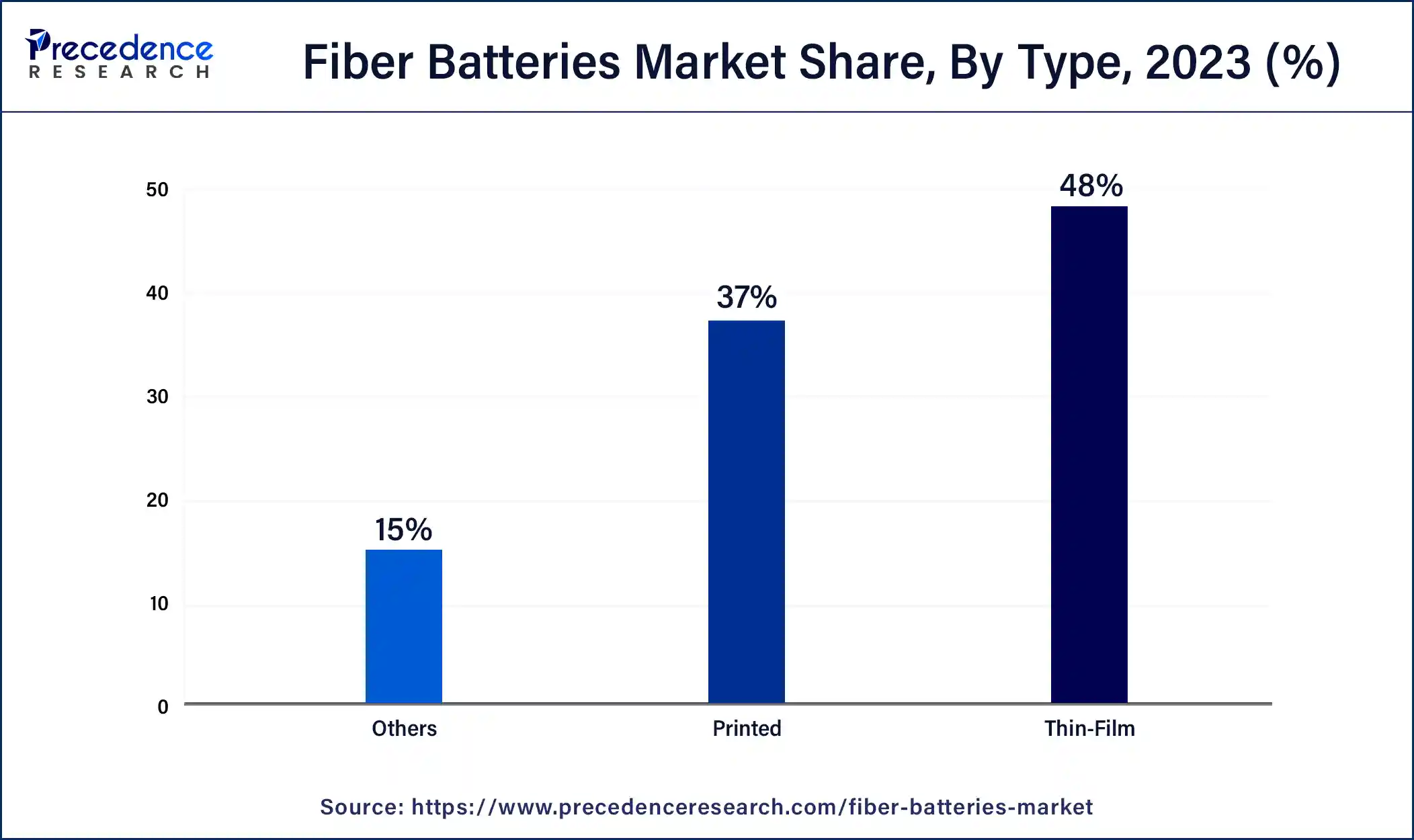

According to the type, the thin-film segment held a 48% revenue share in 2023. Thin-film fiber batteries are a type of fiber battery characterized by their ultra-thin and flexible construction. They are designed for applications where space and weight are critical, making them suitable for slim and compact devices, including wearable technology and medical sensors. The trend in the thin-film fiber batteries market is the continued development of even thinner and more energy-dense variants, enhancing their utility in a wide range of applications, from smart clothing to small IoT devices.

The reusable segment is anticipated to expand at a significant CAGR of 20.8% during the projected period. Printed fiber batteries are known for their manufacturing process, which involves printing battery materials onto various substrates. This type of fiber battery offers versatility in design and can be customized to fit specific device requirements. In the printed fiber batteries market, the prevailing trend centers on scalable production techniques, cost-efficiency, and seamless integration into a wide array of devices. These devices encompass flexible displays, intelligent packaging, and other printed electronics. As technological advancements continue to drive innovation, printed fiber batteries are poised to gain increased prominence in the market, offering versatile and customizable power solutions for a broad range of applications.

Based on the rechargeability, the secondary segment is anticipated to hold the largest market share of 68% in 2023. Secondary fiber batteries, commonly referred to as rechargeable batteries, are designed for repeated use. They can be charged and discharged multiple times, reducing waste and environmental impact. The market trend favors secondary fiber batteries, driven by the increasing emphasis on sustainability and cost-efficiency. These batteries offer long-term solutions and are particularly well-suited for applications requiring continuous power sources, furthering their adoption in various industries.

On the other hand, the above primary segment is projected to grow at the fastest rate over the projected period. Primary fiber batteries, often called non-rechargeable or disposable batteries, are engineered for single-use purposes. They supply power until their energy is exhausted, at which point they are disposed of. Despite their convenience, primary fiber batteries are being eclipsed by rechargeable alternatives, primarily due to sustainability considerations and the demand for enduring and cost-effective solutions.

Based on the capacity, the 10 mAh to 100 mAh segment held the largest market share of 39.5% in 2023. Fiber batteries within the 10 mAh to 100 mAh capacity range are typically employed in low-power and compact electronic devices, such as smartwatches, fitness trackers, and IoT sensors. These batteries offer a balance between size and energy output, making them ideal for wearables and portable gadgets. The trend in this segment focuses on improving energy density, enhancing longevity, and maintaining a slim form factor to cater to the growing market of lightweight and long-lasting wearables.

On the other hand, the above 100 mAh segment is projected to grow at the fastest rate over the projected period. Fiber batteries with capacities exceeding 100 mAh are designed for more demanding applications, including larger wearables, medical devices, and even aerospace equipment. The trend for high-capacity fiber batteries centers on achieving even greater energy storage, enabling extended operational lifespans for devices with higher power requirements. These batteries are expected to play a crucial role in the continued expansion of wearable technology and the electrification of various industries, from healthcare to aerospace.

In 2023, the consumer electronics segment had the highest market share of 43% based on the end user. In the fiber batteries market, consumer electronics refer to the use of fiber batteries in devices like smartwatches, fitness trackers, and smartphones. The trend in this segment revolves around the demand for longer battery life in these gadgets, as consumers seek seamless and prolonged usage. Fiber batteries, due to their lightweight and flexible nature, offer extended power while maintaining the slim and portable design of such devices, making them a popular choice among manufacturers.

The medical devices segment is anticipated to expand at the fastest rate over the projected period. Fiber batteries' application in medical devices is a growing trend, catering to devices like wearable health monitors and medical patches. The medical field increasingly relies on these devices for patient monitoring and health management. The trend here is focused on developing advanced medical wearables that provide real-time health data, and fiber batteries play a crucial role in ensuring these devices offer continuous and reliable operation. As the healthcare sector embraces digital health solutions, the demand for fiber batteries in medical devices is on the rise.

Segments Covered in the Report

By Type

By Rechargeability

By Capacity

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

October 2024

February 2025

July 2024