January 2025

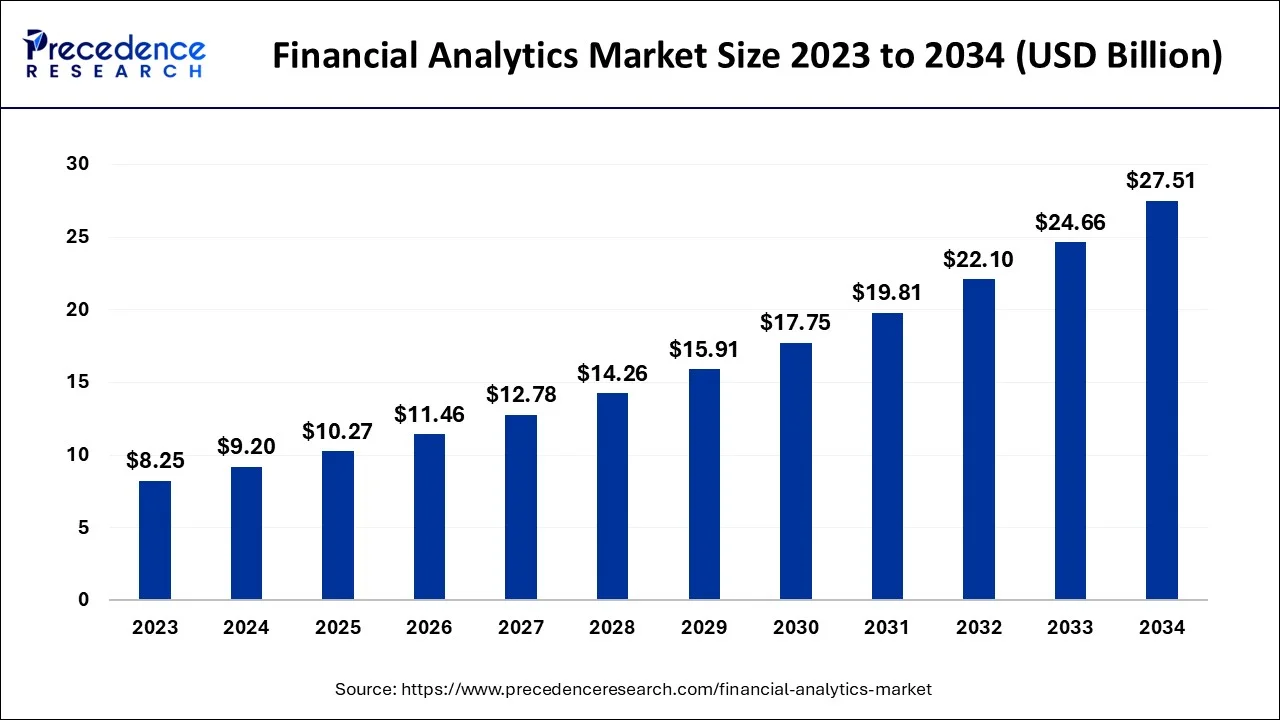

The global financial analytics market size is estimated at USD 9.2 billion in 2024, grew to USD 10.27 billion in 2025 and is predicted to surpass around USD 27.51 billion by 2034, expanding at a CAGR of 11.57% between 2024 and 2034.

The global financial analytics market size accounted for USD 9.20 billion in 2024 and is anticipated to reach around USD 27.51 billion by 2034, expanding at a CAGR of 11.57% from 2024 to 2034.

Financial analytics refers to the process of using advanced analytical tools, techniques, and models to examine financial data, identify patterns, and derive meaningful insights for informed decision-making in the financial sector. It helps organizations, including banks, investment firms, insurance companies, and corporate finance departments, to gain a deeper understanding of their financial performance, risks, and opportunities.

Organizations across sectors are recognizing the significance of data-driven decision-making, leading to an increased demand for advanced financial analytics solutions. Key trends include the adoption of artificial intelligence and machine learning, enabling quick and accurate analysis of large volumes of financial data for valuable insights.

Real-time analytics is gaining prominence, empowering organizations to make faster decisions and respond swiftly to market changes. Cloud-based solutions are becoming popular due to their scalability and cost-effectiveness, facilitating seamless integration and comprehensive data analysis. Data security and privacy measures are prioritized as organizations handle sensitive financial information. Moreover, predictive analytics and forecasting techniques are used to anticipate future trends and optimize financial planning. These trends highlight the growing importance of financial analytics in gaining a competitive edge and making informed decisions in today's business landscape.

Financial analytics is used in various industries and sectors for different purposes. In banking and finance, it helps with things like assessing risk, catching fraud, and making smart investment decisions. Insurance companies use it to understand and manage risks, set prices, and improve how they handle claims. In retail, it helps with things like understanding what customers buy, setting prices, and predicting how much inventory to have.

In healthcare, it helps with things like analyzing costs, finding ways to make more money, and catching fraud in billing. Governments and regulators use financial analytics to keep an eye on financial markets, catch illegal trading, and make sure everyone follows the rules. It's also used in supply chain management to figure out how much inventory to have, find ways to save money, and make better decisions when buying things. In short, financial analytics is used in many industries to help make smart decisions, be more efficient, and stay ahead of the competition.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.2 Billion |

| Market Size by 2034 | USD 27.51 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11.57% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Components, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Data-driven decision-making

One important factor is the increasing recognition of the value of data-driven decision-making. Organizations understand that using data to make informed choices leads to better outcomes. Financial analytics provide insights from large amounts of financial data, helping organizations make smart and strategic decisions. Strict regulations in the financial sector require organizations to have strong risk management and reporting systems. Financial analytics solutions help them comply with these regulations by providing accurate reporting, risk assessment, and regulatory monitoring. Risk management is a key focus, and financial analytics help organizations identify and mitigate risks effectively. Technological advancements, such as artificial intelligence and machine learning, have improved the capabilities of financial analytics. financial analytics help organizations reduce costs and improve operational efficiency by identifying areas for improvement and streamlining financial processes.

Talent and skill gap

Effective utilization of financial analytics requires skilled professionals who possess a combination of finance, data analytics, and domain expertise. However, there is often a shortage of professionals with the necessary skill set and knowledge to effectively leverage financial analytics tools and interpret the insights generated. Bridging the talent and skill gap is a challenge that organizations need to address to fully maximize the potential of financial analytics. However, one important factor is the quality and availability of data. If the data used for financial analytics is inaccurate or incomplete, it can lead to wrong insights and make the analysis less effective. Another concern is data privacy and security. Since financial analytics deals with sensitive financial information, it's crucial to protect that data from unauthorized access or misuse. Furthermore, Cost is another consideration. Implementing and maintaining financial analytics solutions can be expensive. Organizations need to invest in technology, software, skilled staff, and ongoing support.

Growth in cloud-based analytics solutions

The adoption of cloud computing continues to grow across industries, and the financial analytics market is no exception. Cloud-based analytics solutions offer scalability, flexibility, and cost-effectiveness. They allow organizations to access and analyze financial data from anywhere, streamline collaboration, and benefit from the latest updates and advancements in analytics technologies. However, there is a growing interest in integrating alternative data sources, such as social media, satellite imagery, and IoT sensors. By incorporating these diverse data sets, organizations can gain new insights, and improve financial forecasting. Furthermore, Real-time and streaming analytics offer the opportunity to analyze data as it is generated, enabling organizations to detect anomalies, monitor market trends, and make immediate adjustments to their financial strategies. Apart from this, AI and ML algorithms can analyze large volumes of financial data, uncovering complex patterns and relationships that human analysts may overlook. This opportunity enables organizations to improve decision-making, automate processes, and enhance risk management.

One of the main challenges is ensuring that the data used for financial analysis is accurate and reliable. Sometimes, the data may be incomplete or come from different sources, making it difficult to integrate and analyze effectively. Another challenge is the protection of data privacy and security. Financial analytics deals with sensitive financial information, so it's crucial to have measures in place to keep that data safe from unauthorized access or misuse. Furthermore, Financial analytics must comply with various regulations, such as data protection laws and financial reporting standards. Resistance to change and organizational culture can also hamper the implementation of financial analytics. Some people within organizations may be resistant to adopting new processes and technologies or may lack awareness of the benefits of financial analytics.

The financial analytics market is segmented by components into solutions and services. The solutions segment includes database management systems (DBMS), data integration tools, queries, reporting and analysis, analytics solutions, and others. The services segment includes professional services and managed services.

The solutions segment is the largest segment of the financial analytics market, and it is expected to continue to grow in the coming years. This is due to the increasing demand for financial analytics solutions that can help organizations to make better decisions, comply with regulations, and improve risk management.

The services segment is also expected to grow in the coming years. This is due to the increasing complexity of financial analytics solutions, and the need for organizations to have help from experts to implement and use these solutions effectively.

Some of the key trends, drivers, and opportunities in the financial analytics market segmentation by component include The increasing demand for cloud-based financial analytics solutions. The growing adoption of artificial intelligence and machine learning in financial analytics. The increasing focus on regulatory compliance in the financial sector. The growing need for real-time financial analytics.

The financial analytics market is segmented by application into risk management, customer relationship management (CRM), fraud detection, budgeting and forecasting, asset and liability management, and others. The risk management segment is the largest segment of the financial analytics market, and it is expected to continue to grow in the coming years. This is due to the increasing demand for financial analytics solutions that can help organizations to identify and mitigate risks. Financial institutions use financial analytics to identify and mitigate risks, such as credit risk, market risk, and operational risk. For example, banks use financial analytics to assess the creditworthiness of borrowers and to predict the likelihood of default.

The CRM segment is also expected to grow in the coming years. This is due to the increasing use of financial analytics to improve customer relationships. For example, financial institutions can use financial analytics to identify customers who are at risk of defaulting on loans, and then take steps to prevent these defaults. The fraud detection segment is also expected to grow in the coming years. This is due to the increasing sophistication of fraudsters, and the need for organizations to have effective fraud detection solutions. For example, financial institutions can use financial analytics to identify fraudulent transactions, and then take steps to prevent these transactions from being completed.

The financial analytics market is segmented by end-user into banking, financial services, and insurance (BFSI), government, retail and consumer goods, healthcare, and others. The BFSI segment is the largest segment of the financial analytics market, and it is expected to continue to grow in the coming years. Financial institutions use financial analytics to improve their risk management, fraud detection, and customer relationship management. For example, banks use financial analytics to assess the creditworthiness of borrowers and to predict the likelihood of default. The global financial analytics market is expected to reach $32.7 billion by 2025.

The government segment is also expected to grow in the coming years. This is due to the increasing use of financial analytics by government agencies to improve their financial management, risk management, and fraud detection capabilities. For example, the Internal Revenue Service (IRS) uses financial analytics to identify potential tax evasion.

The retail and consumer goods segment is also expected to grow in the coming years. This is due to the increasing use of financial analytics by retailers and consumer goods companies to improve their customer insights, marketing campaigns, and inventory management. For example, Walmart uses financial analytics to track customer spending habits and optimize its inventory levels.

The financial analytics market is segmented by geography into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America is the largest market for financial analytics, and it is expected to continue to grow in the coming years. This is due to the increasing demand for financial analytics solutions from financial institutions, government agencies, and other organizations in the region.

Europe is also a major market for financial analytics, and it is expected to grow at a steady pace in the coming years. This is due to the increasing adoption of financial analytics solutions by financial institutions, government agencies, and other organizations in the region. The United Kingdom is the largest market for financial analytics in Europe. Major financial institutions in the UK, such as banks, insurance companies, and investment firms, are also increasingly adopting financial analytics solutions.

Asia-Pacific is a rapidly growing market for financial analytics, and it is expected to see the highest growth in the coming years. This is due to the increasing demand for financial analytics solutions from financial institutions, government agencies, and other organizations in the region. China is the largest market for financial analytics in Asia-Pacific. Major financial institutions in China, such as banks, insurance companies, and investment firms, are rapidly adopting financial analytics solutions.

Segments Covered in the Report:

By Components

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

July 2024

August 2024