August 2024

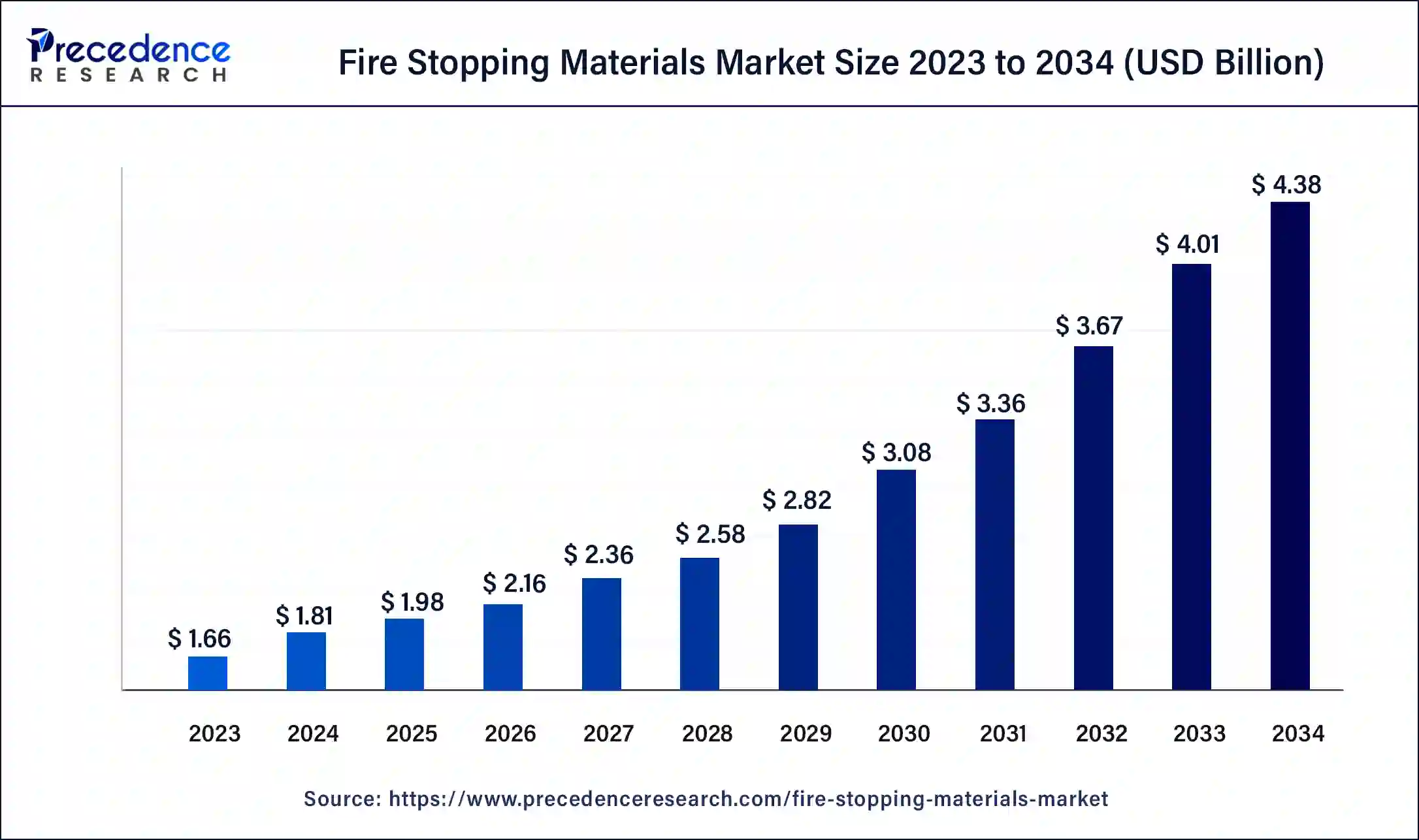

The global fire stopping materials market size was USD 1.66 billion in 2023, calculated at USD 1.81 billion in 2024 and is expected to be worth around USD 4.38 billion by 2034. The market is slated to expand at 9.22% CAGR from 2024 to 2034.

The global fire stopping materials market size is projected to reach around USD 4.38 billion by 2034 from USD 1.81 billion in 2024, at a CAGR of 9.22% from 2024 to 2034. The North America fire stopping materials market size reached USD 580 million in 2023. Stringent safety regulations and growing demand for fire protection across industrial and commercial sectors drive the fire stopping materials market.

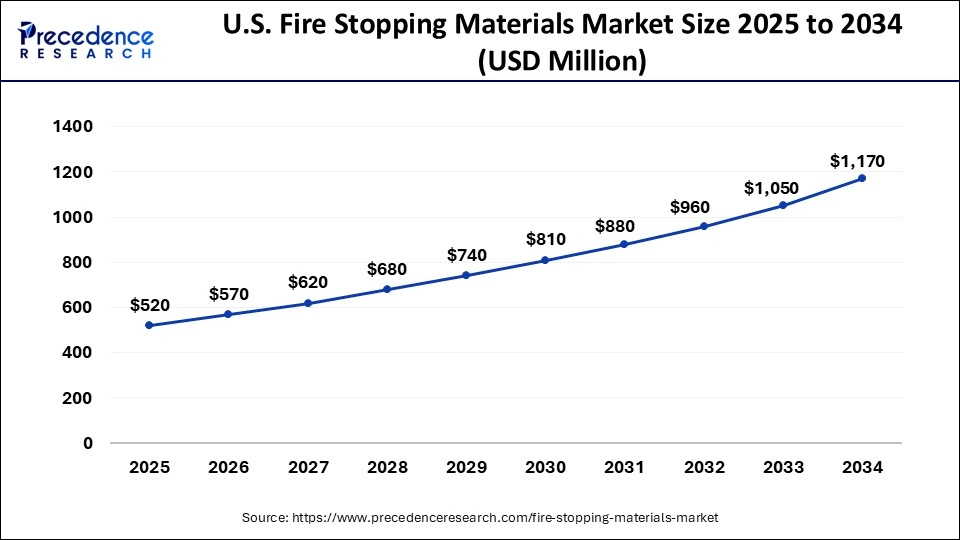

The U.S. fire stopping materials market size was exhibited at USD 440 million in 2023 and is projected to be worth around USD 1,170 million by 2034, poised to grow at a CAGR of 9.29% from 2024 to 2034.

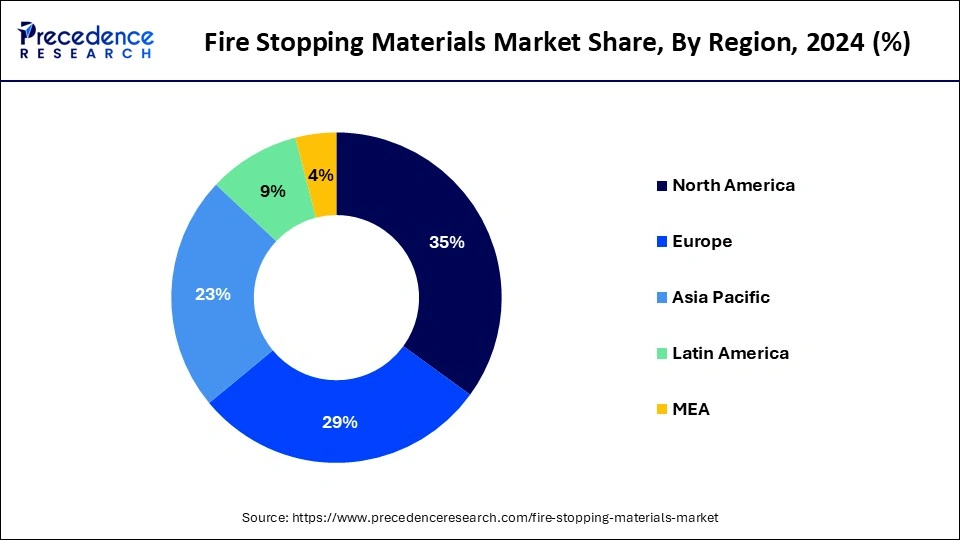

North America accounted for the largest market share of 35% in 2023. Factors such as economic growth, urbanization, and government policies significantly influence construction rates. Economic expansion often stimulates construction activity, while urban development in major cities increases demand for new projects. Additionally, trends in the housing market, advancements in technology, and a focus on sustainability also influence construction rates.

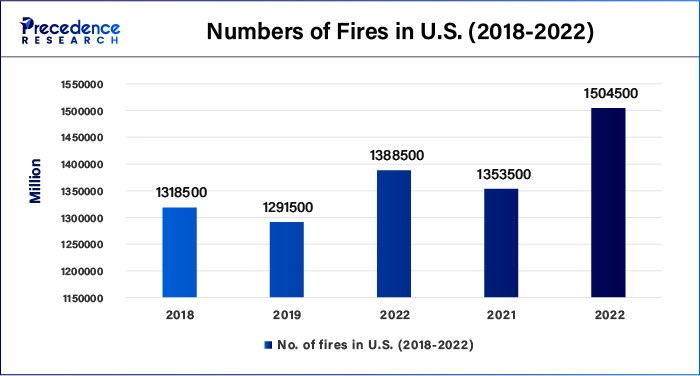

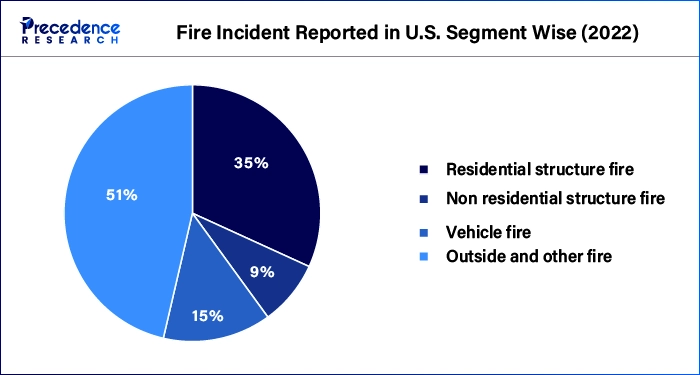

In the U.S. specifically, the increase in fire incidents is driving market growth. The rising frequency of fires in residential, commercial, and industrial sectors is leading to greater emphasis on effective fire protection measures to enhance safety and reduce damage. Also, the rise in construction spending is likely to impact the fire stopping materials market.

Asia Pacific is expected to grow at the fastest rate in the fire stopping materials market during the forecast period. This expansion is driven by increased construction activities, rapid urbanization, and stringent fire safety regulations. Major players in the region include China, India, Japan, and South Korea. The Growing emphasis on building safety standards and regulatory compliance is fueling demand for advanced fire stopping solutions. Furthermore, the expansion of both commercial and residential infrastructure is further boosting market growth.

Fire-stopping materials are crucial components for fire protection systems installed in buildings. Their primary goal is to stop the fire blaze and smoke passing through walls, floors, and roofs. There are a variety of fire-stopping materials that can be used for a variety of purposes and requirements. These materials are important to building safety, adding to passive fire protection by safeguarding the respectability of fire-evaluated compartments and barriers. Fire-stopping products are utilized to re-establish the fire resistance ratings of walls and floors, successfully fixing openings made for mechanical, electrical, and plumbing systems. Their essential capability is to upgrade safety by giving additional time for escape during a fire and reducing property damage.

The fire stopping materials market is growing promptly, driven by its vital role in meeting safety standards and regulations across various industrial and commercial sectors. This growth is driven by their critical applications in defending assets, machinery, and infrastructure from fire hazards as the demand for fire safety solutions in high-rise buildings and various industrial sectors rises.

AI Integration in the Fire Stopping Materials Market

In the fire stopping materials market, the integration of artificial intelligence and IoT technology changes fire safety management. IoT-empowered fire-stopping arrangements work with continuous observing and controller, working on functional productivity and reaction times. Smart detectors with advanced sensors can rapidly identify irregularities like smoke, intensity, or gas, reducing false alarms. AI-driven analysis of information designs upgrades the capacity to predict fire dangers and implement proactive measures. Computerized checking systems further develop fire-stopping maintenance by giving immediate insights into the condition and execution of fire-stop establishments, allowing for early issue detection and advancing the adequacy of fire assurance systems.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.38 Billion |

| Market Size in 2023 | USD 1.66 Billion |

| Market Size in 2024 | USD 1.81 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.22% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing occurrences of fire accidents

Materials that prevent fire play a crucial role in enhancing building safety. These materials are intended to seal holes and openings in walls, floors, and roofs that could somehow or another permit fire and smoke to spread. By maintaining the integrity of fire-evaluated boundaries, fire-stopping materials help to hold fire inside a particular region, giving an important chance for occupants to get away and for crisis administrations to answer. They likewise limit property harm by preventing the quick spread of flames and poisonous gases. Fire-stopping materials are fundamental for viable fire protection, particularly as fire mishaps become more frequent. Such factors are driving the fire stopping materials market.

Strengthening fire safety regulations

Strengthening fire safety regulations is a basic driver in upgrading overall building safety. All buildings, particularly high-risk ones like hospitals, schools, and high-rises, should be subject to mandatory, ongoing fire safety audits and inspections. These audits should ensure compliance with fire safety codes, identify potential hazards, and recommend necessary corrective actions, with penalties for non-compliance. Furthermore, updating fire safety infrastructure and equipment is fundamental, including modernizing fire administrations and guaranteeing sufficient fire stations, vehicles, and hardware.

Fire safety regulations are different all over the world because of different national priorities and approaches. For example, the U.S. sticks to norms set by the Public Fire Assurance Affiliation (NFPA), the Global Construction Law (IBC), and OSHA. The United Kingdom's regulations are governed by the Building Regulations and the Regulatory Reform (Fire Safety) Order. The European Union follows the EU Construction Products Regulation (CPR) and European Norms (EN), while Canada conforms to the National Building Code of Canada (NBC), and China involves the Code for Fire Protection Design of Buildings. These regulations play a crucial role in developing fire safety and protecting lives and property.

High cost

High costs associated with fire-stopping materials can significantly impact their adoption and market growth. Advanced fire-stopping systems and high-quality fire-stopping material can be costly. The ongoing costs for maintaining and inspecting fire-stopping systems also contribute to their high cost.

Advances in innovative fire-stopping systems

Recent advancements in fire-stopping systems have created lucrative opportunities for key players in the fire stopping materials market. The advancement of innovative fire-resistant materials has expanded the scope of fire-stopping arrangements. Present-day improvements incorporate high-level fire-evaluated gypsum sheets, insulation materials, and fire-resistant fabrics and coatings, which give superior fire protection while safeguarding aesthetic and functional qualities. These materials improve building design by integrating enhanced safety highlights with design flexibility.

For example, nanotechnology-based coatings offer extraordinary fire retardancy, and eco-friendly options support sustainability without compromising safety standards. Architects and engineers can improve a building’s structural integrity, stop fires from spreading, and make communities more resilient by using cutting-edge materials in construction. This will ultimately reduce the damage caused by fires.

The sealants segment held the dominating share of the fire stopping materials market in 2023. Fire sealants and gap fillers are significant for preventing the spread of fire and smoke through openings in buildings. When presented with high temperatures, these fire-stopping materials extend to form a protective barrier. Depending on the substrate and the specific application, selecting the appropriate sealant or filler is crucial.

Chemicals in intumescent sealants, which are frequently utilized in fire-rated walls and floors around pipes, cables, and other penetrations, expand when heated to prevent smoke and fire from entering. Firestop sealants, available in types like silicone, intumescent, and elastomeric, are utilized to fill holes and joints. Silicone sealants are excellent for moist environments due to their flexibility and resistance to water. While elastomeric sealants retain their flexibility and effectiveness in extreme temperatures, intumescent sealants expand significantly when heated, sealing gaps to prevent the passage of smoke and fire.

Tthe putty & putty pads segment is expected to grow at a notable rate in the fire stopping materials market during the forecast period. Firestop putty is a flexible substance that can be molded to fit around pipes, cables, and other small openings in fire-rated walls and floors. It is especially useful in limited spaces where other fire-stopping materials might be difficult to install.

The electrical segment accounted for the biggest share of the fire stopping materials market in 2023. The fire resistance of separating elements can be weakened by ‘partial penetrations, like down-lighters, electrical sockets, switches, and sound systems. Under fire conditions, these fittings might permit heat to enter the holes of walls, segments, floors, or roofs all the more rapidly, possibly leading to premature failure. To resolve these issues, the National Fire Protection Association upholds National Electrical Security Month, a drive by the Electrical Safety Foundation (ESFI) that aims to bring issues to light about home electrical dangers, feature the significance of electrical fire security, and guarantee the safety of electrical workers.

The plumbing segment is expected to witness considerable growth in the fire stopping materials market over the forecast period. Fire stopping includes carrying out preventative measures to restrict the spread of fire and smoke all through a building. This means pipes, gaps, and openings in fire-rated walls, floors, and ceilings in the plumbing industry. The objective is to maintain these barriers' fire resistance ratings. Effective fire-stopping arrangements, including smart intumescent products, are critical for preventing the fire from going through the pipework. By slowing the spread of fire and smoke, passive fire and smoke barriers in walls, ceilings, and floors contribute significantly to building safety. Maintaining the fire resistance of the compartment walls and floors, preventing the fire from spreading. Particular fire-stopping items are utilized to seal pipe penetrations, accordingly improving building fire safety.

The commercial segment held the largest share of the fire stopping materials market in 2023. This area incorporates various offices, such as cafes, hospitals, retail and supermarkets, hotels, and institutional buildings like secondary schools and universities. Modern commercial and public structures are continually advancing, which can influence the adequacy of introduced fire assurance frameworks. In particular, building administrations frequently cause breaks in fire obstructions. The development of fire-resistant building materials that are resistant to fire is reshaping construction safety.

The industry segment is expected to grow at the fastest rate in the fire stopping materials market during the forecast period. Fire-stopping materials, including sealants, mortars, and coatings, have become crucial for meeting stringent safety standards and regulations in the construction industry. Their applications extend beyond construction to various sectors such as manufacturing, oil and gas, aerospace, electrical, automotive, and telecommunications. These materials are highly valued for their ability to safeguard critical assets, machinery, and equipment from fire. The adoption of fire stopping materials is rapidly increasing due to their vital role in providing fire safety solutions for high-rise buildings and other structures.

Segments Covered in the Report

By Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

February 2024

January 2025

September 2024