December 2024

Flat Steel Market (By Type: Hot Rolled Coil (HRC), Cold Rolled Coil (CRC), Sheets, Others; By Application: Construction, Automotive & Transportation, Mechanical Equipment, Energy, Packaging, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

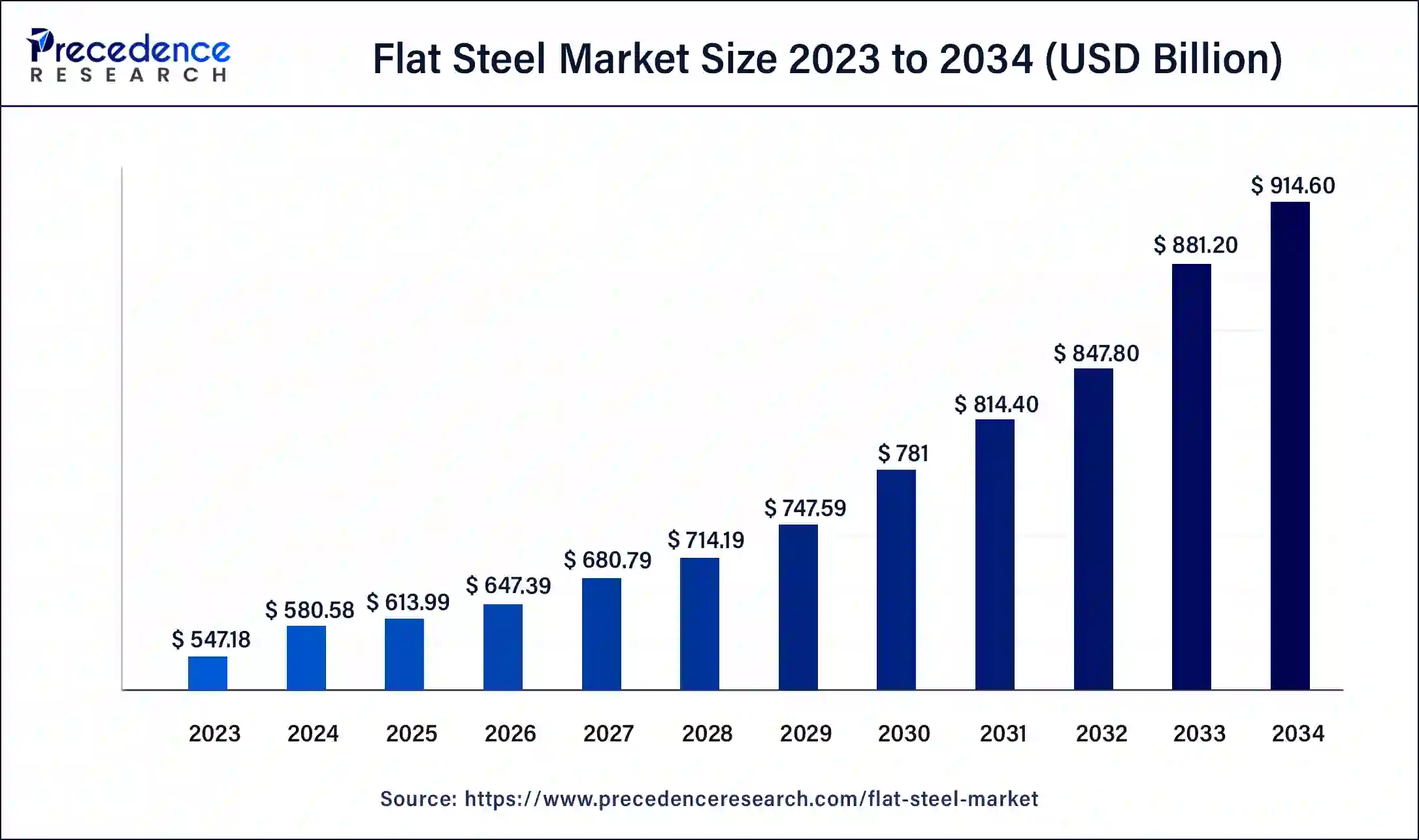

The global flat steel market size was USD 547.18 billion in 2023, calculated at USD 580.58 billion in 2024 and is expected to reach around USD 914.60 billion by 2034, expanding at a CAGR of 4.65% from 2024 to 2034.

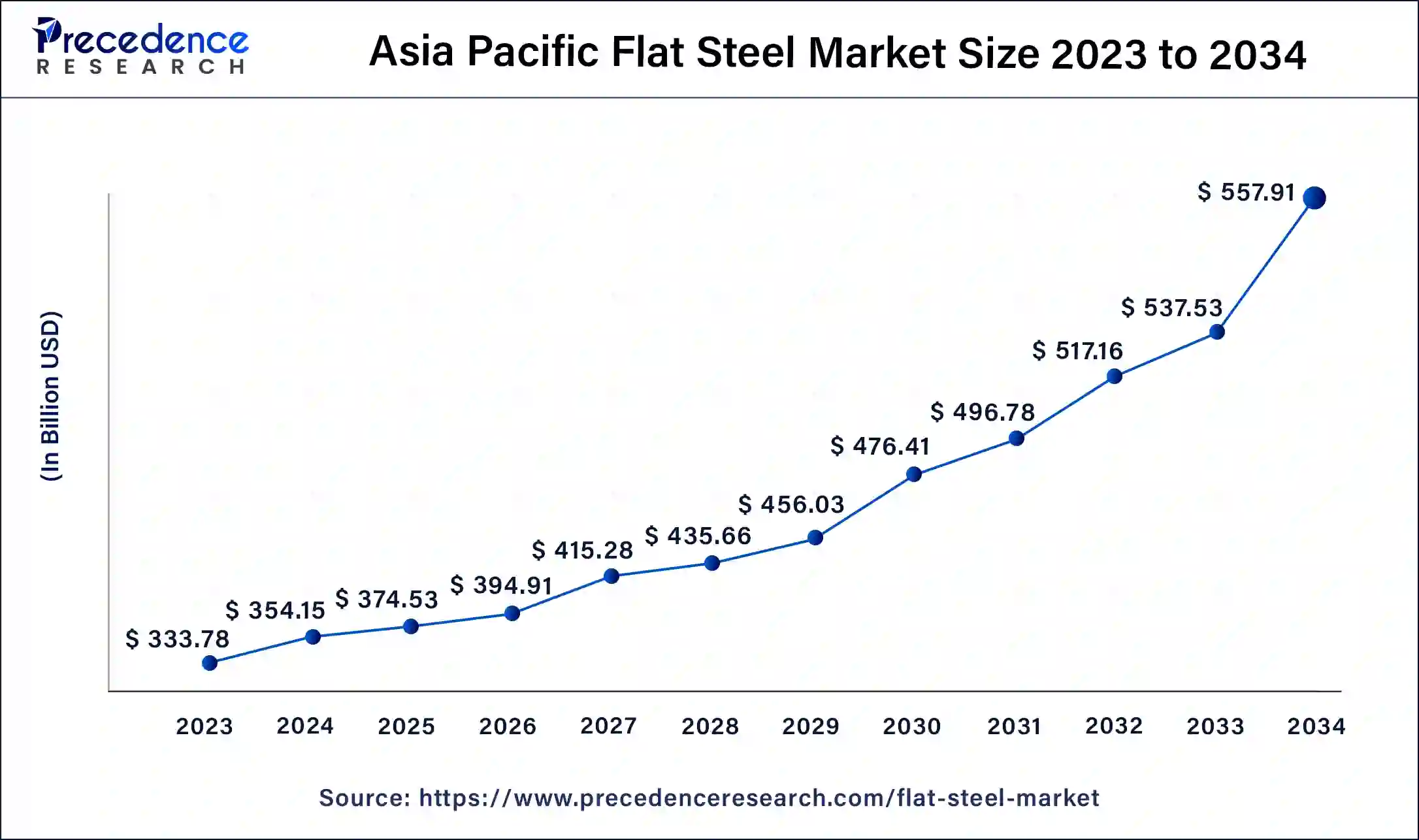

The Asia Pacific flat steel market size was valued at USD 333.78 billion in 2023 and is expected to reach around USD 557.91 billion by 2034, growing at a CAGR of 5% from 2024 to 2034.

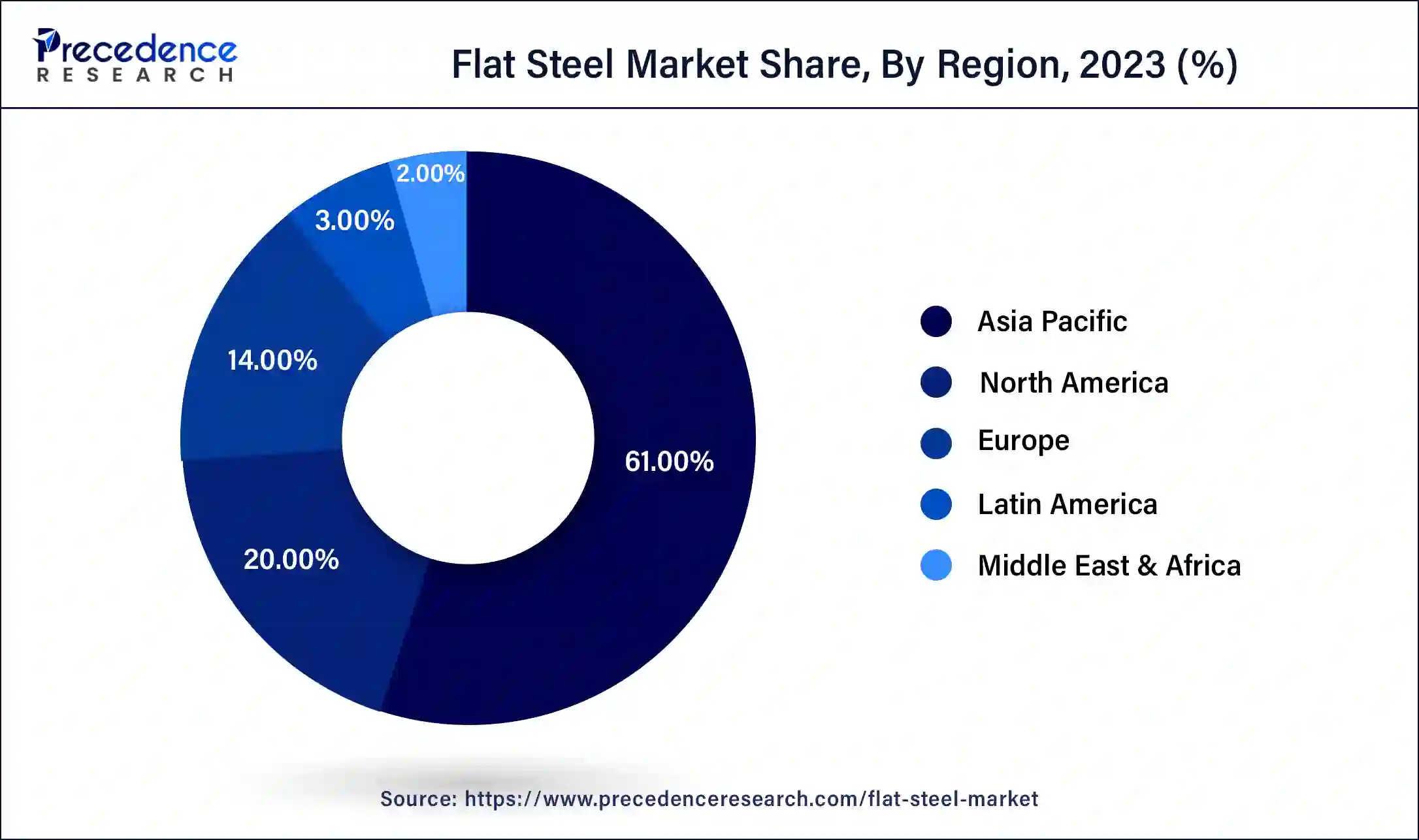

Asia Pacific has held the largest revenue share of 60.2% in 2024. Asia-Pacific stands as a dominant force in the flat steel market, driven by vigorous industrial growth, swift urban expansion, and substantial infrastructure initiatives.

The area's prominence is further propelled by heightened construction and flourishing automotive manufacturing. India, a key contributor, is also experiencing a significant upsurge in infrastructure endeavors. With these factors in play, Asia-Pacific retains a leading position in the global flat steel market, wielding considerable influence on demand patterns and industry trajectories.

Meanwhile, Europe's notable growth in the flat steel market can be attributed to robust demand from the construction and automotive sectors. The recovery of these industries post-pandemic, coupled with increased infrastructure investments, fuels the demand for flat steel. Moreover, the region's commitment to sustainable practices aligns with the material's recyclability and eco-friendly features. Favorable economic conditions, technological advancements, and a focus on energy-efficient applications contribute to Europe's prominence in the expanding flat steel market.

North America is poised for rapid growth in the flat steel market due to several factors. The region is experiencing a resurgence in construction activities, including infrastructure development and residential projects. Additionally, the recovering automotive industry, coupled with advancements in technology and a focus on lightweight materials, is driving increased demand for flat steel in vehicle manufacturing. The region's commitment to renewable energy projects, such as wind power, further contributes to the growing need for flat steel in the energy sector. These combined factors position North America as a key player in the expanding flat steel market.

Flat steel refers to a class of steel products characterized by their flat and thin shapes, typically in the form of sheets or strips. These sheets exhibit a rectangular cross-section and are produced through processes such as hot rolling or cold rolling. Flat steel finds extensive use in various industries, including construction, automotive manufacturing, appliances, shipbuilding, and infrastructure projects.

Its versatility stems from its ability to be easily manipulated and formed into different shapes, making it a crucial material for constructing buildings, manufacturing vehicles, and creating diverse consumer goods. The flat steel market is influenced by factors such as economic conditions, infrastructure development, and technological advancements, reflecting its integral role in supporting the global industrial and construction sectors.

Flat Steel Market Data and Statistics

Steel export and import data for the top 10 countries in the world:

| Country | Exports (Million Tonnes) | Imports (Million Tonnes) | Trade Balance (Million Tonnes) |

| China | 62.2 | 55.3 | 6.9 |

| Japan | 35.1 | 19.2 | 15.9 |

| India | 11.2 | 8.3 | 2.9 |

| South Korea | 33.6 | 26.2 | 7.4 |

| Russia | 35.9 | 7.8 | 28.1 |

| United States | 10.1 | 23.9 | -13.8 |

| Germany | 24.1 | 21.4 | 2.7 |

| Italy | 21.3 | 15.8 | 5.5 |

| Turkey | 16.2 | 12.1 | 4.1 |

| France | 14.9 | 12.8 | 2.1 |

| Report Coverage | Details |

| Market Size by 2034 | USD xx Billion |

| Market Size in 2023 | USD xx Billion |

| Market Size in 2024 | USD xx Billion |

| Growth Rate from 2024 to 2033 | CAGR of xx% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Infrastructure Investments

Infrastructure investments play a crucial role in fueling the demand for the flat steel market. As both government bodies and private enterprises allocate funds towards extensive construction ventures like bridges, highways, and commercial structures, the necessity for flat steel escalates. The adaptability and structural reliability of flat steel make it a fundamental material in these projects. Whether in roofing, flooring, or support structures for buildings, flat steel proves indispensable. Additionally, the transportation sector, including bridges and roads, heavily relies on flat steel due to its resilience and ability to bear substantial loads.

The upswing in infrastructure investments not only triggers an immediate surge in flat steel demand but also initiates a prolonged domino effect. As new infrastructure projects come to fruition, they catalyze economic activities, instigating a continuous cycle of construction and development initiatives. This symbiotic relationship leads to an enduring and expanding need for flat steel, positioning it as a primary beneficiary of heightened infrastructure investments, both at the national and global levels.

Data analysis challenges

Trade disputes and tariffs impose significant restraints on the flat steel market by disrupting the global supply chain and influencing market dynamics. When tariffs are imposed on steel imports or exports, it often leads to increased costs for manufacturers, impacting their competitiveness. The imposition of tariffs can result in a complex web of retaliatory measures and countermeasures, creating uncertainty for flat steel producers and consumers alike. Trade disputes, especially between major economies, can lead to reduced international trade and market fragmentation. This fragmentation can disrupt established supply chains, making it challenging for flat steel manufacturers to source raw materials and distribute products efficiently.

Moreover, the threat of protectionist measures can dampen investor confidence and hinder long-term strategic planning for flat steel companies. The flat steel market's growth is intricately tied to global economic cooperation, and trade disputes introduce volatility and obstacles that can hinder market expansion and stability.

E-commerce and warehousing growth

With the rise of online retail, the demand for robust and efficient logistics infrastructure, including storage and distribution centers, has soared. flat steel plays a pivotal role in constructing these facilities, offering structural support and durability essential for the safe storage and handling of goods. As e-commerce continues to thrive globally, the need for expansive and well-equipped warehousing facilities is expected to persist, creating a sustained demand for flat steel. Moreover, the trend towards automated warehouses and smart logistics centers further amplifies the requirements for durable and versatile flat steel products, positioning the industry at the forefront of supporting the evolving landscape of modern commerce.

The hot rolled coil (HRC) segment dominated the flat steel market in 2023; the segment is observed to continue the trend throughout the forecast period. Hot Rolled Coil (HRC) is a type of flat steel produced through the hot rolling process, involving heating steel and then pressing it between rollers to achieve the desired thickness. Renowned for its malleability and durability, HRC finds extensive application in construction and automotive manufacturing. Within the flat steel market, there is a growing trend towards increased demand for HRC due to its versatility and strength. This reflects the ongoing preference for HRC in manufacturing processes where flexibility and robustness are critical factors.

The cold rolled coil (CRC) segment is expected to grow at a significant rate throughout the forecast period. Cold Rolled Coil (CRC) in the flat steel market refers to flat steel products that undergo a cold rolling process, enhancing surface finish and dimensional accuracy.

The CRC segment is characterized by its smooth and uniform surface, making it ideal for applications requiring precision. The CRC market has seen increasing demand, driven by its use in automotive manufacturing. In 2021, global automotive production reached approximately 77 million units, highlighting the significance of CRC in meeting the stringent quality standards of the automotive industry.

The construction segment is observed to hold the dominating share of the flat steel market during the forecast period. In the flat steel market, the construction segment pertains to the application of flat steel in various construction facets, including building structures and infrastructure. With the global construction sector expanding, the demand for flat steel remains robust. Flat steel's versatility in roofing, flooring, and structural components positions it as a crucial material, aligning with the escalating construction activities worldwide and underscoring its significance in shaping modern architectural landscapes.

The energy segment is expected to generate a notable revenue share in the market. In the flat steel market, the energy segment involves using flat steel in applications related to the energy sector. This includes constructing wind turbines, transmission towers, and components for oil and gas infrastructure. With a rising global emphasis on renewable energy, especially wind power, there's a growing demand for flat steel in building sturdy wind towers. As the energy industry shifts towards sustainable practices, the role of flat steel in supporting renewable energy infrastructure represents a notable and expanding market trend.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

September 2024

January 2024

January 2025