March 2025

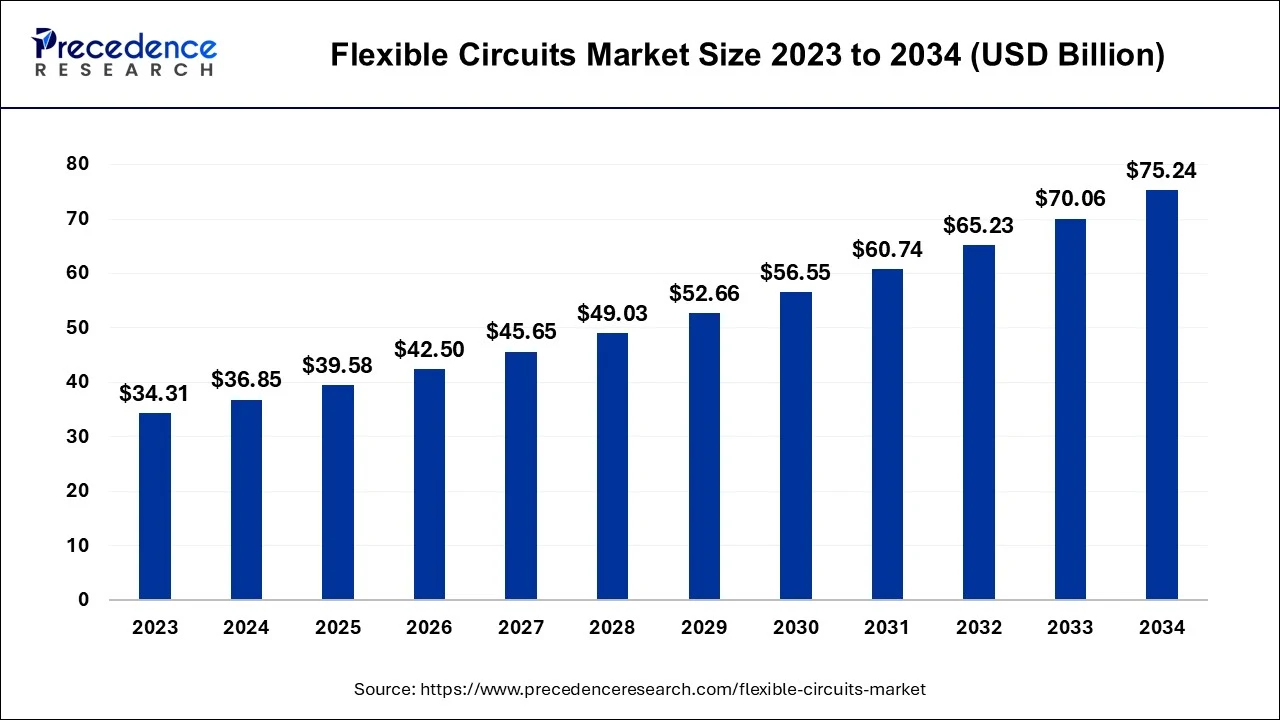

The global flexible circuits market size is estimated at USD 36.85 billion in 2024, grew to USD 39.58 billion in 2025 and is predicted to surpass around USD 75.24 billion by 2034, expanding at a CAGR of 7.40% between 2024 and 2034.

The global flexible circuits market size is estimated at USD 36.85 billion in 2024 and is anticipated to reach around USD 75.24 billion by 2034, growing at a CAGR of 7.40% between 2024 and 2034.

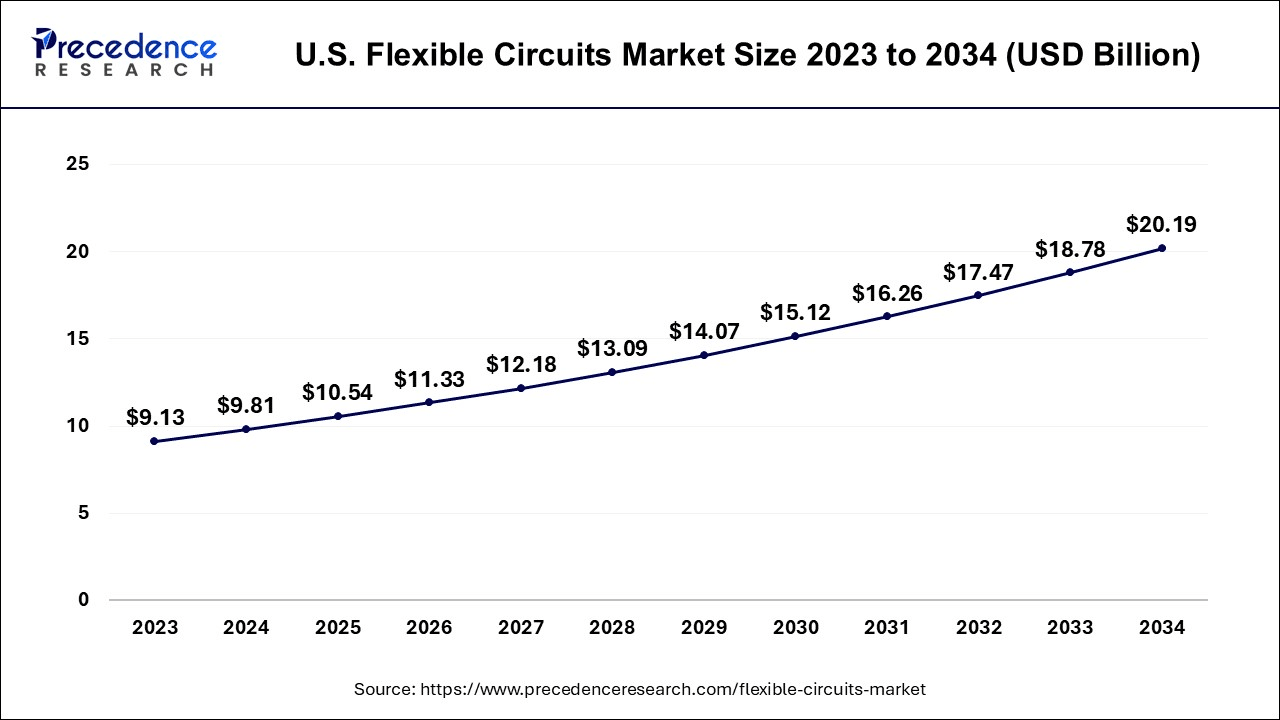

The U.S. flexible circuits market size is estimated at USD 9.81 billion in 2024 and is expected to be worth around USD 20.19 billion by 2034, at a CAGR of 7.48% from 2024 to 2034.

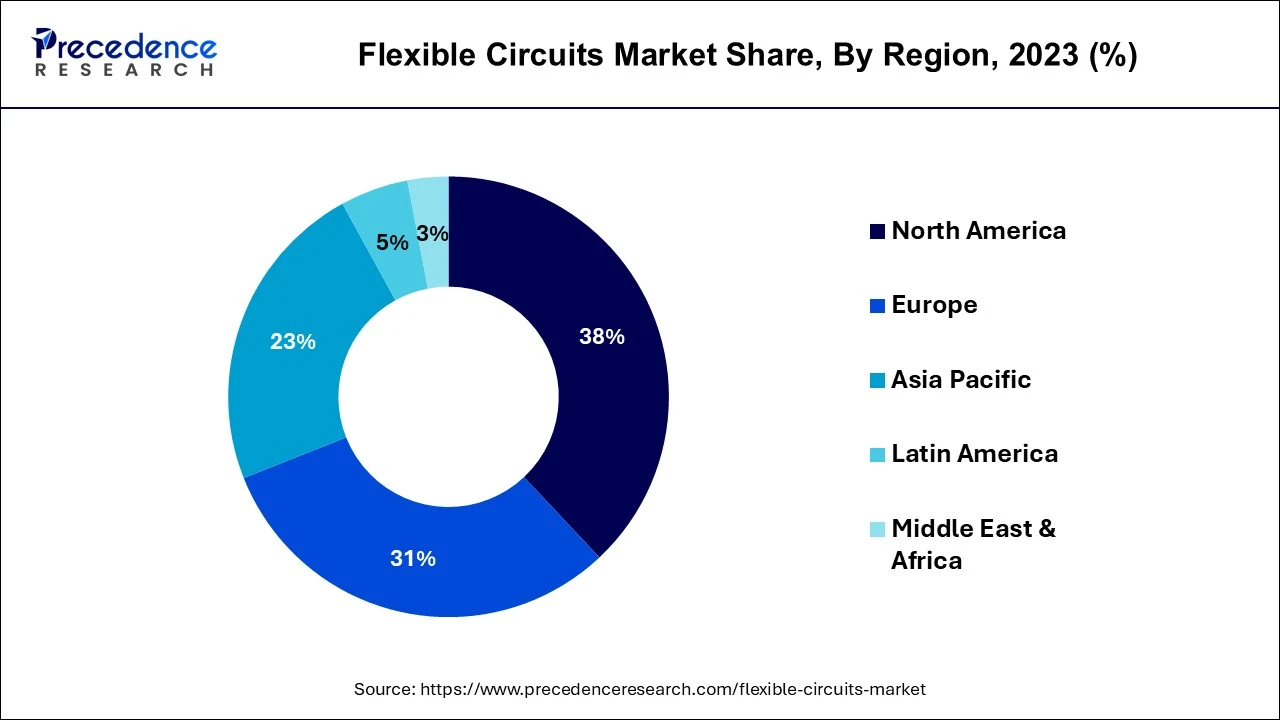

North America has held largest revenue share 38% in 2023. North America is witnessing a growing trend in the flexible circuits market driven by the rapid advancements in consumer electronics. The demand for flexible circuitry in smartphones, tablets, and wearables is surging. Additionally, the automotive sector is increasingly integrating flexible circuits in infotainment systems and advanced driver-assistance systems. The emphasis on sustainability and green technologies further influences the market, with a focus on eco-friendly materials. Collaborations with research institutions and tech companies contribute to innovation and a thriving market.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific dominates the flexible circuits market, mainly due to its status as a global electronics manufacturing hub. The region experiences a surge in the production of IoT devices, wearables, and smartphones, driving the demand for flexible circuits. Miniaturization and innovation in materials are paramount trends. Moreover, Asia Pacific focuses on cost-effective production, expanding market reach and diversity. Collaboration among industry players and research institutions fosters technological advancements and strengthens its leading position in the global flexible circuits market.

The flexible circuits market is a dynamic segment of the electronics industry, characterized by using flexible substrates like polyimide or polyester. Flexible circuits are lightweight, compact, and malleable electronic components that conform to various shapes. They are prized for their space-saving attributes and durability, making them a preferred choice in consumer electronics, automotive, aerospace, and medical devices.

The market's expansion is fueled by the rising need for compact, lightweight electronic solutions, complemented by material and manufacturing advancements, ensuring a promising future for flexible circuits in various industries. The flexibility of these circuits provides design versatility, and their adoption is expected to continue expanding across various industries.

| Report Coverage | Details |

| Market Size in 2024 | USD 36.85 Billion |

| Market Size by 2034 | USD 75.24 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.40% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Application, By Material, and By Construction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Miniaturization and consumer electronics

Miniaturization is a key driver surging the market demand for flexible circuits. As consumer and industrial electronics continue to shrink in size and weight, traditional rigid PCBs struggle to keep pace. Flexible circuits, due to their bendable and adaptable nature, offer a compelling solution. They allow manufacturers to create smaller, lighter, and more compact electronic devices while maintaining functionality. This trend is particularly evident in the smartphone industry, where consumers demand increasingly sleek and lightweight designs. Flexible circuits are integral in achieving these design goals, and their ability to fit into tight spaces and conform to various form factors has revolutionized product design and manufacturing across various sectors.

These circuits have become a staple in the design of such devices, enabling curved displays, flexible components, and robust connections. As consumers seek the latest innovations and cutting-edge technology, consumer electronics manufacturers must turn to flexible circuits to meet these demands. This surge in consumer electronics drives both the adoption and continuous development of flexible circuit technology, establishing it as a pivotal component in the ever-evolving world of portable and consumer-oriented electronic products.

Signal integrity challenges and high production costs

Signal integrity issues can pose significant restraints on the flexible circuits market. Maintaining the integrity of data and power transmission within flexible circuits is a complex task, particularly as these circuits need to accommodate bending and flexing. Signal degradation can lead to data loss, electrical noise, and reduced performance. Ensuring signal integrity demands rigorous design and testing methodologies, which can increase production time and costs. Additionally, in high-frequency applications, signal integrity challenges can be even more pronounced, limiting the application of flexible circuits in critical industries like telecommunications and high-speed data transmission.

The flexible circuits market faces limitations due to high production costs. Developing cost-effective manufacturing processes for flexible circuits remains a primary concern. The intricate design and specialized materials required for flexible circuits can be expensive. Achieving the necessary precision, consistency, and reliability in production adds to the overall cost. These factors can lead to a higher price point for flexible circuit solutions, making them less accessible for some applications and potentially limiting their adoption, particularly in cost-sensitive industries. Reducing production costs while maintaining quality is a continual challenge for the flexible circuits market to address market demand effectively.

IoT expansion and sustainability initiatives

The flexible circuits market experiences a substantial boost in demand due to the widespread adoption of Internet of Things (IoT) devices. With IoT applications expanding into various sectors, flexible circuits become indispensable components, offering the required flexibility and adaptability for these smart devices. Their crucial role in connecting and powering IoT devices is evident as the IoT ecosystem continues to grow, further driving demand in the flexible circuits market.

The adaptability of flexible circuits allows them to conform to the unique shapes and spaces within IoT devices, enabling the miniaturization and integration of electronics. As IoT applications diversify, including smart home devices, wearable technology, and industrial sensors, the demand for flexible circuits grows exponentially. Their flexibility and versatility make them an ideal choice for connecting and powering these intelligent devices, further driving market demand.

The global shift toward sustainability and eco-friendliness is a significant driver for the flexible circuits market. As environmental concerns intensify, manufacturers are increasingly adopting green and sustainable materials in their production processes. Flexible circuits, when designed with eco-friendly materials and manufacturing techniques, align with these sustainability initiatives.

Moreover, the durability and longevity of flexible circuits reduce electronic waste and contributes to a more sustainable electronics ecosystem. As environmental regulations and consumer preferences emphasize sustainability, the adoption of eco-friendly flexible circuits is gaining momentum, generating heightened demand in a market that prioritizes both performance and environmental responsibility.

According to the application, the consumer electronics segment has held of 48% revenue share in 2023. In the flexible circuits market, consumer electronics encompass devices such as smartphones, wearables, and tablets. Trends in this segment include the demand for thinner and more lightweight devices, where flexible circuits play a pivotal role in achieving sleek designs. As consumers seek innovative and portable technology, flexible circuits enable compact and durable solutions. Additionally, the market trend involves integrating flexible circuits into foldable screens and advanced displays, catering to the growing demand for flexible and immersive consumer electronic experiences.

The automotive sector segment is anticipated to expand at a significant CAGR of 8.5% during the projected period. Within the automotive sector, flexible circuits are employed for infotainment systems, Advanced Driver Assistance Systems (ADAS), and electronic control units (ECUs). The trend in this application involves the integration of flexible circuits for space-saving and weight reduction.

Automakers are increasingly using flexible circuits to streamline vehicle electronics and achieve better designs, enhancing vehicle safety and user experiences. As electric and autonomous vehicles gain prominence, the role of flexible circuits in enabling advanced automotive technologies continues to grow.

Based on the material, the base material segment held the largest share of 42% in 2023. In the flexible circuits market, the base material refers to the substrate upon which the flexible circuit is constructed. It serves as the foundation for the entire circuit and must possess attributes like flexibility, durability, and good thermal performance. Manufacturers are increasingly adopting advanced materials such as polyimide, polyester, and liquid crystal polymer to enhance the base material's properties, enabling thinner and more resilient flexible circuits. Additionally, sustainable and eco-friendly base materials are gaining prominence, aligning with the growing demand for environmentally responsible electronics.

On the other hand, the conductor materials segment is projected to grow at the fastest rate over the projected period. Conductor materials in flexible circuits refer to the conductive elements that transmit electrical signals. Key trends involve the use of materials with high conductivity and flexibility. Copper remains a primary choice due to its excellent electrical properties. However, advancements in nanomaterials and conductive inks are expanding the possibilities, allowing for thinner and more flexible conductors, reducing weight and improving performance in various applications, including IoT devices and wearables.

In 2023, the single-sided flex circuits segment had the highest market share of 37% based on the end user. Single-sided flex circuits are designed with a single conductive layer. They are highly flexible and often used in applications where bending or twisting is required. Trends in the flexible circuits market show an increasing demand for single-sided flex circuits due to their lightweight, compact design and cost-efficiency. Their use is prevalent in consumer electronics, automotive, and healthcare devices, as they offer space-saving solutions while maintaining reliability.

The multi-layer flex segment is anticipated to expand at the fastest rate over the projected period. Multi-layer flex circuits consist of multiple conductive layers separated by insulating layers. These circuits are known for their enhanced functionality and versatility. In the flexible circuits market, the trend is shifting towards multi-layer flex circuits, especially in high-end electronics and complex applications like aerospace and telecommunications. The demand for increased functionality and miniaturization in electronic devices is driving this trend, as multi-layer flex circuits offer the necessary flexibility while accommodating a higher level of complexity and interconnections.

Segments Covered in the Report

By Application

By Material

By Construction

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

August 2024

September 2024

December 2024