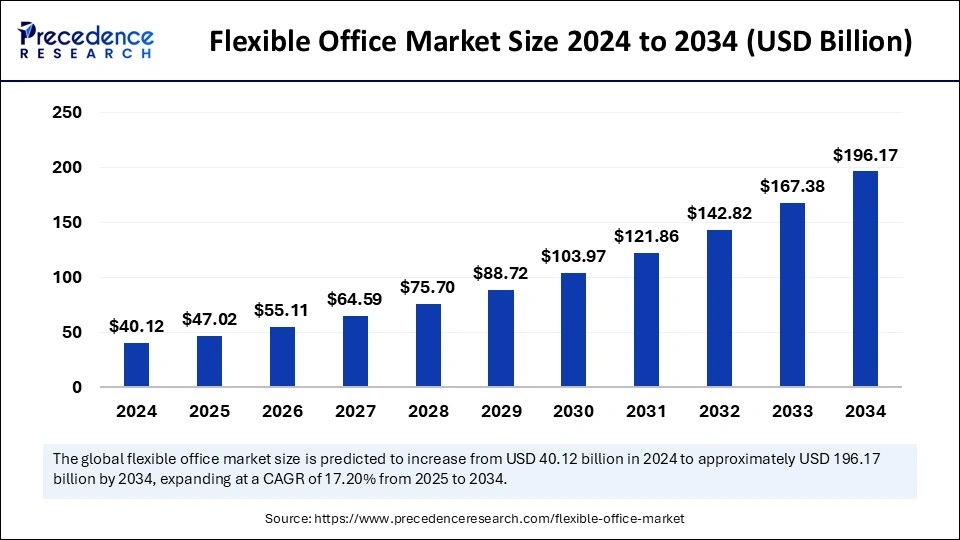

The global flexible office market size is calculated at USD 47.02 billion in 2025 and is forecasted to reach around USD 196.17 billion by 2034, accelerating at a CAGR of 17.20% from 2025 to 2034. The North America market size surpassed USD 14.04 billion in 2024 and is expanding at a CAGR of 17.36% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global flexible office market size is accounted for USD 40.12 billion in 2024 and is predicted to increase from USD 47.02 billion in 2025 to approximately USD 196.17 billion by 2034, expanding at a CAGR of 17.20% from 2025 to 2034. The demand for hybrid work models has increased, driving the growth of the global flexible office market. The rising demand for flexible and cost-effective solutions to reduce overheads is boosting the market.

Flexible office spaces are a spectacular area to showcase the ‘AI everywhere’ concept. The implementation of cutting-edge technologies in workspaces is the key tool to advance their flexibility. Artificial Intelligence integration with flexible office space is enabling efficient space management features, enhancing user experiences, data-driven decision-making, and improving security and flexibility.

AI-powered features like predictive maintenance, smart space management, personalized recommendations, automated customer support, and real-time analytics and monitoring are evaluated to enhance user experience and flexible office efficacy. AI integration is projected to increase the adoption rate of flexible office spaces and adapt novel business models.

76% of employees have predicted the implementation of AI and machine learning technology will transform workplace operations in 2025. Additionally, 84% of employees agree on the capabilities of AI-powered tools to drive productivity, emphasizing their potential to optimize workflows and decision-making to enhance workplace settings.

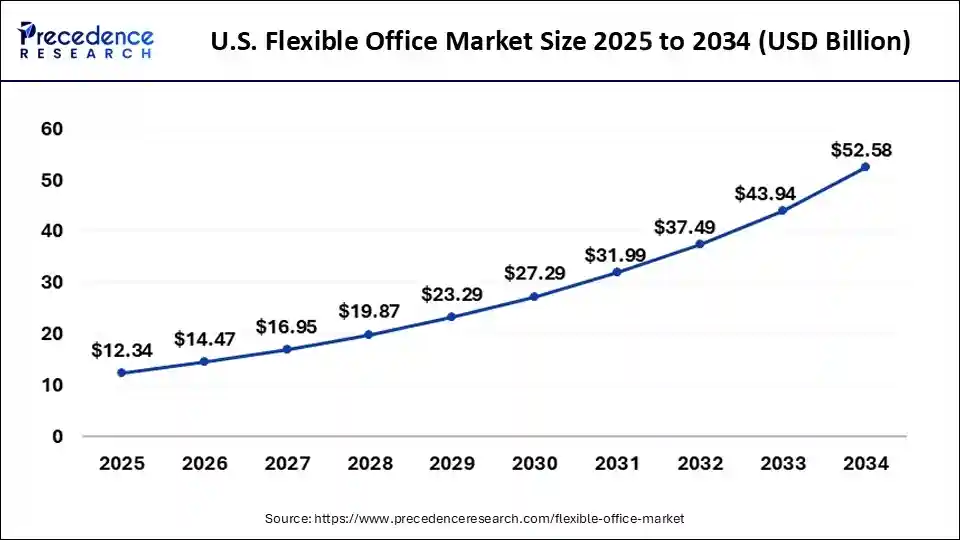

The U.S. flexible office market size was exhibited at USD 10.53 billion in 2024 and is projected to be worth around USD 52.58 billion by 2034, growing at a CAGR of 17.44% from 2025 to 2034.

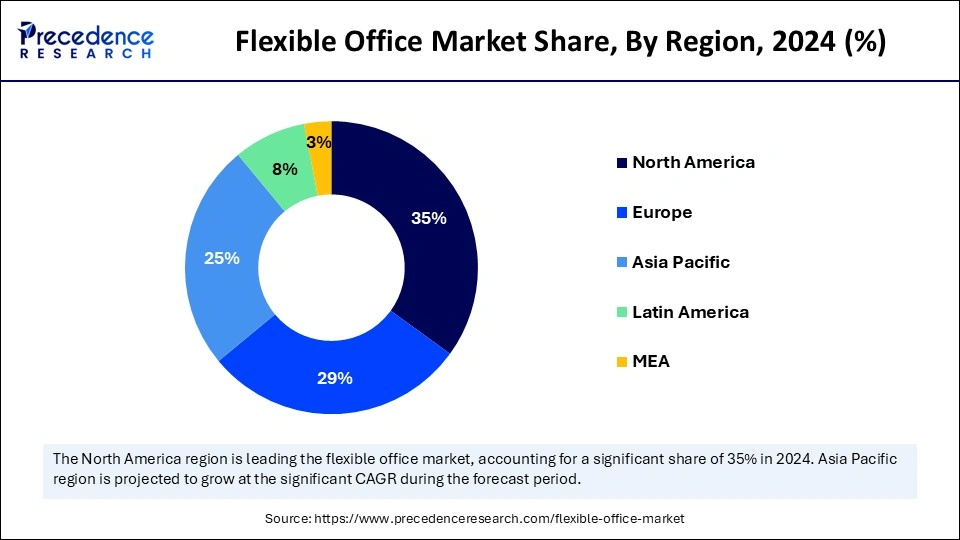

North America as market dominant

North America dominates the global flexible office market due to changing work lifestyles in the region. The strong economy settings and presence of major players, including WeWork, Regus, and IWG, play a crucial role in this growth. The expansion of major IT players and the adoption of remote work drives market expansion in the region. The COVID-19 pandemic has had a major impact on the regional working structure. The increased demand for work flexibility by employees in countries like the United States and Canada and the rapid adoption of coworking spaces to provide cost-effective office space for hybrid work models are high contributors to the growth in the market.

United States' emphasis on the flexible Office market

The United States is leading the regional market with broad adoption of flexible work arrangements and a thriving startup ecosystem. The United States has a mature, flexible office market due to the country's high demand for flexible workspaces. The high adoption of a remote working culture and a strong economy led the country to dominate the North American market. The presence of key market players contributes to a higher share in the growth. However, with the implementation of federal return-to-office plans, the United States is likely to witness less adoption of flexible office space in the upcoming period.

What factor contributes to Asia's flexible office market area?

Asia Pacific is seen to grow at the fastest rate in the flexible office market. The rapid growth of urbanization and the rising popularity of remote working are driving the regional market growth. Growing startup ecosystem, thriving adoption of flexible office in the region. Government support and investment to boost small and medium enterprises and startup companies are playing a favorable role in regions' adaptable capacity for flexible workspaces.

The survey by real estate consulting firm CBRE South Asia, released in July 2024, unveiled that 58% of companies are projected to have over 10% of their office portfolio in flexible workspace by 2026.

According to the ‘2024 India Office Occupier Survey’, 30% of companies were projected to increase their flexible office space as their primary portfolio strategy till the end of 2024.

India's flexible office market outlook

Indian cities are contributing an extreme share in the regional flexible office market growth. Countries with a well-established TI sector and startup ecosystem are the crucial adopters of flexible workspaces. The increased demand for co-working spaces and the adoption of remote working among SMEs and startups are leveraging flexible workspace settings in India. Additionally, the Indian market growth is anticipated due to the increased preference of corporates for flexible offices for equipped hybrid work models.

India’s managed flexible workspace sector is expected to witness extreme growth in 2025, with five major IPOs projected to raise over Rs 7,000 crore.

China's flexible office market trend

China is leading the regional market with the presence of large domestic and international operators. Countries rapidly growing urbanization and economic rise are leading to an increasing demand for flexible office spaces. Government support for coworking and innovation is shaping support for flexible office space entry in businesses. Cities like Beijing, Guangzhou, and Shenzhen are the pioneers and major adopters of flexible workspaces.

How will Europe illustrate the flexible office market?

Europe is observed to grow at a considerable rate in the flexible office market. Countries like the U.K., Germany, and France have boosted the adoption of flexible office space in Europe. The increased demand for fully managed spaces, along with access to soft services, is the major trend driving the adoption of flexible workspace in European countries. The expanding small and medium-sized businesses in all major countries of Europe are fulfilling the market expansion. Europe is anticipated to boost flexible workspace settings in the upcoming period with the presence of a favorable business environment with a high level of economic stability, a strong IT infrastructure, and a skilled workforce.

UK flexible office market trends

The United Kingdom is leading the regional market due to the country's increased surge in small and medium-sized businesses. The country's market is rapidly expanding, driven by increasing startup and IT sectors. The major players present in the country are showcasing demand growth for office leases and the need for flexible workspaces. The demand for flexible workspace has increased to enhance scalability and affordability.

The flexible office market reflects the global surge for flexible workspaces with affordable and scalable approaches. The flexible work arrangements benefit both in-office and remote work scheduling. Major industries like BFSI and small & medium-sized enterprises are the prior adopters of flexible office spaces. Companies are adopting flexible workspaces to enter new markets and provide on-demand meeting and collaboration facilities and networking. Companies are offering coworking spaces, virtual offices, serviced offices, and shared offices to provide flexible work management. Factors like increased demand for remote working, cost-effective solutions, and flexibility in offices are trending in the market. Growing urbanization and traveling issues are significant drivers for increased demands for remote and hybrid work models.

Flexible offices provide access to all office services and opportunities for new and expanded networking. A growing surge of start-ups and freelancers are demonstrating flexible workspace solutions to advance their flexibility, efficiency, scalability, and cost-saving natures. Technological advancements to improve user experiences and operational efficiency are emerging in the novel approaches in flexible office space settings. Additionally, a rising preference for amenities in the office space is likely to boost the structure of flexible workspaces. The market is projected to witness extreme demand for green-certified workplaces in the forecast period.

| Report Coverage | Details |

| Market Size by 2034 | USD 196.17 Billion |

| Market Size in 2025 | USD 47.02 Billion |

| Market Size in 2024 | USD 40.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Industry, Application, and Regions. |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Shift toward remote working

The shift toward remote working is the key driver of the flexible office market. The increased demand for flexibility is leading to the adoption of remote working. Shift of remote working fulfilling for adopting coworking spaces and hot desks to scale offices according to requirements. Remote work needs to collaborate with colleagues, partners, or clients, making it essential for flexible offices. Changing the workflow of freelancers, startups, and small enterprises is driving demand for flexible offices.

Remote working is a major cost-effective approach for offices. As the employee prefers to work remotely, companies require less physical working space, allowing them to provide flexible approaches. The surge of cost-effective solutions and technological advancements are boosting the adoption of flexible offices. However, with a growing preference for remote working, the market growth is accelerated to witness further highlights.

Economic volatility

The business is reducing its spending on office space during economic downturns, which leads to decreased demand for flexible office space. The increased shift of cost-saving strategies is likely to boost its priority over flexible options during economic downturns. Due to economic instability, businesses can reduce employee hiring due to the chances of fewer office space requirements. Additionally, the higher cost per employee leads businesses to minimize their commitment to flexible office contracts. Global trade tensions can hamper demand for flexible office space, making a preference for traditional leases.

Freelancers and startups

The rising preference for freelance and startups is signifying market potential. Freelancers and startups require adaptable workspace solutions. The requirement for professional environments without the high cost of dedicated office space for freelancers and startups is boosting advancements in flexible office settings. Freelancers seek community and networking opportunities as drivers’ attraction of flexible offices to advance connections with clients and collaborators.

The need for cost-effective desks makes flexible offices a more attractive solution for freelancers. Additionally, rapidly changing business demands and the need for innovations and collaborations make a flexible office ideal for startups. The need for diversification of services and expansion of new market approaches is fueling the importance of flexible office space for freelancers and startups.

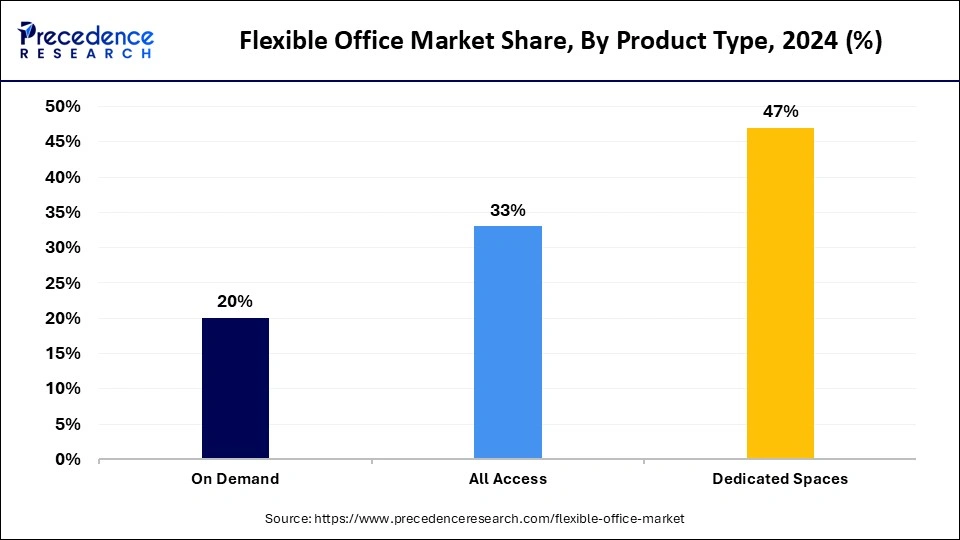

Based on product type, the dedicated spaces segment dominated the market due to the increased need for dedicated space for large businesses. A large enterprise is seeking more stability and control over the workspace while preserving the privacy of individual offices. Flexible offices can attract large companies by providing dedicated space to improve the co-working environment and reduce privacy hesitations. Growing adoption of office arrangements and growth of commercial real estate areas are the major drivers of segment growth. Moreover, the growing emphasis on increasing flexible services in dedicated space among flexible office providers is leveraging segment growth.

On the other hand, the all-access segment is expected to grow at the fastest rate over the forecast period. The segment growth is attributed to the rising popularity of flexible offices, which can offer greater flexibility, convenience, and scalability for businesses. All-access memberships provided by flexible offices attract businesses. The flexible office provides access within the office location, including co-working areas, meeting rooms, and phone booths. The growing trend of remote work and digital nomadism is leading the segment to grow further.

Based on industry, the IT/ITES segment accounted for the biggest market share in 2024. The IT/ITES sector is a prior adopter of flexible offices. The demand for flexible workplaces in the IT/ITES sector is high due to the increased adoption of hybrid work models. The rapidly changing business of the IT/ITES sector requires adaptable workspaces to accommodate changes. The increased demand for scalable and cost-effective workplaces is driving the popularity of flexible offices among IT/ITES sectors. IT/ITES companies look up flexible workspaces as a key tool for attracting and retaining top talents.

The BFSI segment is projected to grow at the fastest CAGR during the forecast period due to the growing demand for agile and flexible workplaces in BFSI companies. This company is a prime adopter of digitalization, the ongoing digital transformation driving a need for flexible workspace to support companies’ technological needs. Increased need for scalability and the ability to be equipped with changing workforce insights are driving the trend for flexible offices in these companies.

Based on application, the SME segment accounted for the largest share of the market because of the demand for flexible and cost-effective workspaces. Flexible office provides various advantages for small and medium-sized enterprises, including scalability, access to resources, and increased networking. Limited budgets and resources make flexible office solutions popular among SMEs. The rising adoption of remote working and digitalization requires flexible office space to support the workforce in SMEs.

However, the large enterprise segment is projected to witness significant growth in the forecast period. The segment growth is accounted for due to changing work dynamics and demand for agile and flexible workspaces. Large enterprises are prioritizing affordable solutions and improvement of employee engagement. Large enterprises are adopting flexible work arrangements like remote working and coworking to advance business settings.

By Product Type

By Industry

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client