January 2025

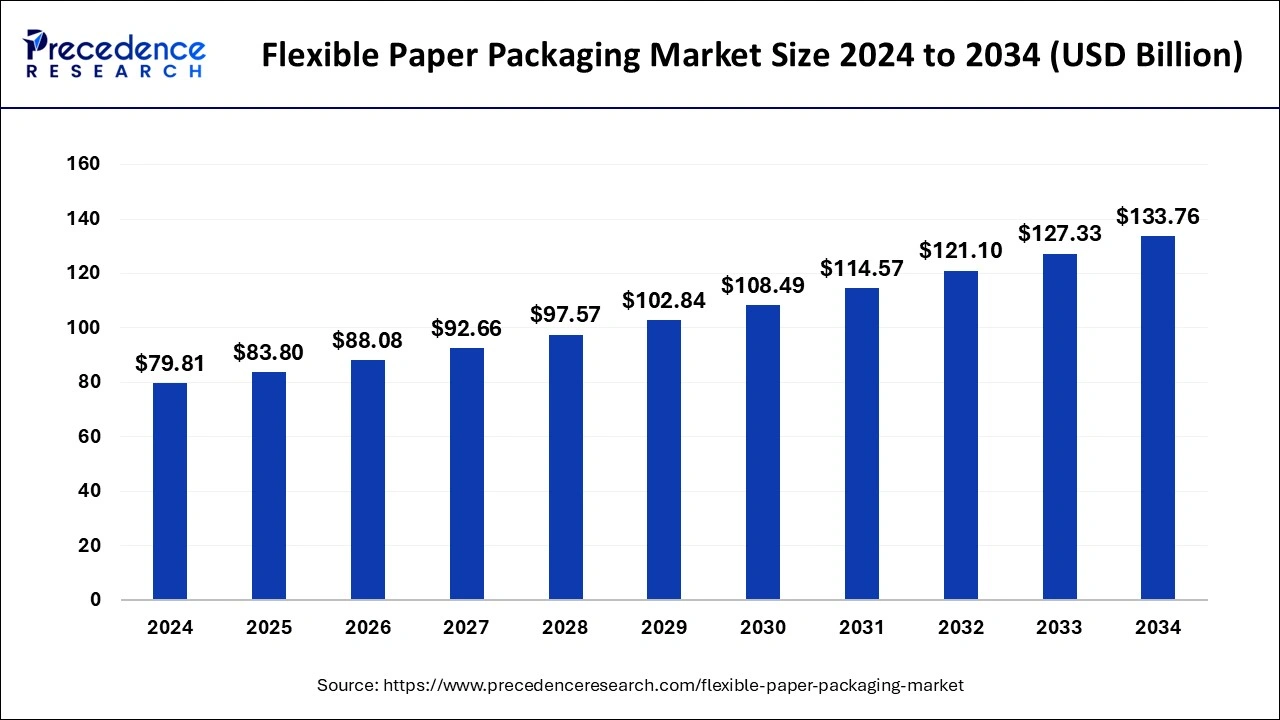

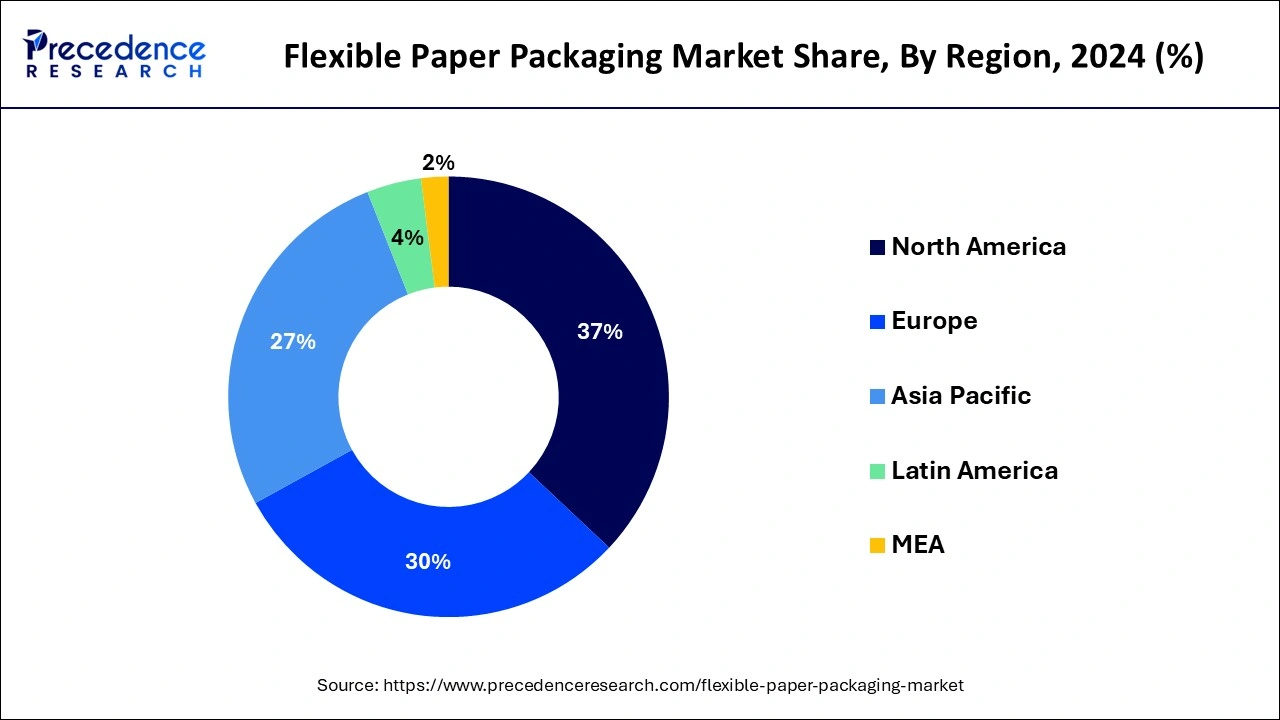

The global flexible paper packaging market size is calculated at USD 83.80 billion in 2025 and is forecasted to reach around USD 133.76 billion by 2034, accelerating at a CAGR of 5.30% from 2025 to 2034. The North America flexible paper packaging market size surpassed USD 29.53 billion in 2024 and is expanding at a CAGR of 5.32% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global flexible paper packaging market size was estimated at USD 79.81 billion in 2024 and is predicted to increase from USD 83.80 billion in 2025 to approximately USD 133.76 billion by 2034, expanding at a CAGR of 5.30% from 2025 to 2034.

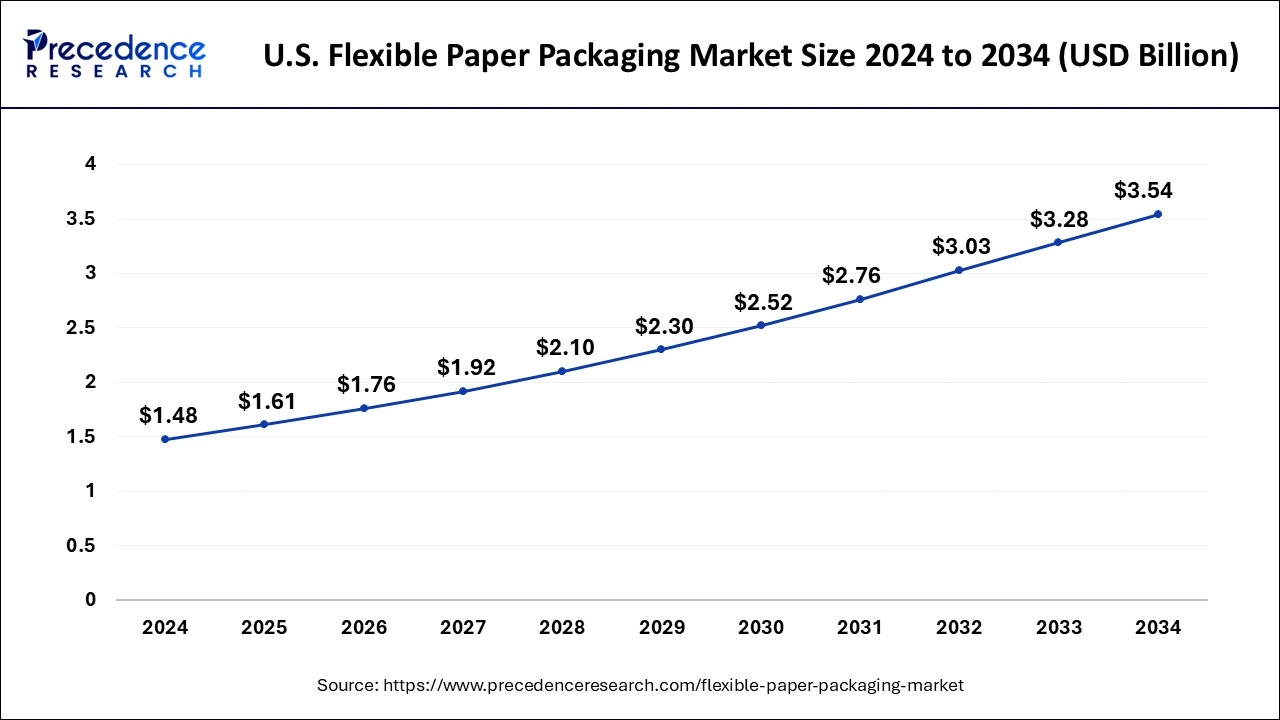

The U.S. flexible paper packaging market size was valued at 17.37 billion in 2024 and is projected to reach around USD 30.21 billion by 2034, growing at a CAGR of 5.69% from 2025 to 2034.

North America has held the largest revenue share 37% in 2024. In North America, the flexible paper packaging market encompasses a diverse range of sustainable paper-based packaging solutions. Driven by a heightened emphasis on sustainability, there is a growing demand for eco-friendly packaging materials that reduce environmental impact. Additionally, the adoption of digital printing technologies has surged, enabling brand personalization and visually appealing packaging. The COVID-19 pandemic reinforced the importance of hygienic packaging, leading to increased use of flexible paper materials in food and healthcare sectors.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific Flexible paper packaging market is marked by a robust demand for sustainable packaging solutions. As environmental concerns mount, there is a substantial shift towards paper-based materials due to their recyclability and biodegradability. The region is also witnessing a surge in customized and personalized packaging designs, driven by digital printing technologies. With the e-commerce boom, flexible paper packaging has gained prominence for its role in secure and convenient product delivery. The pandemic further heightened the need for hygienic and tamper-evident packaging solutions, propelling the use of flexible paper materials in the healthcare and food sectors.

Flexible paper packaging refers to a versatile and sustainable form of packaging primarily composed of paper materials. This packaging category includes a diverse range of solutions such as pouches, bags, wrappers, and sachets, serving various industries, including food, pharmaceuticals, and personal care. It combines the strength and lightweight properties of paper with the ability to conform to different shapes and sizes.

Several key drivers fuel the growth of the flexible paper packaging market including the global shift toward sustainability and eco-friendliness has propelled the adoption of paper-based packaging materials. Consumers increasingly seek environmentally responsible packaging options, making flexible paper packaging a preferred choice. Moreover, the convenience and versatility of flexible paper packaging have garnered attention, particularly in the food industry, where it provides ease of use and preservation of product freshness. Additionally, innovations in printing technologies enable eye-catching branding and designs, further boosting the market. Industry trends encompass innovations in recyclable and biodegradable packaging solutions, aligning with sustainability goals.

Customization and personalization of flexible paper packaging designs are on the rise, catering to diverse product needs and branding requirements. Moreover, the COVID-19 pandemic has emphasized the need for hygienic and tamper-evident packaging, which flexible paper packaging materials can provide. Challenges in the flexible paper packaging market include addressing competition from alternative materials like plastics and ensuring that sustainability goals do not compromise packaging performance. Fluctuations in raw material costs and supply chain disruptions also pose challenges for manufacturers. Business opportunities in the market include innovating sustainable packaging solutions, exploring collaborations for recycling initiatives, and expanding into emerging markets with rising consumer demands for eco-friendly packaging options. Meeting the demand for hygienic and tamper-evident packaging is another valuable opportunity in the current market landscape.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.30% |

| Market Size in 2025 | USD 83.80 Billion |

| Market Size by 2034 | USD 133.76 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material, By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Innovations in printing, convenience and versatility

The integration of cutting-edge printing technologies has revolutionized the appearance and functionality of flexible paper packaging. Digital printing, in particular, allows for intricate, high-quality graphics, vibrant colors, and customizable designs. This level of customization enhances brand visibility and consumer engagement, making products more appealing on the retail shelf. The ability to print detailed product information, QR codes, and captivating visuals on flexible paper packaging not only aids in branding but also conveys crucial product details, fostering consumer trust.

As a result, businesses are increasingly turning to flexible paper packaging to leverage these printing advancements for effective marketing and product differentiation. Moreover, Flexible paper packaging embodies two indispensable attributes: convenience and versatility. Pouches, sachets, and bags made from flexible paper are not only easy to open and reseal but also lightweight, reducing transportation costs.

Additionally, their flexibility facilitates space-saving storage. This convenience factor resonates with modern consumers' busy lifestyles and their preference for on-the-go, hassle-free packaging solutions. The ease of use, combined with the material's sustainability, underscores the growing consumer demand for flexible paper packaging, thereby driving its market demand.

Concerns about the possibility of errors in complex battle situations

One of the significant restraints affecting the flexible paper packaging market is competition from alternative packaging materials, particularly plastics. While flexible paper packaging is favored for its eco-friendliness and recyclability, plastics offer advantages such as durability, moisture resistance, and longer shelf life for certain products. In industries where these properties are critical, manufacturers may opt for plastic-based packaging solutions, posing a challenge to the market. To overcome this restraint, the flexible paper packaging industry needs to continually innovate, offering enhanced performance and features while maintaining its sustainability credentials.

Moreover, another notable restraint is supply chain disruptions, which have become more prevalent due to various global factors such as the COVID-19 pandemic, natural disasters, and geopolitical issues. Disruptions in the supply chain can lead to delays in the availability of raw materials and packaging components, affecting production schedules and creating uncertainty in the market. This can hinder the timely delivery of flexible paper packaging solutions to customers, potentially leading to a loss of business. To mitigate this restraint, companies in the flexible paper packaging market must invest in robust supply chain management strategies, diversify sourcing options, and ensure adequate inventory levels to address unforeseen disruptions effectively.

Sustainable packaging solutions, customization and personalization

The global shift towards sustainability and eco-friendliness has ignited a surging demand for flexible paper packaging. Consumers increasingly seek environmentally responsible packaging options that minimize their carbon footprint. Flexible paper packaging, made from renewable and biodegradable materials, aligns perfectly with these preferences. As consumers become more conscientious about their choices, manufacturers are responding by embracing sustainable practices, such as utilizing recyclable and FSC-certified paper. This emphasis on sustainability not only meets regulatory requirements but also fosters a positive brand image and consumer loyalty.

Moreover, in an era of personalized experiences, customization and personalization have emerged as key drivers of flexible paper packaging's popularity. Brands are leveraging digital printing technologies to craft visually appealing and unique packaging designs. Whether it's tailored messaging or intricate branding elements, flexible paper packaging allows for versatile and individualized packaging solutions. This trend not only enhances product visibility but also fosters a sense of connection with consumers, making it a valuable tool for brand differentiation in competitive markets. As consumers increasingly seek products that resonate with their preferences, customization and personalization options have surged the demand for flexible paper packaging, underscoring its importance in the packaging industry.

According to the material, the paper segment has held 43% revenue share in 2024. Paper-based flexible packaging involves the use of paper materials as the primary substrate for packaging solutions. This eco-friendly option offers recyclability, biodegradability, and sustainability, aligning with the global emphasis on eco-conscious packaging choices. Trends in paper-based flexible packaging include advancements in barrier coatings, which enhance the packaging's ability to protect products from moisture and oxygen, making it suitable for various applications. Additionally, digital printing technologies are gaining prominence, allowing for intricate and customizable designs on paper-based packaging, thereby enhancing product visibility and brand differentiation.

The bioplastics segment is anticipated to expand at a significant CAGR of 5.8% during the projected period. Bioplastics in the flexible paper packaging market: Bioplastics are an emerging trend in the flexible paper packaging market. These materials, derived from renewable sources like cornstarch and sugarcane, offer biodegradability and reduced environmental impact compared to traditional plastics. Bioplastics can be integrated into flexible paper packaging to enhance its sustainability profile. This trend aligns with the increasing consumer demand for eco-friendly alternatives, and it reflects the industry's commitment to reducing its carbon footprint while maintaining packaging functionality and performance.

Based on the product, films & wraps segment held the largest market share of 29% in 2024. In the flexible paper packaging market, the films and wraps segment encompasses packaging materials that are thin, pliable, and suitable for various applications. These materials include paper-based films and wraps used for items such as snacks, confectionery, and small consumer goods. A notable trend in this segment is the increasing use of paper-based films and wraps for single-use packaging, driven by sustainability concerns. Brands are opting for these materials to provide eco-friendly options to consumers, emphasizing recyclability and biodegradability. Additionally, innovations in coatings and barrier technologies enhance the performance of paper films, making them more resilient to moisture and external factors while maintaining their eco-friendly appeal.

On the other hand, the bags segment is projected to grow at the fastest rate over the projected period. The bags segment in the flexible paper packaging market refers to pouches, sachets, and bags made from paper materials. These bags are popular for packaging a wide range of products, including snacks, coffee, and personal care items. An emerging trend in this segment is the demand for customizable and aesthetically pleasing bags. Brands are leveraging digital printing technologies to create visually appealing packaging with unique designs and branding elements. Moreover, there is a growing preference for resealable and easy-to-open bags, catering to consumer convenience and product freshness. Sustainable packaging remains a key focus, with brands using recyclable and compostable materials for bag production to align with eco-friendly packaging goals.

In 2024, the food & beverages segment had the highest market share of 57% on the basis of the installation. Flexible paper packaging in the food and beverages sector refers to the use of paper-based materials for packaging various food products and beverages. This type of packaging offers eco-friendly and sustainable solutions for preserving the freshness and quality of edibles. In this segment, there is a growing trend towards eco-conscious packaging to align with consumer preferences. Innovative designs, such as stand-up pouches and resealable paper bags, are gaining popularity. Additionally, the demand for hygienic and tamper-evident packaging solutions, fueled by the COVID-19 pandemic, has led to the adoption of flexible paper packaging in this sector to ensure product safety and convenience.

The pharmaceutical is anticipated to expand at the fastest rate over the projected period. In the pharmaceutical industry, flexible paper packaging involves the use of paper-based materials to package pharmaceutical products, medicines, and medical devices securely and in compliance with stringent regulatory requirements. This segment is witnessing an increased emphasis on safety and security, driven by tamper-evident packaging solutions. Moreover, the demand for single-dose and unit-dose packaging formats has grown. Sustainable packaging is also a notable trend in pharmaceutical flexible paper packaging, as manufacturers strive to meet eco-friendly standards while ensuring product integrity and patient safety.

By Material

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

January 2025

November 2023