October 2024

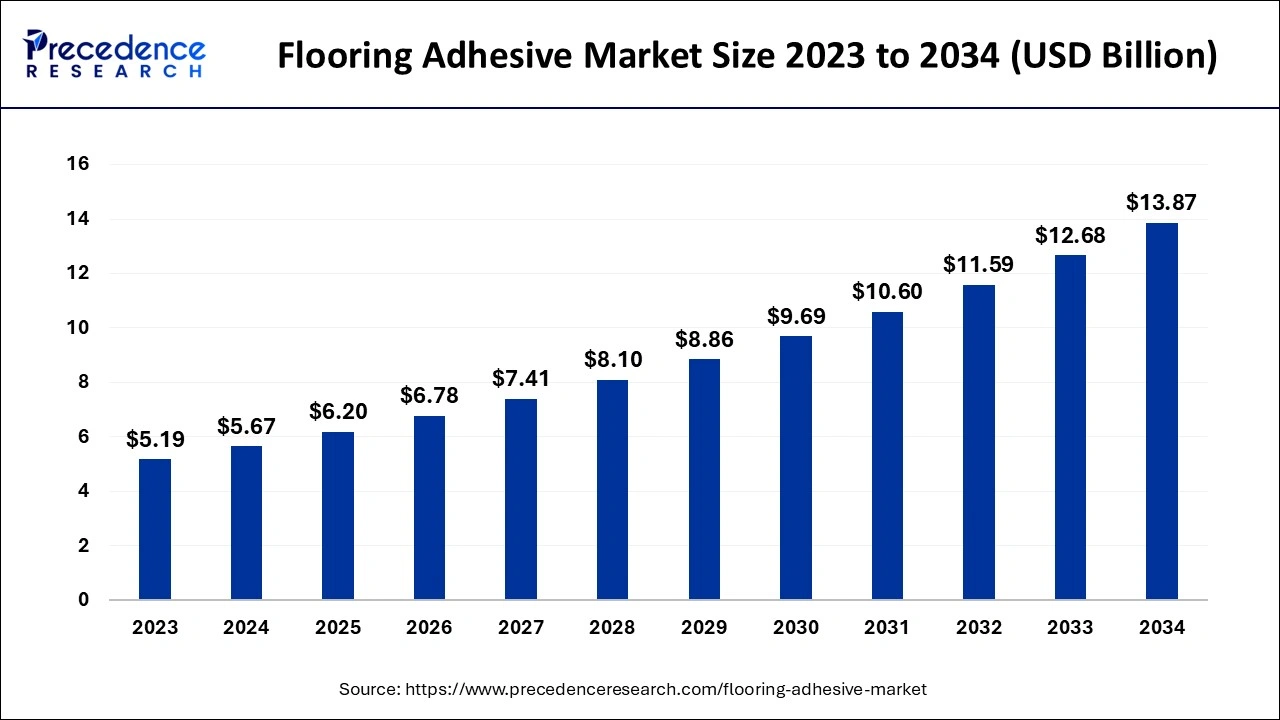

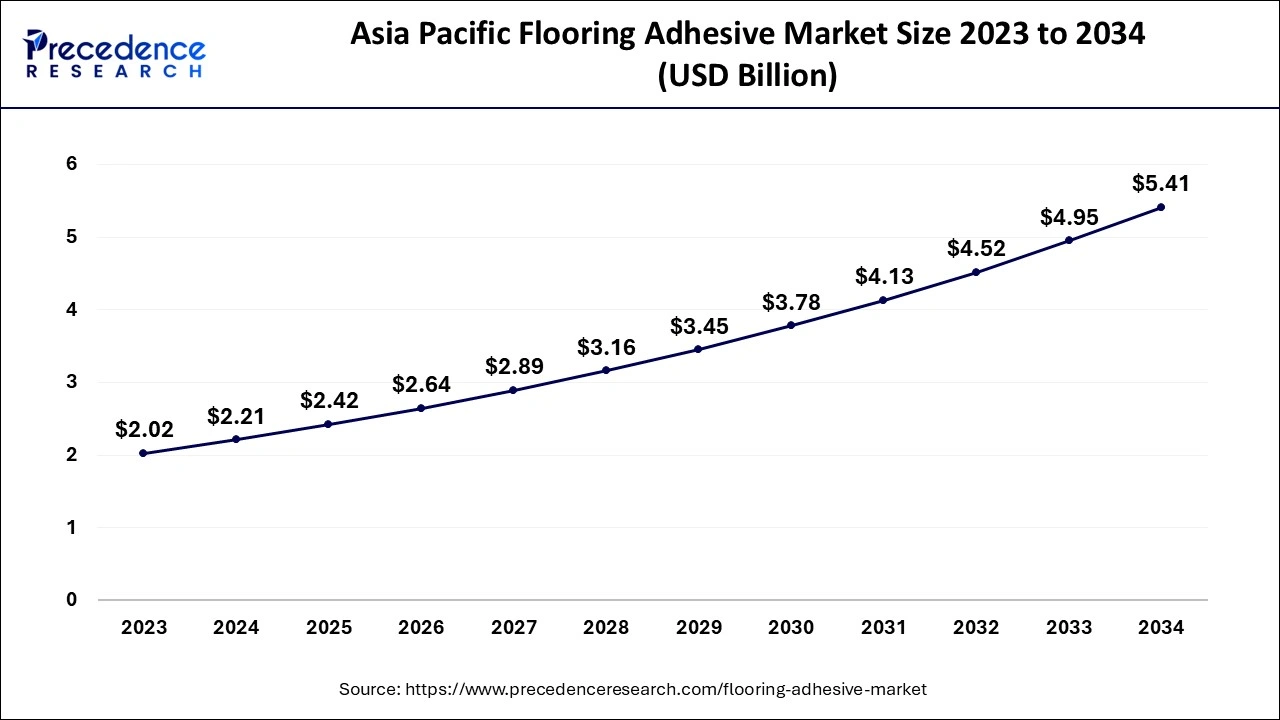

The global flooring adhesive market size accounted for USD 5.67 billion in 2024, grew to USD 6.20 billion in 2025 and is projected to surpass around USD 13.87 billion by 2034, representing a CAGR of 9.36% between 2024 and 2034. The Asia Pacific flooring adhesive market size is calculated at USD 2.21 billion in 2024 and is expected to grow at a CAGR of 9.37% during the forecast year.

The global flooring adhesive market size is calculated at USD 5.67 billion in 2024 and is predicted to reach around USD 13.87 billion by 2034, expanding at a CAGR of 9.36% from 2024 to 2034. The rising need to inculcate durable, strong, and long-lasting bonds between tiles and substrates is increasing the adoption of the flooring adhesive market.

The integration of artificial intelligence (AI) in the flooring adhesive market offers a transformation in lifestyle and business. AI in the adhesive and sealant industry provides software solutions that formulate adhesives to improve service to customers, improve efficiency, and optimize material flows and workflows.

The Asia Pacific flooring adhesive market size is exhibited at USD 2.21 billion in 2024 and is expected to be worth around USD 5.41 billion by 2034, growing at a CAGR of 9.37% from 2024 to 2034.

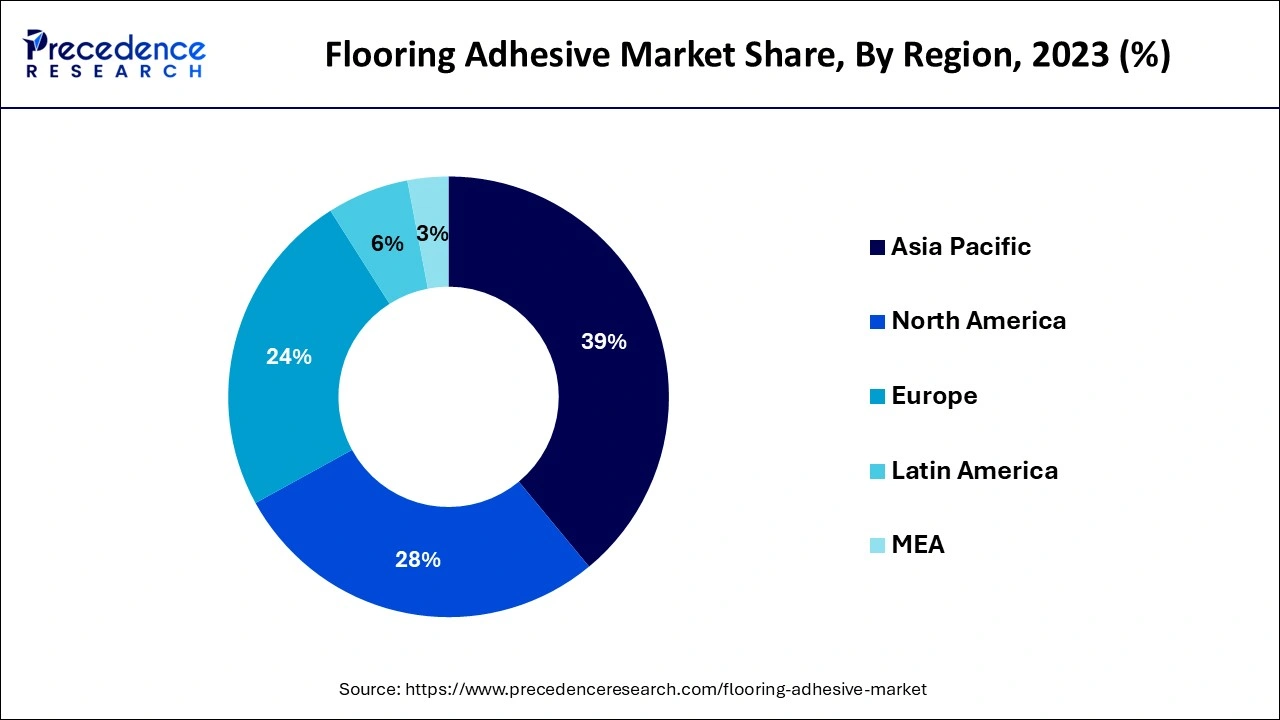

Asia Pacific dominated the global floor adhesive market in 2023. The dominance of this region is noted owing to Increasing urbanization and rising disposable incomes. The surge in urbanization represents the increasing opportunities for businesses in the region. This rapid pace of urbanization has significantly influenced the construction industry. As cities expand, the population migrates from rural to urban areas, which increases the demand for infrastructure, housing, and related materials.

North America is anticipated to grow significantly in the flooring adhesive market during the forecast period of 2024 to 2034. The growth of the market in this region is attributed to continuous consumer interest in home improvement projects such as kitchen and bathroom remodeling. Frequently used to replace older or worn flooring. United States has a wide availability of polyvinyl acetate (PVA) adhesive used for porous materials such as wood, paper, and cloth. Additionally, the region has rising commercial building construction, boosting the demand for vinyl, ceramic, and carpet tile products.

Flooring adhesive is a material that functions as a fastening agent to stick two or more solid materials by using glue, cement, or other adhesives. The floor adhesives prevent tiles from shifting or cracking while being walked on or placing a heavy object on. Compared to conventional mortar, flooring adhesive helps to minimize overall effort, time, and expenses. There are 5 different types of floor adhesive catering to specific requirements in the construction process. Moreover, they are extremely useful in ensuring a strong, long-lasting bond between the tiles and the substrates underneath.

| Report Coverage | Details |

| Market Size by 2034 | USD 13.87 Billion |

| Market Size in 2024 | USD 5.67 Billion |

| Market Size in 2025 | USD 6.20 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.36% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Resin, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

The demand in the construction industry

The flooring adhesive market services are highly demanded in construction flooring sectors such as education, retail, and industrial. Adhesives have an extremely versatile role in buildings and construction. Traditional and newly developed construction materials, such as concrete, plastics, wood panels, and much more, need adhesive to have high-quality adhesion, improve performance, and easier application. These benefits are increasing the demand for floor adhesives in the construction industry.

Adhesive failure

When the adhesive does not bond properly to the substrate, it happens due to dampness in the subfloor, a curing compound on the surface, or weak material or dust on the surface; this results in the failure of the flooring adhesive market. The common cause of failure is the late placement of sheets. To avoid this problem, a simple thing can be done to prevent the adhesive from drying or setting. Using the wrong adhesive can also lead to this problem, which results in worn or incorrectly-sized notched trowel.

Infrastructure in economic development

The flooring adhesive market has a promising future in the development of infrastructure and economic growth. Infrastructure development is the milestone of economic growth and social progress. The regions with rapid urbanization and economic expansion require robust infrastructure to achieve the development goal. The goals can be supported by facilitating trade and commerce, attracting domestic and foreign investments, improving the quality of life for residents by providing essential services, and promoting sustainable development.

The acrylic segment contributed the largest share of the flooring adhesive market in 2023. The dominance of this segment is noted due to its broad utility, which includes primed metals, direct-to-metal, wood, and masonry. Acrylic adhesives are available in a variety of colors and gloss levels. The Superior water-based acrylic floor adhesive is used for resilient tiles and sheets, wood parquet, linoleum, and carpets. It is best installed on concrete, chipboard, hardboard, plywood, and other types of sub-floors. The common applications of acrylics are wall panel bonding, grout sealing, textile bonding, paper stamps, leather tile envelopes, labels, and many more. To conclude, acrylic is a versatile material that is in high demand in various industries.

The Polyvinyl Acetate segment is anticipated to grow at a significant CAGR in the flooring adhesive market during the forecast period of 2024 to 2034. Polyvinyl Acetate adhesive is used mainly for interior applications. The growth of this segment is observed due to its high initial bonding strength and ease of use. They are available for both hot and cold pressing conditions and are suitable for various applications, such as lightweight panels, doors, foil lamination, and solid wood laminations. Additionally, PVA chips are added by applying a standard or moisture-removing primer coat and color coat, resulting in a chip system flooring.

The resilient flooring segment stood dominant in the flooring adhesive market in 2023. The dominance of this segment is due to its highly engineered sheet and tile products, which can withstand heavy use in a variety of commercial and residential buildings. They are firm, and bounce-back property makes them the preferred choice by healthcare and education designers. Compared to other flooring, resilient flooring offers a degree of flexibility under the foot, providing more comfort. Resilient floors are durable and last a long time, which saves money on replacement. Additionally, it reduces noise in places like schools and public places.

The wooden flooring segment is anticipated to grow significantly in the flooring adhesive market during the forecast period of 2024 to 2034. Choosing the right flooring adhesive when it comes to wooden flooring is essential. Different types of woods respond better to varying adhesives. Solid wood requires more room to expand and contract with the atmospheric environment. These movements increase the chance of the flooring breaking. To prevent the floorboard from breaking, the right adhesive with great flexibility or elasticity is required. Some trusted brands for wooden flooring in the industry are Ardex, Bostik, Mapei, Tilemaster, and many more.

The commercial segment led the global flooring adhesive market in 2023. The dominance of this segment is observed due to the availability of a wide range of adhesives to use in commercial settings. There are various adhesives available, but only four are commonly used within the industry, such as epoxy, polyurethane, acrylic, and pressure-sensitive adhesives. The right floor adhesive should fulfill the environmental requirement intended and be labeled for commercial use. According to the standards, it should attain environmental and health requirements and prevent toxicity, hazardous ingredients, and volatile organic compounds (VOCs).

The residential segment is anticipated to grow at a significant CAGR in the market during the forecast period of 2024 to 2034. The expansion of the segment is noticed due to the rising number of houses that have been remodeled and renovated. According to the U.S. Census Bureau, the average U.S. home is 40 years old and increasing.

By Resin

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

March 2025

August 2024