October 2024

Flooring Market (By Product: Ceramic Tiles, Vitrified (Porcelain) Tiles, Carpet, Vinyl, Luxury Vinyl Tiles, Linoleum/Rubber, Wood & Laminate, Natural stone, Other Flooring Materials; By Application: Residential, Commercial, Industrial; By Type: Resilient Flooring, Soft Coverings, Non-Resilient Floorings, Seamless Flooring) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

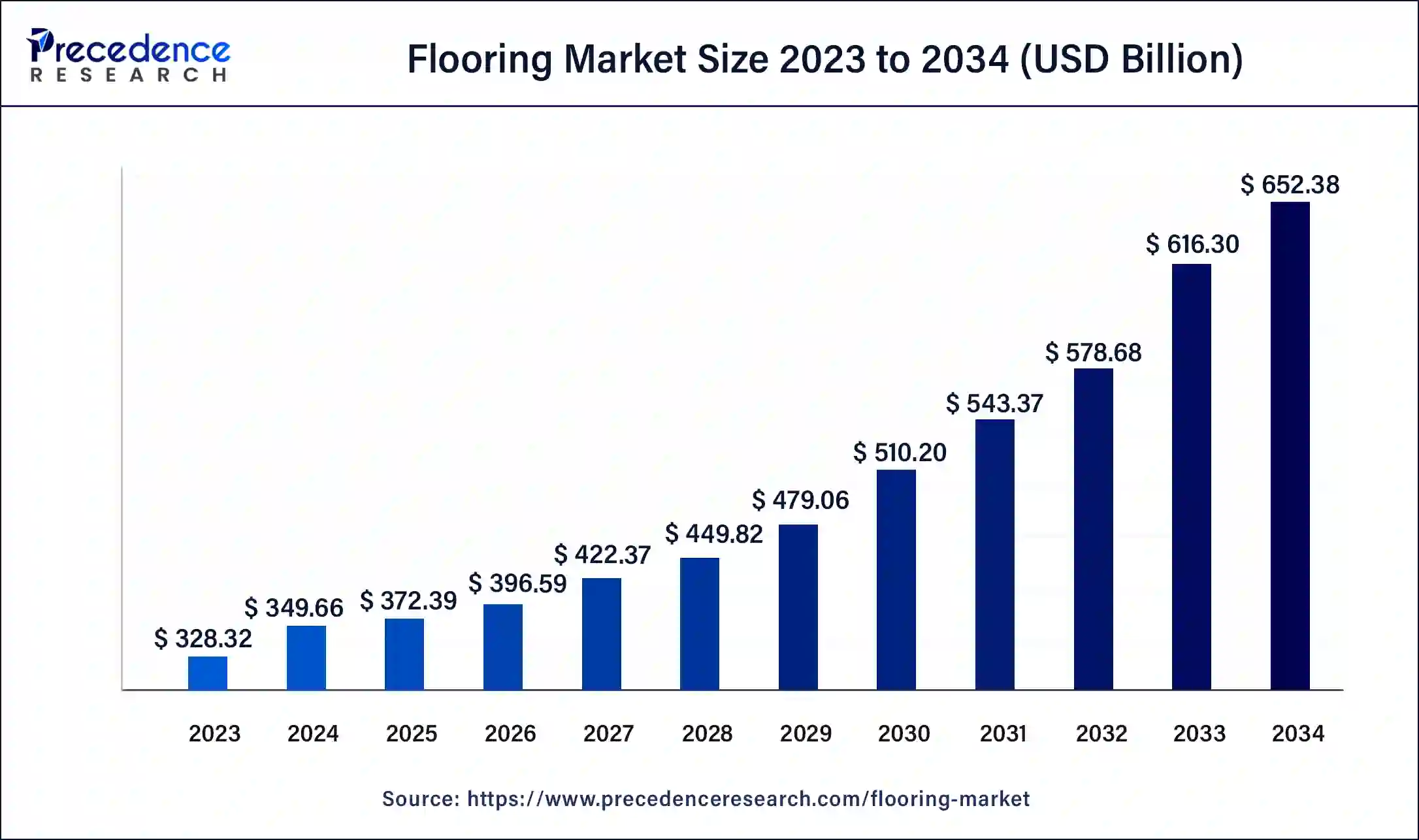

The global flooring market size accounted for USD 349.66 billion in 2024 and is expected to reach around USD 652.38 billion by 2034, expanding at a CAGR of 6.5% from 2024 to 2034.

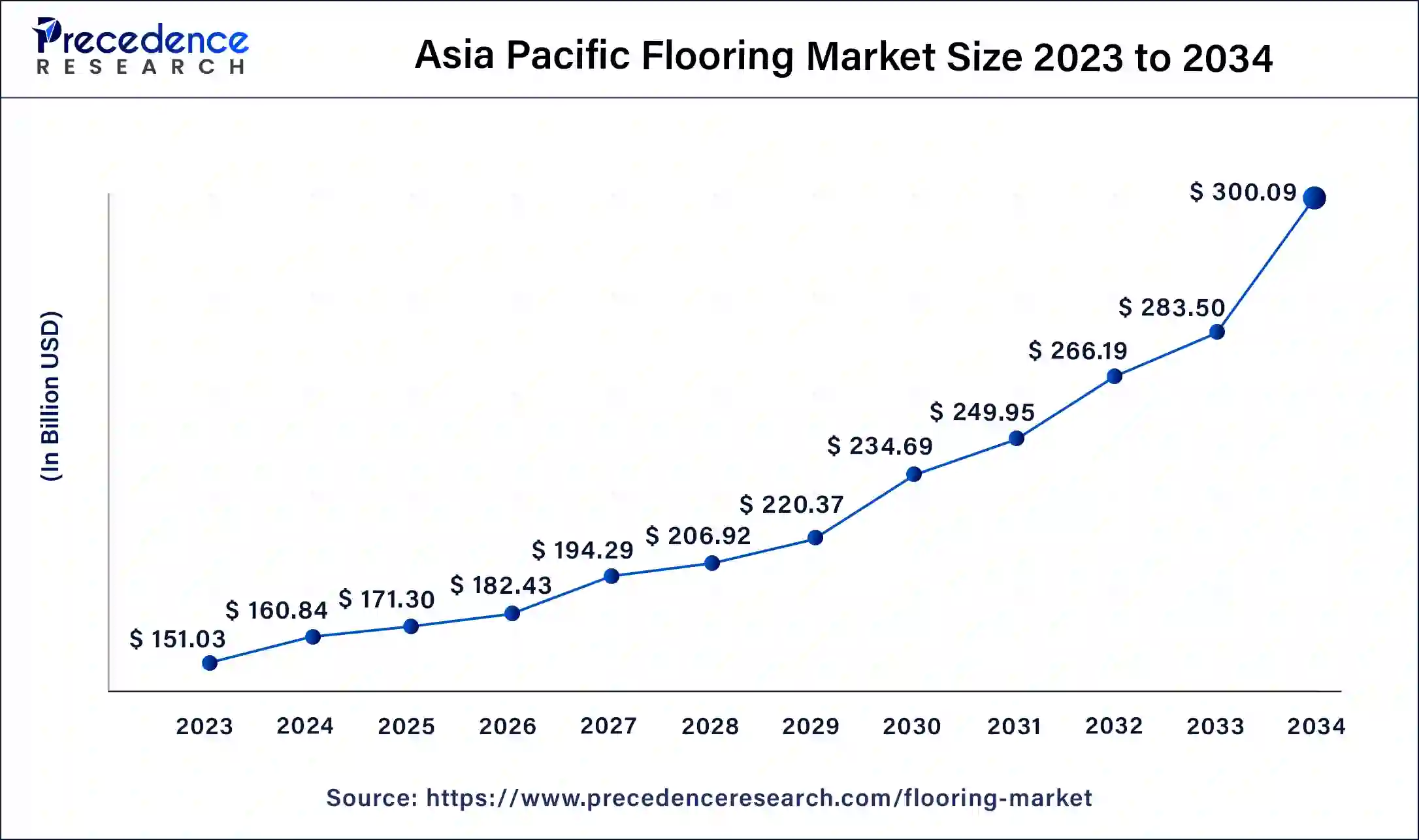

The Asia Pacific flooring market size was estimated at USD 151.03 billion in 2023 and is predicted to be worth around USD 300.09 billion by 2034, at a CAGR of 6.7% from 2024 to 2034.

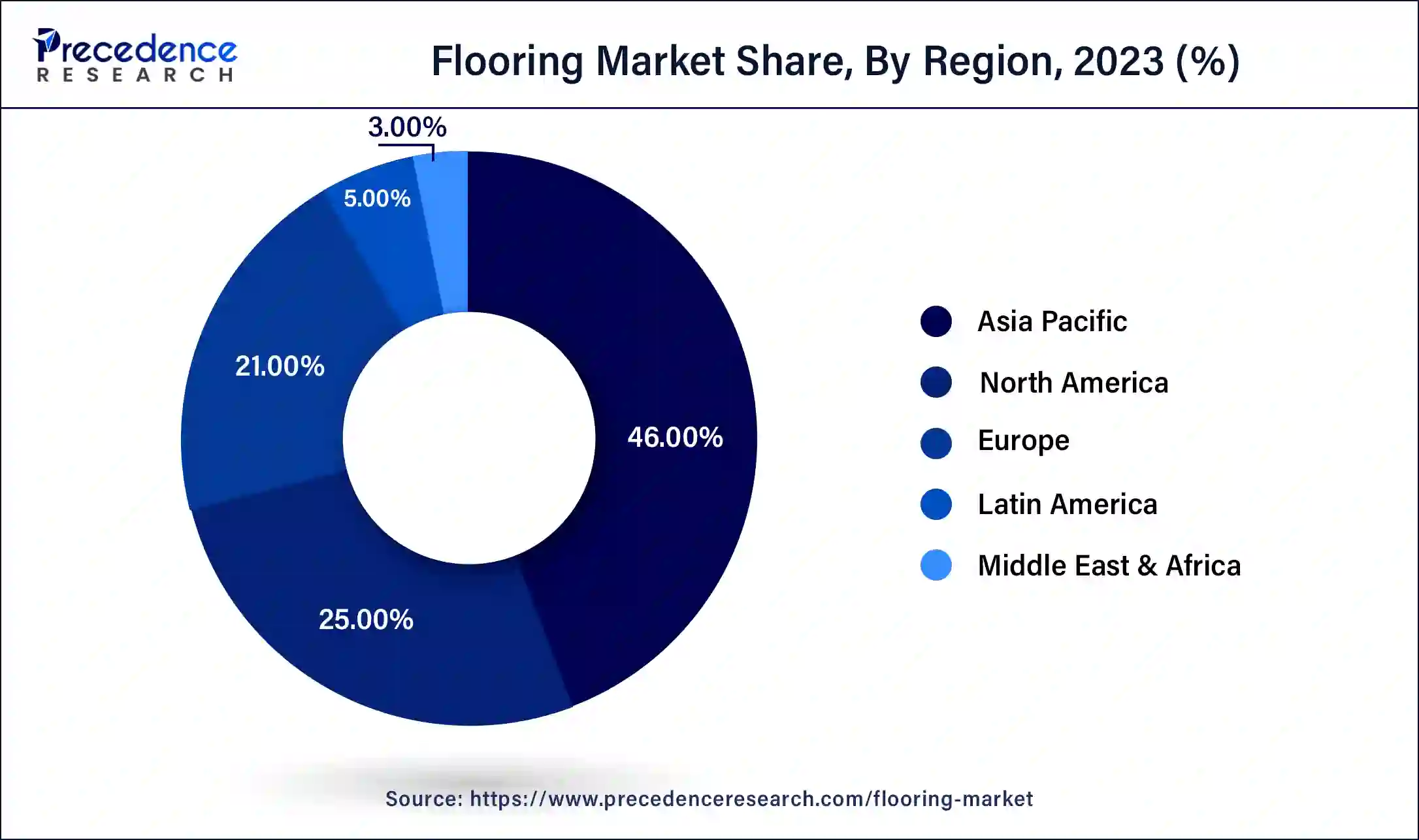

Asia Pacific region has generated the highest revenue share in 2023, and it is projected to maintain its leading position and grow at a faster rate than other regions in the flooring market. This can be attributed to the increasing investments and construction policies in countries such as China, India, furthermore Southeast Asia. Moreover, the rapid industrialization in the region is expected to drive the market further, with China leading the market growth due to increasing the population with the need for infrastructure and new buildings.

In Europe, the growing use of ceramics and also vinyl in non-residential buildings is expected to drive growth, along with rising consumer expenditure and the preference for luxurious living spaces.

The Middle East & Africa market is projected to grow due to rising the demand for floor coverings from ongoing construction projects.

In North America, the market is expected to grow due to rising the demand for healthcare facilities, luxurious houses, and commercial buildings. In South America, the market is projected to see major growth due to the growing renovation and remodeling activities in private and multi-story houses.

Market Overview

Flooring refers to a type of surface material that is applied over the floor and subfloor formation to provide a smooth and safe foot surface. Products are known for their resistance to dents, scratches, and moisture, making them easy to clean and maintain. Popular flooring products include vinyl tiles, ceramic tiles, carpets, also laminates, which offer a clean, hard, and visually appealing surface to floors. As a result, consumers widely use these products during the construction and renovation of both residential and non-residential buildings.

Several factors such as the growth of the construction industry, increasing disposable income, and rising demand for eco-friendly and sustainable flooring materials drive the market. The industry is highly competitive, and numerous players offer a wide array of flooring products at different price points.

The flooring market is expected to grow due to several growth factors. Here are the key factors driving the growth of the flooring market:

| Report Coverage | Details |

| Market Size in 2023 | USD 328.32 Billion |

| Market Size in 2024 | USD 349.66 Billion |

| Market Size by 2034 | USD 652.38 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.5% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Application, and By Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The market is expected to be driven by the growing demand for vinyl flooring in both residential and non-residential buildings

Vinyl is a versatile material commonly used in tiling applications, with luxury vinyl tile being the most popular. It is ideal for applications where spills are a concern, as it is moisture and mold resistant. Furthermore, due to its affordability, ease of installation, and durability, it is becoming increasingly popular as a finishing material in both residential and non-residential buildings. As a result, the growing use of vinyl in these types of buildings is expected to drive the growth of the flooring market.

Rising requirements for multi-storey buildings to further drive the demand for flooring products

The demand for multistory buildings has increased in both the residential and commercial sectors, with population growth and rising consumer expenditure driving demand for multistory residential buildings. Meanwhile, the growth of commercial multistory buildings is attributed to the increasing industrialization and urbanization in developing economies. Furthermore, government initiatives to build smart cities are expected to further drive market demand. The rapidly expanding real estate sector has also contributed to the growth of multistory buildings. Consequently, these favorable factors are expected to drive the demand for tiling during the forecast period.

The flooring market faces several challenges that can impact its growth in the coming years

The vitrified (Porcelain) tiles segment had the highest revenue share in 2023, due to their superior properties such as greater strength and durability compared to general ceramic tiles. Porcelain tiles those made from ultrafine and dense clays and fired at extreme temperatures, making them more resistant to mold, bacteria, and fading. The ceramic tiles segment accounted for 21.8% of revenue in 2023, with three primary types including glazed, unglazed, and scratch-resistant tiles.

The scratch-resistant tile is popular for use in high-traffic areas. The wood & laminate segment is expected to grow substantially in the coming years, with an estimated value of USD 51.2 billion in 2023. The increasing significance of wood in luxury construction for both residential and commercial areas is driving this growth, with benefits including durability, strength, high monetary value, easy maintenance, aesthetics, steady appearance, option for improved acoustics, refinishing, and improved air quality.

The natural stone segment is comparatively expensive but extensively used for its durability, lasting value and beauty. This segment includes marble, granite, limestone, sandstone, quartzite, and other materials. These stones are popular in bathrooms, hallways, living areas, and outdoor spaces. Due to the growing demand for natural stones, those companies are investing more to strengthen their position in the market.

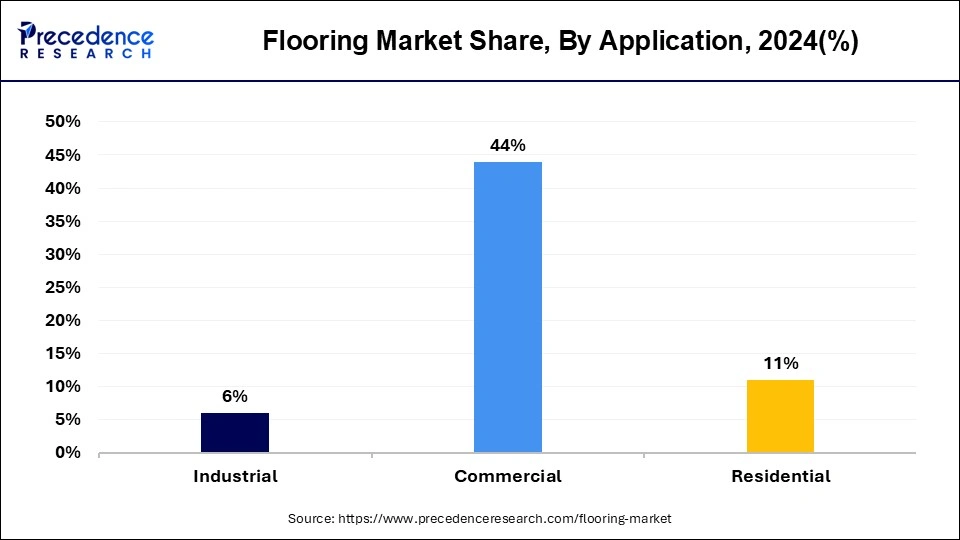

In 2023, the flooring market was dominated by the residential application segment. This segment includes various types of residential buildings such as complexes, apartments, and small houses. The growth of the residential sector has been positively impacted by government subsidies for first-time homebuyers in both developing and developed economies.

Furthermore, many countries in the Asia Pacific have introduced diverse schemes to prop up the development of the real estate sector. Those schemes are either partially or fully funded by the governments in the countries, in turn, benefit the demand side of the construction sector. This is expected to drive the growth of the flooring market in the coming years.

In 2023, the commercial applications segment held a significant revenue share. These applications are often in high area traffic so require very durable flooring options like resilient and wooden flooring. The flooring product is widely used in various commercial buildings, including shopping malls and other types of retail stores.

The increasing construction of commercial buildings, such as big-box stores, drugstores, and grocery stores, in recent years, is expected to drive growth in this segment in the upcoming years. Additionally, there is a robust demand for office spaces, particularly in the urban areas of emerging economies, which is also driving the demand for high-quality flooring products.

The non-resilient type of flooring held the dominant position in the market. This growth can be attributed to the increasing construction activities in developing countries, driven by population growth and industrial activities. The non-resilient flooring segment is expected to continue leading the market during the forecast period, thanks to its water resistance and long-term durability.

The resilient type of flooring accounted for 15% of the total market in 2023, mainly due to its growing use in commercial buildings such as gyms, offices, fitness centers, and hospitality buildings. Resilient flooring is durable and cost-effective, with low maintenance costs, and is comfortable to walk on due to its density and non-absorbent nature.

Several types of synthetic floorings, such as vinyl sheet flooring, planks, vinyl composition tile, luxury vinyl tiles, rubber, linoleum, and cork are also available in roll and tile forms. Manufacturers also offer color and texture customization, which is expected to drive the market's growth.

Segments Covered in the Report:

By Product

By Application

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

December 2024

March 2025

July 2024