July 2024

Flow Assurance in Oil and Gas Market (By Type: Steady State Simulation, Transient State Simulation; By Sector: Upstream, Midstream, Downstream; By Operation: Onshore, Offshore; By Application: Scale Management, Asphaltene Management, Hydrate Prevention, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

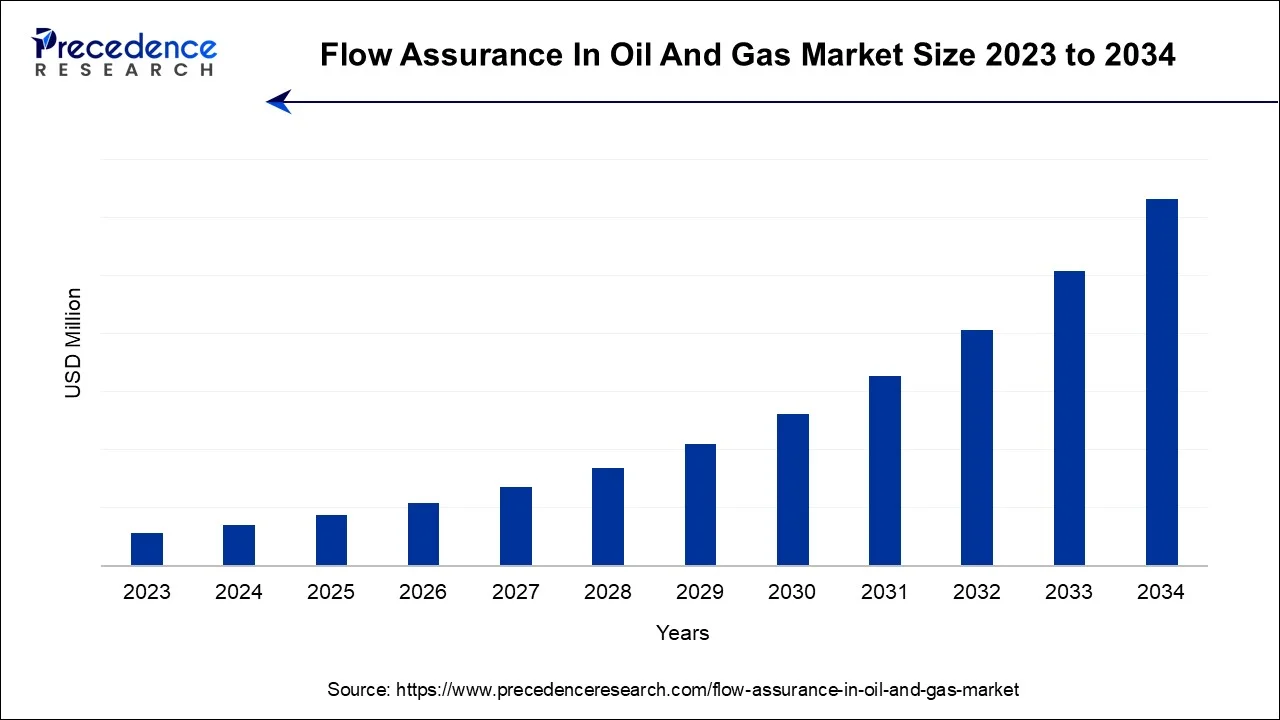

The global flow assurance in oil and gas market is surging, with an overall revenue growth expectation of hundreds of millions of dollars during the forecast period from 2024 to 2034.

Flow assurance is a critical aspect of the oil and gas industry and other industries involving the transportation of fluids through pipelines or different carriers. It refers to the set of measures and strategies implemented to ensure the safe, reliable, and efficient flow of fluids (usually hydrocarbons like oil and natural gas) from the reservoir to their destination, which can be a processing facility, storage tanks, or a point of export.

To avoid the development and deposition of undesirable solids (such as hydrates, wax, asphaltenes, and scales) during the production and transportation of crude oil, understanding fluid characteristics and operating conditions is essential. Methane gas hydrates may crystallize or asphaltenes may precipitate in pipelines under the condition of severe heat and pressure. The asphaltene, wax, or hydrate crystals might precipitate and clump together to the point of clogging the pipeline if they are not adequately regulated. It can be expensive and risky to remove an asphaltene or hydrate clog from a subsea pipeline.

| Report Coverage | Details |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Sector, Operation, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The global energy demand continues to grow, leading to the development of more remote and unconventional oil and gas reserves. Ensuring the reliable flow of hydrocarbons from these reserves to processing facilities and markets is essential to meet the growing energy needs. For instance, according to the European Commission, the consumption of oil products increased in the industry sector both for non-energy use (+6.3 pp) and for energy use (+2.7 pp), and in some cases, the increase was significant, such as in the services sector (+11.4 pp) and the transport sector, the largest user of oil products (+9.4 pp overall for different types of transports). Thus, the growing energy demand is expected to propel the market growth during the forecast period.

Flow assurance solutions often require a deep understanding of fluid behavior, thermodynamics, and fluid mechanics. The complexity of these systems can make them challenging to design, implement, and maintain effectively. Moreover, implementing flow assurance measures can be expensive, particularly in remote or challenging environments. The cost associated with chemical inhibitors, insulation, heating systems, monitoring equipment, and maintenance can strain operational budgets. Thus, this is expected to limit the market growth during the forecast period.

The growing offshore and deepwater exploration is expected to offer a potential opportunity for market growth during the forecast period. As offshore and deepwater exploration activities continue to expand, the demand for flow assurance solutions in these challenging environments is expected to grow. Innovation in subsea technologies and equipment will be crucial to meeting this demand.

The global flow assurance in the oil & gas market is segmented into steady state simulation and transient state simulation. The steady state simulation segment is expected to dominate the market during the forecast period. Steady state simulation is a crucial tool in flow assurance, as it helps engineers and operators model and analyze the behavior of fluids within pipelines and production systems under steady-state conditions. Steady state simulations are used to analyze the hydraulic behavior of pipelines and production systems.

Engineers can determine pressure drops, flow rates, and fluid velocities throughout the system. This information is essential for designing pipelines and facilities to ensure the desired flow conditions are maintained. Moreover, these simulations predict temperature distributions and identify potential areas where hydrate and wax formation might occur. This information guides the design of insulation and heating systems to prevent solid deposit formation. Thereby, driving the market growth over the forecast period.

The global flow assurance in oil & gas market is segmented into upstream, midstream and downstream. The upstream segment is expected to capture the largest market share over the forecast period. The wellbore, where hydrocarbons are first generated, is where managing flow assurance starts. There are several difficulties could occur, including the potential for wax and hydrate production. To avoid obstructions and sustain flow, procedures for flow assurance include the injection of chemical inhibitors and the use of heating systems. Thus, flow assurance in the upstream oil and gas industry is critical for ensuring the economic viability and safety of production operations.

The global flow assurance in oil & gas market is segmented into onshore and offshore. The offshore segment is expected to grow at the highest CAGR over the forecast period. Offshore environments often involve low temperatures and high pressures, which increase the risk of hydrate and wax formation. These deposits can block pipelines and equipment, causing flow disruptions, which in turn, drive the flow assurance industry. Moreover, the growing offshore oil & gas project investments further drive the market growth over the projection period.

The global flow assurance in oil & gas market is segmented into scale management, asphaltene management, hydrate prevention and others. The scale management is expected to hold the largest market share over the forecast period. Flow assurance experts use analytical tools and modelling techniques to identify the potential for scale formation in pipelines and equipment. They predict when and where scaling is likely to occur based on factors such as fluid composition, temperature, pressure, and flow rate. Thus, this is expected to propel the segment's growth.

North America is expected to dominate the market during the forecast period. The market growth in the region is attributed to the growing shale gas production. The region is known for its extensive shale oil and gas resources, particularly in the Permian Basin in Texas and New Mexico. Flow assurance is essential in these areas to manage the production of unconventional hydrocarbons and transport them efficiently. The overall technological innovation and rapid adoption of the same also promote the market’s growth.

Moreover, the increasing offshore production in the region is also the main contributor to the market expansion. The Gulf of Mexico is a major hub for offshore oil and gas production in North America. Deepwater and subsea operations in this region require specialized flow assurance measures to address the challenges posed by high pressures, low temperatures, and the risk of hydrate and wax formation.

Segments Covered in the Report

By Type

By Sector

By Operation

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024