March 2025

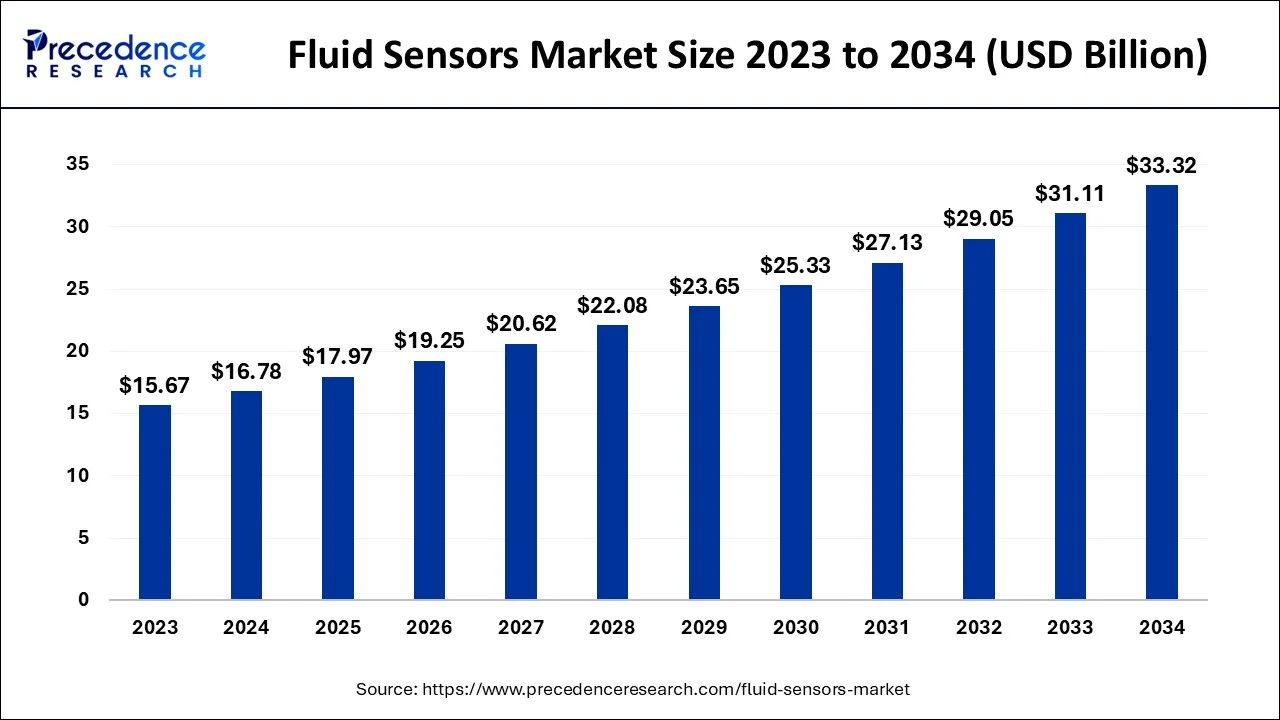

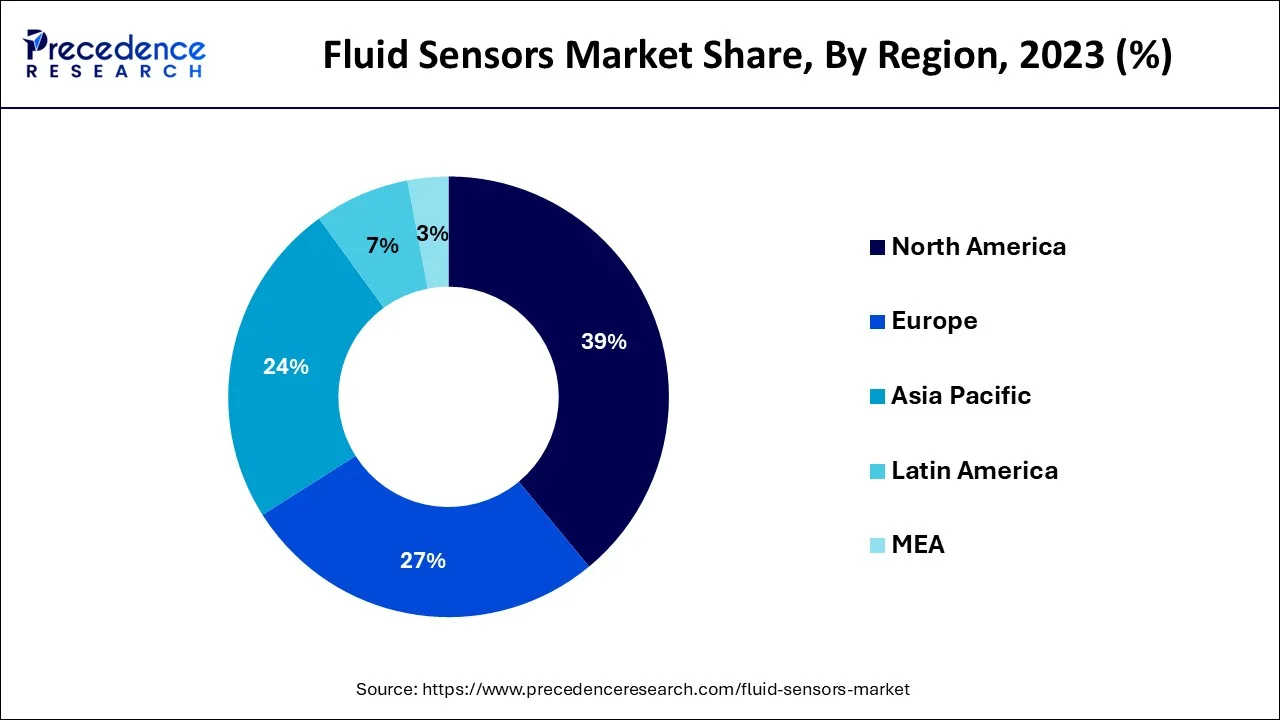

The global fluid sensors market size accounted for USD 16.78 billion in 2024, grew to USD 17.97 billion in 2025 and is predicted to surpass around USD 33.32 billion by 2034, representing a healthy CAGR of 7.10% between 2024 and 2034. The North America fluid sensors market size is calculated at USD 6.54 billion in 2024 and is expected to grow at a fastest CAGR of 7.22% during the forecast year.

The global fluid sensors market size is estimated at USD 16.78 billion in 2024 and is anticipated to reach around USD 33.32 billion by 2034, expanding at a CAGR of 7.10% from 2024 to 2034.

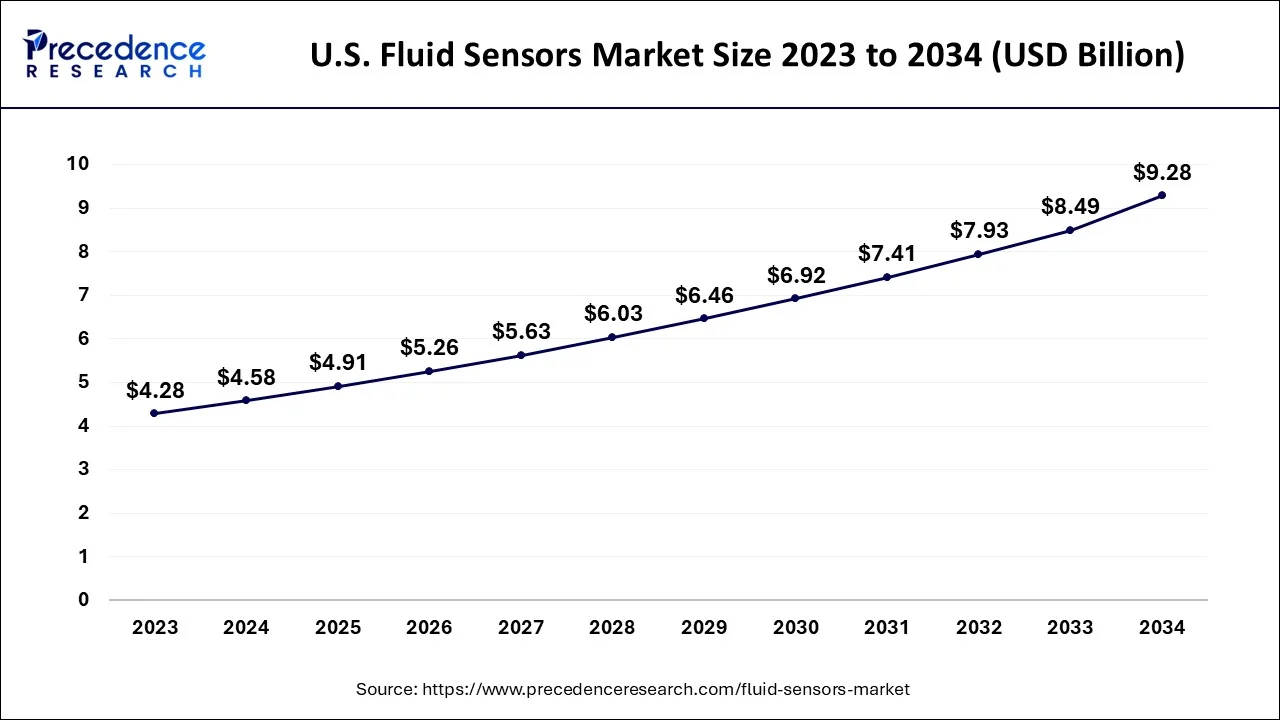

The U.S. fluid sensors market size is estimated at USD 4.58 billion in 2024 and is expected to be worth around USD 9.28 billion by 2034, rising at a CAGR of 7.29% from 2024 to 2034.

On the basis of geography, Asia-Pacific accounted highest revenue share in 2023. Since China, India, Japan, and South Korea are the primary production centers for industrial fluid sensors, the market is growing in the region as a result of the rising rate of industrial output in these developing and growing countries. A further factor contributing to the Asia-Pacific region's quick economic development is the high usage of fluid sensors in the oil and gas, water and wastewater, chemical, food and beverage, automotive, and other sectors. This high usage is what is fueling the fluid sensors market's expansion. The expansion of the fluid sensors market is anticipated to be fueled by the rising use of artificial intelligence in APAC nations. Government initiatives like the National Mission for Clean Ganga (NMCG) also place demands on the level and flow detection sensors, which is good for the market's expansion.

Fluid sensors are electrical devices used in the oil and gas, petroleum, and automotive sectors to continually measure the flow rate of fluid into and out of pipelines. The need for fluid sensors is anticipated to expand significantly throughout the anticipated period of time due to rising demand in the oil and gas industry for a variety of applications, including tank level monitoring and oil quality testing. The demand for crude oil and natural gas has expanded as a result of greater mobility and industrialization. Due to the extreme and harsh conditions, there is a growing need for trustworthy and high-quality sensors in the oil and gas business. The industry is using pressure and temperature sensors more and more to control ambient conditions and oil composition. The rise of the fluid sensors market share will also be aided by the need for multi-level sensors for oil separation in oil drilling operations.

The market for fluid sensors has been negatively impacted by Covid-19. Automobile, oil and gas, chemical, food and beverage, power and utilities, and other companies and sectors that use fluid sensors in equipment saw a dip in growth during the pandemic period due to a drop in consumer demand. These elements are anticipated to have a detrimental effect on the market for fluid sensors. However, during the epidemic phase, businesses everywhere are feeling the necessity to manage their operations digitally. Implementing technologies like the industrial internet of things (IIOT) will allow for virtual production control and real-time monitoring of the manufacturing process for fluid sensor devices. These elements are anticipated to positively affect market expansion as well as the size of the fluid sensors market during the pandemic.

Rapid industrialization and urbanization have made it more important than ever to use cutting-edge methods for fluid detection and analysis. These sensors make sure that all liquid-related activities and procedures take place without the need for human intervention.

| Report Coverage | Details |

| Market Size in 2024 | USD 16.78 Billion |

| Market Size by 2034 | USD 33.32 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.10% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

On the basis type, the flow sensor segment is expected to have the largest market share in the coming years period. Due to the increased emphasis on industrial automation, it is predicted that the flow sensor sub-segment would grow throughout the forecast period. As measurement technology has improved in industries including oil and gas, manufacturing, automotive, chemical, medical, and power generation, fewer people are using manual measuring techniques for fluid parameters like temperature, fluid pressure, humidity, and fluid acceleration. These factors are predicted to lead the flow sensor sub-segment to grow fastest.

On the basis of end-user, the power & utility segment is expected to have the largest market share in 2023. A rise in the number of powers producing facilities and a huge demand for energy in businesses due to the world's growing population have both contributed to the need for more electricity and are supporting the expansion of the power and utility sub-segment.

The use of fluid sensors in power production units like thermal and hydropower plants provides benefits like ensuring the lowest number of emissions is ensured by the flow sensor. For instance, sophisticated flow meters and varied installation options for flow measurement equipment assist monitor the rate of ammonia (NH3) gas coming from the chimneys. These elements are anticipated to support the sub-growth segments within the anticipated time frame.

By Type

By Technology

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

July 2024

January 2025

November 2024