January 2025

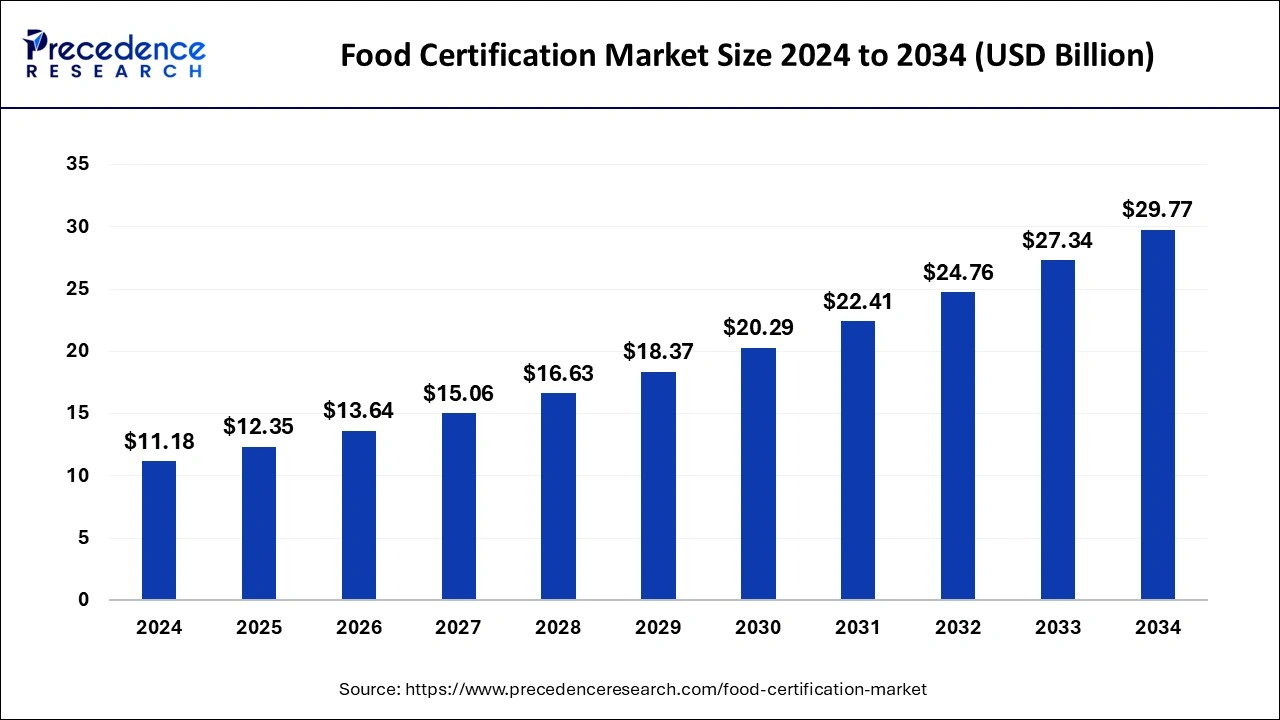

The global food certification market size is calculated at USD 12.35 billion in 2025 and is forecasted to reach around USD 29.77 billion by 2034, accelerating at a CAGR of 10.29% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global food certification market size was estimated at USD 11.18 billion in 2024 and is predicted to increase from USD 12.35 billion in 2025 to approximately USD 29.77 billion by 2034, expanding at a CAGR of 10.29% from 2025 to 2034. Food certification helps improve efficiency, food safety, customer confidence, and market access. Improves respect from the customers, which helps to the growth of the market.

The food certification market is an essential component of the food industry, ensuring the safety, quality, and sustainability of our food supply. By choosing certified food products, consumers can make informed choices and support companies that prioritize food safety and ethical practices. Food certification is a procedure by which a third party gives written assurance that a product or process is in conformity with the corresponding standard.

Benefits of the food certification market include cost efficiency, liability, consultation, due diligence, and consistency. It also helps to enjoy expert partnership, minimizes hazards and risks, includes high control of risks for food safety, enhances consumer confidence in products, makes easy observation with legislation, is desirable for regulators, and meets requirements of food safety legal compliance and corporates. Prevents and identifies the hazards from food contamination and is responsible for ensuring food safety for food distributors or manufacturers. These factors help to the growth of the market.

| Report Coverage | Details |

| Market Size in 2025 | USD 12.35 Billion |

| Market Size by 2034 | USD 29.77 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.29% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Certification Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Economic conditions and technological advancements

Currency exchange rates, interest rates, inflation rates, and economic growth can constantly impact the growth of the food certification market. A great economic situation may lead to high demand for food certification, while low economic situations or economic downturns may decrease food certification demand. The market for traditional food certification was disrupted due to innovation in new technologies that can change consumer behavior and create novel opportunities.

For companies’ rapidity, it keeps pace with advanced technologies. Advanced technologies help to improve product safety, quality, efficiency, and environmental sustainability and reduce waste. These economic conditions and technological advancements help the growth of the food certification market.

Regulatory environment and consumer preferences

Government policies and regulations may control the food certification market. Government regulations related to environmental policies, safety standards, trades, and production may impact business operations and market dynamics. Buying behaviors, changing lifestyles, and consumer preferences are necessary for businesses. These factors help to the growth of the food market.

Market fragmentation and high initial investment

For the installation and development of the food certifications, high initial investment is required for the large-scale products, and these factors can be a barrier to the growth of the food certification market. The number of players offering the same services and products may lead to a fragmented market. These factors can restrict the growth of the market.

Digital transformation and advanced technologies

The food certification market is going through a digital transformation, with businesses accepting digital platforms for customer engagement, marketing, and sales. E-commerce platforms are rapidly important channels for reaching consumers. Increased advanced technologies like integration of IoT, blockchain, and AI to improve scalability, efficiency, and security. These factors help to the growth of the market.

Trends in health and wellness

Consumers prefer certified food products for health and wellbeing which leads to the growth of the certified products demand. Food certification companies offer incorporating wellness properties and healthier alternatives. Food certification training programs offer safe preparation, storage, and handling of food, which can help to prevent cross-contamination and foodborne illness that may be fatal or sometimes severe. Public health protection is the main role of food certification. These factors help to the growth of the food certification market.

The ISO 22000 segment dominated the food certification market in 2024. Obtaining the ISO 22000 food certification has many benefits, including improved food safety, which reduces contamination risk and increases food safety. It also provides confidence to stakeholders and other customers in the safety of foods. Global recognition is accepted worldwide and helps in the meeting of several laws and regulations. It increases consumer conference and marketability and is compatible with HACCP and QMS.

It also helps to generate a food safety culture, control and identify food safety hazards, and reduce food safety incidents, risks, and environmental pollution. It gives high-quality jobs for the food industry, more efficient documentation of procedures, techniques, and methods, reduction of foodborne disease rates, insurance of food safety, increased economic growth, and company profits and trusts increased. Builds trust by certification, investing for long-term viability, which helps the growth of the market. These factors help the growth of the ISO certification segment and contribute to the growth of the market.

The dairy product segment led the food certification market in 2024. The standards for dairy products include the testing of their protein content, bacterial count, fat content, and other parameters. With the certification of dairy products, consumers can ensure their quality and enhance producers' marketing prospects. Dairy product certification benefits include sustainable and high-quality dairy products. It also includes organic dairy products, ghee, butter, cheese, and ghee. This type of dairy certification plays a main role in sustainable agriculture. The products made that are healthier as well as better for the environment and health. These organic dairy products are without or free from herbicides and synthetic pesticides that may lead to various health conditions like hormone disruption and cancer. By selecting these types of certified organic dairy products, consumers may remove their exposure to hazardous substances, and their health can be protected. These factors help the growth of the dairy product application type segment and contribute to the growth of the market.

The processed & packaged food segment is expected to grow rapidly during the forecast period. Processed & packaged food certification includes safety testing for keeping food safe from quality degradation and contamination. The Processed & packaged food certification allows packaged food manufacturers, packaging manufacturers, and food retailers to reduce the risk of costly product recalls, regulatory violations, and potential legal liabilities. Certification of processed & packaged food is necessary due to the quality and quantity of the product. These factors help the growth of the processed and packaged food application type segment and contribute to the growth of the food certification market.

North America held a significant share of the food certification market in 2024. Increasing consumer awareness about food safety and several government initiatives for food safety help the growth of the market in the region. In North America, for food safety certification and auditing, Bureau Veritas supports all the contributors within the food chain. A certified food safety quality auditor (CFSQA) also helps with food certification for food safety. Food safety and food certification are necessary in this region because more than half of the health issues in the United States are related to delis or restaurants.

In Canada, food certification is governed by the SFCR (Safe Food Canadian Regulations). It covers the requirements of consumer protection for net quantity, grades, standards of identity, packaging, and labeling. Here are many food certifications available, including Hazards Analysis Critical Control Point Certifications, Preventive Controls, and Certified Food Scientists. It helps to maintain the food safety standards for the professionals in the food service industry.

Asia Pacific is projected to grow at a rapid rate in the global food certification market during the forecast period of 2024-2033. In the region, there are high food safety issues, which is why there is a need for food certification. These factors help to grow the food certification market in the region.

In China, the Global Food Safety Initiative (GFSI) recognized a CHINA-HACCP (China’s Hazard Analysis and Critical Control Point) certification system. Food certifications include an organic food certification system, a green food certification system, and a hazard-free food certification system.

Food certification in Japan includes JGAP Certification, which was founded by the Japan GAP Foundation and covered food and environmental, occupational safety, and human rights standards for farms, and JFS standards that specify requirements for food products business operators that were developed by the Japan Food Safety Management Association.

In India, food products are certified by the BIS (Bureau of Indian Standards). It operates a product certification scheme by granting licenses to manufacturers that cover each industrial discipline, including food, agriculture, textiles, and electronics. In India, food certifications include FSSAI, BIS, ISO 22000, AGMARK, etc.

By Certification Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

January 2025