January 2025

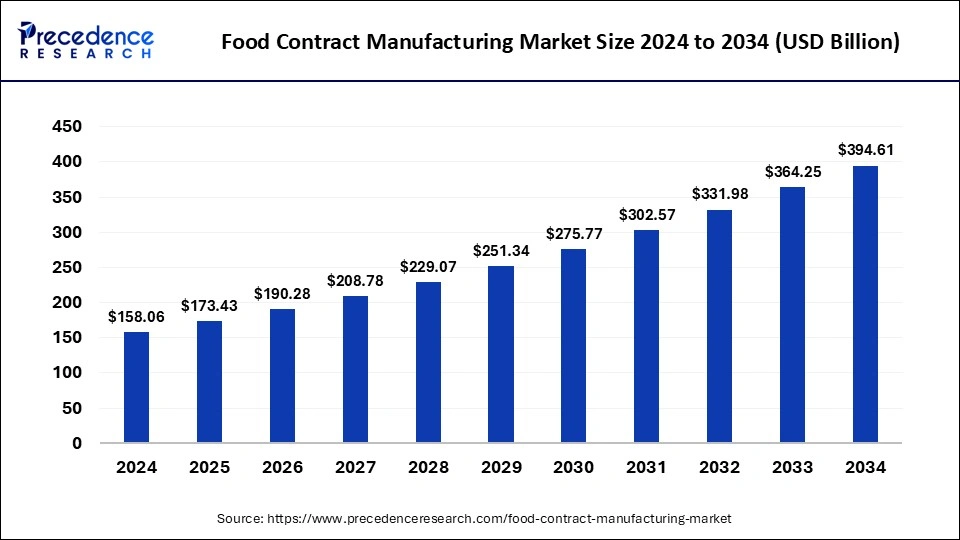

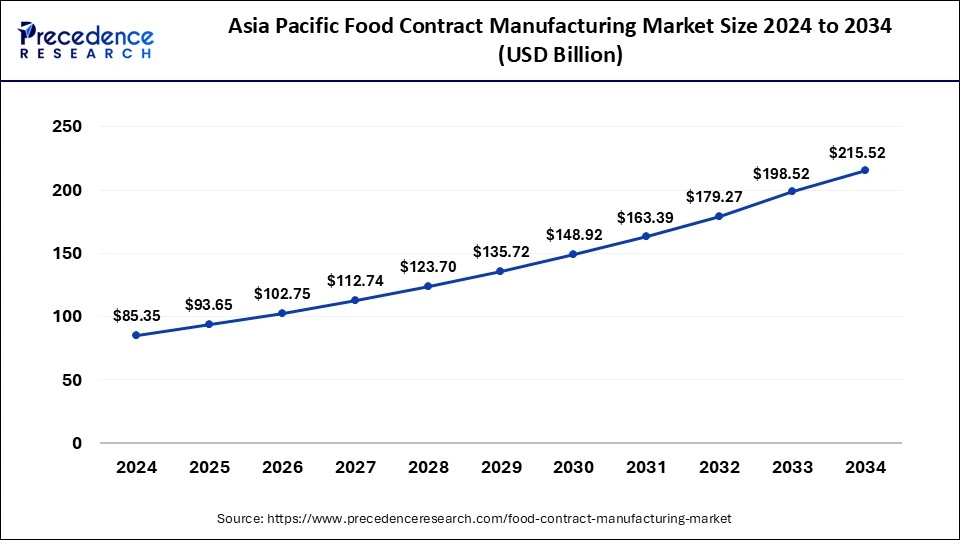

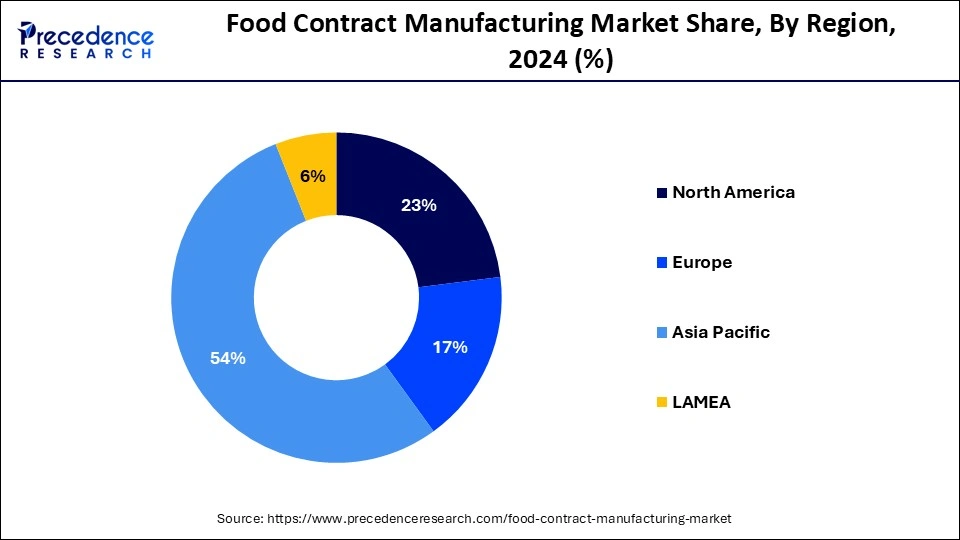

The global food contract manufacturing market size is calculated at USD 173.43 billion in 2025 and is forecasted to reach around USD 394.61 billion by 2034, accelerating at a CAGR of 9.58% from 2025 to 2034. The Asia Pacific food contract manufacturing market size surpassed USD 93.65 billion in 2025 and is expanding at a CAGR of 93.65% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global food contract manufacturing market size was estimated at USD 158.06 billion in 2024 and is predicted to increase from USD 173.43 billion in 2025 to approximately USD 394.61 billion by 2034, expanding at a CAGR of 9.58% from 2025 to 2034. The demand for food contract manufacturers is being driven by the growing emphasis on sustainability and minimizing the environmental effect of food production, this can boost the food contract manufacturing market.

The Asia Pacific food contract manufacturing market size was exhibited at USD 85.35 billion in 2024 and is projected to be worth around USD 215.52 billion by 2034, poised to grow at a CAGR of 93.65% from 2025 to 2034.

Asia Pacific dominated the food contract manufacturing market by region in 2024. The demand for a variety of food goods has surged due to the region's vast and quickly expanding population, rising disposable incomes, and urbanization. The Asia Pacific contract manufacturers meet this need by providing a broad selection of specialized food items and mixes. Asia Pacific is renowned for its ability to produce goods at a reasonable cost, particularly when it comes to labor and operating expenditures when compared to Western markets. The food companies looking for competitive and efficient manufacturing solutions are drawn to this cost advantage.

The need for contract manufacturing services is fueled by the rise of the food and beverage sectors in Asia Pacific, which is being driven by dietary changes and economic growth. Contract manufacturers are essential to businesses in industries like drinks, convenience foods, and snacks because they enable scalable manufacturing and market development.

North America is expected to grow at the highest CAGR during the forecast period. Convenient foods, such as frozen dinners, snacks, and ready-to-eat meals, are becoming more and more popular among consumers. These handy food items are produced by food contract manufacturers in North America with a focus on meeting the needs of modern lifestyles and shifting dietary preferences. The demand for natural, organic, and functional food items is being driven by consumers' growing emphasis on health and well-being in North America.

The region's contract manufacturers are skilled in creating and manufacturing healthier substitutes that satisfy both customer demands and legal requirements. North America is at the forefront of food innovation and product customization, prioritizing distinctive tastes, dietary requirements (such as gluten-free and veganism), and nutritional characteristics. R&D-capable contract manufacturers are well-positioned to satisfy these demands in the food contract manufacturing market.

The food contract manufacturing market encompasses the practice of contract manufacturing of food, sometimes referred to as co-packing, whereby food production processes are outsourced to a third-party producer. In this arrangement, a food firm or brand collaborates with a contract manufacturer to make food items in accordance with their requirements, recipes, and standards for quality. For food firms looking to maximize production efficiency, cut costs, and maintain excellent product quality while concentrating on company growth and market expansion, food contract manufacturing provides a strategic outsourcing alternative.

| Report Coverage | Details |

| Market Size by 2034 | USD 394.61 Billion |

| Market Size in 2025 | USD 173.43 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.58% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for packaged and processed foods

The growing demand for packaged and processed foods can boost the food contract manufacturing market. Convenient, prepared, and packaged meals are in greater demand as a result of consumers' busy lifestyles and rising disposable incomes. The need for contract manufacturing services is increased by this development.

Increasing awareness of health

The increasing awareness about health can boost the food contract manufacturing market. There is an increasing demand for specialty food items like organic, gluten-free, and non-GMO foods as customers become more health-conscious. These specialty items are frequently produced by contract manufacturers.

Difficulties in quality control

The issues and difficulties in quality control may hamper the growth of the food contract manufacturing market. The food sector places a high value on maintaining consistent product quality. The contract manufacturer and the brand they are producing for may suffer from a loss of business as a result of any quality control failures.

New product development and innovation

New product development and innovation can be the opportunity to grow the food contract manufacturing market. The food contract manufacturers can create themselves as vital partners for food firms striving to maintain competitiveness, satisfy customer wants, and propel market expansion by emphasizing innovation and product development.

The manufacturing segment dominated the food contract manufacturing market by service in 2024. The food goods may be produced at scale by contract manufacturers who specialize in manufacturing services because they have the infrastructure, tools, and knowledge required. They provide full manufacturing capabilities, which include labeling, packing, filling, mixing, and food processing. The contract manufacturers with an emphasis on manufacturing are able to adjust production levels in response to customer demand. The capacity to scale is essential for meeting the demands of many brands, market trends, and seasonal variations in product requirements. For food manufacturers, it is frequently more affordable to outsource manufacturing to specialist facilities rather than building and maintaining their own production facilities. Production costs can be decreased by contract manufacturers by utilizing economies of scale and operational efficiency.

The custom formulation and R&D segment is expected to grow at the highest CAGR in the food contract manufacturing market by service during the forecast period. Food businesses are putting more emphasis on product innovation and differentiation in order to adapt to changing customer trends and market conditions. The brands may create distinctive goods that are suited to certain dietary requirements, nutritional profiles, and flavor profiles by using custom formulation and R&D services. The demand for healthier and more useful food products such as organic, natural, plant-based, and fortified foods is rising. The contract manufacturers may produce goods that follow these wellness and health trends with the help of custom formulation services. The demand for bespoke formulation capabilities is being driven by the growing popularity of specialist and niche food items, such as gluten-free, allergen-free, and vegan choices. The products that target certain customer categories can be developed by contract manufacturers with R&D experience.

By Service

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

September 2024

January 2025